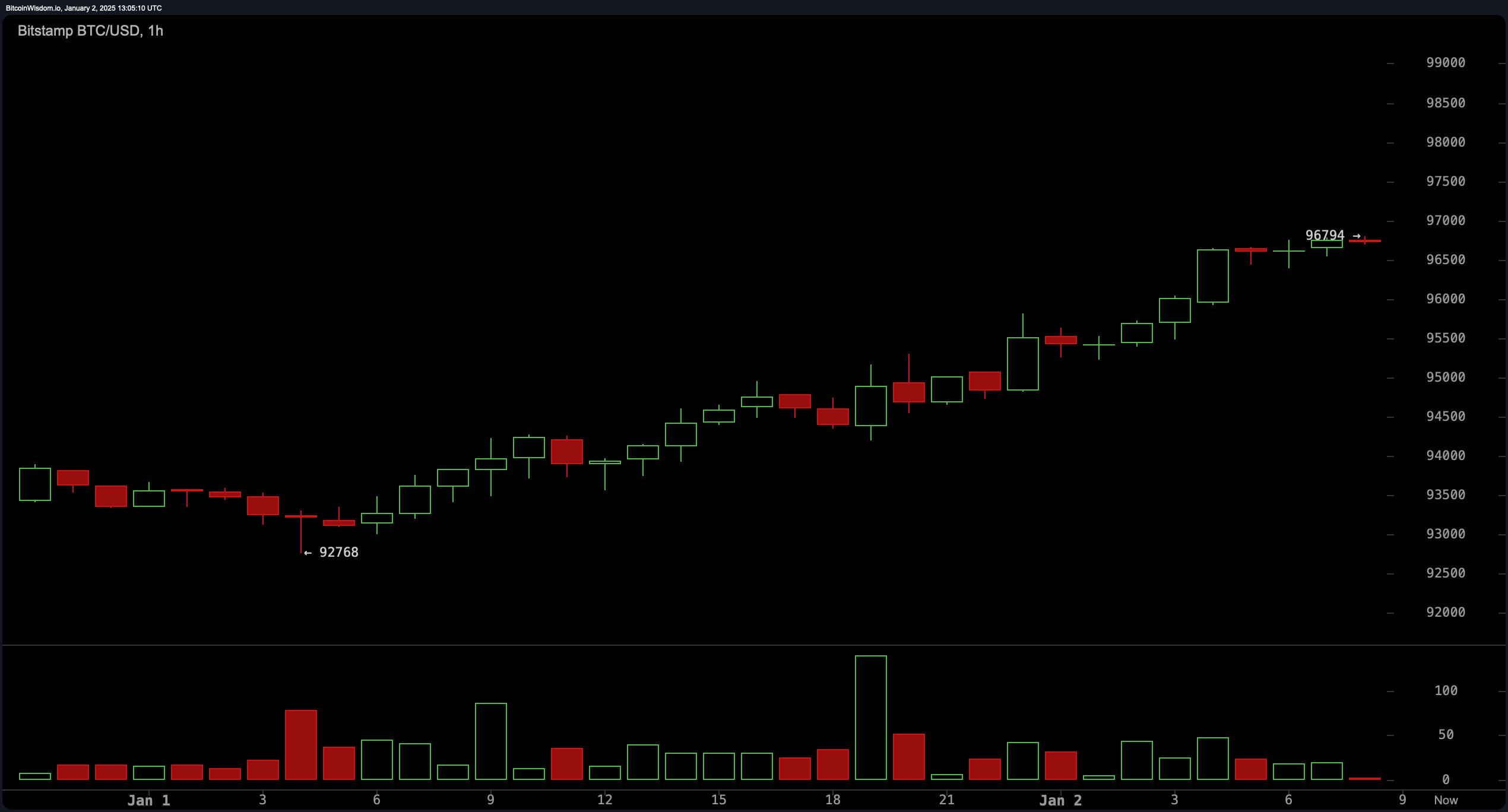

On the hourly chart, bitcoin‘s price has been on an impressive upward climb from $92,768 to $96,794, now taking a little breather. This chill near resistance levels hints at an upcoming breakout or a slight backtrack, with support at $95,800 and resistance waiting at $97,500. Volume spikes during these ascents point to a flurry of activity, possibly from those cashing in or making strategic moves.

BTC/USD 1H chart on Jan. 2, 2025.

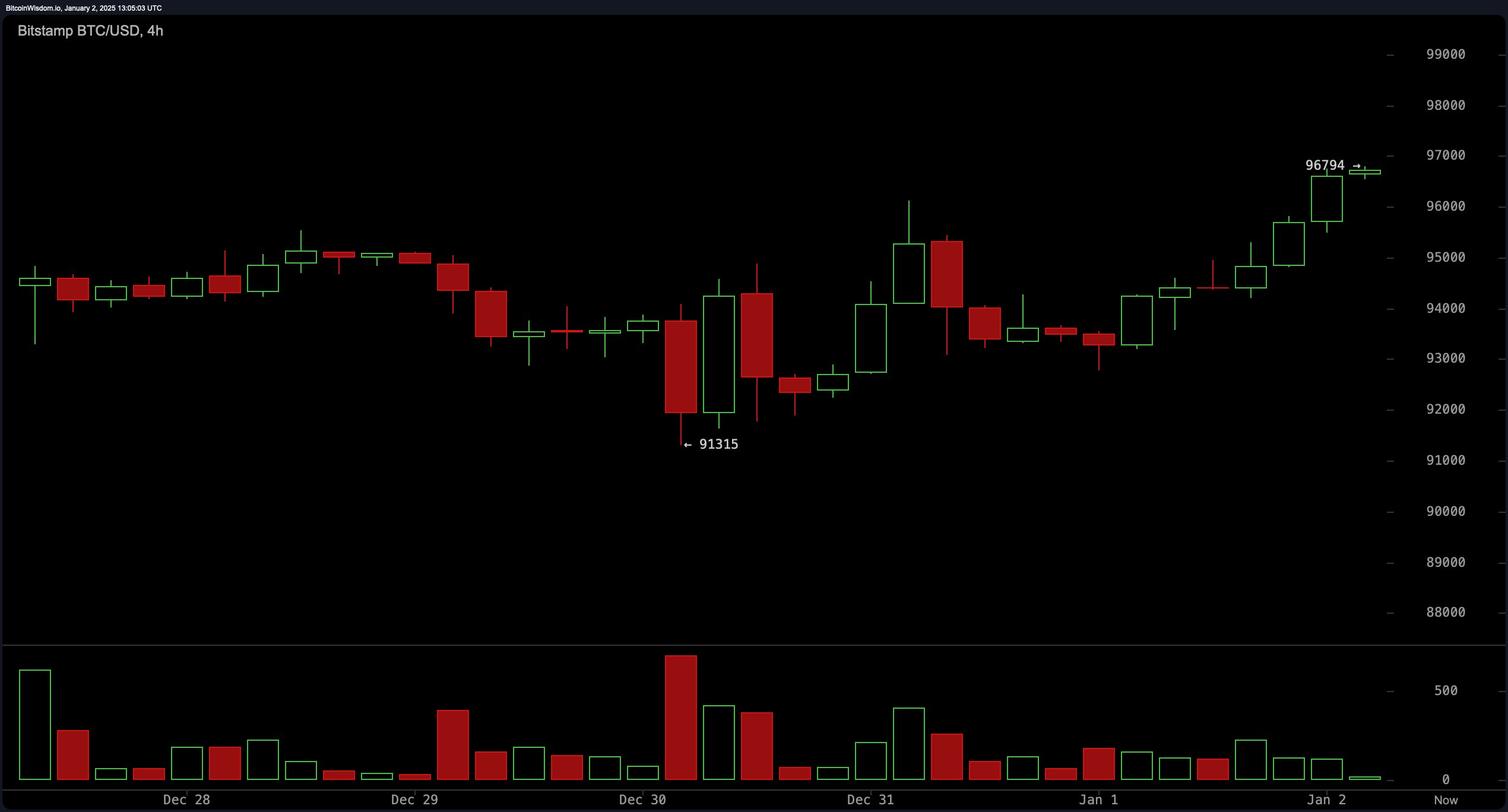

Switching to the 4-hour chart, bitcoin’s recovery from $91,000 to $96,794 is bolstered by consistent higher lows and an upbeat momentum. Key levels to watch are $94,500 for support and $97,500 to $98,000 for resistance, coinciding with noticeable volume upticks around these markers. The price action shows a recovery within a wider range, buoyed by heightened interest at crucial points.

BTC/USD 4H chart on Jan. 2, 2025.

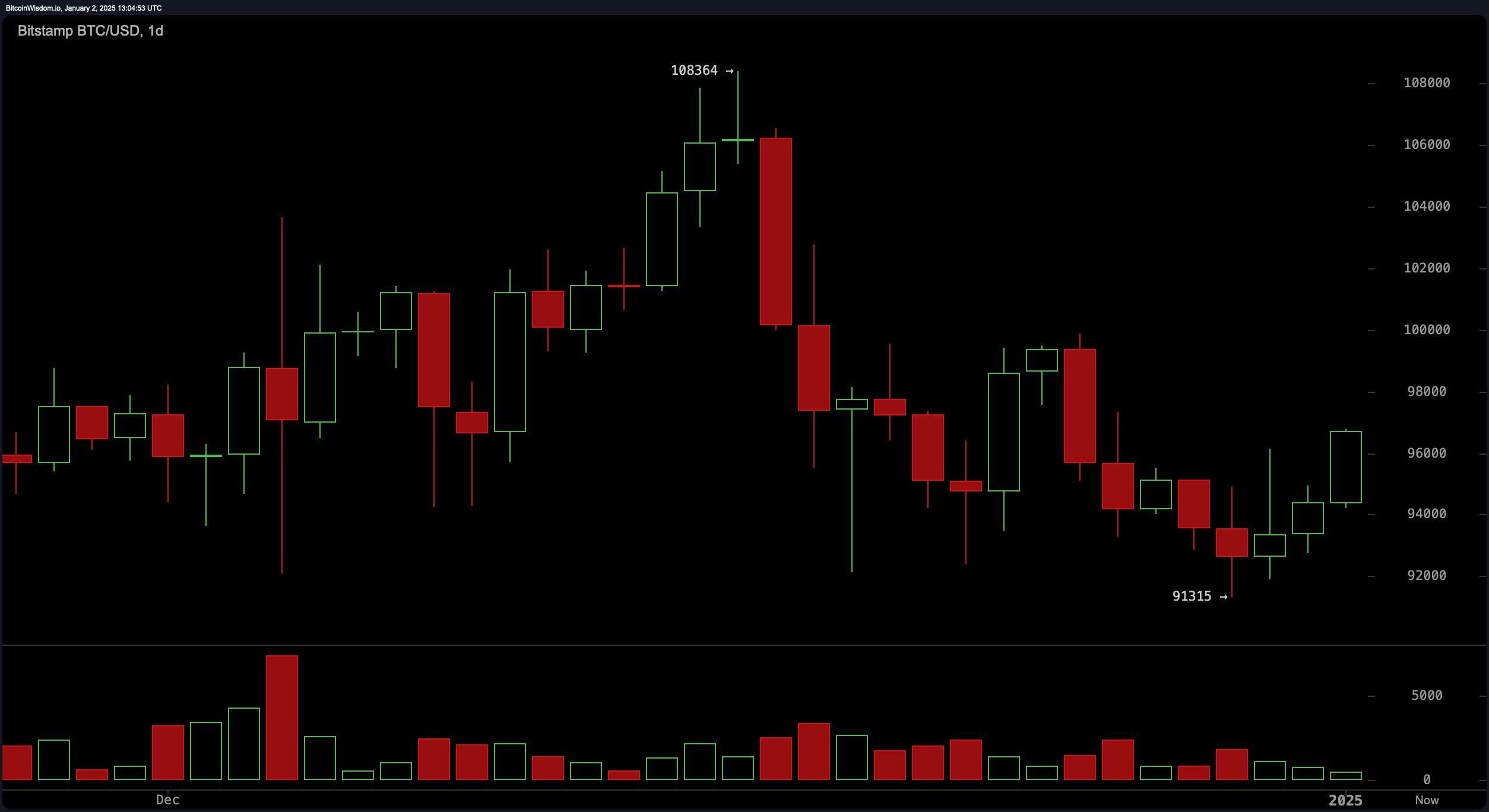

The daily chart showcases a shift from a downward trend, where bitcoin rebounded from a local bottom of $91,315 and soared past $96,000. Moving averages like the EMA and SMA across different timeframes reveal a mixed bag of emotions, with immediate buy signals clashing against resistance from longer-term averages.

BTC/USD Daily chart on Jan. 2, 2025.

Oscillators, such as the relative strength index (RSI) at 51 and the Stochastic at 34, stay neutral, pointing to market indecision. The momentum oscillator gives a buy signal at 1,955, while the MACD at −616 suggests lingering selling pressure. Together, they paint a picture of a market that’s balanced yet cautious.

Bull Verdict:

Bitcoin’s recent recovery from $91,000 to $96,794, coupled with bullish signals from short-term moving averages and upward momentum on hourly and 4-hour charts, indicates the potential for a breakout above $97,500. A successful breach of this resistance could pave the way for a test of the $100,000 psychological barrier, bolstered by strong market interest and steady volume spikes.

Bear Verdict:

Despite the recovery, neutral oscillators and selling pressure indicated by the MACD suggest caution. If bitcoin fails to break above $97,500 or retraces below $94,500, bearish momentum could take over, potentially testing support levels around $91,000 as the broader market sentiment appears mixed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。