Bulgaria and Germany Become the "Best Clowns for Selling BTC," with Four Major Tiers Established.

Written by: Wenser, Odaily Planet Daily

With less than two weeks until Trump takes office as President of the United States, he may announce a series of governance policies on his first day in office, January 20. Among the many speculations, the question of "Will Trump promote the establishment of a national strategic reserve for Bitcoin in the U.S.?" has become a focal point. Odaily Planet Daily has compiled information on the major countries currently holding Bitcoin to help readers gain an early understanding of the current basic situation regarding national strategic reserve plans for Bitcoin.

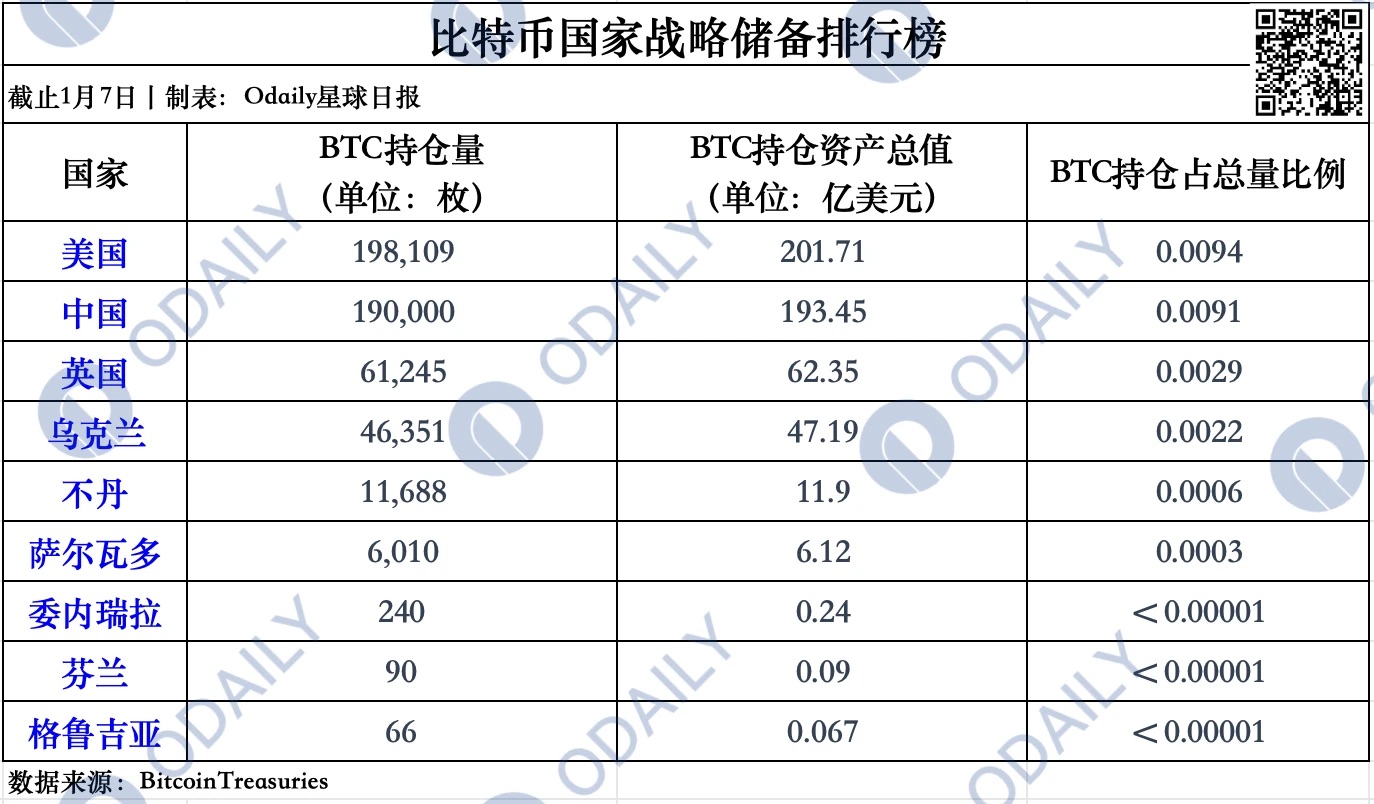

Bitcoin National Reserve Ranking: Four Major Tiers, Total Holdings Exceeding 510,000 BTC

Overview of National BTC Reserve Data

Tier One: The U.S. and China Lead by a Wide Margin

First and foremost, we must mention the "big holders" — the United States currently holds 198,109 BTC, valued at $20.171 billion, accounting for approximately 0.94% of the total BTC supply; China holds 190,000 BTC, valued at $19.345 billion, with a holding ratio of about 0.91% of the total BTC supply.

It is worth noting that, according to information from the BitcoinTreasuries website, the U.S. government's BTC holdings all come from the seized assets of the Silk Road website, and Trump had previously promised to release Silk Road founder Rose after taking office, which may also become a major topic of speculation. According to sources from that website, China's BTC holdings may primarily stem from the PlusToken hacking incident that occurred in 2020, where approximately 194,000 BTC were seized, and some believe that its BTC holdings may far exceed this number.

Tier Two: The U.K. and Ukraine Follow Closely

Compared to the first tier, the BTC holdings of the U.K. and Ukraine in the second tier have decreased by an order of magnitude.

The former holds 61,245 BTC, valued at approximately $6.24 billion. According to sources, this batch of BTC primarily comes from seized funds, which also originated from China.

In January 2024, according to British media Skynews, a woman who previously worked as a delivery driver at a Chinese restaurant was investigated after attempting to purchase a Hampstead mansion worth £23.5 million. Subsequently, the police seized Bitcoin worth over £1.4 billion. It is understood that 42-year-old Ms. Wen acted as a "front person" to help money launderer Qian Zhimin handle part of the profits from an investment fraud case in China that amounted to £5 billion between 2014 and 2017. At that time, British police seized 61,000 BTC. Later, according to on-chain data monitored by the Arkham platform, the U.K. government purchased 245 BTC at an average price of $59,376 in September 2024, increasing its holdings to 61,245 BTC.

The latter holds 46,351 BTC, valued at approximately $4.72 billion. There is currently no accurate information regarding the specific source of Ukraine's BTC holdings, which are based on results from multiple channels. Ukraine began holding BTC on September 14, 2022, when the price was only $20,185, representing an increase of over 400% compared to the current price above $100,000. Given the outbreak of the Russia-Ukraine war in early 2022, we have reason to speculate that part of this holding may come from crypto donations.

Tier Three: Bhutan and El Salvador as Firm HOLDERS

Bhutan and El Salvador in the third tier resemble "national-level holding players."

The former's BTC holdings primarily come from the mining income of the Bhutanese royal family, currently holding over 11,000 BTC, valued at $1.19 billion. It is worth mentioning that the Bhutanese royal family is not a steadfast "diamond hand"; they have sold small amounts of BTC multiple times, including selling 420 BTC at around $98,000 and 103 BTC at around $97,000 in December last year.

In contrast to Bhutan, El Salvador is more like a "firm believer in holding" — the country not only pioneered the implementation of a national strategic reserve plan for BTC but has also been consistently executing a plan to "buy one BTC daily"; additionally, there has been extra accumulation. The latest on-chain data shows that El Salvador's BTC holdings have grown to around 6,010 BTC, valued at $612 million.

Tier Four: Venezuela, Finland, and Georgia Hold Small Amounts

Countries in the fourth tier have seen their BTC holdings drop sharply to hundreds or even dozens of coins.

Venezuela, as a Latin American country, has long been plagued by inflation issues. There have been incidents where the Venezuelan president used cryptocurrency to evade U.S. sanctions, Venezuelan oil companies accelerated their embrace of the USDT stablecoin, and Venezuelan authorities seized over 11,000 Bitcoin mining machines and cut off power to several mining sites. In September last year, Venezuelan opposition leader María Corina Machado even proposed using Bitcoin as a national reserve asset. Currently, the source of their holdings is reported by Forbes magazine.

Finland's BTC holdings previously peaked at 1,981 BTC, valued at nearly €7.5 million, primarily sourced from assets seized by Finnish customs during drug raids before 2018. After the outbreak of the Russia-Ukraine war in 2022, Finnish authorities sold 1,891 BTC, valued at $47.35 million at the time, with an average selling price of only around $23,000.

Georgia's BTC holdings have yet to find a specific source. According to information from the BitcoinTreasuries website, we only know that these 66 BTC were purchased in September 2022 at an average price of $20,185, with specific details still a mystery.

Other Countries: Bulgaria and Germany as "Sell High, Always Profit"

In addition to the above countries, Bulgaria and Germany deserve special mention.

According to media reports, the former seized over 200,000 BTC from criminals. It is understood that a regional organization consisting of 12 member countries, including Bulgaria, announced that 213,519 BTC were seized that month, resulting in the arrest of 23 Bulgarian nationals. The arrests and subsequent asset seizures were conducted during an investigation into a customs fraud case. At that time, the price of BTC was approximately $15,524, with a total value of about $3.3 billion. According to a media report from 2022, this fund was ultimately sold off secretly by the Bulgarian government to Asian investors and sovereign wealth funds at an average price of about $16,900, totaling about $3.6 billion, with the funds raised primarily used to establish a new squadron for the Bulgarian military. Looking back, the Bulgarian government effectively "sold high" for around $17 billion, making it arguably "the most expensive price in history."

The German government serves as another example of "sell high, always profit," and compared to the "historical" actions of the Bulgarian government, it is undoubtedly a "fresher case."

In June 2024, the German government sold all 50,000 BTC seized from the pirated movie site Movie 2 k, with an average selling price of around $60,000, which at one point caused the price of BTC to drop significantly by about 15%, triggering panic in the market. After BTC gradually broke new highs to around $108,000 following Trump's successful election as the next U.S. president, in some respects, the German government undoubtedly became the "biggest clown in the cryptocurrency field" — its sell-off generated over $2.5 billion, with less than a six-month gap.

One cannot help but sigh that even a national entity may not be able to grasp "sudden wealth," truly a matter of timing and fate.

Summary: The Establishment of National Strategic Reserves for Bitcoin Will Take Time

Recent news indicates that Dennis Porter, co-founder of the Satoshi Action Fund advocating for the establishment of national strategic reserves for Bitcoin, stated that the 14th state in the U.S. is now preparing to introduce "strategic Bitcoin reserve" legislation. Meanwhile, Simon Gerovich, CEO of the Japanese listed company Metaplanet, which saw its stock price surge after emulating MicroStrategy's BTC reserve purchases, previously stated that if Trump adopts a Bitcoin strategic reserve, other Asian countries may follow suit.

Additionally, according to betting information from the well-known U.S. prediction platform Kalshi, the probability of Trump promoting the establishment of a Bitcoin reserve by January 2026 is currently reported at 53%, a significant drop from the peak of 67.6%.

At present, it seems that Trump still has many tests to pass before fulfilling his previous promises made at the Nashville Bitcoin conference. However, regardless, the continuous inflow of funds into BTC spot ETFs has become a foregone conclusion, and the process of mainstreaming cryptocurrency has gradually accelerated. The year 2025 is bound to be an important year for the increase in cryptocurrency penetration.

Will the U.S. BTC holdings further increase? Will the U.S. Bitcoin strategic reserve be established soon? What will the specific operational model be?

Only time will tell us the final answer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。