Table of Contents:

This week's large token unlock data;

Overview of the crypto market, a quick read on the weekly rise and fall of popular coins/fund flows in sectors;

Inflow and outflow situation of spot ETF funds;

Analysis of on-exchange BTC balances;

Interpretation of contract funding rates;

1. This week's large token unlock data;

Tokens such as SUI, OP, and ZETA will experience significant unlocks this week, including:

Sui (SUI) will unlock approximately 64.19 million tokens at 8 AM on January 1, accounting for 2.19% of the current circulating supply, valued at about $270 million;

Optimism (OP) will unlock approximately 31.34 million tokens at 8 AM on December 31, accounting for 2.32% of the current circulating supply, valued at about $58.6 million;

ZetaChain (ZETA) will unlock approximately 53.89 million tokens at 8 AM on January 1, accounting for 9.35% of the current circulating supply, valued at about $32 million;

Beldex (BDX) will unlock approximately 330 million tokens at 8 AM on December 30, accounting for 4.78% of the current circulating supply, valued at about $26.1 million;

Sleepless AI (AI) will unlock approximately 23.21 million tokens at 8 AM on January 1, accounting for 17.85% of the current circulating supply, valued at about $14.6 million;

dydx (DYDX) will unlock approximately 8.33 million tokens at 8 AM on January 1, accounting for 1.17% of the current circulating supply, valued at about $12.8 million;

Ethena (ENA) will unlock approximately 12.86 million tokens at 3 PM on January 1, accounting for 0.44% of the current circulating supply, valued at about $12.1 million.

This week, pay attention to the negative effects brought by the unlocking of these tokens, avoid spot trading, and seek shorting opportunities in contracts. Among them, ZETA and SUI have a larger proportion and scale of unlocked circulating supply, warranting extra attention.

2. Overview of the crypto market, a quick read on the weekly rise and fall of popular coins/fund flows

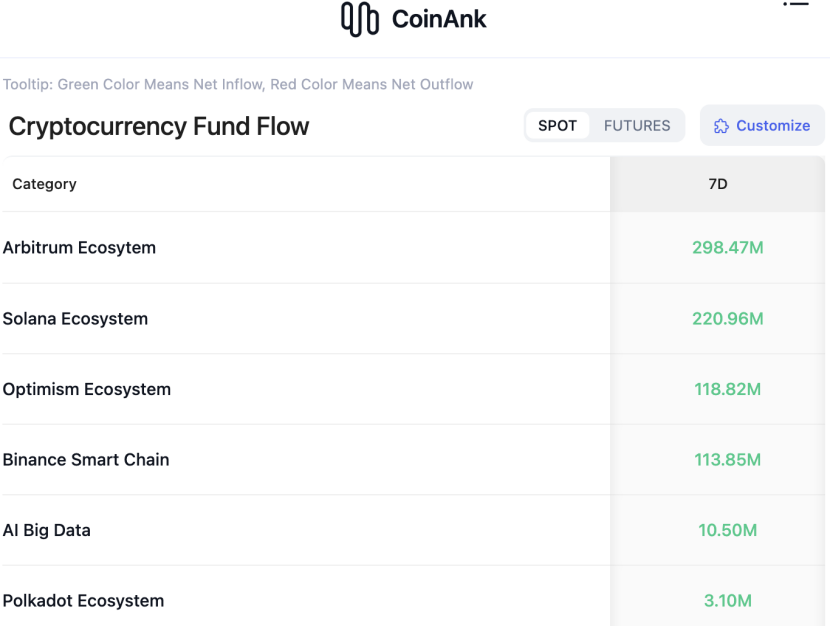

Data shows that in the past week, the net inflow of funds in the crypto market, categorized by concept sectors, was largely concentrated in major areas such as the Arbitrum ecosystem, Solana ecosystem, Optimism ecosystem, Binance Smart Contract, and AI. In the past week, many tokens have also experienced significant rotational increases. The following are the top 500 by market capitalization, with tokens such as PHA, AGLD, NCT, AIXBT, POND, and VIRTUAL showing relatively high gains.

3. Inflow and outflow situation of spot ETF funds.

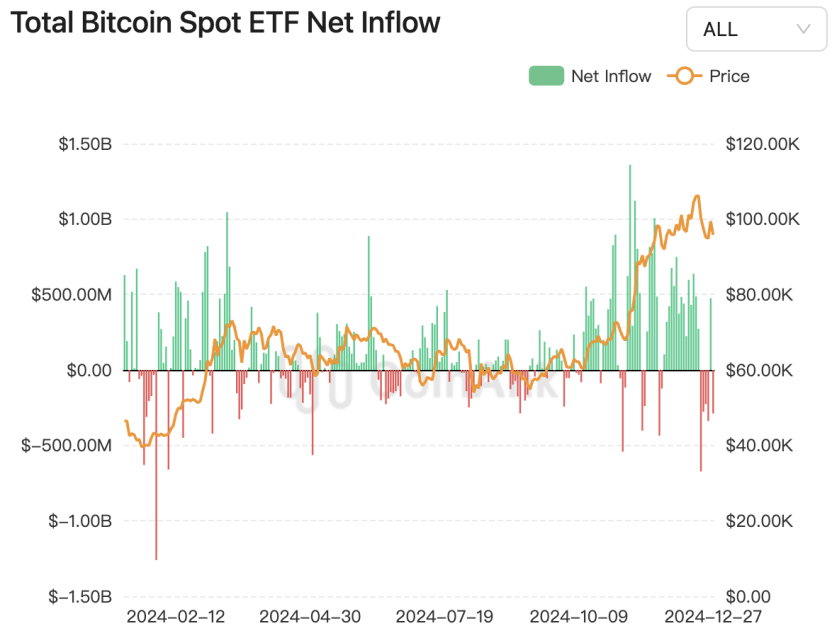

Data shows that the U.S. spot Bitcoin ETF has been online for 50 weeks, with BlackRock's IBIT holdings increasing from 2,621 BTC in the first week to 552,555 BTC, fully absorbing the selling pressure from Grayscale's GBTC, which saw its Bitcoin holdings drop from 619,200 BTC in the first week to 206,860 BTC.

Grayscale Bitcoin Trust was previously the main avenue for investors to enter the Bitcoin market, having accumulated a large amount of holdings before the launch of the spot Bitcoin ETF, with an initial holding of up to 619,200 BTC. After transitioning to a spot ETF, it directly inherited the previous large asset base. The management fee rate of GBTC (1.5%) is higher than that of other competitors, leading investors to choose to redeem GBTC shares and turn to other ETFs after the launch of the spot ETF, resulting in a phenomenon of outflow between BlackRock's IBIT and Grayscale's GBTC holdings.

The U.S. spot Bitcoin ETF has purchased 511,314 BTC this year, with the total on-chain holdings of the ETF at approximately 1.129 million BTC, accounting for 5.70% of the current BTC supply, with the on-chain holdings valued at about $106.8 billion. In contrast, the net inflow of gold ETFs in 2024 was $454 million, while the net inflow of Bitcoin ETFs was $36.8 billion, which is 81 times that of gold ETFs.

We believe that the launch of the U.S. spot Bitcoin ETF has had a significant impact on the market. The increase in BlackRock's IBIT holdings not only demonstrates the ETF's immense appeal to the market but also reflects a shift in investors' channels for Bitcoin investment. The U.S. spot Bitcoin ETF accounts for 5.70% of the current BTC supply, highlighting the ETF's important role in the Bitcoin market. The net inflow of Bitcoin ETFs is 81 times that of gold ETFs, underscoring Bitcoin's attractiveness and growth potential as an emerging asset class. Bitcoin ETFs are reshaping the investment landscape, providing investors with more convenient investment channels while also significantly boosting market demand.

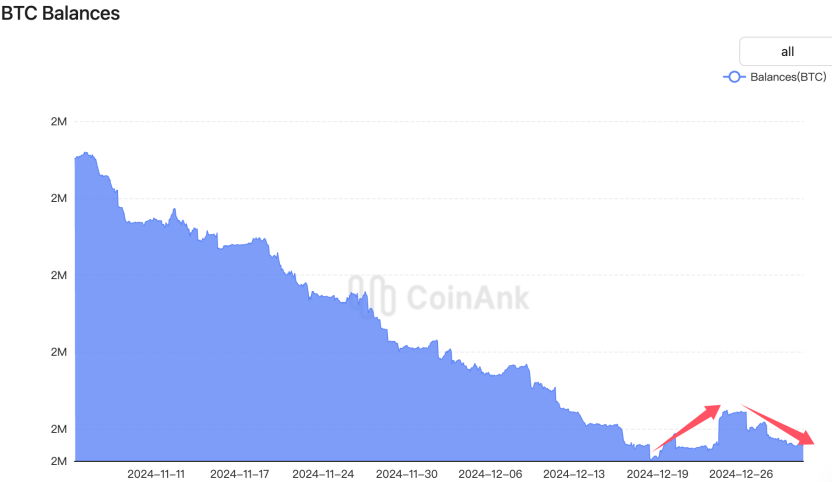

4. On-exchange BTC balances first increased and then decreased.

According to CoinAnk data, in the past 24 hours, 5,143.46 BTC flowed out of exchange wallets, with 1,656.99 BTC flowing out in the past 7 days, and 68,430.63 BTC flowing out in the past 30 days. Currently, the total balance of exchange wallets is 2,241,041.19 BTC. The recent overall change in BTC balances has been an increase followed by a decrease.

These data indicate that investors are more inclined to transfer Bitcoin to personal wallets, reducing their holdings on exchanges to lower potential security risks and enhance control over their funds. The recent overall change in BTC balances has been an increase followed by a decrease, which may relate to the market's dual expectations of short-term price volatility and long-term value storage for Bitcoin. This trend may signal an increase in market confidence in holding Bitcoin, while also potentially impacting market liquidity and price stability.

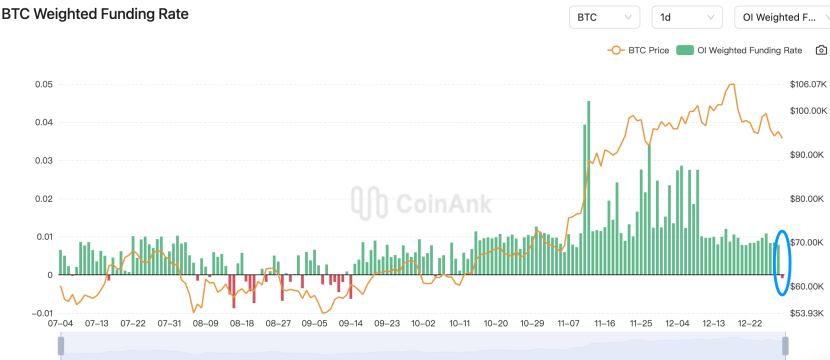

5. Interpretation of contract funding rates.

According to contract data, after three and a half months, the funding rate has turned negative, which may reflect a significant change in market sentiment. The funding rate is an indicator of market participants' demand for Bitcoin futures contracts; when the rate is negative, it indicates that there may be excessive selling or shorting pressure in the market, and holders of long positions need to pay fees to holders of short positions.

This shift may be related to the market's short-term bearish expectations for Bitcoin prices or indicate that holders of long positions are reducing their holdings while holders of short positions are increasing theirs. Additionally, this may also signal a market adjustment, as investors may be reassessing their holding strategies. In the context of increased market volatility, this change in funding rates is worth close attention, as it may signal a shift in market trends or impending price fluctuations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。