January promises to be pivotal for the Federal Reserve as investors await its decision on interest rates. In December 2024, the central bank trimmed the federal funds rate by 25 basis points—the third cut in a row last year. Afterward, during his press conference, Chair Jerome Powell stressed a cautious stance on future rate changes, rattling the markets significantly.

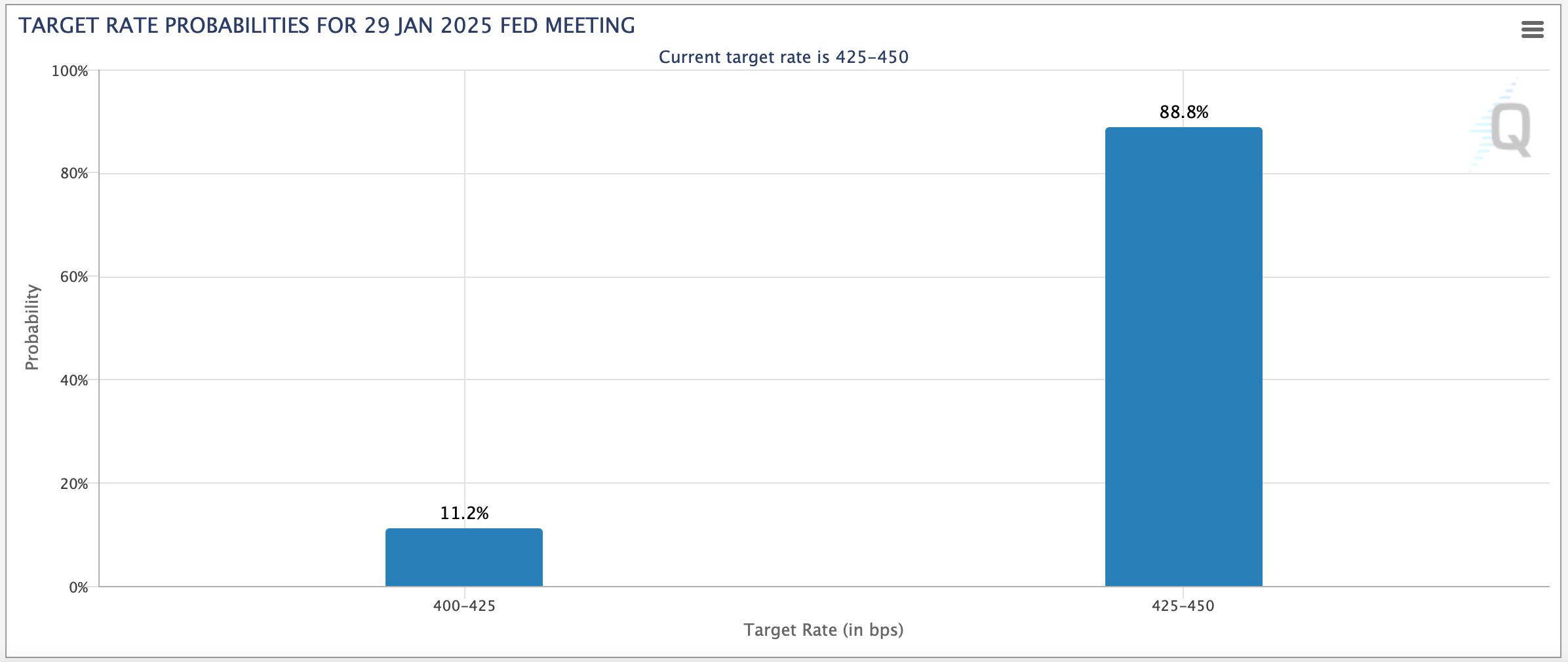

Now, with the January FOMC meeting around the corner, analysts largely expect the benchmark rate to stay put. Projections for 2025 suggest only two additional rate reductions, a shift from earlier estimates of nearly four. According to CME’s Fedwatch tool, there’s an 88.8% chance the central bank will maintain the current range of 4.25%-4.5% this month.

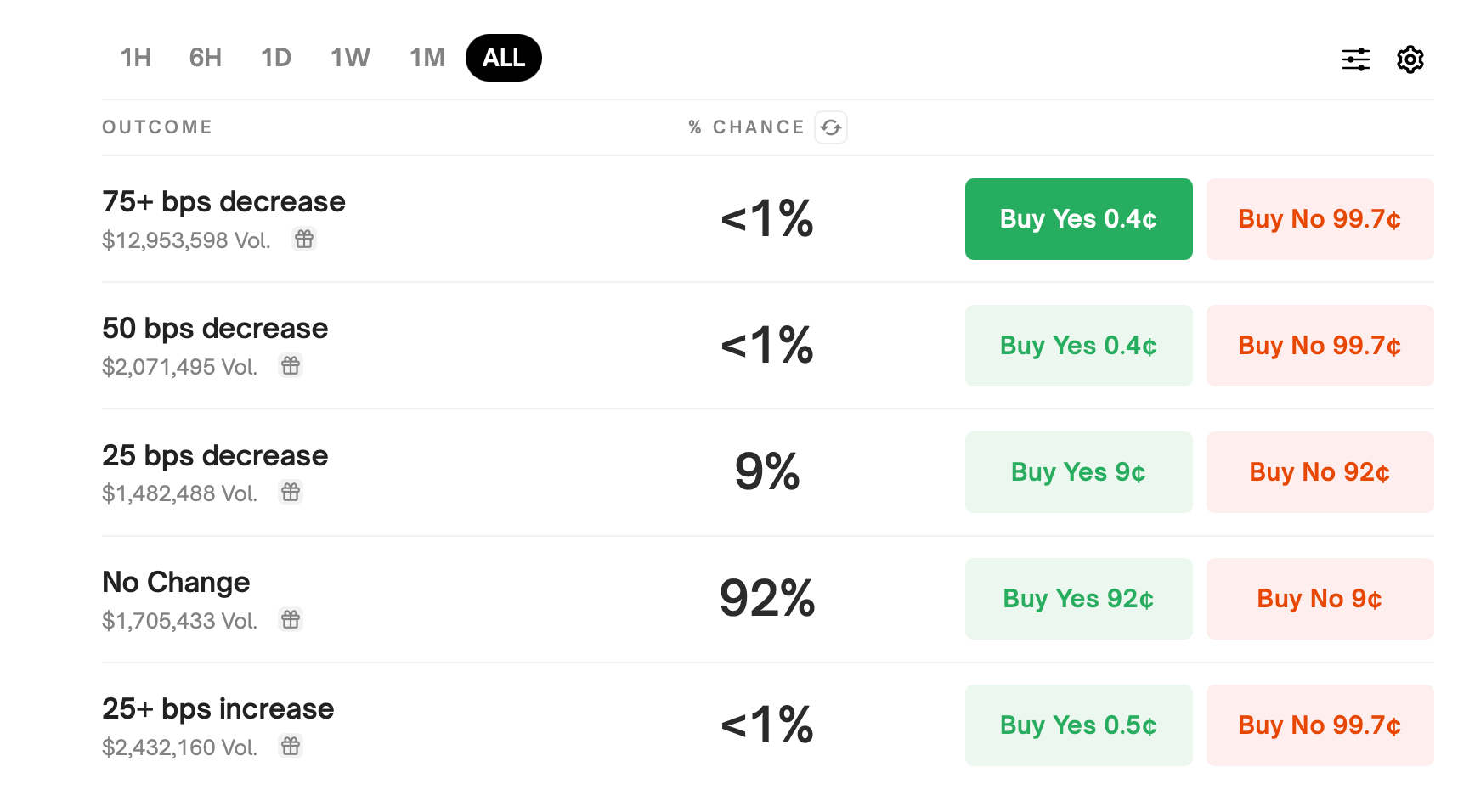

The tool also points to an 11.2% likelihood of a 25-basis-point cut. Polymarket participants seem equally confident in a steady rate. The prediction platform, which boasts $20.63 million in trading volume, reflects a 92% probability of no change. Bets on a quarter-point reduction sit at 9%, while other outcomes have a minimal negative 1% chance. Kalshi bettors align closely, pegging the odds of no rate adjustment at 91%.

Around 10% of Kalshi wagers lean toward a quarter-point decrease. Market watchers will likely keep a close eye on the Fed’s language for any subtle hints about future policy shifts in 2025. Potential policy changes under the incoming Trump administration could also stir the pot. Yet, even after the meeting concludes, speculation about monetary direction may persist, particularly if unforeseen challenges arise.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。