Macroeconomic Interpretation: With Trump set to take office again as President of the United States on January 20, 2025, global financial markets are facing a new round of policy uncertainty and challenges. We will delve into the new trends in monetary policy from major global central banks under the "Trump 2.0" era and explore their potential impact on the cryptocurrency market. By comparing and analyzing the monetary policy directions of the United States, Europe, Japan, and emerging economies, we will assess the changes in the global economic landscape under Trump's policy agenda, as well as the opportunities and challenges it brings to the crypto market.

Trump's re-election marks another significant adjustment in the global political and economic landscape. His post-election policy agenda, which includes substantial tax cuts domestically, increased tariffs internationally, large-scale deportations of immigrants, and loosening regulations on cryptocurrencies, will have far-reaching effects on the global economy and financial markets. Against this backdrop, the monetary policies of major global central banks are also showing new trends and differentiation.

II. New Trends in Monetary Policy of Major Global Central Banks.

(A) United States: Interest Rate Cuts May Face Variables.

After Trump's re-election, the path of the Federal Reserve's monetary policy may encounter more variables. Although the Fed has cut interest rates multiple times in 2024, the inflationary pressures that Trump may bring could lead to a more cautious approach to rate cuts. Trump's significant tax cut plans, increased tariffs, and large-scale deportations may further stimulate domestic demand and elevate inflation levels. This presents more challenges for the Fed in balancing economic growth and inflation levels. In the future, adjustments to the Fed's monetary policy will rely more on economic data performance and policy assessment results, which may introduce variables into the interest rate cut path.

(B) Europe: Rate Cuts Expected to Exceed the U.S.

Compared to the Federal Reserve, the European Central Bank's rate cuts in 2025 are expected to be more pronounced. The Eurozone continues to face economic weakness, and Trump's trade disputes may further harm the European economy. Therefore, the European Central Bank will need to continue cutting rates to stimulate economic growth and alleviate inflationary pressures. It is anticipated that the European Central Bank's rate cuts in 2025 will be significantly higher than those of the Federal Reserve, potentially widening the interest rate differential between the U.S. and Europe.

(C) Japan: Dovish Stance Likely to Persist.

Following Trump's re-election, the Bank of Japan's dovish stance is unlikely to change. Although the Japanese economy is gradually recovering, core inflation is only rising at a moderate pace, which keeps the Bank of Japan cautious regarding interest rate hikes. It is expected that the Bank of Japan is unlikely to take further measures at least until mid-2025, and any rate hike will be very gradual.

(D) Emerging Economies: Increasing Divergence in Monetary Policy.

Monetary policies in emerging economies are expected to show a more divergent trend following Trump's re-election. Some economies may face challenges such as export obstacles and slowing economic growth due to Trump's trade policies, prompting them to adopt rate cuts to stimulate growth. Conversely, other economies may have to maintain or tighten monetary policies due to rising inflationary pressures.

III. Impact of "Trump 2.0" on the Cryptocurrency Market

(A) Policy Easing Brings Market Opportunities.

Trump has explicitly stated in his policy agenda that he will loosen regulations on cryptocurrencies, which may bring unprecedented development opportunities to the cryptocurrency market. On one hand, easing regulations will lower compliance costs in the cryptocurrency market, promoting innovation and development; on the other hand, Trump's plans to explore using digital currencies to repay national debt will further enhance the status and influence of cryptocurrencies in the global financial system.

(B) Inflationary Pressures Affect Market Trends.

However, Trump's tax cuts and increased tariffs may also exacerbate inflationary pressures in the U.S., negatively impacting the cryptocurrency market's trends. Rising inflation will increase investors' demand for safe-haven assets, potentially leading to a shift of funds from high-risk assets (such as cryptocurrencies) to low-risk assets (such as gold and bonds). This will intensify the volatility of the cryptocurrency market and may suppress its long-term upward trend.

(C) Geopolitical Risks Increase Market Uncertainty.

The uncertainty in Trump's foreign policy may also pose risks to the cryptocurrency market. His proposals to end the Russia-Ukraine and Israel-Palestine conflicts, as well as pressuring NATO allies to increase military spending, could escalate geopolitical tensions. This will increase volatility in global financial markets and may impact the cryptocurrency market.

IV. Conclusion and Outlook.

In the "Trump 2.0" era, the monetary policies of major global central banks are showing new trends and differentiation. In the face of the uncertainties and challenges brought by Trump's policy agenda, investors should closely monitor changes in the global economy and financial markets, as well as dynamics in the cryptocurrency market. In investment decisions, it is recommended that investors reasonably allocate their asset portfolios to cope with potential risks. At the same time, policymakers should enhance communication and coordination to jointly maintain the stability and development of global financial markets.

In the future, as the global economy continues to recover and financial markets develop, the cryptocurrency market is expected to achieve more robust growth driven by policy easing and technological innovation. However, investors must remain vigilant about the potential risks and challenges posed by Trump's policy agenda, as well as the impact of geopolitical situations on financial markets. In light of the differentiation trend in global central bank monetary policies, investors should pay more attention to risk management and the formulation and implementation of asset allocation strategies.

BTC Data Analysis:

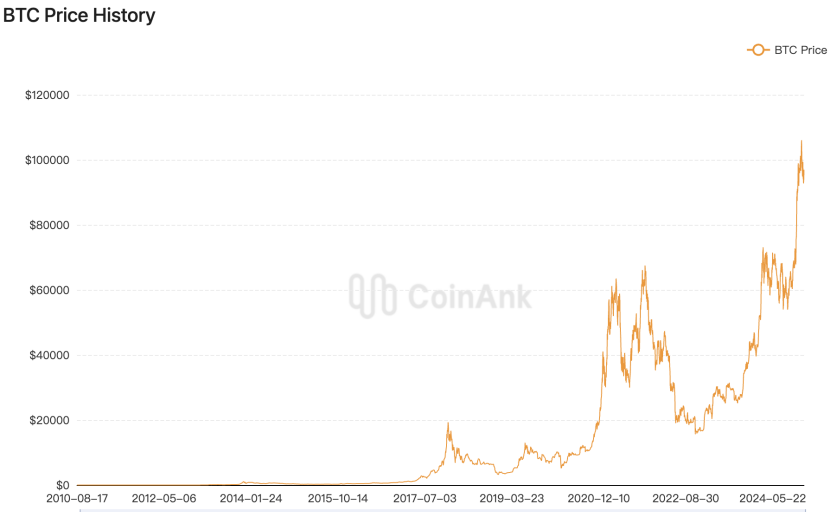

Coinank data, historical prices of Bitcoin.

Happy 16th birthday to BTC, marking the 16th anniversary of the Bitcoin genesis block!

If we consider the release of the Bitcoin white paper on October 31, 2018, as the day Bitcoin was conceived, then I believe the mining of the Bitcoin genesis block by Satoshi Nakamoto is BTC's birthday.

The Bitcoin genesis block was mined on January 3, 2009 (UTC+8 time January 4, 2009, 02:15:05) by Satoshi Nakamoto, with a block reward of 50 BTC. As of today, it has been 16 years, and the total Bitcoin block height has reached 877630.

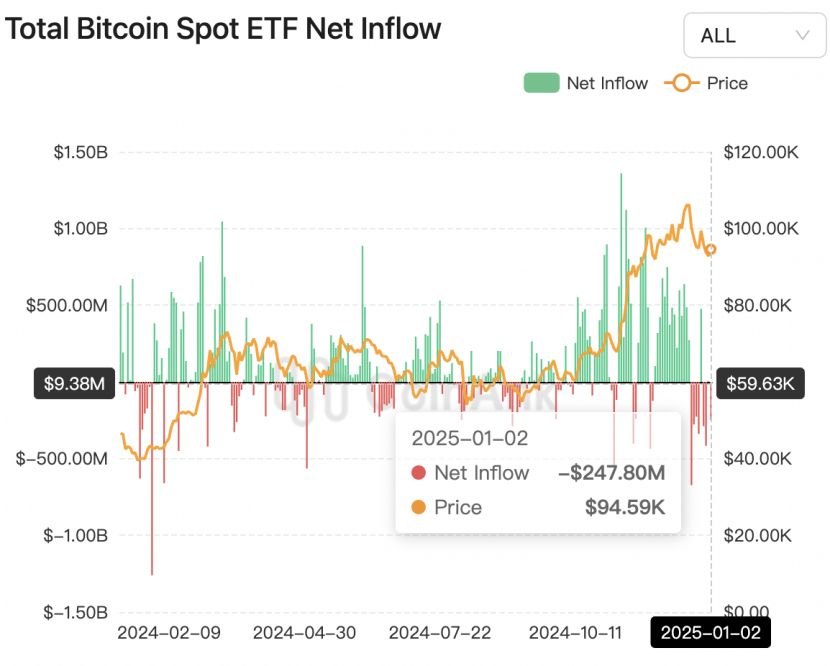

Data shows that yesterday, the U.S. spot Bitcoin ETF experienced a net outflow of $248 million.

Since December 19, 2024, the ETF has shown a trend of net outflows, with only two trading days during this period experiencing net inflows, one of which had an inflow of only $5.3 million, which is almost negligible.

I believe this may be related to two factors: first, the U.S. stock market had previously formed a temporary top, and second, the #BTC price had peaked at over $108,350 the day before.

These two factors may have affected market sentiment and confidence, leading investors to worry about market volatility, especially after Bitcoin's significant price increase, which may have prompted them to take profits at high levels and anticipate a short-term market adjustment, resulting in capital outflows.

It is worth noting that despite the outflows from the ETF, the overall fundamentals of the Bitcoin market remain strong, including a net inflow of $3.566 billion into Bitcoin ETFs in 2024, indicating that long-term investors still have a strong interest in Bitcoin. This short-term capital outflow may be part of a natural market adjustment, while the long-term trend still requires attention to the fundamentals of Bitcoin and changes in market sentiment, such as MicroStrategy's increased holdings of BTC and Bitcoin's strategic reserves.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。