Since adopting its bitcoin (BTC) strategy in 2020, Microstrategy, led by founder Michael Saylor, has become a notable name in the crypto space. Four years later, the move appears to be paying off—its bitcoin holdings have climbed by 50%. Saylor revealed on X that the company now holds an eye-popping 446,400 BTC, worth approximately $42.13 billion, after the latest acquisition.

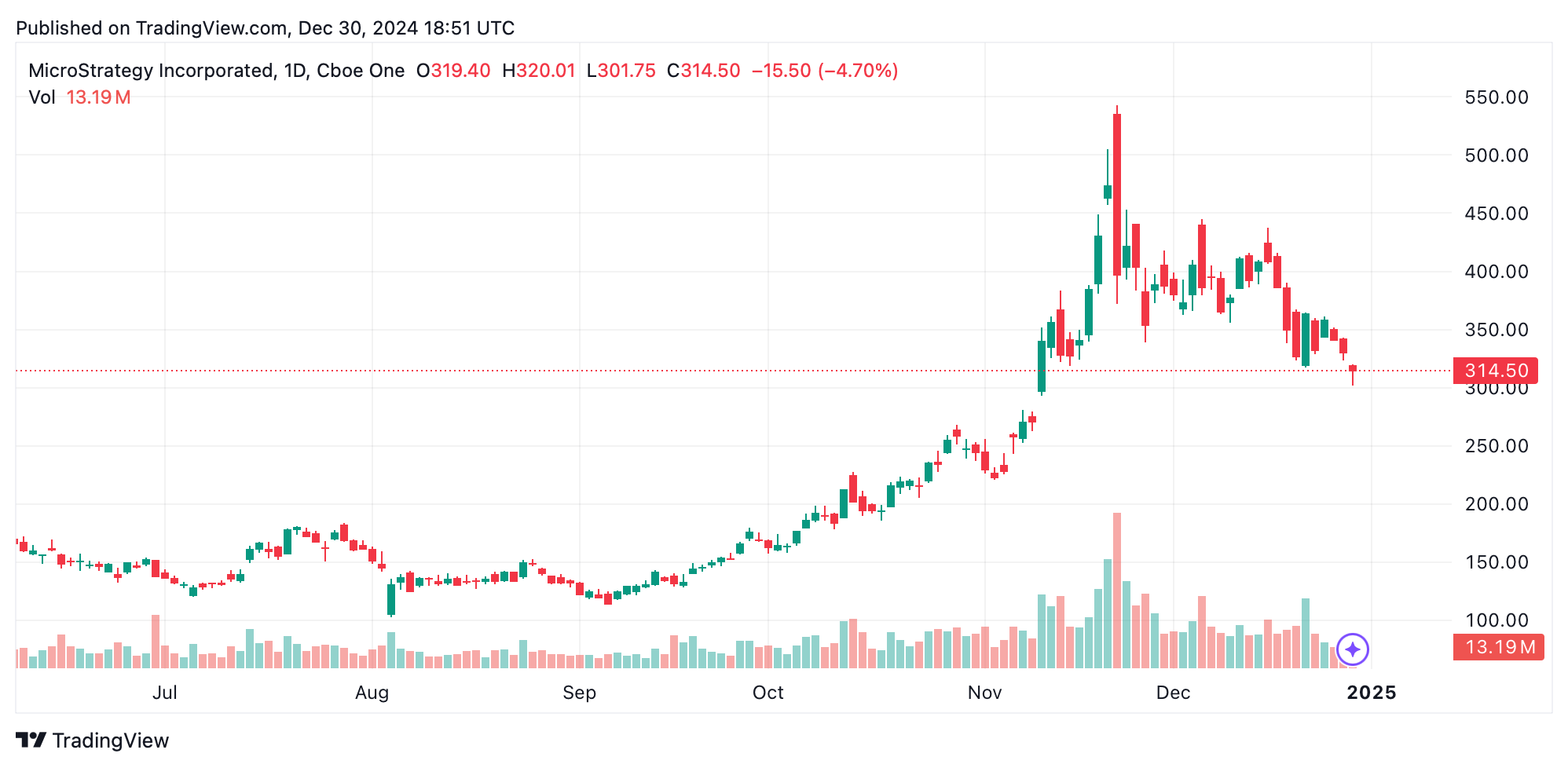

While its crypto portfolio shines, Microstrategy’s stock has taken a downturn. On Nov. 20, 2024—40 days ago—MSTR shares hit an all-time high of $494.73. As of 1 p.m. ET Monday, the stock was trading at $312.66, marking a 36.81% drop since the peak.

Over the past five days, MSTR has shed 12.8%, and it’s down 23.1% for the month. Following Saylor’s announcement on X, gold advocate Peter Schiff took the opportunity to critique the move. “Once again you’ve announced a smaller buy at an average price that’s above the current price. You’re no longer buying enough bitcoin to keep the price rising,” Schiff said to the Microstrategy founder.

Many cheered Microstrategy’s decision on Monday, applauding the bold move with enthusiasm. “Michael [Saylor] just erased another 2,138 whole-coiners. You’re not stacking hard enough,” an individual replied in Saylor’s thread.

Amid the excitement from bitcoin (BTC) enthusiasts, Microstrategy’s falling stock price might pose challenges to its bold crypto strategy. Betting big on bitcoin can still bring risks, especially given the wild swings in MSTR’s share value.

Still, loyal supporters of both MSTR and BTC hold onto their optimism, hoping that savvy acquisitions will pave the way for future gains. Observers are now watching for indicators that this strategy will further solidify Microstrategy’s role in the bitcoin ecosystem. Time will tell how this unfolds.

By 1:45 p.m. ET, MSTR shares climbed to $317.10, though the stock remains 35.9% below the all-time high reached on Nov. 20.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。