Friday's spot ETF data was another fragmented day. Before discussing the data, it must be mentioned that Americans truly take their holidays; BlackRock's official website has been down since Christmas and has yet to be fixed. Recently, BlackRock's data has been calculated based on fund volume, and it's uncertain if anyone will be back to work on Monday.

In recent days, the #ETH spot ETF data has been performing well, while #BTC data has been relatively poor. This situation can be attributed to two main reasons. First, BTC started to rise when ETF expectations were high, maintaining a trend of fluctuating upward from June 2023 until after the U.S. elections. Moreover, U.S. media has been reporting various news related to #Bitcoin, and even U.S. stocks have begun to increase their market value by holding BTC.

This has led to a heavy FOMO sentiment, so when prices correct, combined with some market FUD and the holiday effect, it is normal for investors to start exiting the market. In contrast to BTC, ETH's performance has been criticized by investors. The two ETFs available have price movements that are quite different from BTC, leading many investors to switch positions early.

Currently, assuming that the rights transfer on January 20 can bring about a market increase, the lagging ETH may see a higher percentage increase than BTC, as the pressure is not as great. Second, ETH still performs well in the decentralized application field, with substantial infrastructure, especially since BlackRock's RWA project is built on ETH. It is evident that BlackRock's investors are currently one of the main forces purchasing the ETH spot ETF, so it is not ruled out that BlackRock's financial managers may promote #Ethereum to users.

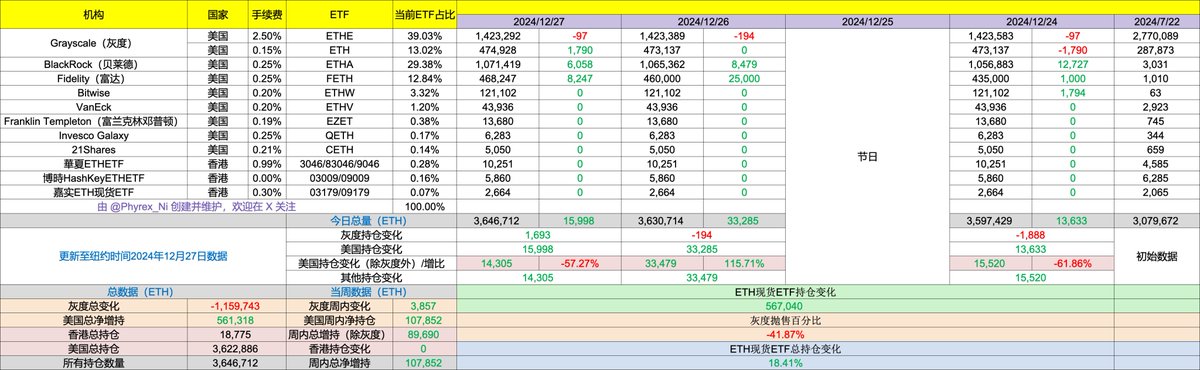

In the twenty-third week, both BlackRock and Fidelity have been buying a large amount of ETH. Even when investors are selling BTC, they are buying ETH. Even Grayscale's $ETHE has seen net inflows. The overall increase in the U.S. has risen 14.5 times compared to the twenty-second week, with net purchasing power increasing by 1.7 times. Currently, the nine spot ETFs in the U.S. hold a total of 3,627,936 ETH, with Grayscale's two funds holding a total of 1,898,219 ETH, BlackRock holding 1,071,419 ETH, and Fidelity holding 468,247 ETH, while other figures are relatively low.

Since the start of the ETH spot ETF until Friday, the U.S. ETFs have seen a net inflow of 567,040 ETH, with almost all sell-offs coming from Grayscale, which sold a total of 1,346,797 ETH.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1W7JJ8lMQiUUlBb9U-BvFoq2H-2o5CpUuPO4D_KK3Ubw/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。