Defillama, a top-tier analytics hub and data collector for the defi sector, revealed that stablecoin issuers topped the revenue charts over the past 30 days, raking in $664.12 million. This update was shared by Defillama on Jan. 2, 2025, as the firm noted:

Defi and onchain protocols collected over $1.5b in total revenue over the past 30 days. Of this, over 80% went to Stablecoin Issuers, Chains, Dexes, Telegram Bots, and Launchpads. Stablecoin Issuers alone accounted for 43.7% of revenue.

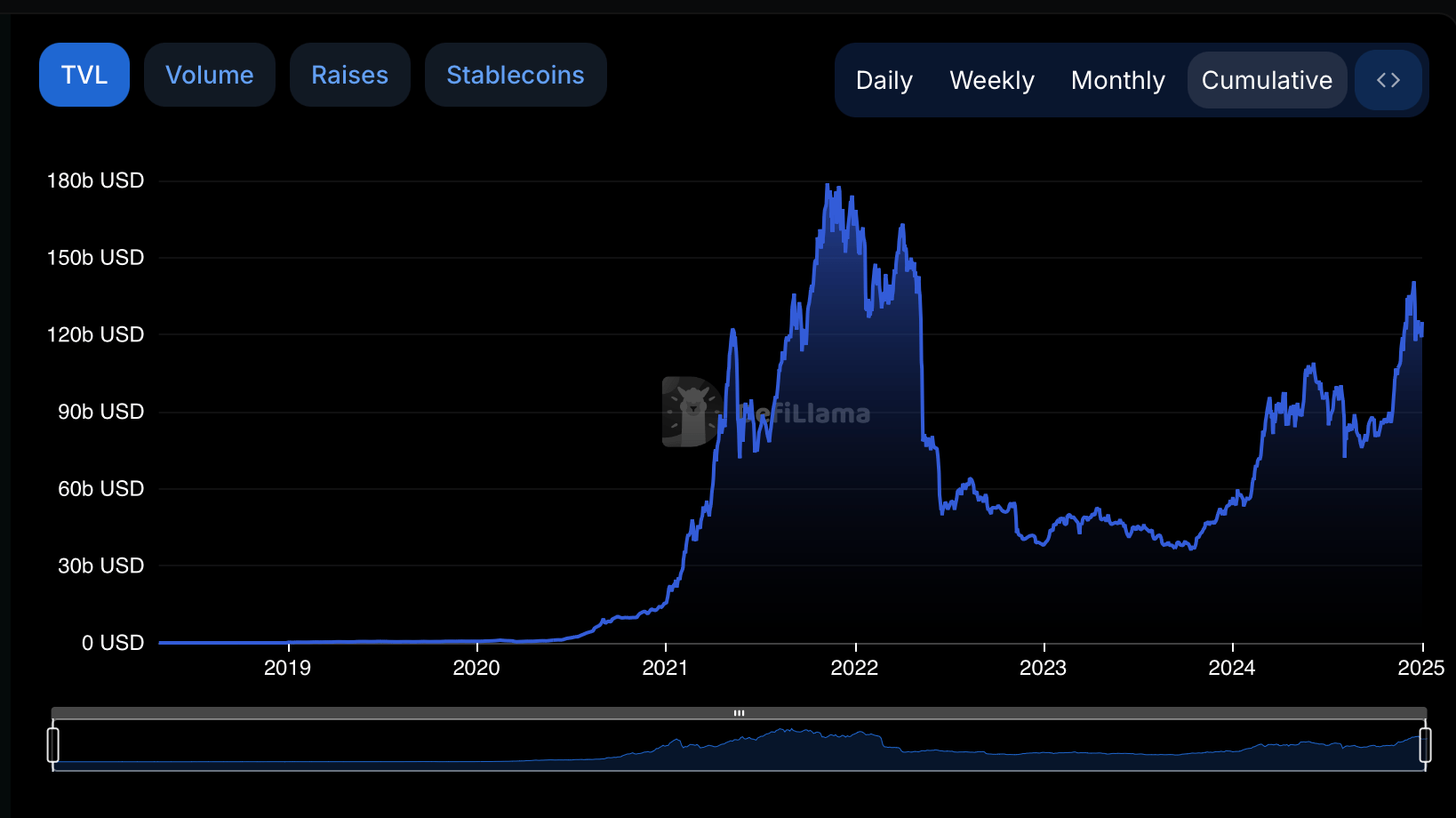

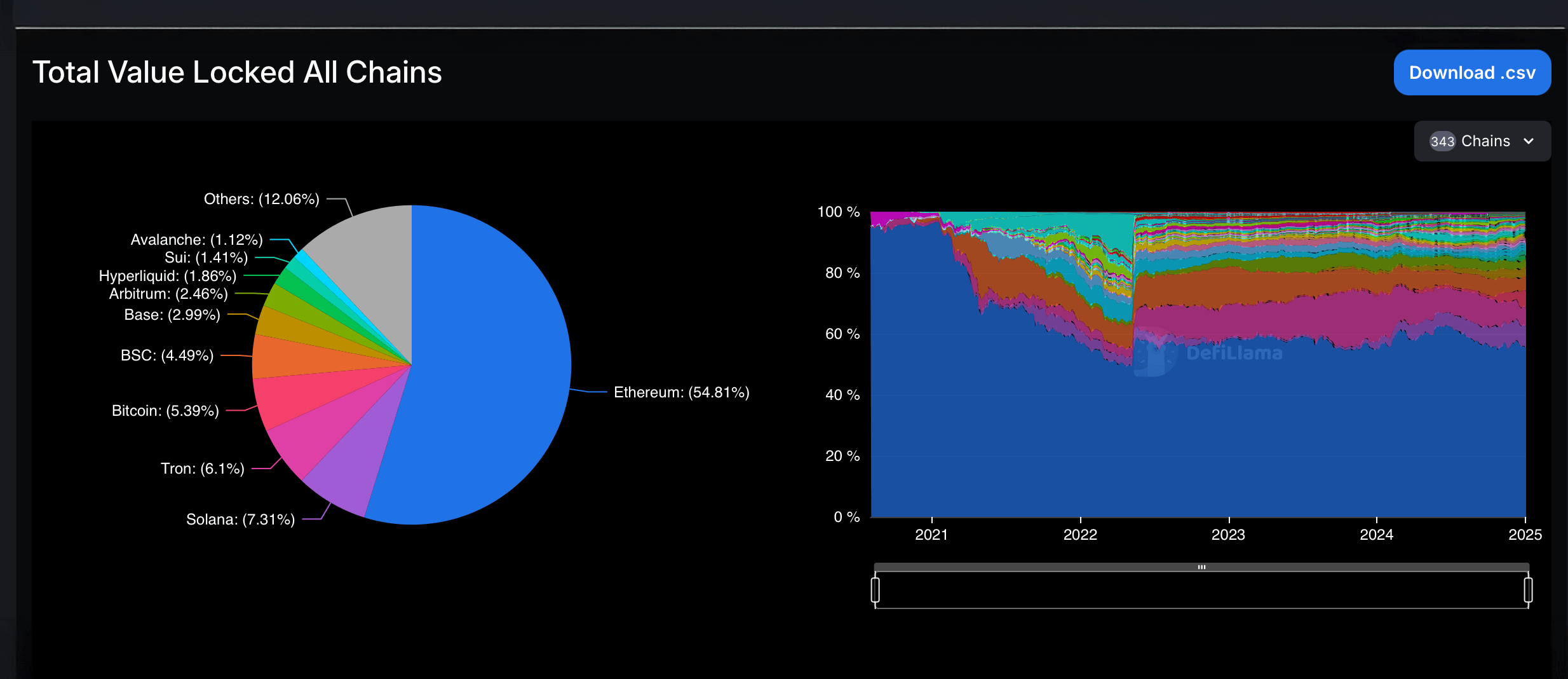

Defi enjoyed a dynamic expansion throughout 2024, with the total value locked (TVL) surging by 133.8% from $53.369 billion to a hefty $124.773 billion. In the first week of January 2024, the liquid staking leader Lido boasted a TVL of approximately $21.33 billion. Fast forward to today, on Jan. 2, 2025, and that figure has jumped to $33.573 billion. Alongside this growth in TVL, there’s been a notable reshuffling of the top defi protocols.

Back then, the heavyweight champs of TVL were Lido, Makerdao (now rebranded as Sky), Aave, Justlend, and Uniswap. As of January 2025, the leaders are Lido, Aave, Eigenlayer, Ether.fi, and Binance’s Staked Ether protocol.

Sky, once a runner-up, has now slipped to the tenth slot. As of today in 2025, Ethereum holds a dominant 54.82% of the TVL in defi, while Solana holds 7.34% and Tron captures 6.09%. Bitcoin holds the fourth spot, securing 4.5% and $6.669 billion in value locked.

As 2025 begins, the landscape of decentralized finance not only celebrates a remarkable year of growth in 2024 but also positions itself for future innovations. With TVL soaring and revenues reaching new heights in December, defi continues to evolve, reshaping financial ecosystems worldwide.

This dynamic shift suggests a maturing market, ready to welcome broader adoption and deeper integration across varied sectors for years to come.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。