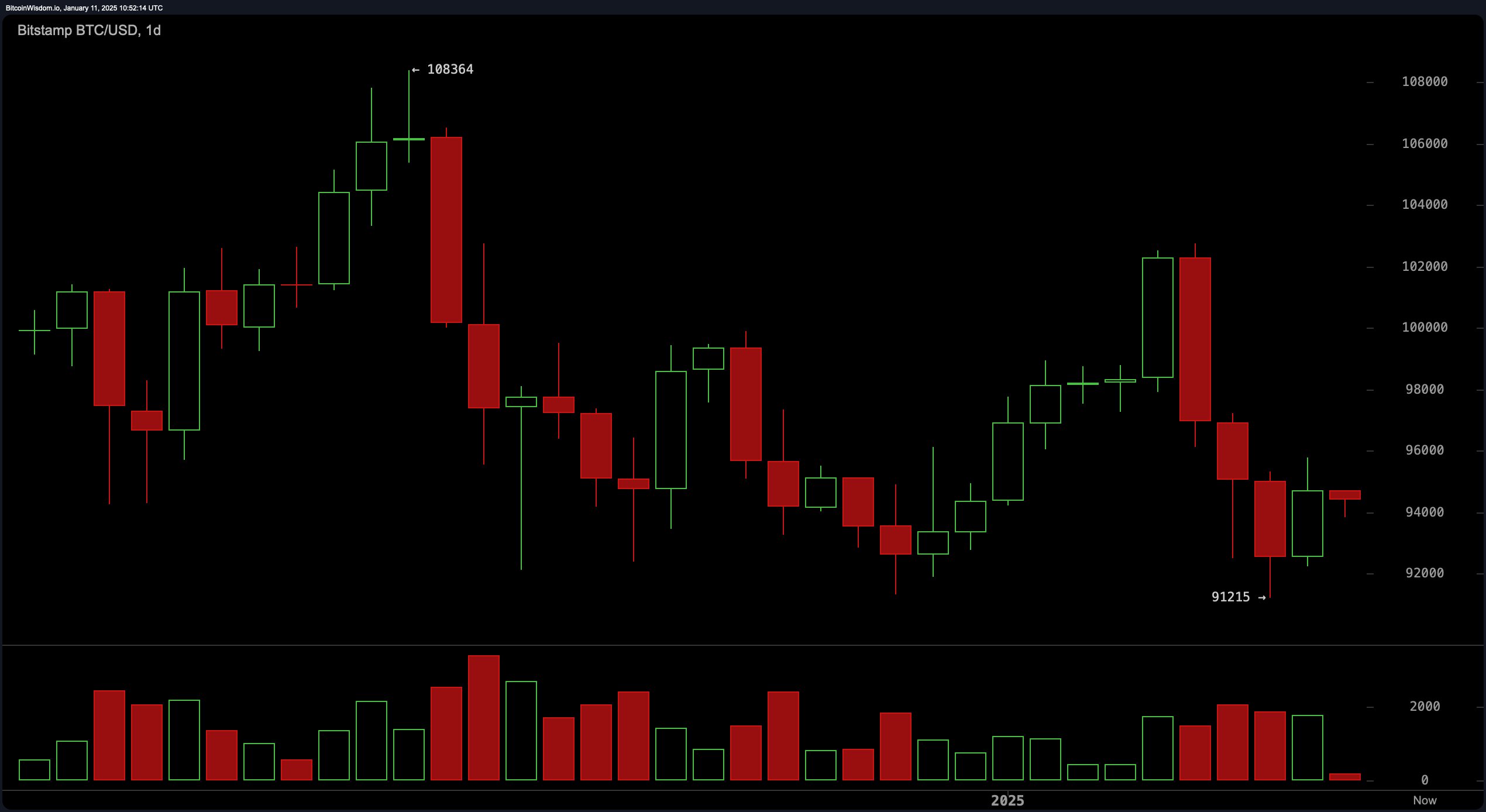

The daily chart illustrates a prevailing bearish tone after a sharp retreat from a high near $108,364. The price rebounded from a $91,215 low to consolidate around $94,000. Support at $91,000 holds firm, while resistance at $95,000 remains intact, forming a critical juncture for traders. Indicators such as the moving average convergence divergence (MACD) at −445 and momentum at 31 point to bearish sentiment, signaling caution for bullish positions without clear validation.

BTC/USD 1H chart on Jan. 11, 2025.

On the 4-hour chart, bitcoin shows short-term stabilization, oscillating between $94,000 and $95,000 following a plunge from $102,760 to $91,215. The relative strength index (RSI) at 46 and Stochastic oscillator at 23 suggest neutrality, while the 10-period exponential moving average (EMA) at $95,702 indicates bearish conditions. Volume surges during pivotal movements highlight active trading, emphasizing the importance of a breakout above $96,000 as a key event to watch.

BTC/USD 4H chart on Jan. 11, 2025.

The hourly chart offers a granular perspective, revealing coiling price action with descending highs and ascending lows. Resistance at $95,800 and support near $93,500 outline a narrow range, often a precursor to significant movement. Lower trading volumes suggest dwindling momentum, but a decisive move beyond these thresholds—accompanied by strong volume—could provide actionable insights for short-term traders.

BTC/USD 1D chart on Jan. 11, 2025.

Across timeframes, moving averages (MAs) paint a mixed picture. Shorter-term signals, such as the 10-day simple moving average (SMA) at $96,748, suggest bearish momentum, contrasting with the longer-term optimism of the 200-day EMA at $78,285. This interplay reflects the tension between immediate bearish pressures and enduring bullish trends, with the $91,000 support level remaining pivotal to preventing further declines.

Traders should remain vigilant, as current consolidation patterns could result in deceptive breakouts. A push above $95,800 could signify renewed bullish momentum, while a dip below $93,500 risks exacerbating bearish trends, particularly if $91,000 support falters. Employing stop-loss strategies and confirming volume patterns will be essential in navigating bitcoin’s current market dynamics.

Bull Verdict:

Bitcoin’s current consolidation near $94,000 suggests the potential for a bullish breakout, particularly if the price decisively moves above $95,800 with robust volume. The resilience of the $91,000 support level and the longer-term bullish trend indicated by the 200-day EMA reinforce optimism for upward momentum. A confirmed breakout above $96,000 could attract fresh buying interest, paving the way for a test of higher resistance levels.

Bear Verdict:

Persistent bearish indicators, such as the MACD at −445 and the short-term SMA signaling downward pressure, underline the risk of further declines. A break below $93,500 could intensify selling, with the $91,000 support level being the critical line of defense. Failure to hold this level could lead to deeper losses, as bearish momentum consolidates its grip on the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。