Author: ChainCatcher

Important Data Summary:

- 81.3% of individual investors use RootData for investment analysis, making it the most popular data tool

- 88.4% of individual investors rely on X (formerly Twitter) for industry information

- 72.3% of individual investors are most concerned about token distribution and funding history

- 23.2% of individual investors believe the BTC ecosystem is currently the most undervalued sector

- 54.2% of individual investors believe we are currently in the mid-stage of a bull market

- 41.9% of individual investors plan to increase their investments in the next three months

Analysis of the Current Situation of Cryptocurrency Individual Investors

As the BTC price fluctuates at a high level, there is a significant divergence in market sentiment. During this critical period, understanding the investment behavior and market judgments of individual investors is particularly important. As a key participant group in the Web3 market, the decision-making tendencies of individual investors often reflect the overall market sentiment and future direction. To this end, ChainCatcher conducted a comprehensive survey of cryptocurrency individual investors, collecting 1,570 responses, providing important references for understanding current market investment behavior.

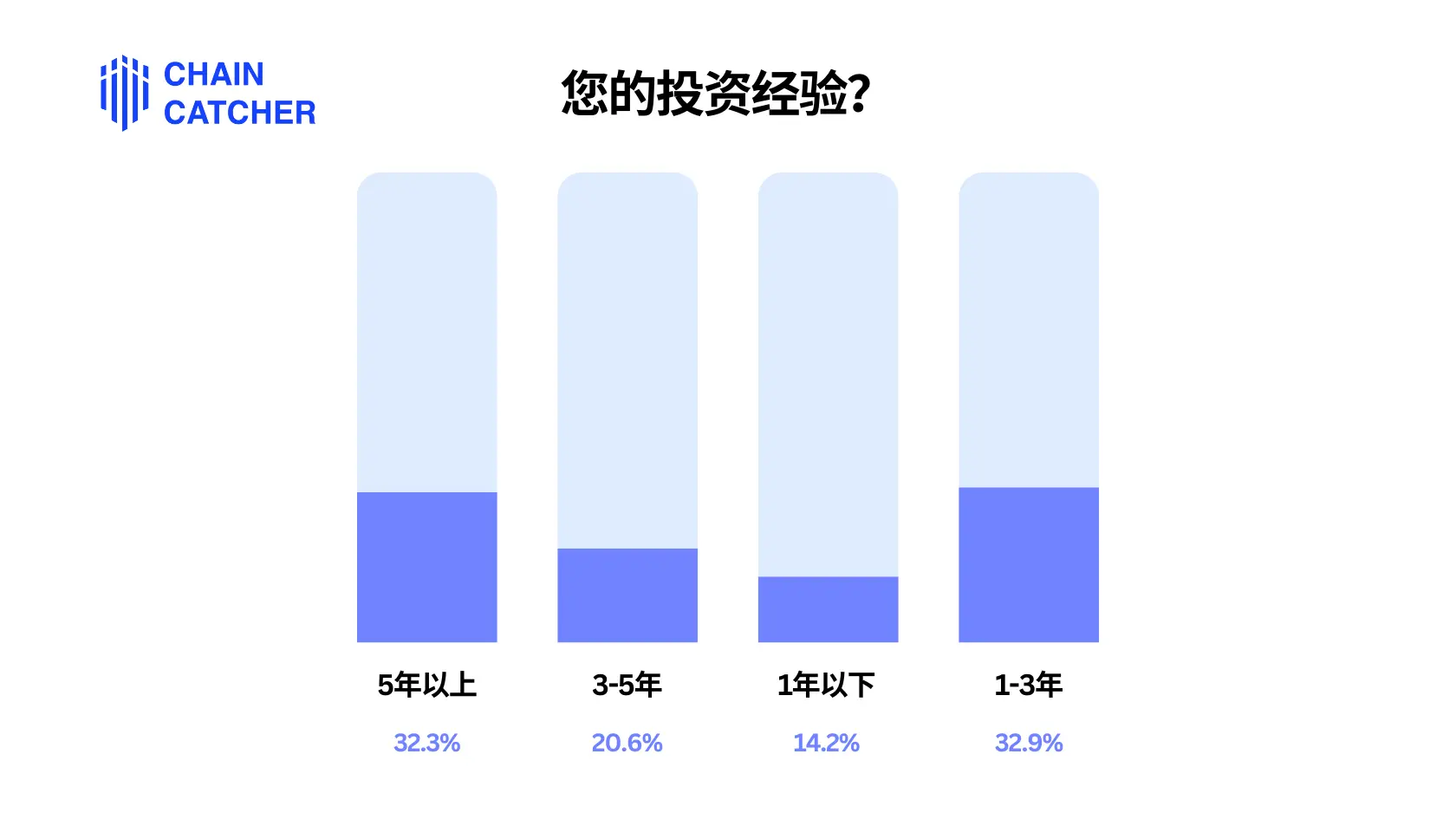

1. Investment Experience Distribution

The survey shows that 32.3% of individual investors have over 5 years of experience, 32.9% have 1-3 years of experience, 20.6% have 3-5 years of experience, and 14.2% have less than 1 year of experience.

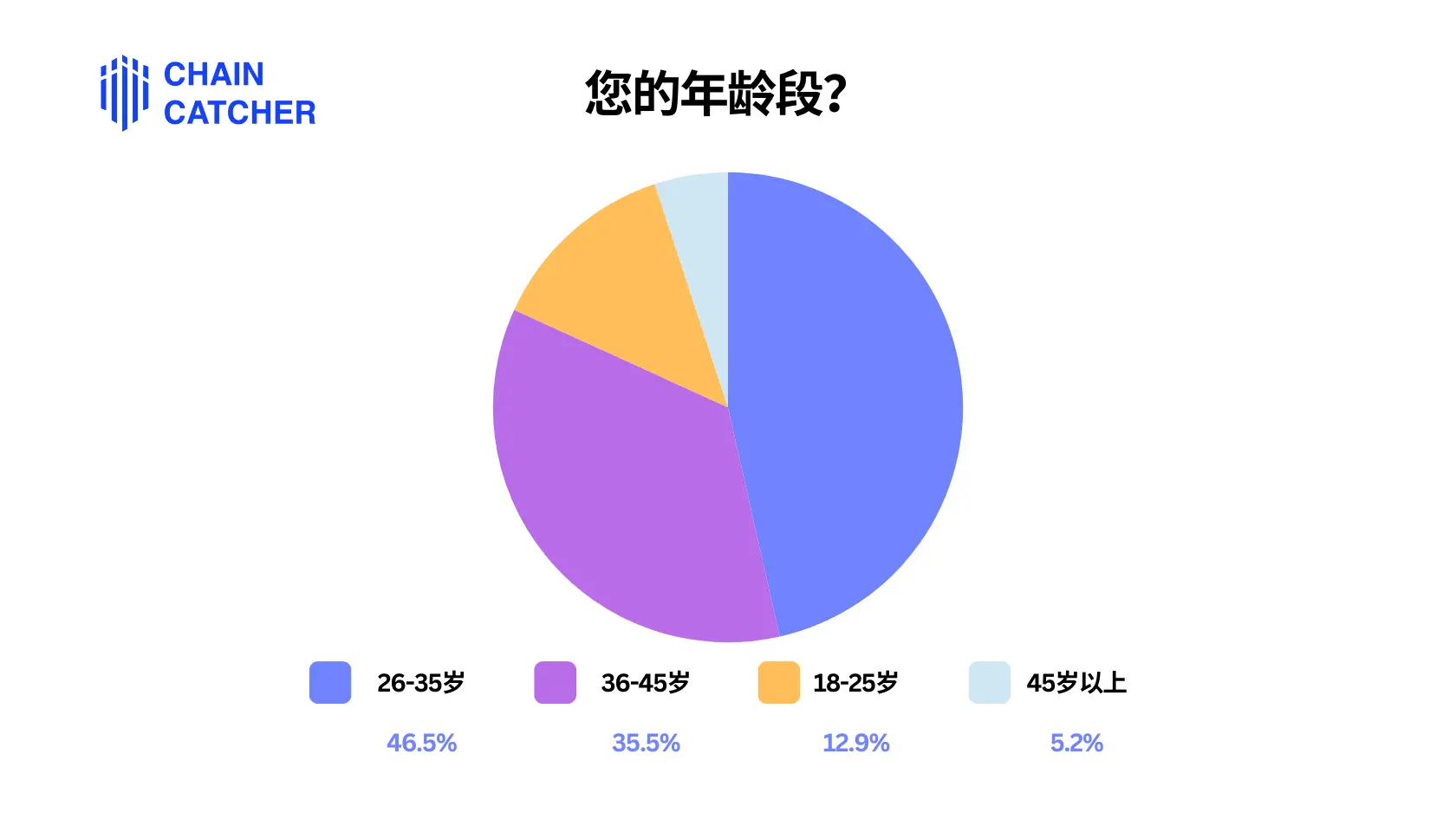

2. Age Distribution

Individuals aged 26-35 make up the largest proportion at 46.5%; followed by those aged 36-45 (35.5%) and 18-25 (12.9%), with those over 45 accounting for 5.2%.

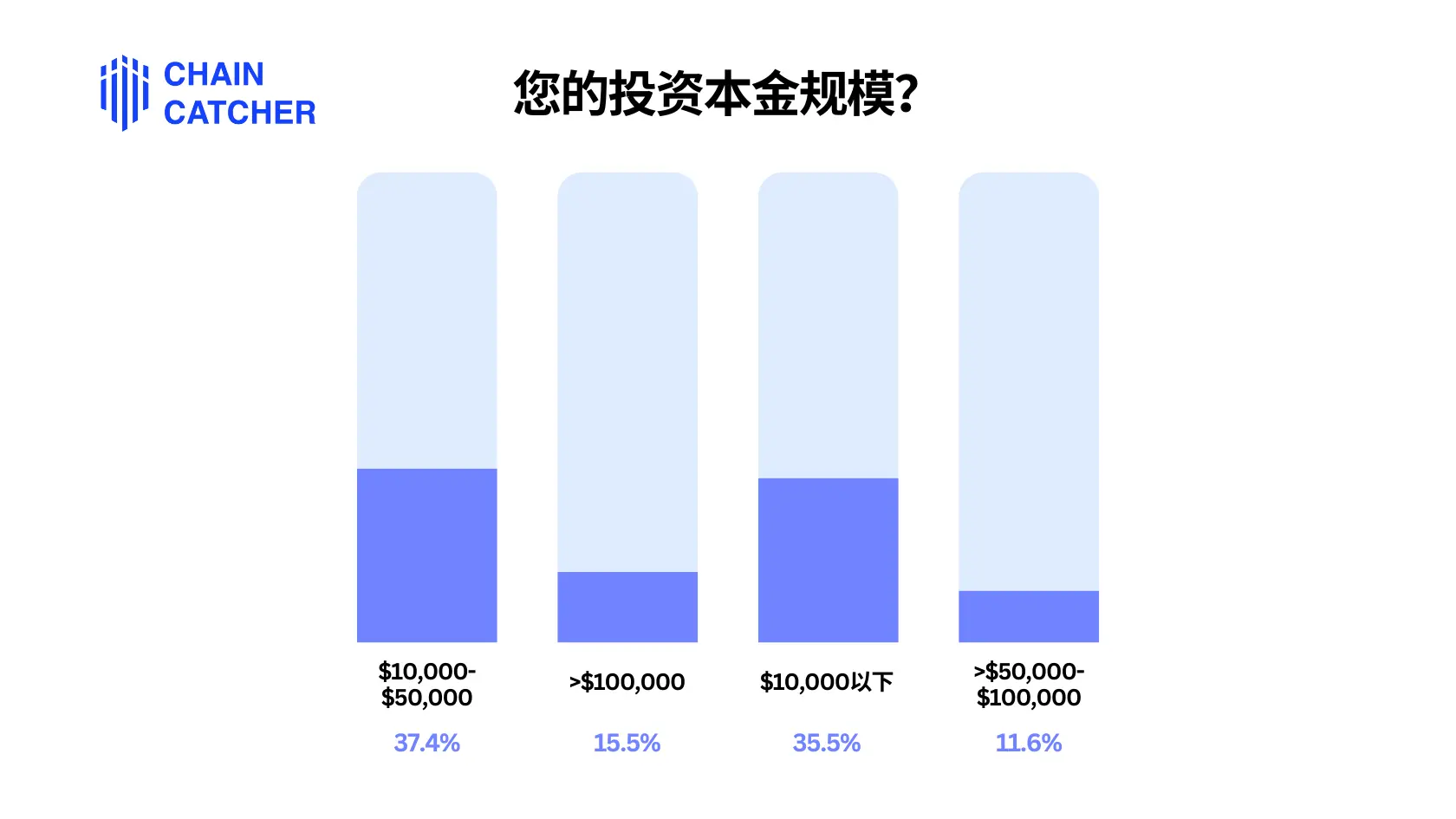

3. Investment Scale Distribution

37.4% of individual investors have an investment scale between $10,000 and $50,000, 35.5% are below $10,000, 15.5% exceed $100,000, and 11.6% are between $50,000 and $100,000.

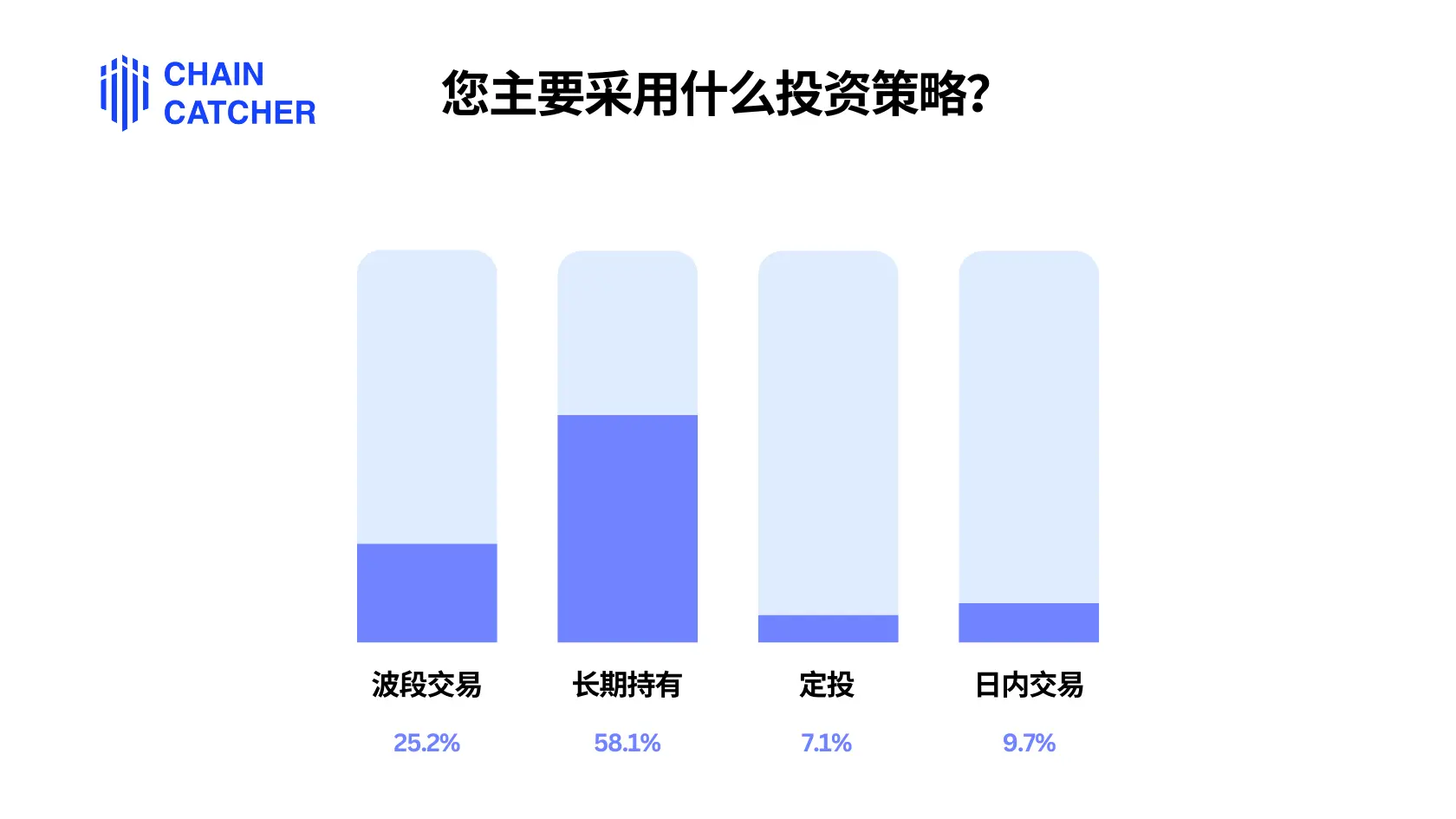

4. Investment Strategy

58.1% of individual investors choose a long-term holding strategy, 25.2% prefer swing trading, 9.7% engage in day trading, and 7.1% adopt a dollar-cost averaging strategy.

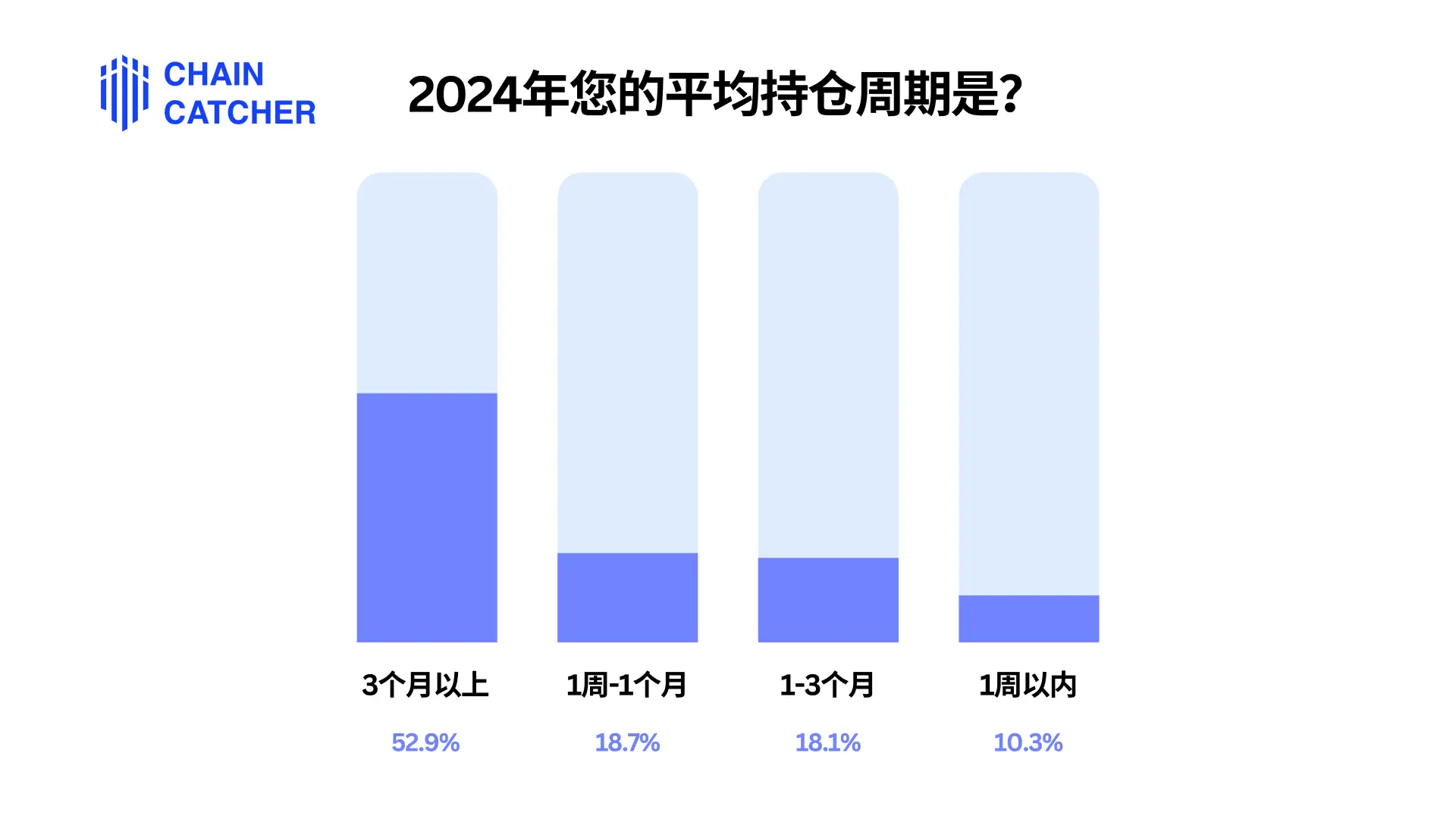

5. Holding Period

52.9% of individual investors have an average holding period of over 3 months, 18.7% hold for 1 week to 1 month, 18.1% for 1-3 months, and 10.3% for less than 1 week.

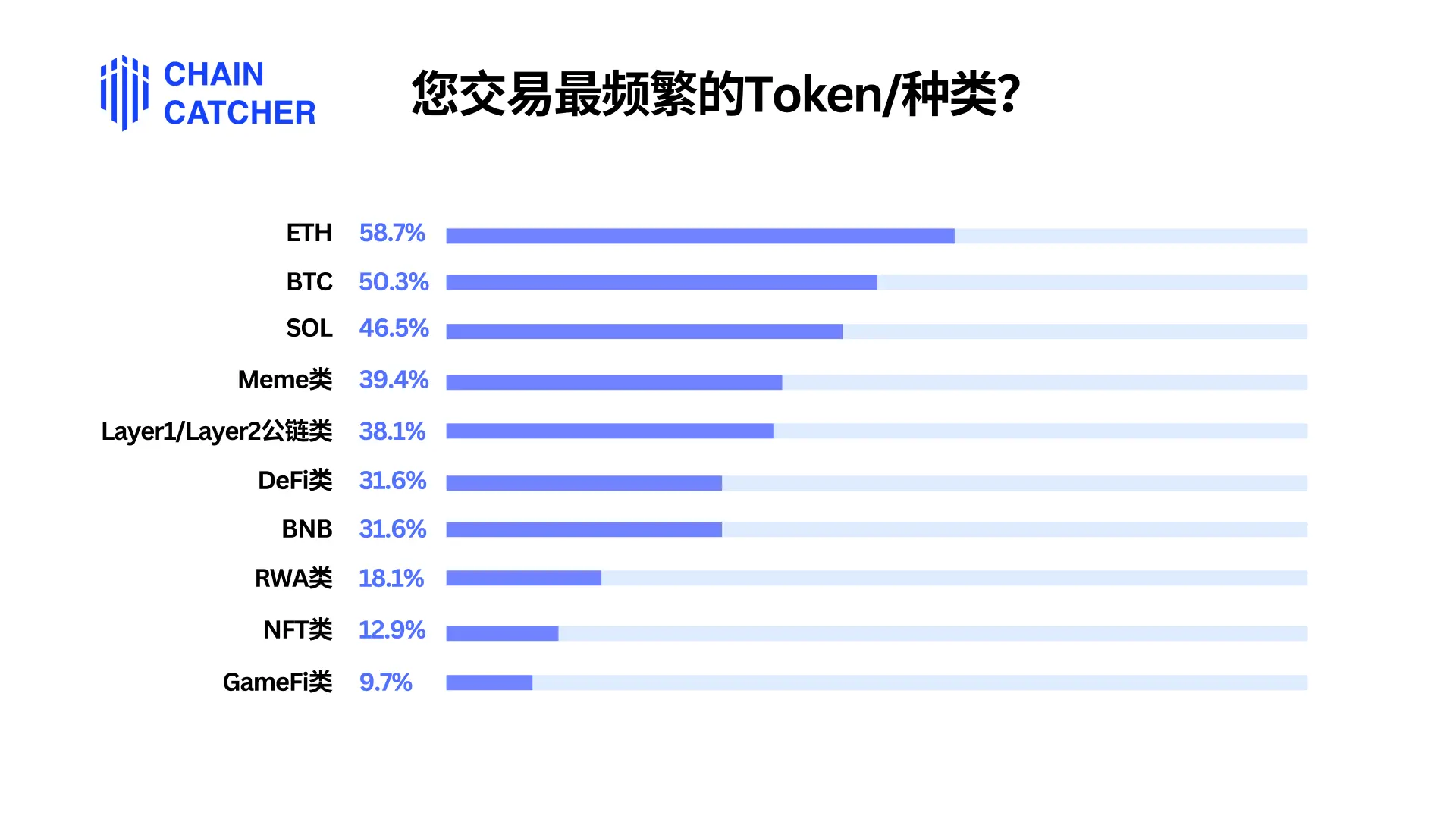

6. Trading Preferences

ETH and BTC remain the most favored trading targets for individual investors, with 58.7% and 50.3% frequently trading them, respectively. SOL (46.5%), Meme tokens (39.4%), and Layer1/Layer2 public chains (38.1%) also received significant attention.

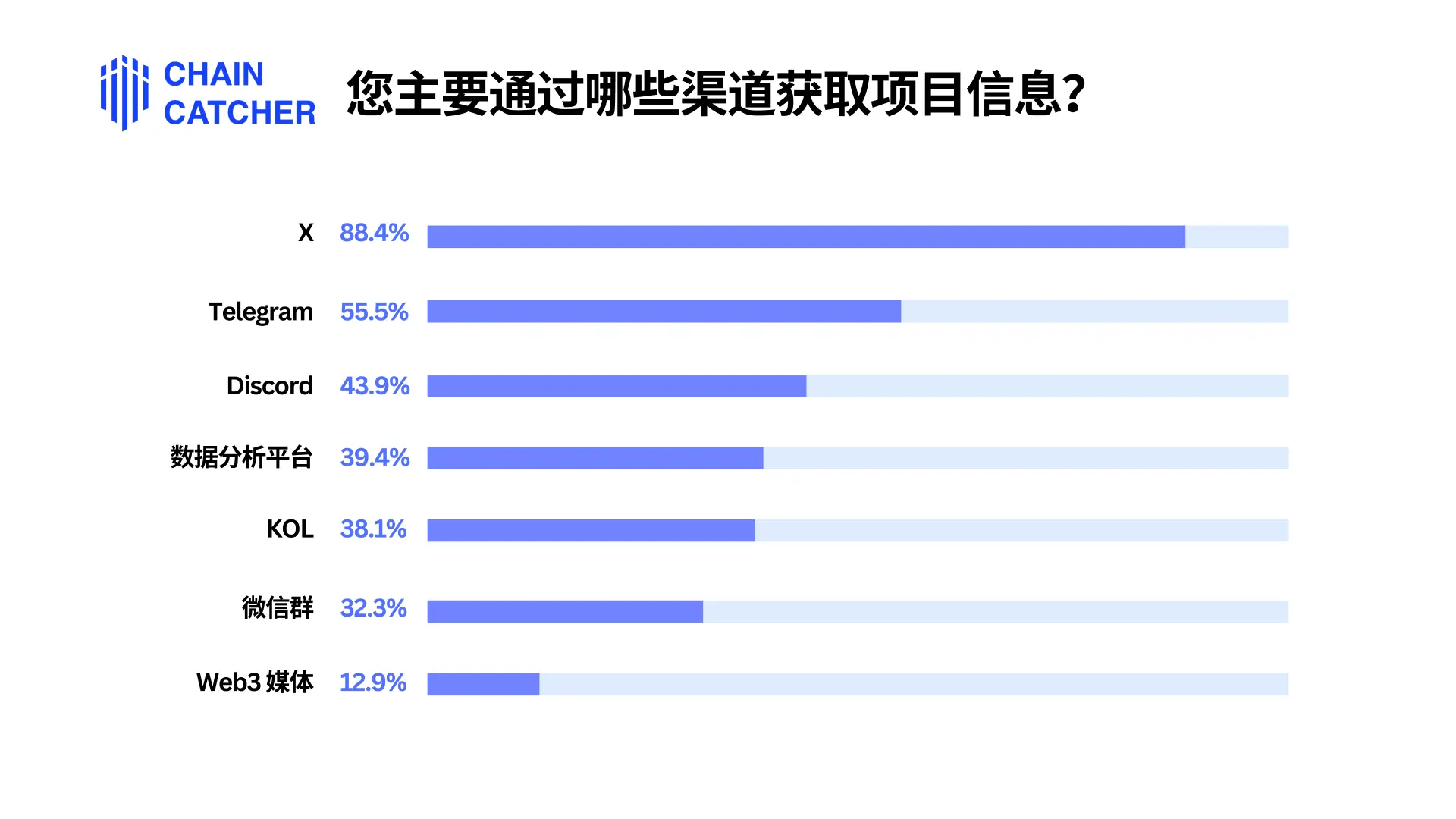

7. Information Acquisition Channels

The X platform, with a usage rate of 88.4%, is the primary source of information, followed by Telegram (55.5%), Web3 media (54.8%), and Discord (43.9%).

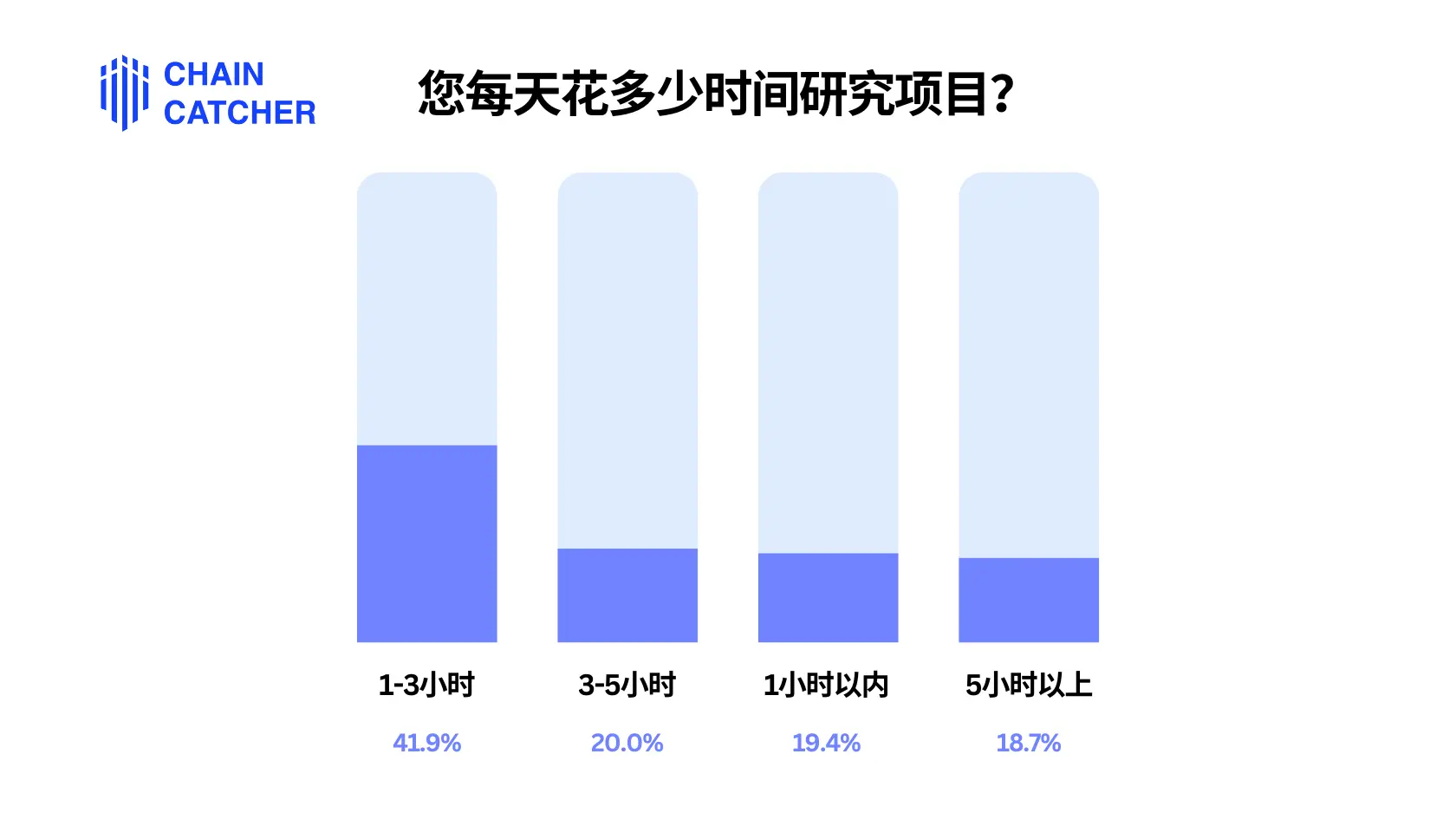

8. Research Time Investment

41.9% of individual investors spend 1-3 hours daily researching projects, 20% invest 3-5 hours, 19.4% spend less than 1 hour, and 18.7% exceed 5 hours.

9. Investment Decision Factors

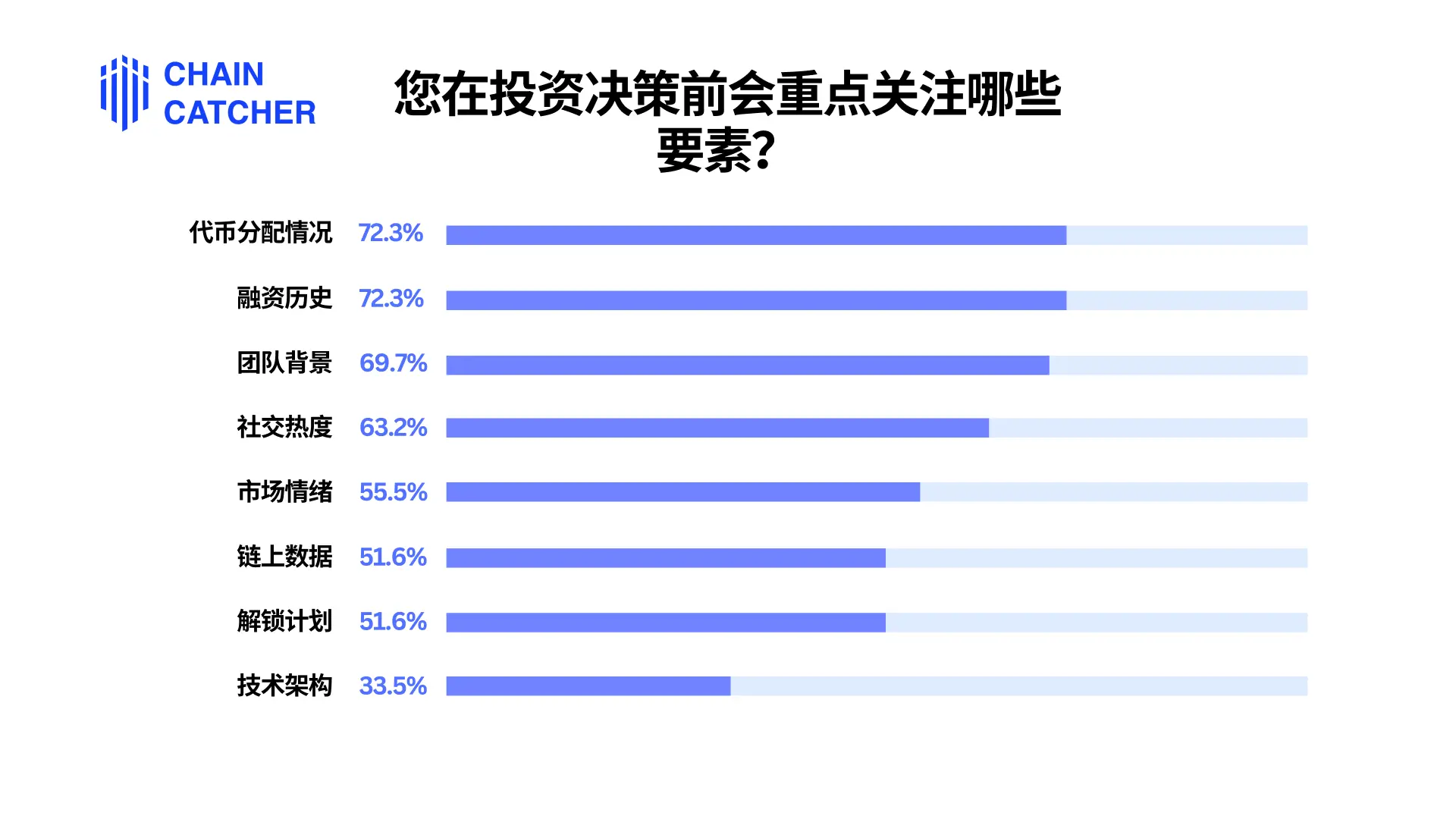

Token distribution and funding history, both at 72.3%, rank as the top concerns for individual investors, followed by team background (69.7%), social media popularity (63.2%), and market sentiment (55.5%). On-chain data and unlocking plans each account for 51.6%, while technical architecture is at 33.5%.

10. Data Analysis Tools

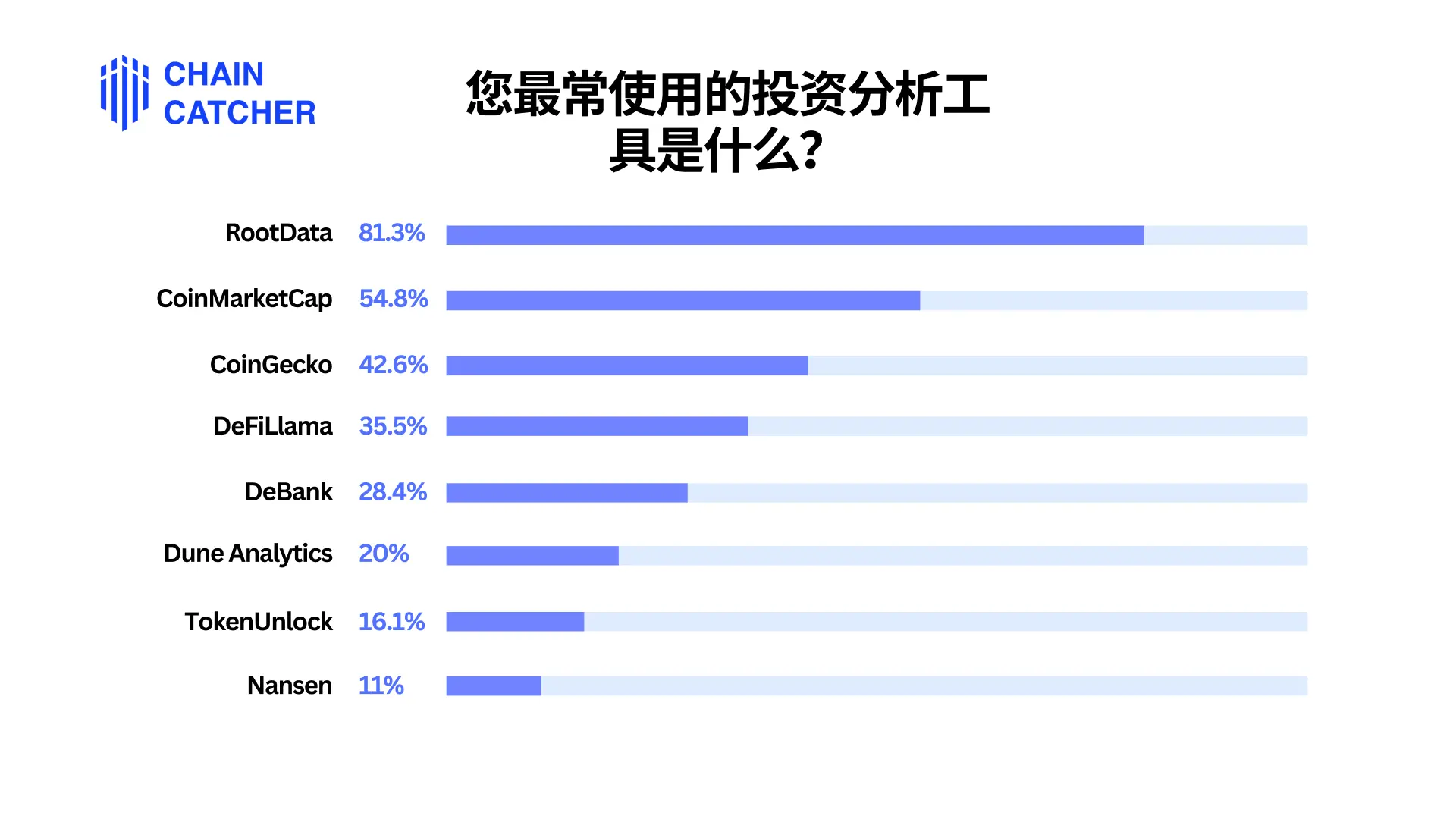

RootData, with an 81.3% usage rate, is the most trusted data analysis platform among individual investors. CoinMarketCap (54.8%) and CoinGecko (42.6%) rank second and third, respectively. DeFiLlama (35.5%) and DeBank (28.4%) also have high usage rates.

11. Purpose of Tool Usage

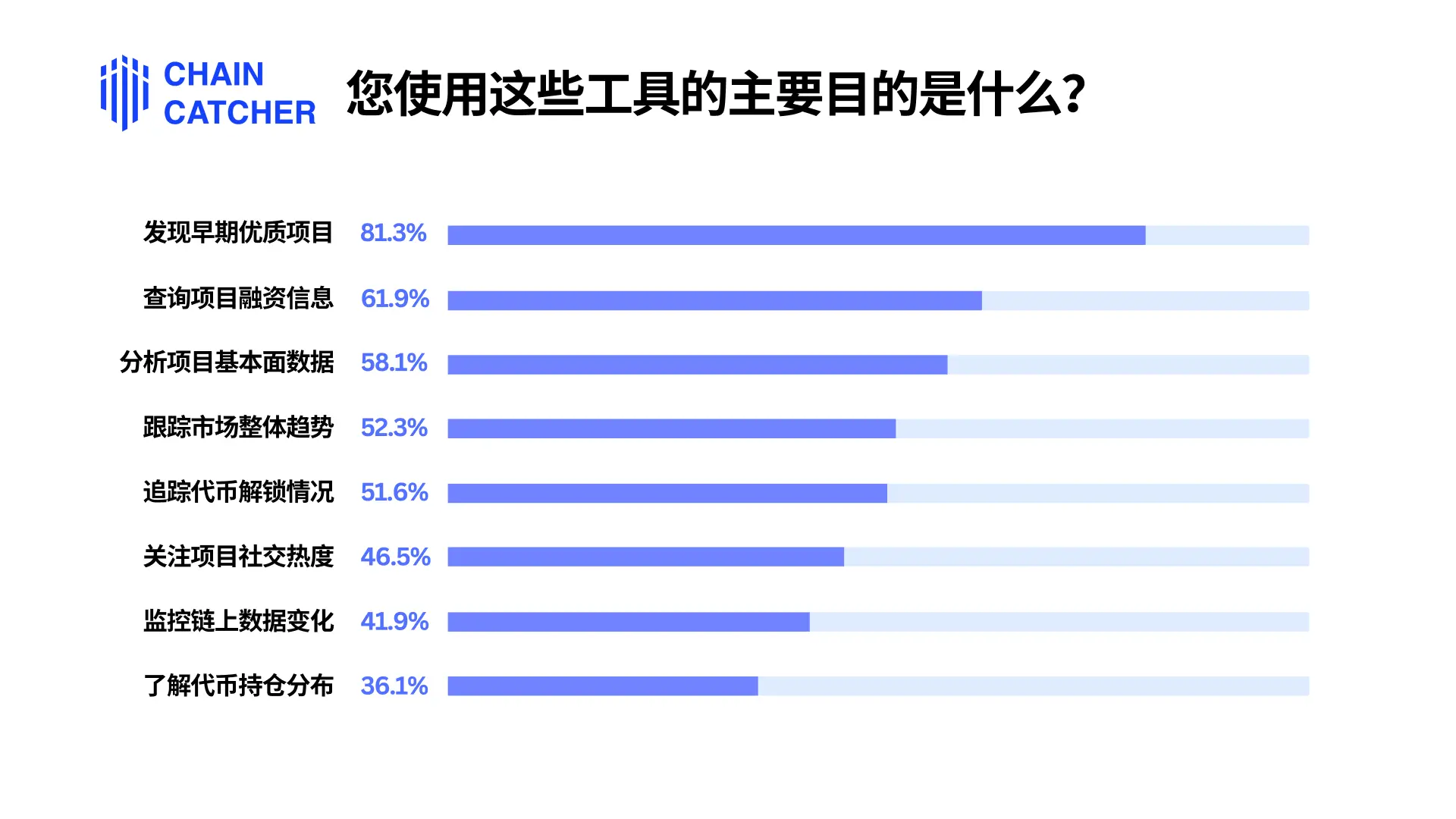

81.3% of individual investors use these tools to discover early-stage quality projects, 61.9% for checking project funding information, 58.1% for analyzing project fundamentals, 52.3% for tracking overall market trends, and 51.6% for monitoring token unlocks.

12. Key Data Analysis Features

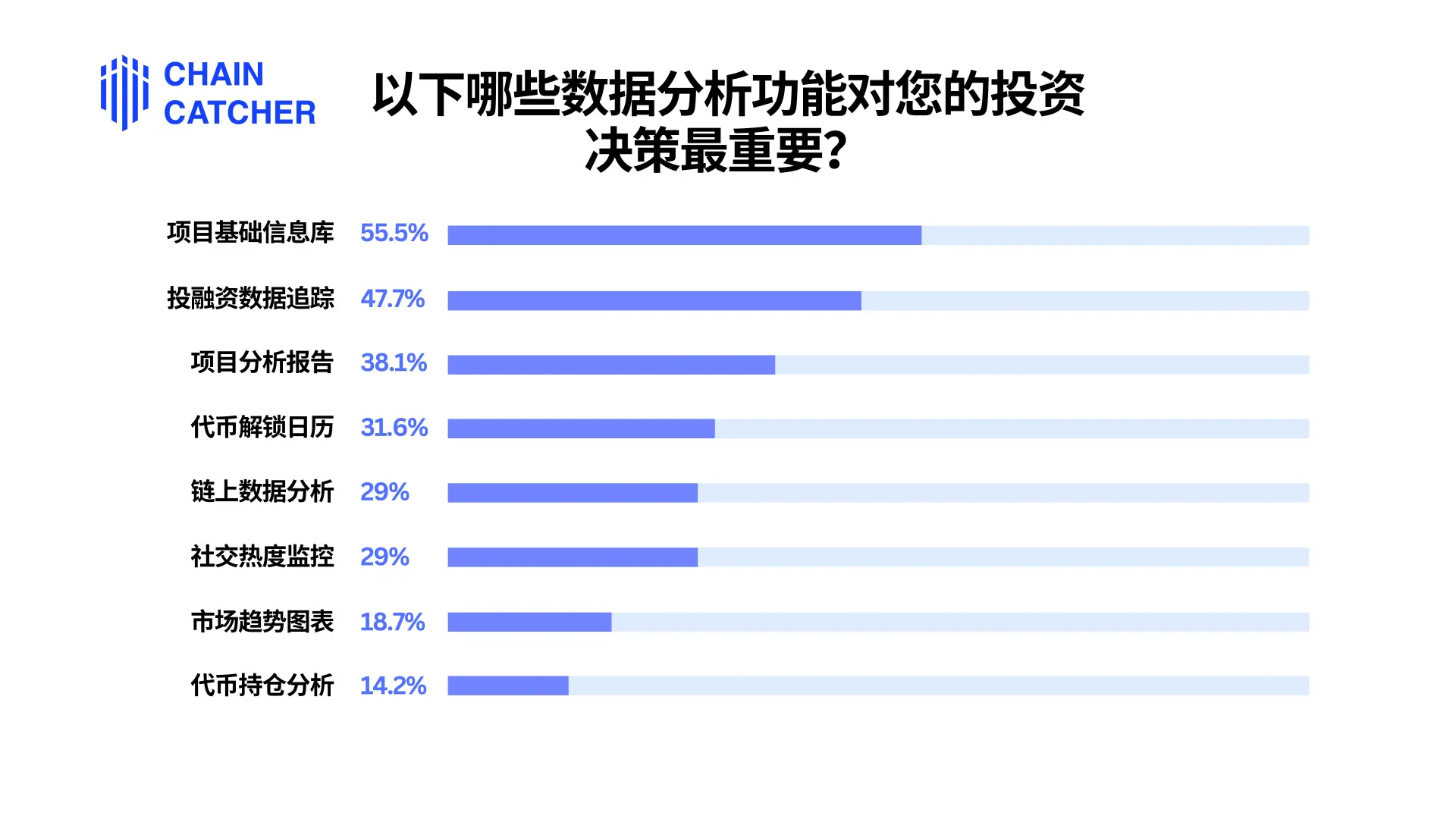

The project information database (55.5%) is considered the most important data analysis feature by individual investors, followed by investment and financing data tracking (47.7%), project analysis reports (38.1%), and token unlock calendars (31.6%). On-chain data analysis and social media popularity monitoring each account for 29%.

13. Profit Situation Analysis

BTC, SUI, SOL, PEPE, and DOGE are the tokens that individual investors mentioned as having the highest profits this year.

14. Loss Situation Analysis

ETH, SATS, BNB, and others are the tokens that individual investors reported significant losses, particularly some Meme tokens that caused substantial losses.

15. Trading Platform Preferences

Binance and OKX are the trading platforms where individual investors made the most profits, followed by Bitget and Dexscreener. Large centralized exchanges remain the primary trading venues for individual investors. Additionally, due to the popularity of the Meme sector this year, Dexscreener has become the main venue for individual investors to speculate on Meme tokens.

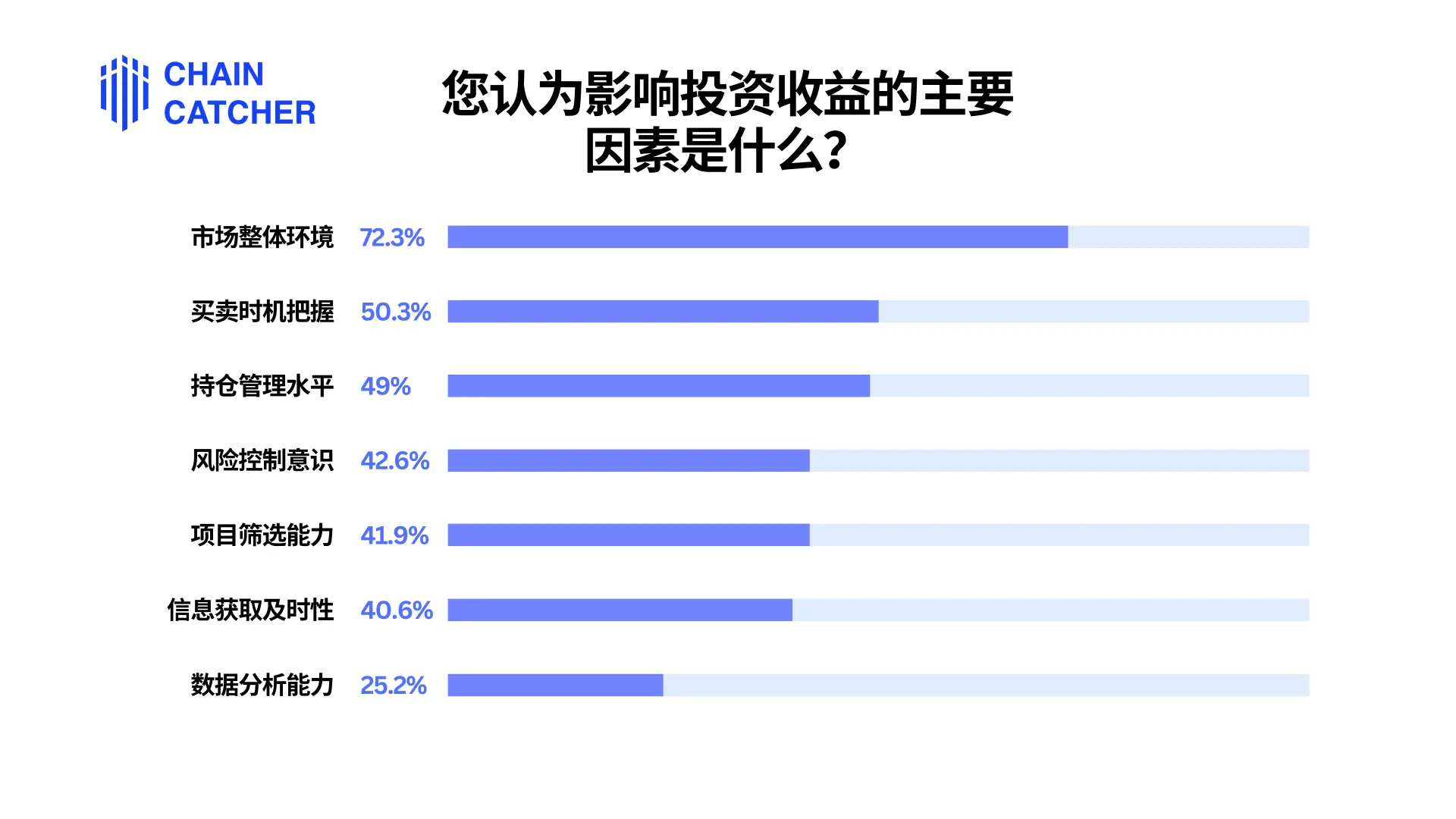

16. Factors Affecting Investment Returns

72.3% of individual investors believe that the overall market environment is the most significant factor affecting returns, followed by timing of trades (50.3%), level of position management (49%), risk control awareness (42.6%), and project selection ability (41.9%).

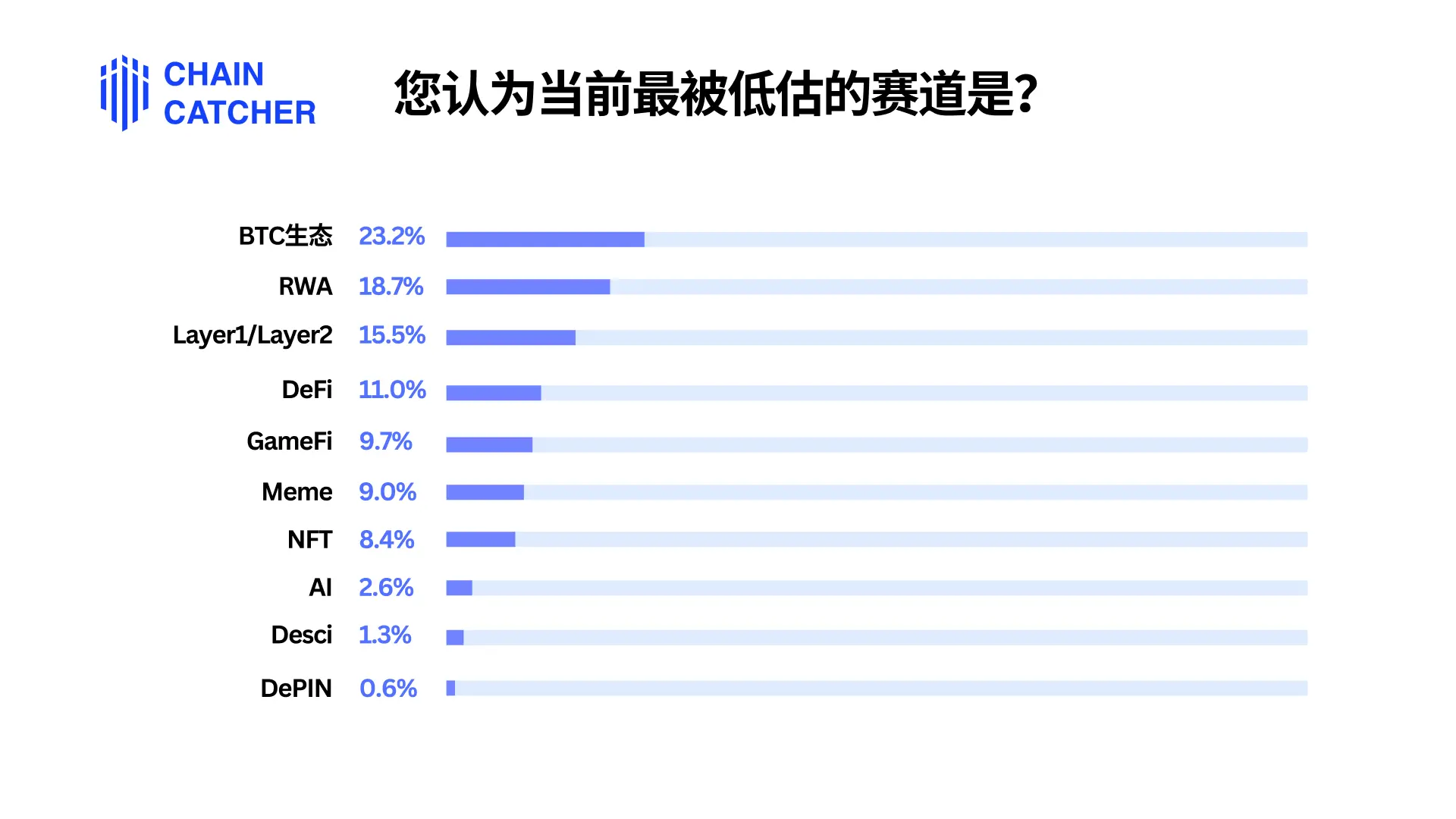

17. Undervalued Sector Assessment

The BTC ecosystem is considered the most undervalued sector at 23.2%, followed by RWA (18.7%), Layer1/Layer2 (15.5%), and DeFi (11%).

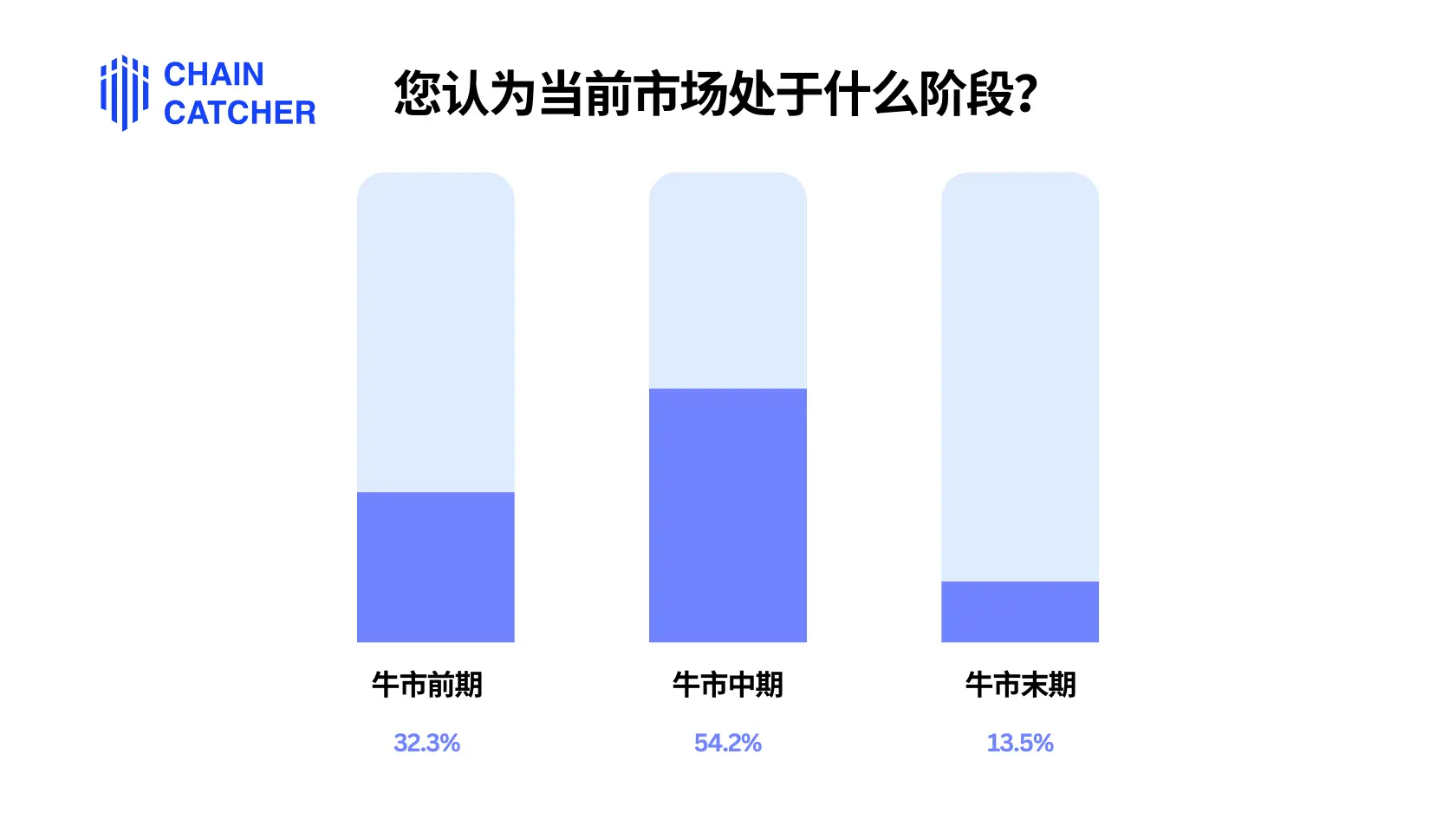

18. Market Stage Judgment

54.2% of individual investors believe the market is in the mid-stage of a bull market, 32.3% believe it is in the early stage of a bull market, and 13.5% believe it is at the end of a bull market. This judgment reflects that most individual investors hold a positive attitude towards the current market.

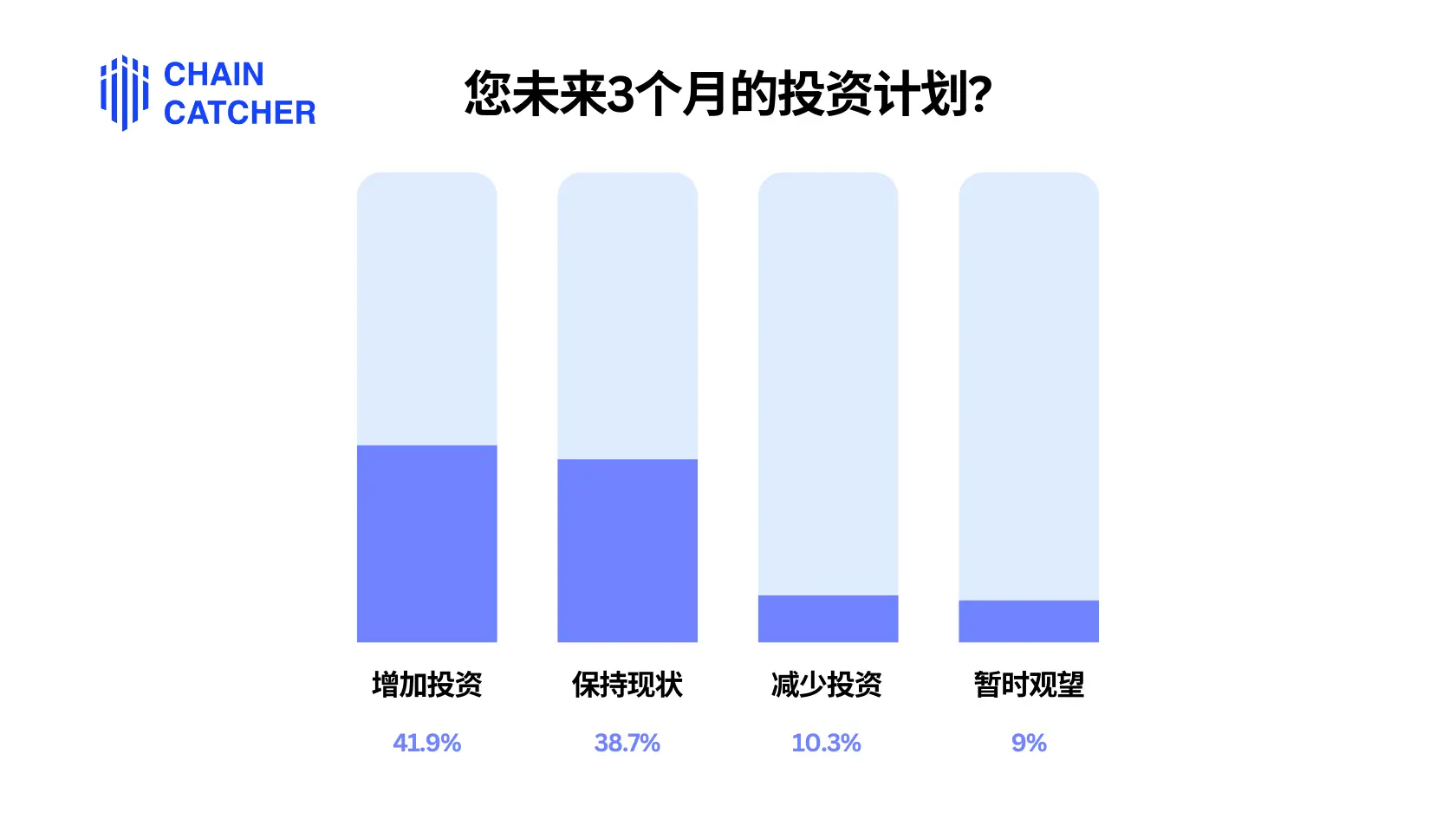

19. Future Investment Plans

41.9% of individual investors plan to increase their investments in the next three months, 38.7% choose to maintain the status quo, and only 19.3% plan to reduce investments or wait and see. This data indicates that most individual investors remain optimistic about the market outlook.

Conclusion

This survey comprehensively reflects the investment behavior characteristics and market perceptions of current Web3 individual investors. The data shows that the individual investor group is becoming more mature and rational, as evidenced by longer holding periods, greater emphasis on fundamental analysis, and increased use of professional data tools. Notably, the importance of professional data analysis tools in individual investment decisions has significantly increased, which not only enhances investment efficiency but also drives the market towards a more mature and rational direction.

Considering the current market situation, most individual investors hold a positive outlook on the market, with over 80% planning to maintain or increase their investments, which may indicate that the market will remain active in the near future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。