New Destination for Stablecoins: Is Resolv the Next Ethena?

Written by: shaofaye123, Foresight News

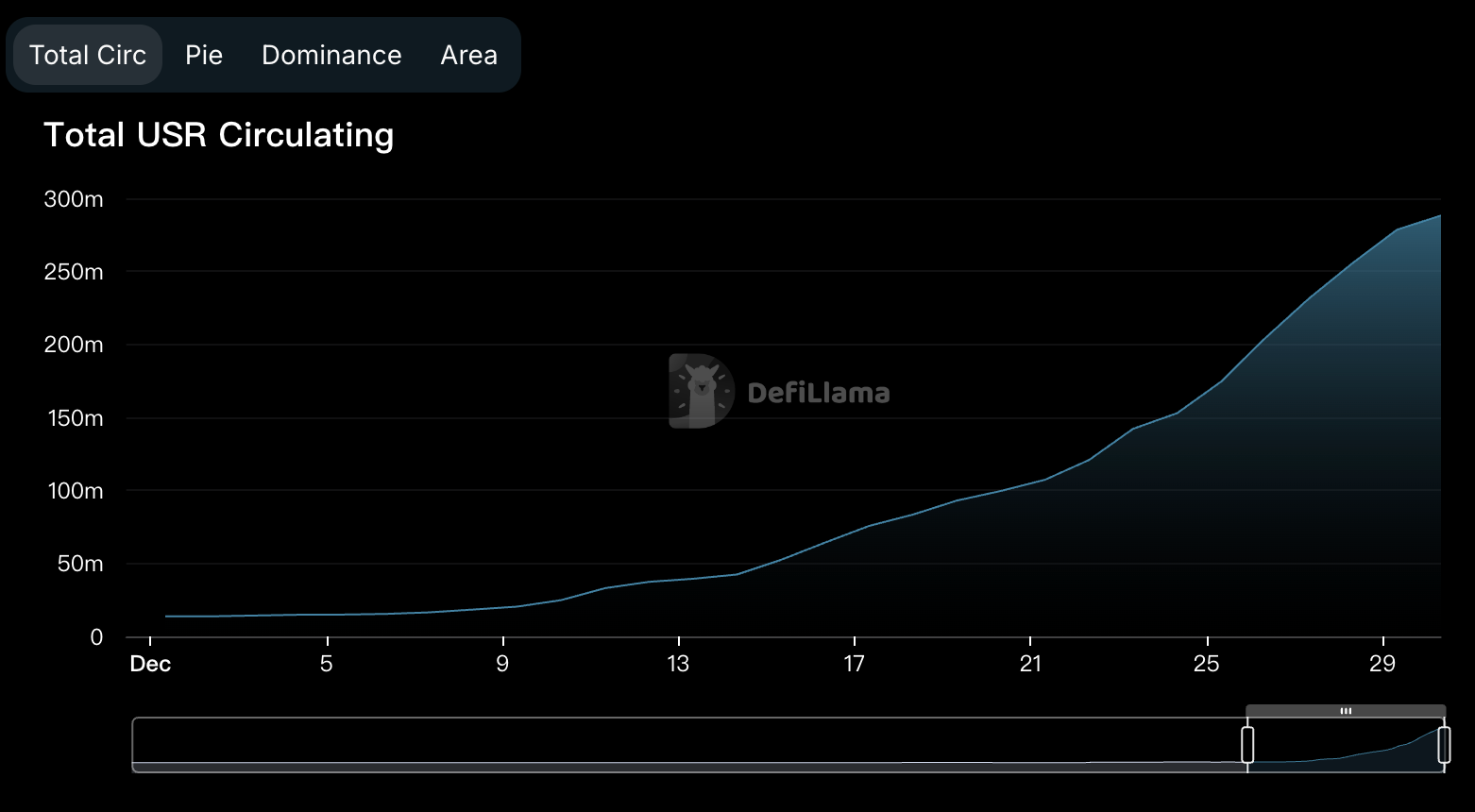

Recently, Fortune magazine reported that Tether is expected to achieve a net profit of over $10 billion by the end of this year. The substantial profits in the stablecoin sector have attracted considerable attention, with many banks worldwide looking to enter the stablecoin market. Its TVL has grown from $130 billion at the beginning of the year to $200 billion. On December 6, the founder of Ethena mentioned the Resolv protocol, and Resolv's TVL has seen rapid growth, increasing nearly 400% in the past two weeks to reach $333 million. What is Resolv? How can its tokens be obtained? With the token issuance imminent, this article provides a quick overview of the participation opportunities in Resolv.

What is Resolv?

Resolv is a Delta-neutral stablecoin protocol that focuses on the tokenization of market-neutral investment portfolios. The Delta-neutral strategy aims to minimize the risks associated with price fluctuations of underlying assets. In a Delta-neutral portfolio, investors balance price fluctuation risks by combining multiple positions that offset each other's price movements, primarily using financial derivatives (such as options or perpetual contracts) to achieve this. This is similar to Ethena, where the product primarily generates stable returns through short funding rates, with a smaller portion of profits obtained from re-staking and other interest-bearing assets. The profits from the liquidity pool are divided into three parts, distributed every 24 hours, including basic rewards—distributed to holders of staked USR (stUSR) and RLP; risk premiums—only for RLP; and protocol fees—transferred to the protocol treasury.

Resolv includes three types of tokens, in addition to the project's governance token RESOLV, there are USR and RLP tokens.

USR — A stablecoin fully backed by ETH collateral, with a stable value pegged to $1. Users can mint and redeem liquid collateral at a 1:1 ratio and earn returns by staking USR.

RLP — Its scalable insurance layer designed to protect USR from market risks, with RLP's value dynamically changing based on the protocol's profits and losses. In exchange, RLP users will receive a higher proportion of profits from the collateral pool but must also bear losses.

Through this, Resolv effectively distinguishes between investors with different preferences.

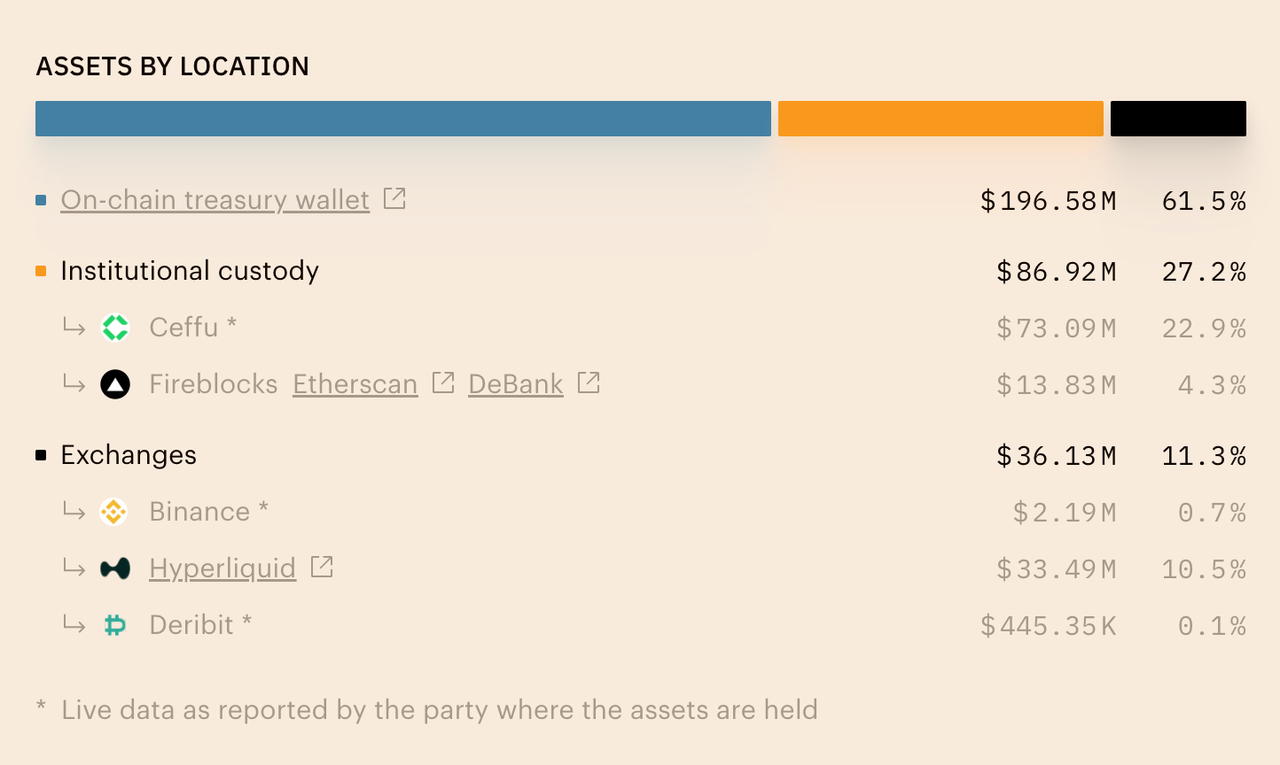

The funding distribution of the Resolv project is clear, transparent, and traceable. Currently, about 61.5% is on-chain, 27.2% of the funds are held by neutral institutions, and 10.5% is on the popular exchange Hyperliquid. It also plans to launch on HyperEVM, expected to become a top stablecoin project on that platform.

Airdrop Guide

Its sources of income can be divided into two parts: daily returns and points.

Daily Returns

The daily returns vary based on the different tokens held:

Low-risk conservative investment preference: By staking the stablecoin USR, the annualized return over the past 7 days is 10.12%.

High-risk aggressive investment preference: By purchasing RLP tokens, the annualized return over the past 7 days is 31.27%.

Points Acquisition and Bonuses

Currently, the main ways to acquire Resolv points are through purchasing USR and RLP. Additionally, participating in other activities can also earn corresponding points and enjoy point bonuses.

According to the rules published by the official, the maximum point bonus is currently around 165%.

The fourth phase of the activity has a default point bonus of 50%. The current activity is in its fourth phase and will end in less than a week.

New users using the invitation link can receive a 20% point bonus. The inviter can earn 10% of the total points of the invited person.

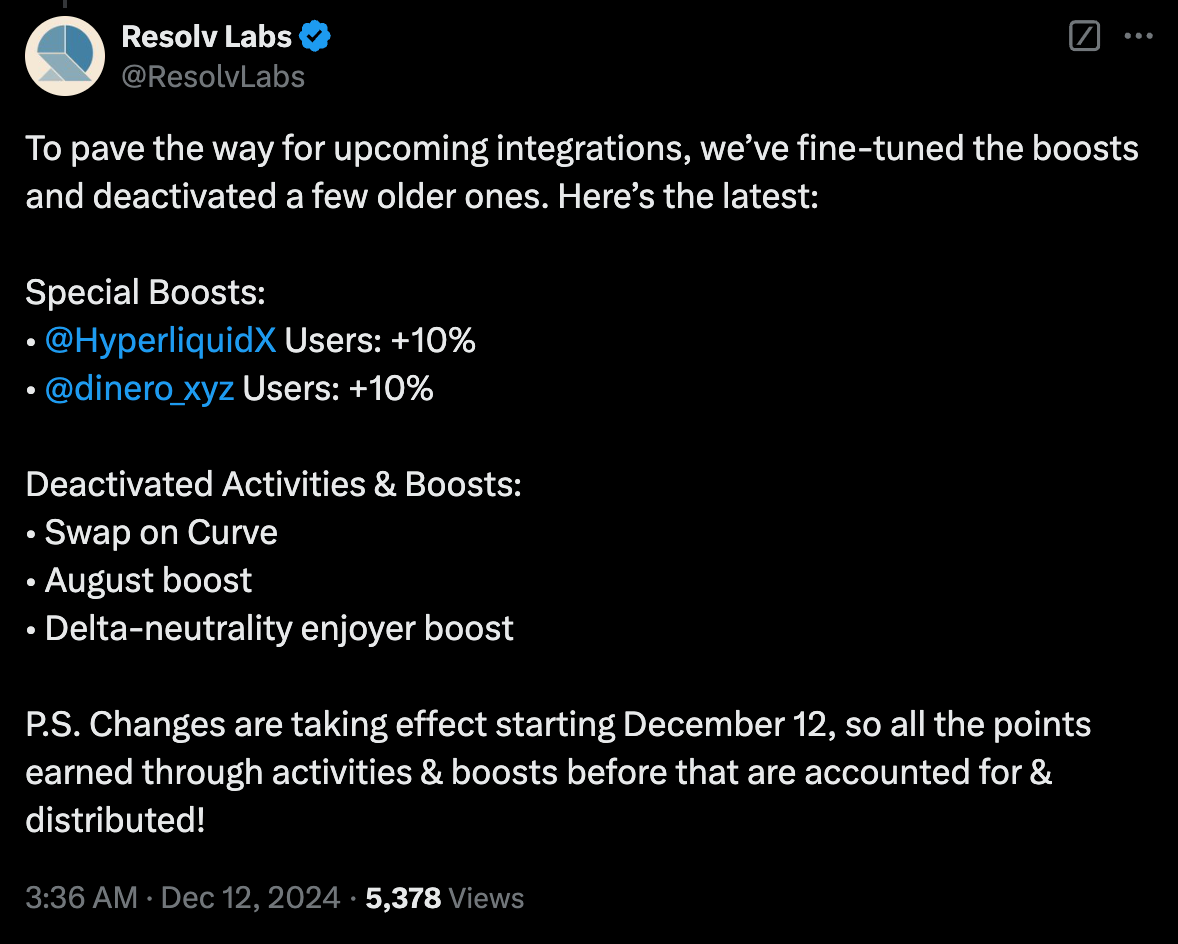

Hyperliquid users can receive a 10% point bonus. Simply performing deposit and withdrawal operations is sufficient, with no need to trade on the platform.

Dinero users can receive a 10% point bonus. They need to stake ETH on that platform to obtain pxETH, which must be in the wallet to earn this benefit.

Completing different numbers of activities grants different levels of point bonuses. Completing 7 or more activities can earn a 50% point bonus; completing 5 or more activities can earn a 25% point bonus; completing 3 or more activities can earn a 10% point bonus. The official website offers over 10 ways to participate in activities.

Purchasing NFTs can earn a 25% point bonus. For large investors, purchasing NFTs is relatively more worthwhile (initially Free Mint), with the current floor price around 0.56 ETH, peaking at 0.79 ETH, an increase of over 20 times.

The maximum activity bonus of 50% requires participation in at least 7 different activities. The following are recommended types that are simple to operate and have lower risks (Note: If your capital is small, you can choose activities on the BASE chain to save on GAS fees.)

Hold USR on ETH;

Hold USR on BASE;

Stake USR on the Ethereum mainnet;

Purchase RLP on the Ethereum mainnet;

Purchase RLP on BASE;

Provide liquidity on Pendle;

Provide liquidity on Aerodrome.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。