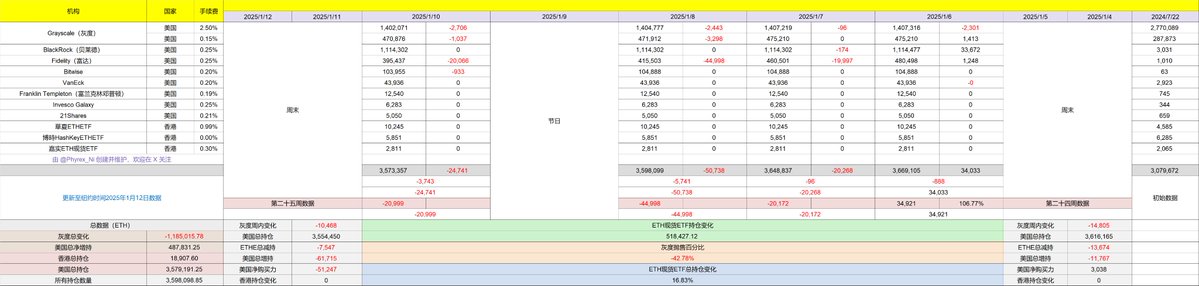

It has been regrettable for two days now, so it should be normal to feel regret for another day. Fidelity's investors have significantly reduced their holdings for the third consecutive working day, exiting over 20,000 #ETH, and in just one week, Fidelity has exited 83,813 ETH, accounting for 17.5% of Fidelity's total holdings. In just three days, this outflow matches Fidelity's net inflow for half of December, and it represents 2.34% of the total for nine U.S. spot ETFs, with no signs of stopping at the moment.

The data for ETH does not look good, and #BTC looks even worse. Currently, the data for BTC is not complete and will only be released tomorrow, but from a funding perspective, although Fidelity did not reduce its BTC holdings on the 10th, BlackRock users have seen significant outflows of BTC for two consecutive working days.

However, aside from Fidelity, the outflow data for ETH is not substantial; Grayscale has shown a decreasing trend, and Bitwise has reduced its holdings by less than 1,000 ETH, with no other changes in ETF institutions, including BlackRock. If we look at it this way, ETH investors seem to be calmer than BTC investors. Of course, BTC investors have made more profits, so it cannot be ruled out that they are exiting to take profits.

In the data for the twenty-fifth week, the outflow of U.S. ETH spot ETFs has further increased, with 61,715 ETH flowing out in just four working days, a 424% increase compared to the twenty-fourth week, indicating the sentiment of users. Currently, all U.S. ETF institutions hold a total of 3,579,191.25 ETH, an increase of 518,427.12 ETH since the opening day.

Among them, Grayscale's two funds hold a total of 1,872,946 ETH, followed by BlackRock with 1,114,302 ETH and Fidelity with 395,437 ETH. Fidelity's holdings have now fallen below 400,000 ETH.

Of course, this does not mean that #Ethereum is necessarily failing; after all, ETFs reflect more of the investors' sentiment. If investor sentiment improves, there is still room for an increase in ETH purchase data. After all, from the data, most investors remain optimistic about the future trends of BTC and ETH.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1W7JJ8lMQiUUlBb9U-BvFoq2H-2o5CpUuPO4D_KK3Ubw/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。