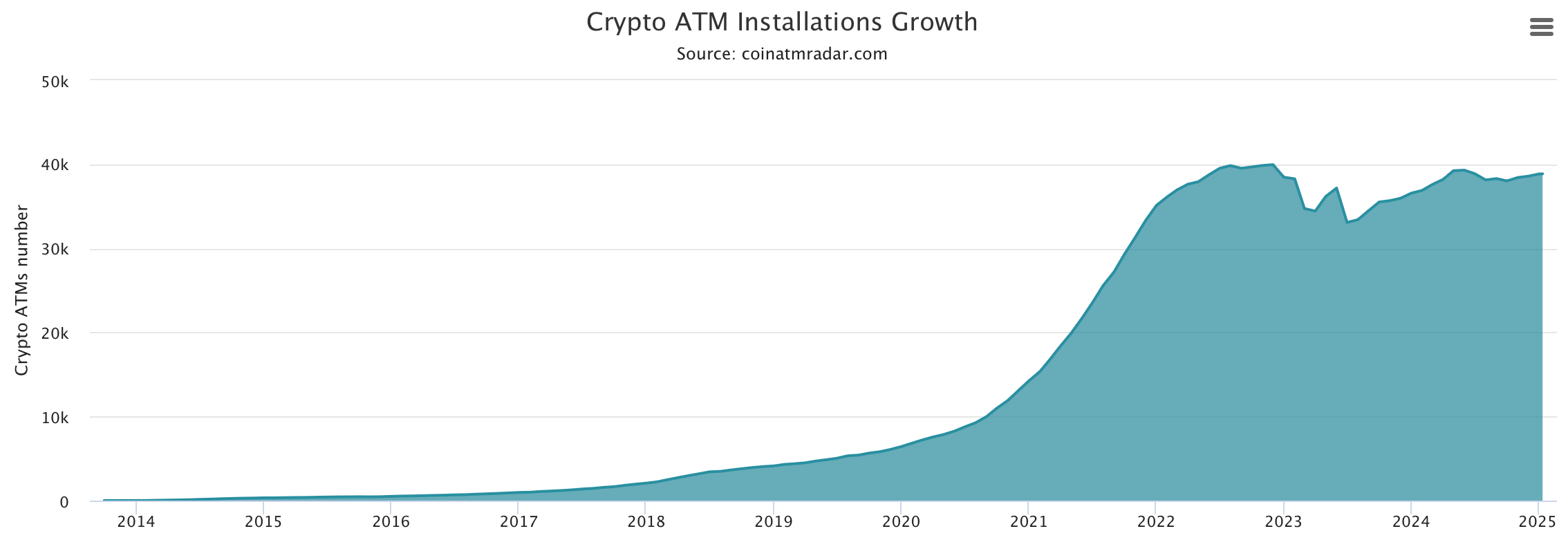

The trajectory of crypto ATMs saw dramatic shifts following the Terra stablecoin crisis and the FTX collapse in Nov. 2022. According to coinatmradar.com, the worldwide count of crypto ATMs hit its zenith of 39,958 by Dec. 1 of that year.

Presently, the total number of these machines is only 1,092 shy of that peak. This marks a significant departure from the declines witnessed in April and July 2023. Following the all-time high, the number of machines experienced a reduction of 6,873, reaching a low of 33,085 on July 1, 2023.

At press time on Jan. 11, 2025, coinatmradar.com metrics show there are 38,866 crypto ATMs in the wild today.

Coinatmradar.com data indicates that, as of Jan. 11, 2025, there are 38,866 crypto ATMs in operation globally. Of those, 283 machines have been installed since the beginning of this year, with 157 added in December alone. November brought a net increase of 404 devices, while October 2024 saw a decline of 280.

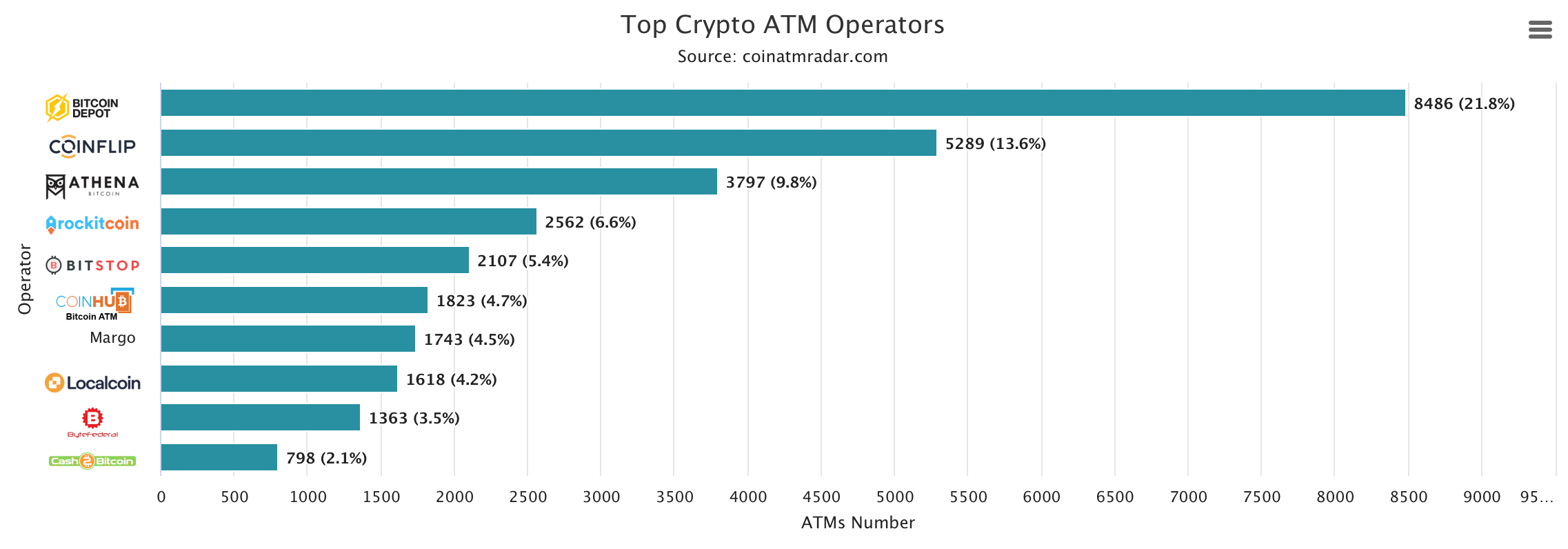

Bitcoin Depot holds the title of the largest operator by machine count, managing 8,486 ATMs worldwide as of Jan. 11, 2025, according to coinatmradar.com stats. Coinflip follows with 5,289 machines, while Athena Bitcoin oversees 3,797 devices.

Coinatmradar.com shows ten crypto ATM operators manage the global count of machines worldwide.

Geographic data from coinatmradar.com shows the United States dominates this space, hosting 81.3% of all crypto ATMs worldwide. On a regional level, Europe accounts for 4.3% of the machines, Oceania claims 4% and 3.5% are stationed in Australia.

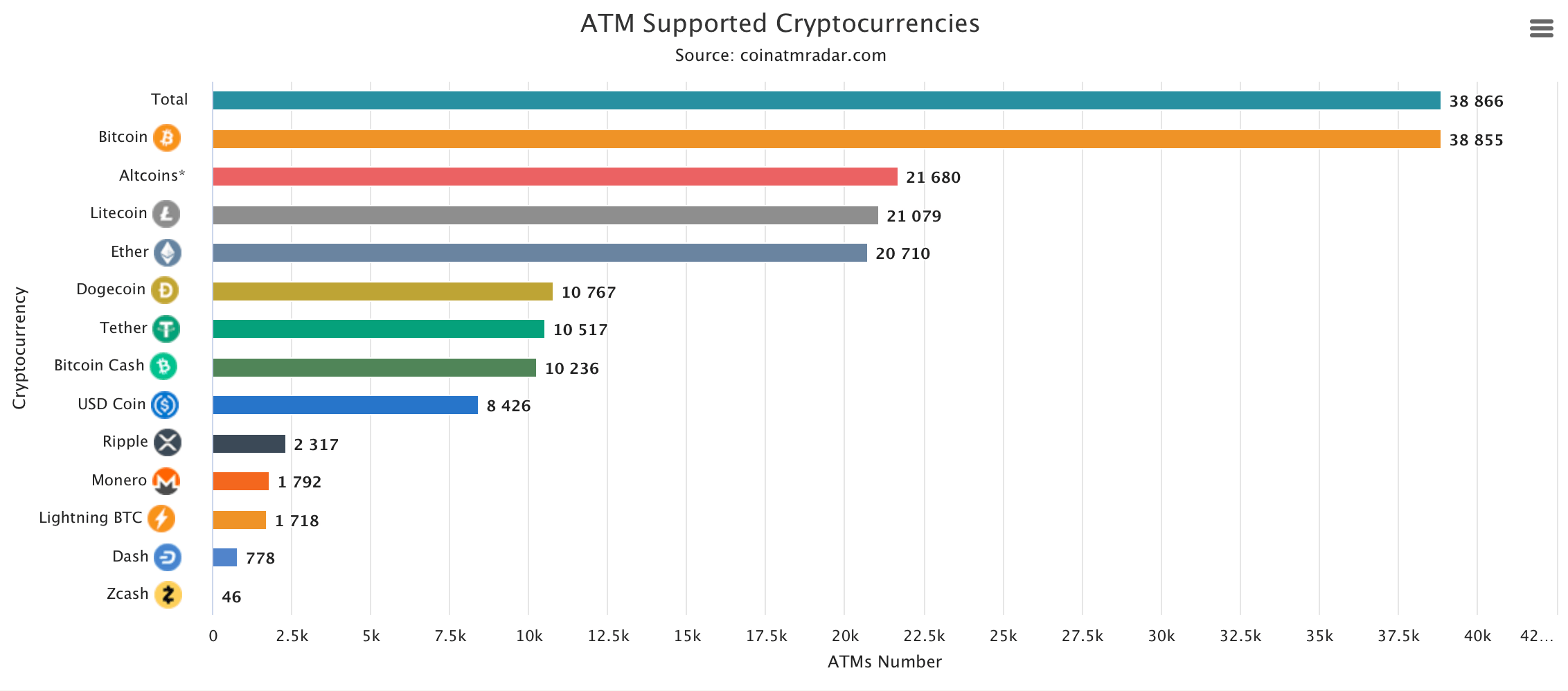

Of the 38,866 devices, a vast majority—38,855—support bitcoin (BTC). Among alternative coins, litecoin (LTC) is the most widely supported, appearing on 54.2% of machines, followed by ethereum (ETH) at 53.3% and dogecoin (DOGE), which is available on 10,767 ATMs or 27.7% globally.

While an assortment of digital assets can be acquired via crypto ATMs,

The global proliferation of crypto ATMs captures a compelling blend of innovation and resilience within the constantly shifting cryptocurrency sphere. As installation trends wax and wane in response to market forces, these machines serve as concrete bridges linking digital currencies to physical access points.

Their evolving distribution reflects an enduring demand for decentralized financial (defi) tools in a tangible world, shaping the future of monetary engagement.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。