Although miners continue to grapple with revenue constraints tied to bitcoin’s price holding below the $100,000 threshold, shares of these publicly listed BTC mining companies are trending upward, hinting at a favorable start to the year. As of Saturday afternoon, data from bitcoinminingstock.io reveals the combined market capitalization of 31 publicly traded bitcoin (BTC) mining firms stands at $44.09 billion. Among these, 26 companies have witnessed their stock values rise against the U.S. dollar.

Source: bitcoinminingstock.io

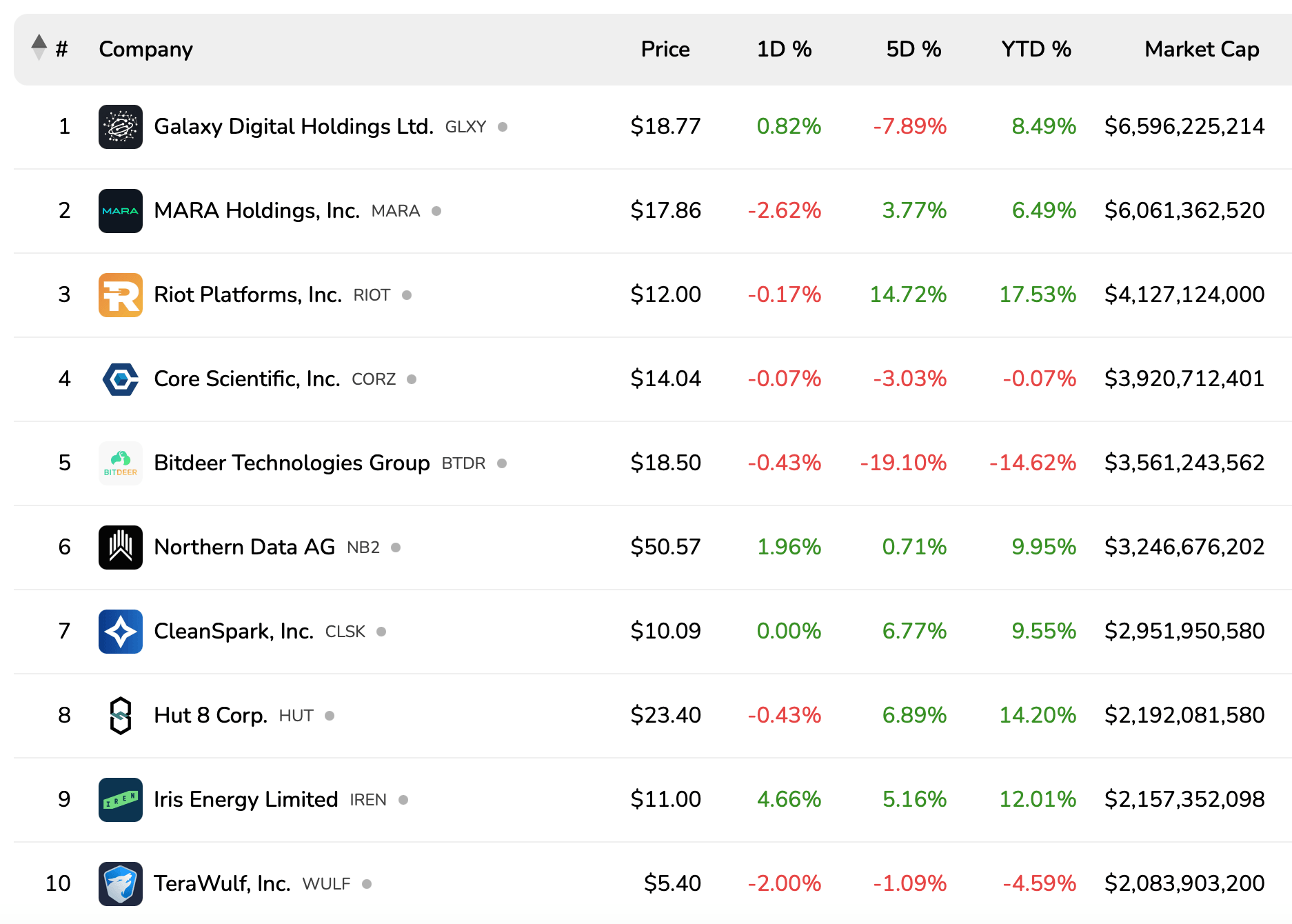

Leading the charge is Cathedra Bitcoin, Inc. (TSXV: CBIT), which has soared 25% year-to-date, marking the most significant gain. Within the top ten firms by market capitalization, Riot Platforms, Inc. (Nasdaq: RIOT) claimed the top spot with a 17.53% increase in 2025. Following closely is Hut 8 (Nasdaq: HUT), which has climbed 14.2%. Meanwhile, companies like Galaxy, MARA, Northern Data, Cleanspark, and Iris Energy experienced gains ranging from MARA’s 6.49% to Iris Energy’s 12.01%.

On the downside, three firms have recorded declines this year, with losses ranging from a marginal 0.07% to a sharper 14.62%. Core Scientific (Nasdaq: CORZ), the fourth-largest firm by market capitalization, dipped by a mere 0.07%. Terawulf (Nasdaq: WULF) has fallen 4.59%, while Bitdeer (Nasdaq: BTDR) has seen a more significant drop of 14.62%. Apart from Bit Origin Limited (Nasdaq: BTOG), which is down 10.32% year-to-date, BTDR emerges as the steepest decliner among the group.

Amid these shifts, several companies are diversifying their focus, exploring high-performance computing (HPC) and artificial intelligence (AI) hosting alongside their BTC strategic reserves. Notably, Blocksbridge Consulting’s theminermag.com reports that publicly listed miners collectively hold record reserves of over 92,000 BTC as of Dec. 2024.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。