Author: Chi Anh, Ryan Yoon, and Yoon Lee, Tiger Research

Compiled by: Luffy, Foresight News

Summary

The decentralized and anti-inflation characteristics of Bitcoin make it a versatile tool for institutions to hedge against economic uncertainty and maintain long-term value.

Institutional purchases of Bitcoin often signify confidence and innovation, while sales are typically for profit-taking or cash flow management.

An increasing number of institutions in Asia are viewing Bitcoin as an investment asset, while governments in countries like El Salvador and the United States are implementing measures to recognize Bitcoin as a strategic asset. These developments highlight Bitcoin's growing influence in global economic strategy formulation.

1. Introduction

As an investment asset, Bitcoin has garnered attention due to its distinct characteristics compared to traditional assets like gold. The decentralized and anti-inflation nature of Bitcoin presents new possibilities for institutional asset management strategies.

MicroStrategy is a prominent example of an institution strategically leveraging Bitcoin's advantages. The company effectively uses Bitcoin to mitigate inflation risks and strengthen its financial position. This success story has prompted numerous companies and financial institutions worldwide to reassess their investment strategies.

However, Bitcoin investment may not be suitable for all institutions. While Bitcoin purchases often attract public attention, many companies have cautiously sold their holdings. This report aims to analyze the reasons behind institutional investment in Bitcoin, explore the key factors influencing different institutions' buying and selling decisions, and examine institutional strategies under similar market conditions. As Bitcoin's status as a corporate investment asset continues to rise, this report will also analyze perspectives and corresponding strategies in the Asian market.

2. Bitcoin as an Investment Asset

Institutions have traditionally favored investment assets like bonds, gold, and foreign currencies due to their ability to hedge risks and sometimes preserve value during economic uncertainty. Bitcoin has emerged as a strategic investment asset, providing institutions with an effective, anti-inflation, and profitable alternative to traditional assets like bonds and gold. The total supply of Bitcoin is capped at 21 million, ensuring scarcity and making it an attractive long-term value preservation option.

2.1. The Role of Bitcoin as an Inflation Hedge

Rodriguez and Colombo conducted a study in 2024 titled "Is Bitcoin an Inflation Hedge?," analyzing Bitcoin's response to inflationary pressures using key economic indicators such as the U.S. Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) data from the past decade. The findings indicate that Bitcoin's returns significantly increase following positive inflation shocks. However, this effect is more pronounced for price indices that are sensitive (mainly applicable to CPI shocks) and is more significant in the early stages before widespread institutional adoption of Bitcoin. This suggests that Bitcoin's ability to hedge against inflation is context-dependent and may weaken as its adoption expands.

2.2. Profitability of Bitcoin as an Investment Asset

Source: TradingView

In 2024, Bitcoin's return was approximately 127%, significantly surpassing gold's 27% increase and the S&P 500's roughly 24% rise during the same period.

However, the value of Bitcoin as an institutional investment asset lies not only in its investment returns; traditional investment assets have limited trading hours and complex trading processes, making it difficult to respond quickly to interest rate changes or market shocks.

In contrast, Bitcoin offers global liquidity, unrestricted by borders or time zones, allowing for 24/7 real-time trading. High liquidity enables Bitcoin to be quickly converted into cash in any country/region, distinguishing it from traditional financial assets. These characteristics allow institutions to effectively manage assets and respond to market conditions.

With high profitability and practicality, Bitcoin is expected to become an increasingly important investment asset in institutional portfolios.

2.3. Bitcoin as a Lever for Attention Economy

With over 3,300 companies listed on NASDAQ, the number of publicly traded companies globally has grown to a substantial scale. As a result, attracting investor attention solely through strong fundamentals has become increasingly challenging. To enhance market visibility, companies are now increasing their investments in marketing.

In such a market environment, Bitcoin creates additional publicity. Since only a few publicly traded companies hold Bitcoin, merely announcing the purchase of Bitcoin as part of a portfolio diversification strategy can generate significant media exposure.

Such media coverage brings many positive outcomes for companies, enhancing brand value, attracting retail investor interest, and bolstering an innovative and forward-looking image. Beyond increasing asset value, Bitcoin also plays a role in enhancing corporate value.

3. Institutional Buying and Selling Behavior

As Bitcoin becomes an indispensable part of institutional portfolios, a unique trading pattern has emerged. Institutions typically publicly announce their Bitcoin purchases, sending a strong signal to the market. This strategy helps highlight the company's innovative stance and boosts market confidence. In contrast, Bitcoin sales are conducted cautiously, usually occurring when profits are realized and funds are reinvested to strengthen core business operations.

3.1. Institutional Buying Behavior: MicroStrategy

MicroStrategy's Bitcoin purchase record, Source: saylortracker.com

MicroStrategy is a leading example of utilizing Bitcoin as an investment asset. By acquiring over 446,400 BTC, the company has garnered widespread market attention. This strategy aims to achieve two key objectives: hedge against inflation and enhance financial stability.

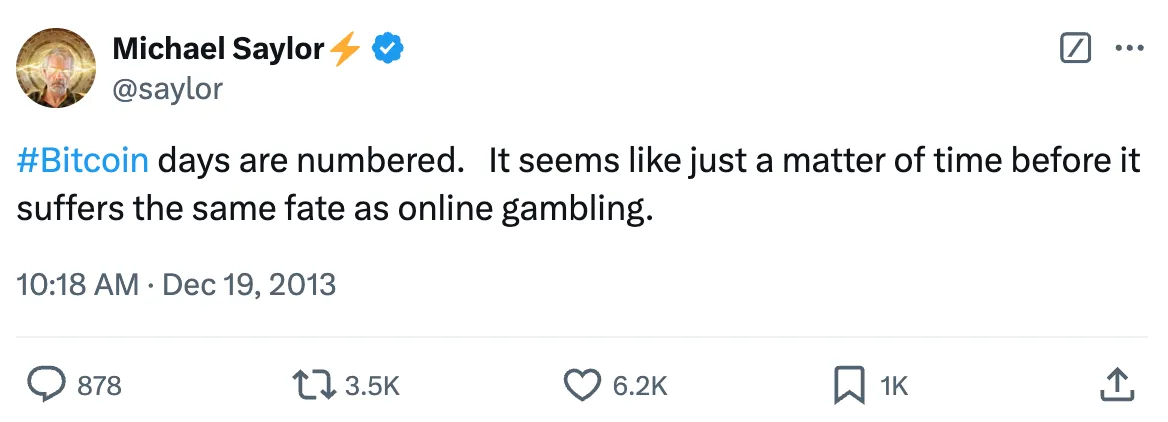

Source: Michael Saylor's X account

CEO Michael Saylor has attracted market attention by radically changing the perception of Bitcoin. He transformed from a former skeptic to an enthusiastic advocate, emphasizing that "cash, low-yield bonds, and overvalued tech stocks are vulnerable to inflation and should be avoided." In the current market environment, Saylor suggests that stock buybacks and Bitcoin are the best uses of a company's excess funds, choosing Bitcoin as a long-term means to hedge against unlimited quantitative easing.

Contrary to early concerns, MicroStrategy's Bitcoin investment strategy has received broad support from many companies. In addition to serving as an inflation hedge, Bitcoin is now viewed as "digital gold," reshaping corporate asset management practices. This innovative approach of using Bitcoin to diversify reserves points to a new direction for global corporate financial strategies.

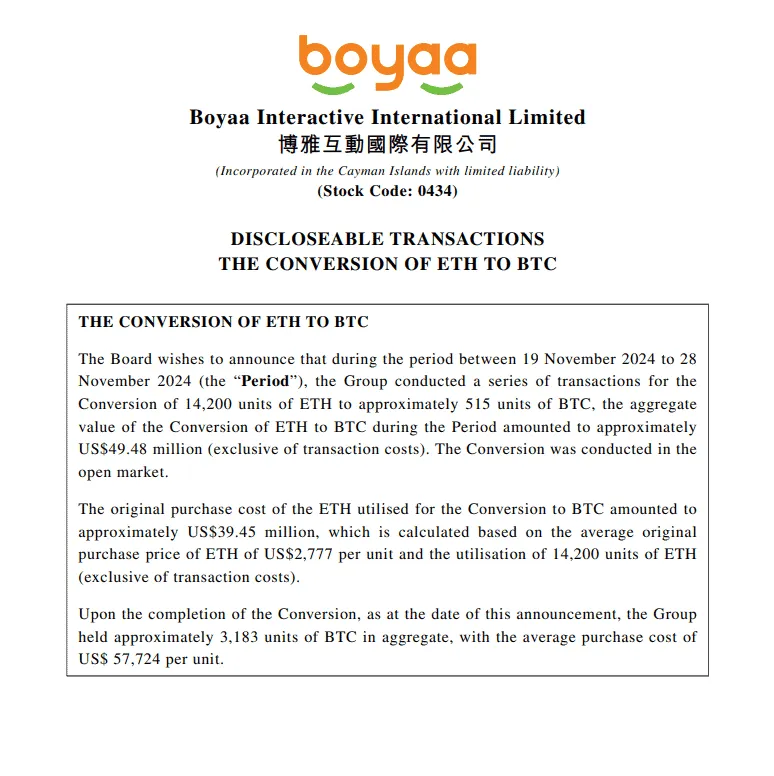

Boya Interactive Announcement

MicroStrategy's success story is also influencing the Asian market. Boya Interactive has converted its Ethereum holdings into Bitcoin, while MetaPlanet has actively purchased Bitcoin in 2024. These initiatives reflect the increasing recognition of Bitcoin's utility in volatility management and long-term value preservation in the Asian market.

3.2. Institutional Selling Behavior: Tesla

Tesla is one of the most notable companies adopting Bitcoin, providing a case that contrasts sharply with companies like MicroStrategy. The company sold 75% of its Bitcoin holdings in 2022, attributing this decision to liquidity needs amid uncertain economic conditions. Recently, in October 2024, Tesla transferred $760 million worth of Bitcoin to an unknown wallet, sparking speculation about further sales.

Tesla's Bitcoin investment has been strategically used to support its operational and expansion needs, including building new factories in Austin, Texas, and Berlin. Tesla's CFO Zachary Kirkhorn stated that the investment in Bitcoin provided liquidity and a certain level of returns, demonstrating its flexibility as a financial tool for a capital-intensive company.

Similarly, when Bitcoin reached $100,000, Meitu realized substantial profits from its sale. Compared to Tesla's strategic profit-taking, Meitu's decision appears to be a deliberate move to sell at a market peak. Unlike Tesla's discreet approach, Meitu publicly explained that the sale was a step to strengthen its financial position amid challenges in its core business. This starkly contrasts with Tesla's secretive selling, indicating that public disclosure helps reduce market uncertainty caused by institutional sales.

The strategic reasons behind institutions buying and selling Bitcoin are directly related to their financial goals and operational needs. Companies typically sell Bitcoin to realize profits during market peaks, as Tesla did in 2022, or to convert held cryptocurrencies into operating capital for reinvestment in core business. The main reasons behind selling behavior can usually be categorized as: 1) profiting under favorable market conditions to expand and improve business operations; or 2) needing funds to address cash flow challenges. This raises questions about whether any future sales are driven by strategic financial planning or are a stopgap measure to address cash flow issues. Furthermore, if the motivation for selling is profit-taking, it raises questions about how these profits will be utilized. Will they be reinvested to enhance the business or primarily benefit stakeholders? Regardless, such actions may lead to missed opportunities for further appreciation and undermine the long-term advantages of holding Bitcoin as an investment asset.

4. Asian Institutional Bitcoin Buying and Selling Behavior

MetaPlanet is a prime example of active Bitcoin adoption in Asia. As its nickname "Asian MicroStrategy" suggests, the company purchased 1,018 Bitcoins in 2024, demonstrating its firm commitment to long-term Bitcoin investment.

The case of MetaPlanet highlights the successful transformation of "zombie companies." Zombie companies generate profits only sufficient to cover operating costs and repay debts but lack the capital to drive growth. Despite having substantial cash reserves, MetaPlanet failed to attract attention from the stock market. By benchmarking against MicroStrategy's strategy, the company successfully turned a profit.

In addition to Bitcoin investment, MetaPlanet also announced plans to expand into new business areas. The company's strategy includes using various financial instruments such as loans, stocks, and convertible bonds to acquire Bitcoin, while also generating profits through put options. This approach is considered an active profit model that goes beyond simple asset holding.

However, this strategy is not applicable to all zombie companies; its success depends on whether companies that have already established a foothold in their respective stock markets can implement differentiated strategies. Latecomers blindly imitating may exacerbate risks and should proceed with caution, considering factors such as corporate cash reserves, market conditions, and risk management capabilities.

5. Conclusion

In summary, the evolution of Bitcoin as an investment asset marks a significant shift in the institutional finance sector. The decentralized nature of Bitcoin, its anti-inflation properties, and unparalleled liquidity make it an attractive option for achieving asset diversification and long-term value preservation.

Some governments are also exploring the potential of Bitcoin. El Salvador's adoption of Bitcoin as legal tender is one example, highlighting the asset's role in national strategies for economic growth and financial inclusion. Recently, Trump announced that the United States would recognize Bitcoin as an investment asset, or as he put it, "a permanent national asset that benefits all Americans." These governmental initiatives indicate that the growing importance of Bitcoin is not only relevant to businesses but also crucial for policymakers aiming to modernize the financial system.

It has been shown that buying and selling Bitcoin benefits companies, especially during market uptrends. In a rising trend, buying indicates confidence in Bitcoin's growth potential, while selling allows companies to realize profits and reinvest in core operations. However, during market downturns, these actions may have negative effects. Buying may raise concerns about whether corporate funds are being used for speculative investments, while selling may lead to questions about whether the company is stopping losses or liquidating assets to cover operating expenses.

For decision-makers, the implications are clear: the potential of Bitcoin as an investment asset is immense, but it needs to be cautiously integrated into corporate strategy. Companies must weigh the financial benefits of holding Bitcoin (such as liquidity and anti-inflation capacity) against operational risks and associated market volatility. Whether for long-term reserves or short-term liquidity needs, effectively utilizing Bitcoin requires careful alignment with corporate goals and market conditions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。