Approximately 171 days—or 5.5 months—have passed since spot ethereum ETFs began trading on Nasdaq, Cboe, and the New York Stock Exchange (NYSE). By tomorrow, Jan. 11, spot bitcoin ETFs will mark nearly a year of activity on those same exchanges since their inception in early 2024. These funds have exhibited an extraordinary level of engagement relative to alternative ETFs launched over the past year.

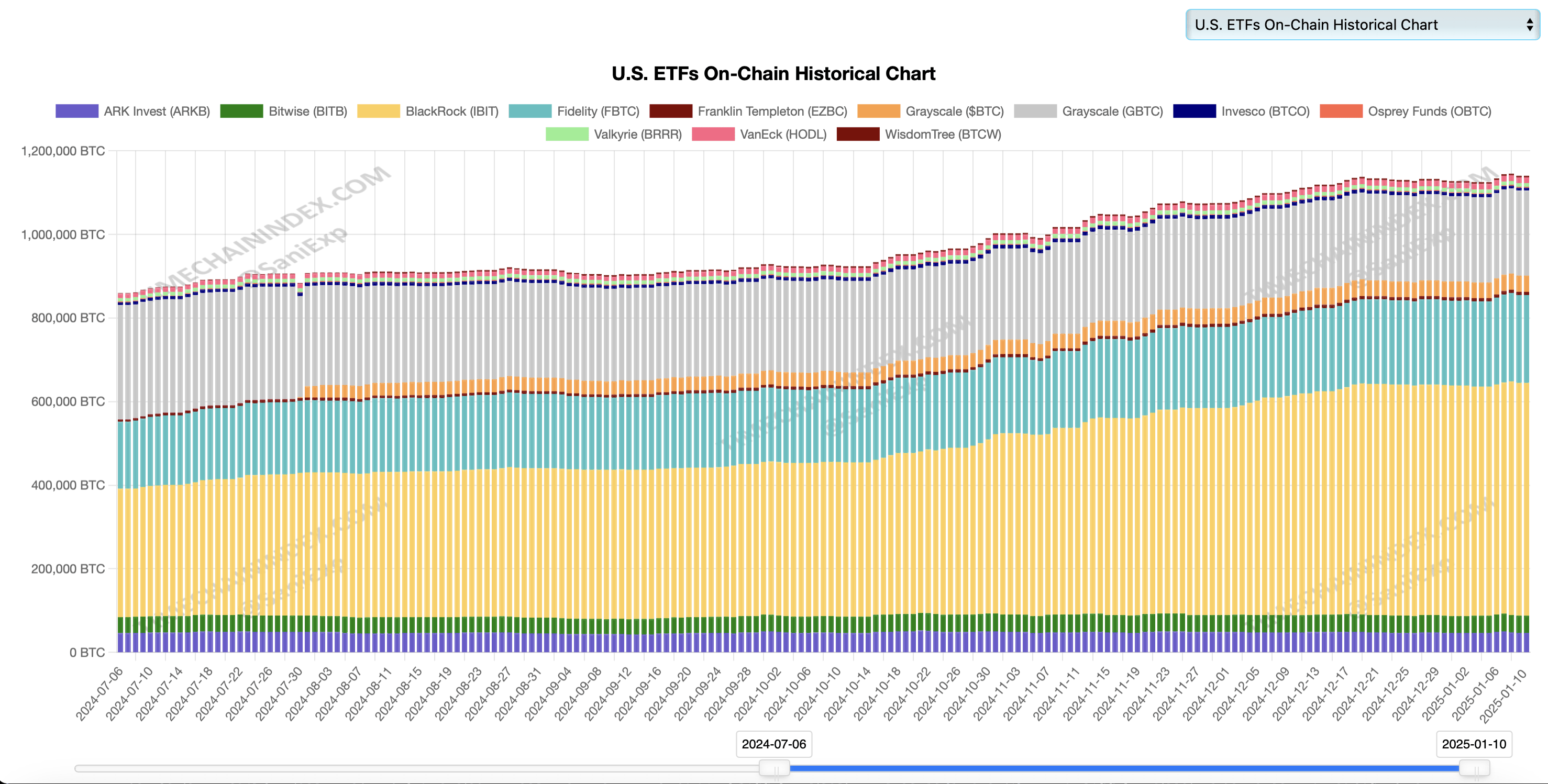

Metrics collected by timechainindex.com indicate that as of Jan. 10, 2025, the ETFs hold 1.14 million BTC that can be verified onchain.

Currently, the 12 bitcoin ETFs collectively hold 5.74% of BTC’s total market capitalization, while data collected from Sosovalue.com indicates that the nine ethereum ETFs secure about 2.97% of ETH’s market value. Eleven out of the 12 bitcoin funds have reported cumulative net inflows ranging from $1.16 million to a substantial $37.85 billion since their inception. Dominating this space, Blackrock’s IBIT fund has captured the lion’s share, amassing $37.85 billion in net inflows. As of Jan. 9, 2025, IBIT boasts a massive reserve of 557,881.83 BTC.

At the onset of ETF trading on U.S. stock exchanges, Grayscale’s GBTC commanded a considerable 620,000 BTC. Today, however, its holdings have diminished dramatically to 204,411.52 BTC. The past year has been turbulent for GBTC, which has not seen any positive inflows; instead, it has suffered $21.58 billion in net outflows. Recently, Fidelity’s FBTC surpassed GBTC in BTC reserves, securing 205,488.45 BTC.

Fidelity’s FBTC ranks as the second-highest fund in terms of cumulative net gains over the last 12 months, capturing $12.14 billion in inflows since Jan. 11, 2024. Beyond IBIT and FBTC, other funds have reported inflows ranging from $1 million to $2.48 billion. Among the leading funds are ARKB, BITB, and Grayscale’s Bitcoin Mini Trust, while Wisdomtree’s BTCW and Hashdex’s DEFI fund trail with the lowest net inflows over the year.

In the ether ETF arena, Blackrock also takes the lead. Its ETHA fund has achieved $3.68 billion in positive inflows since its launch on July 23, 2024. Conversely, Grayscale’s ETHE fund has seen an identical $3.68 billion in outflows. Notably, Grayscale’s Ethereum Mini Trust ranks as the third largest ETH ETF for inflows, garnering $591.53 million. Fidelity’s FETH fund secures the second spot, accumulating $1.39 billion in net inflows.

Bitwise’s ETHW fund has attracted $345.02 million since its launch. Other ether funds report positive flows between $10.22 million and $127.79 million. Altogether, the nine ETH-focused funds have amassed reserves valued at $11.74 billion over the past 5.5 months, with some of these holdings originating from Grayscale’s ETHE prior to the public launch of the funds.

As 2025 progresses, spot bitcoin and ether ETFs continue to reshape the investment landscape, reflecting their increasing importance in the broader market. While inflows remain concentrated among a few dominant funds, the competitive dynamic between asset managers suggests that the evolving regulatory and financial environment may soon spark further shifts. Investors’ continued confidence in these products may redefine BTC’s market trends in the coming months.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。