The Bybit and Block Scholes analysis shared with Bitcoin.com News observes that open interest in bitcoin (BTC) and ethereum (ETH) perpetual swaps maintained equilibrium throughout late December, steering clear of the elevated levels observed earlier that month. Analysts say this equilibrium indicates a restrained reliance on perpetual contracts for hedging expiring options, a factor contributing to diminished market volatility.

The report mentions seasonal lulls in trading activity during the holidays coincided with a significant decline in realized volatility, reaching its nadir for December. Surprisingly, the December bitcoin options expiration did not ignite the anticipated market upheaval. Instead, Bybit’s and Block Scholes’ findings show realized volatility settled at the lower end of its spectrum.

The collaborative crypto derivatives report highlights implied volatility term structure for bitcoin displayed a pronounced incline, with long-dated options reaching an implied volatility of approximately 57%, while one-week at-the-money options lagged by five percentage points. Block Scholes and Bybit note that a balanced call-to-put ratio further reflects the market’s cautiously reserved sentiment among traders.

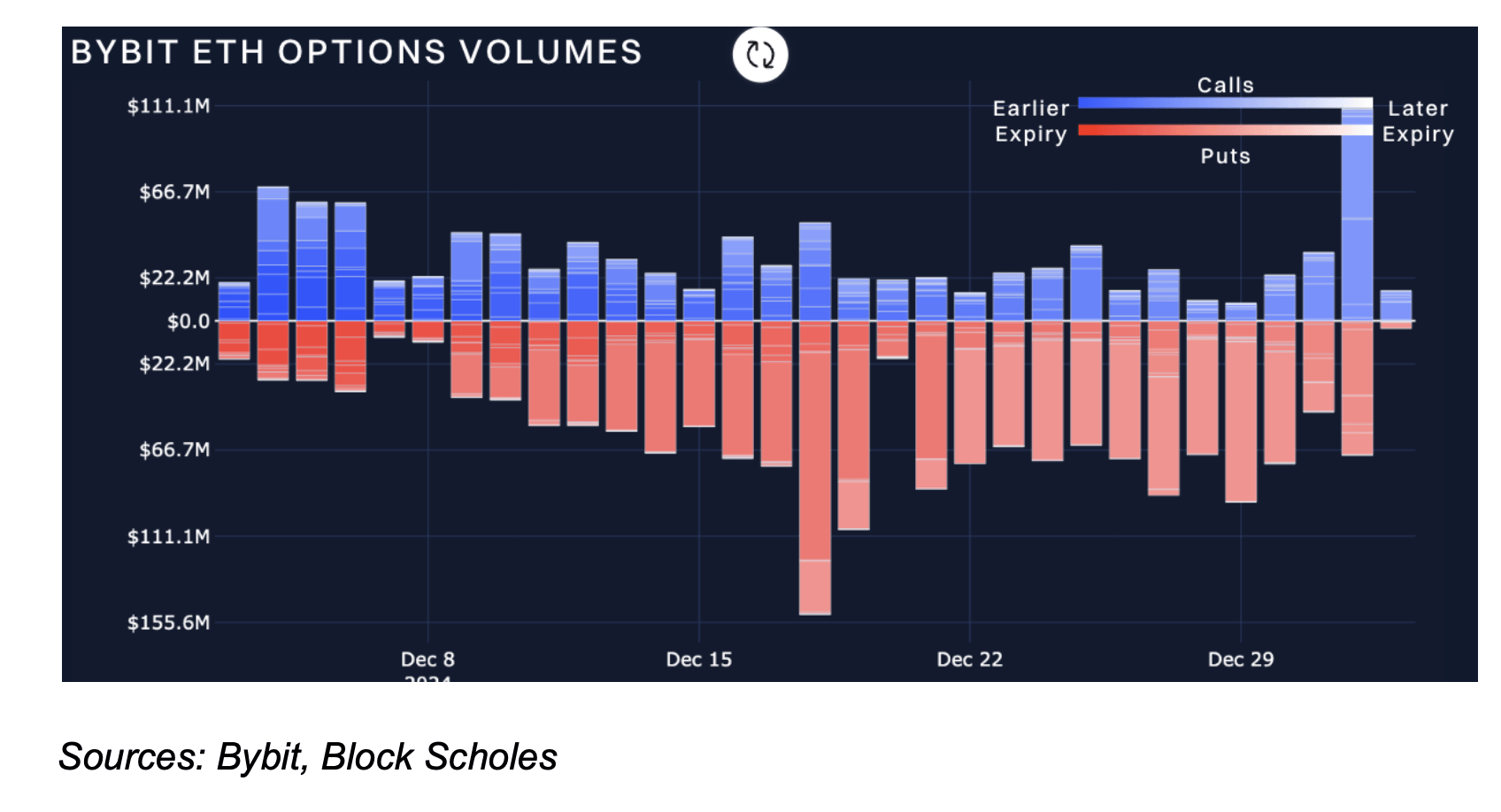

For ether, the options market exhibited composure, even in the wake of substantial December expirations. As realized volatility softened with the turn of the year, ethereum’s implied volatility term structure briefly steepened before reverting to a flatter formation, deviating from bitcoin’s consistently upward-sloping pattern.

This divergence, the study details, hints at potential short-term variances in ETH spot prices. Early 2025 saw an uptick in interest for ETH call options, signaling a wave of optimism in the market’s outlook. The observed dynamics in BTC and ETH derivatives markets highlight the relationship between seasonal trading patterns and evolving market strategies.

As traders navigate a shifting terrain of volatility and sentiment in 2025, the balance between risk management and speculative optimism becomes increasingly critical. These trends exemplify the adaptability of crypto markets during the current bull run, suggesting nuanced strategies may shape the next phase of growth and maturity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。