Since Jan. 1, 2024, bitcoin’s share of the crypto economy has grown by 6.5%, now commanding 56.8% of the $3.29 trillion market. It’s been a standout year for the leading digital currency. On that first day of 2024, bitcoin traded at $42,543 per coin, securing a market capitalization of $832.85 billion while the entire crypto market stood at $1.65 trillion. On the same day, ethereum’s performance was stronger than today, boasting a market valuation of $274 billion, which accounted for 16.6% of the total crypto economy.

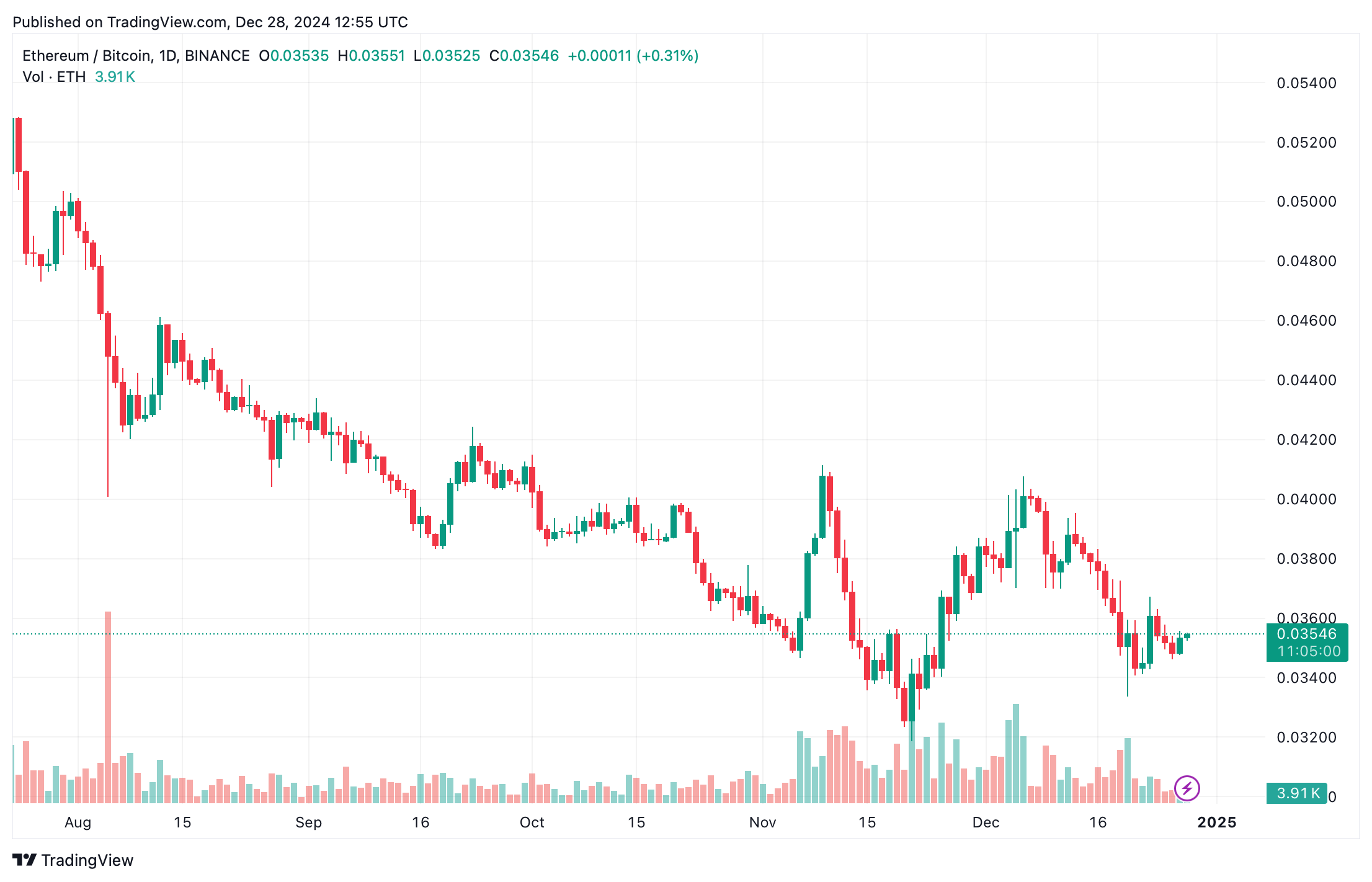

ETH/BTC ratio.

Fast forward to today, ether’s share has dipped by 4.4%, landing at 12.2% of the current $3.29 trillion market. At the start of the year, ether traded at $2,285 per unit, equivalent to 0.0686 BTC. Today, however, a single ether is valued at 0.03537 BTC. While it’s clear that the U.S. dollar lost purchasing power against bitcoin over the year, analyzing this through the lens of stablecoins adds an intriguing twist.

Take tether (USDT), for instance—on Jan. 1, 2024, $1 USDT was worth 0.00002608 BTC. Today, that same dollar’s tether equivalent fetches just 0.00001059 BTC. XRP has had an interesting run in 2024, making gains against BTC. Back in January, XRP held the sixth-largest market cap in the crypto space, but it has since climbed to the fourth spot, just below tether. At the year’s start, one XRP was worth 0.00001607 BTC; today, it’s risen to 0.00002274 BTC.

Other crypto trends paint a different picture. BNB, for instance, traded at 0.008108 BTC 360 days ago but has dipped to 0.007344 BTC today. Similarly, solana (SOL) started the year at 0.002669 BTC and now trades at 0.00196 BTC. Beyond its growing institutional adoption, bitcoin has made significant headway this year in non-fungible tokens (NFTs), tokenization, and decentralized finance (defi) applications.

In the past year, BTC-based NFTs have generated billions in sales, with Bitcoin’s blockchain standing out for having some of the cleanest activity (minimal wash trading) among dozens of NFT-focused blockchain networks. The network’s influence in defi is also notable, with a couple billion locked into staking platforms and lending apps. Additionally, a handful of tokens built on the BRC20 standard and Runes protocol coins have gained attention, carving their own niche and multi-million-dollar market caps in the crypto world.

Bitcoin’s climb in 2024 reflects more than just market growth—it’s a testament to increasing trust from both institutional players and retail defi enthusiasts. As digital assets, both emerging and established, ride the waves of fluctuating performance, the sector’s confidence continues to pivot, with BTC remaining at the center of attention.

Looking ahead, BTC’s evolving ecosystem could experience more shifts as rival digital assets strive for renewed momentum. Interoperable technologies and niche applications may further enhance the network’s importance. As 2024 winds down, the crypto space seems primed for groundbreaking developments in the year ahead, where collaboration, adaptability, and possibly even strategic nation-state reserves could define its future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。