The cryptocurrency industry experienced substantial growth in 2024, spurred by the launch of spot Bitcoin exchange-traded funds (ETFs) in January. These ETFs garnered widespread attention, accumulating over $105 billion in assets under management and holding 5.6% of bitcoin’s (BTC) current supply. This development propelled bitcoin to reach an all-time high of $73,000 in the first quarter, setting a strong foundation for the year’s bullish momentum.

Despite periods of consolidation in mid-year, optimism reigned by year’s end, as bitcoin breached the $100,000 mark following the U.S. presidential election. This milestone was underpinned by institutional adoption, a pro-crypto administration, and a rate-cutting cycle that signaled favorable conditions for the digital asset market.

Source: Coin Metrics’ State of the Network’s 2024 Year in Review report.

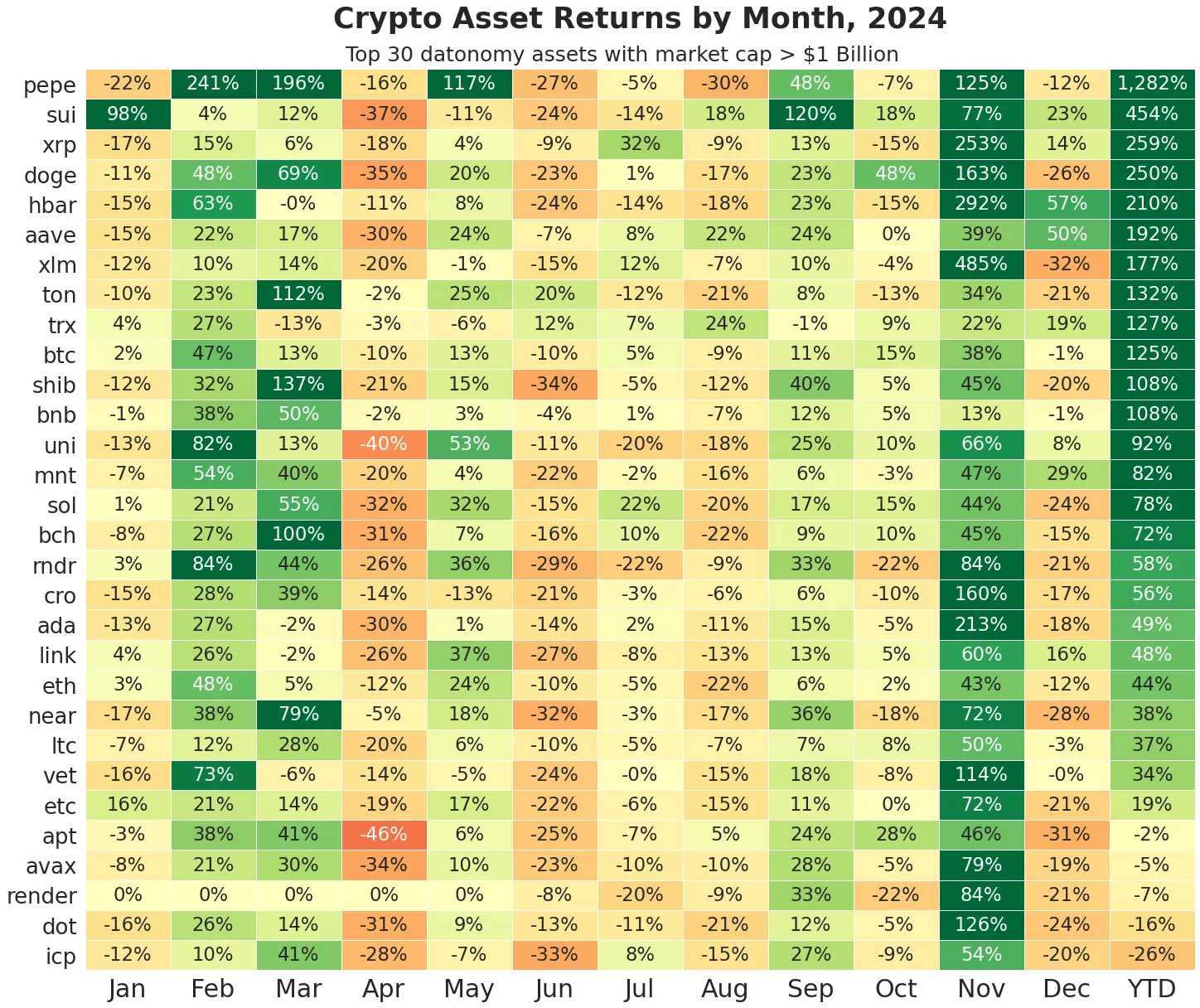

Bitcoin was the standout performer of the year, delivering a remarkable 125% gain. Solana (SOL) and ethereum (ETH) also posted notable increases, rising 78% and 44%, respectively. Meme coins, including dogecoin (DOGE) and pepe (PEPE), captured attention with renewed retail interest, while legacy cryptocurrencies such as XRP and stellar (XLM) staged unexpected comebacks.

Thematic rotations also defined the market, with alternative layer one (L1) platforms like Sui (SUI) and decentralized finance (defi) protocols such as Aave gaining traction. These trends highlighted shifting investor preferences throughout the year, influenced by market catalysts and technological advancements.

“Alternative Layer-1s like Sui (SUI) and established blue-chip defi protocols like Aave also gained traction, reflecting the investor sentiment and thematic rotations that shaped the market in 2024,” Ved details.

Institutional engagement was a driving force in 2024, as evidenced by the rising adoption of Ethereum layer two (L2) rollups and the implementation of the Ethereum Improvement Proposal (EIP-4844). Dubbed “blobs,” this innovation reduced transaction costs and bolstered Ethereum’s scalability. However, the reduced L1 fees also led to diminished value accrual for ETH holders, posing a complex challenge for the network’s economic model.

Additionally, bitcoin’s halving event in April reduced daily issuance to 450 BTC, spurring miners to innovate with more efficient hardware and diversify operations, including ventures into artificial intelligence (AI) data centers. Stablecoins solidified their role as essential components of global financial infrastructure, with aggregate supply surpassing $210 billion.

Tether (USDT) and usd coin (USDC) remained dominant, while tokenized securities gained traction, exemplified by Blackrock’s launch of the BUIDL fund. These developments, the Coin Metrics researcher said, emphasized the expanding utility of stablecoins in payments, savings, and liquidity provisioning.

The regulatory landscape also evolved, with the European Union implementing stablecoin-specific requirements under its Markets in Crypto-Assets (MiCA) regulation, reshaping the Euro-pegged stablecoin sector.

The 2024 U.S. presidential election proved transformative for the crypto market. The administration’s pro-crypto policies catalyzed market optimism, pushing bitcoin (BTC) past $100,000 and driving significant growth in prediction markets and smart contract platforms.

However, uncertainties linger, particularly regarding the timeline and implementation of crypto-friendly policies. As the industry heads into 2025, stakeholders remain cautiously optimistic, awaiting clarity on regulatory frameworks and global economic conditions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。