Table of Contents:

BTC Contract Liquidation Map, Intuitive Reflection of Risk Control Position;

Analysis of Altcoin Index Trading;

Token RSI Overbought and Oversold Status.

Hotspot Interpretation: BTC and S&P 500 Correlation Decreases, Could Reach Historical Highs?

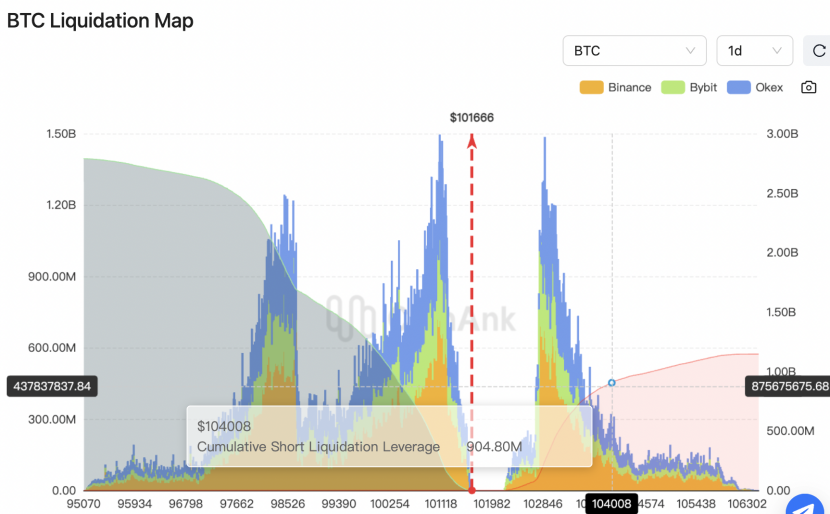

6. BTC Contract Liquidation Map, Intuitive Reflection of Main Risk Control Position

According to the latest data from CoinAnk's contract liquidation map:

If the BTC price breaks above $104,000, there will be $904.8 million worth of short positions liquidated;

If the BTC price falls below $98,200, there will be $2.144 billion worth of long positions liquidated.

These data intuitively reflect the risk control positions of major funds and can also serve as a reference for trading or intervention.

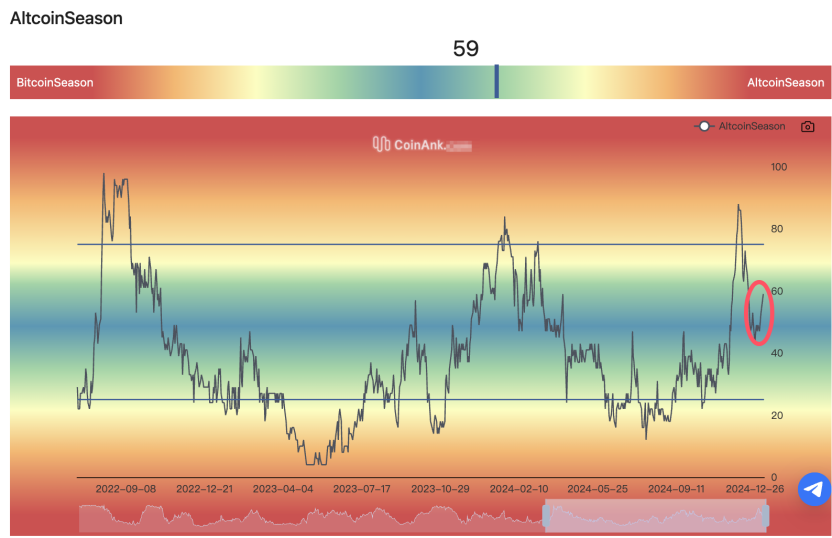

7. Analysis of Altcoin Index Trading.

According to CoinAnk indicators, the current value of the altcoin index is around 59, with a recent low of 43, oscillating below 50 for more than ten days. Since January 1, there has been a noticeable rebound, breaking through the 50 equilibrium position and showing an upward trend, which is also evident in the performance of altcoins, with a certain degree of rebound recently.

We previously analyzed the altcoin index, generally noting that when the altcoin index is below 25, it is a good opportunity for entry. If you are worried about missing the market, you can start to gradually enter after it falls below the midpoint of 50, with positions built in a pyramid style. If entering with light positions below 50, based on the overall increase of the top fifty altcoins during this phase, it is slightly greater than BTC, making it a relatively good profit.

8. Token RSI Overbought and Oversold Status:

According to the CoinAnk RSI indicator filter, on the daily level, HIVE, SPX, and AIXBT are currently in or near the overbought zone due to recent price increases. If they rise to critical points or resistance levels, they may face a correction in the future; PHA, VANA, and others, after recent price declines, are in or near the oversold zone. If they fall to important support areas below, they may face a rebound in the future.

Of course, overbought and oversold indicators lean towards a left-side trading mindset, which is a subjective contrarian thinking of guessing bottoms and escaping tops, while the Matthew effect and right-side trading mindset are completely opposite, as the strong tend to get stronger and the weak tend to get weaker. An objective trend-following trading mindset may allow overbought and oversold tokens to continue their recent strong or weak trends.

9. Hotspot Interpretation: BTC and S&P 500 Correlation Decreases, Could Reach Historical Highs?

Since Trump was elected as the 47th President of the United States, the correlation between the cryptocurrency and stock markets has been relatively high. However, we are now beginning to see Bitcoin's performance leading the S&P 500 index (compared to their normal volatility range). Over the past three years, most of the community has viewed cryptocurrencies as a "high-leverage tech stock." However, signs from early 2025 indicate that Bitcoin may break free from the conventional linkage with the global stock market. Historically, when the correlation between the crypto market and the stock market is low or even non-existent, it often heralds the most significant bull markets. If Bitcoin and other altcoins can continue to grow in January this year without relying on the S&P 500 index, it will be a strong signal indicating a high likelihood of reaching new historical highs.

We believe that the correlation between Bitcoin and the S&P 500 index changed in early 2025, with Bitcoin beginning to show a trend of leading the traditional stock market. This phenomenon may be related to Bitcoin's gradual maturation and the formation of independent market dynamics. Historically, periods of low correlation between the crypto market and the stock market are often accompanied by significant bull markets for Bitcoin, which may suggest that Bitcoin is forming its own value storage and investment case, rather than merely representing a high-risk tech stock. There are many predictions in the market that Bitcoin's price will rise higher in 2025. These predictions, along with the continued growth of Bitcoin ETFs and the warming market sentiment, indicate that investor confidence in Bitcoin remains strong. If Bitcoin can continue to grow independently of the S&P 500 index, it will be a strong signal of market recognition of its long-term potential, possibly heralding the realization of new historical highs.

Written by: Lao Li Mortar

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。