Original | Odaily Planet Daily (@OdailyChina)

Author | Fu Ruo (@vincent31515173)

In 2024, the RWA track emerged prominently, outperforming the broader market.

This year, RWA has moved beyond merely "selling concepts" and has seen substantial progress in many projects. Globally, regulatory policies regarding blockchain technology and the on-chain of physical assets have gradually become clearer, creating favorable conditions for capital inflow and the expansion of investment scale. As more traditional assets flow onto the blockchain, RWA has gradually become a key bridge connecting traditional finance and the crypto world, injecting new growth momentum into the capital markets.

McKinsey has predicted that the market value of tokenized assets will reach $4 trillion by 2030 (excluding stablecoins), which is the most conservative estimate among most institutions regarding the future market value of RWA. According to data from rwa.xyz, the current global market value of RWA, excluding stablecoins, is approximately $14.9 billion. If we follow these institutions' growth expectations, the RWA market needs to grow by about $33 billion in market value each year over the next few years, indicating that this field holds enormous growth potential and investment opportunities.

Although the market is confident about the future of RWA, the current RWA sector primarily serves institutions and large players, with many projects treating asset tokenization merely as part of a distribution tool. For retail investors, choosing suitable investment projects and successfully riding this wave remains a pressing challenge.

To this end, Odaily Planet Daily will review the progress of the RWA track in 2024 in its annual summary and look ahead to the future development direction of the RWA industry in 2025.

Major Event Review and RWA Subsector Analysis

In 2024, the RWA sector welcomed several significant positive events, including the establishment of relevant regulatory policies in various countries, the rush of traditional financial institutions to enter the market, new developments in crypto-native projects, and the breakthrough of landmark market values, all highlighting the development of the RWA sector this year. The following chart summarizes the major landmark events in the RWA sector in 2024.

Stablecoins

There has been ongoing debate about whether stablecoins should be classified as part of the RWA (Real World Assets) sector. Due to the development of stablecoins predating the RWA concept, they are typically not included in the RWA data statistics. However, fundamentally, stablecoins are a form of tokenized fiat currency that achieves value anchoring through a 1:1 peg to fiat currencies like the US dollar. At the same time, the development of stablecoins has provided reference and guidance for other RWA products. Therefore, this article will discuss stablecoins as part of the RWA sector.

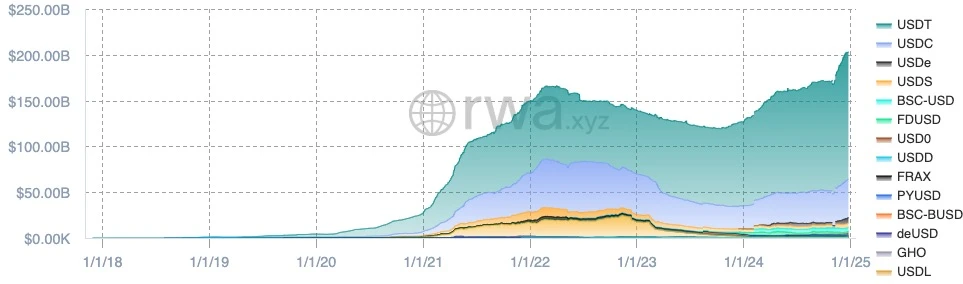

According to data from rwa.xyz, the current total market value of stablecoins is approximately $20.3 billion, with the number of global holders reaching about 139 million. As one of the most mature asset classes in the blockchain field, the application scenarios for stablecoins continue to expand. From on-chain lending and trading to cross-border payments and payments for real goods, stablecoins demonstrate their broad applicability across different fields. Especially in emerging markets, stablecoins are gradually becoming the preferred tools for foreign exchange trading and payments. For instance, mainstream stablecoins like USDT and USDC have firmly established their market dominance, with USDT's trading volume particularly prominent in regions like Southeast Asia and Latin America. Additionally, decentralized stablecoins like DAI have further enhanced their trust and flexibility in DeFi protocols through multi-collateral mechanisms.

However, in 2024, global regulatory scrutiny of stablecoins significantly intensified. Europe clarified the issuance requirements and compliance standards for stablecoins through the MiCA legislation, while the US stablecoin bill further regulated reserve disclosure and transparency. Hong Kong also launched a stablecoin sandbox program. These policies and programs have brought greater transparency and stability to the stablecoin market, but they have also imposed higher compliance costs and technical pressures on small and medium-sized issuers. Nevertheless, the increasingly refined regulatory framework has provided confidence for traditional financial institutions to participate in the stablecoin space. Large institutions, including banks and fund companies, are beginning to explore applications and innovations related to stablecoins more actively.

US Treasury Bonds

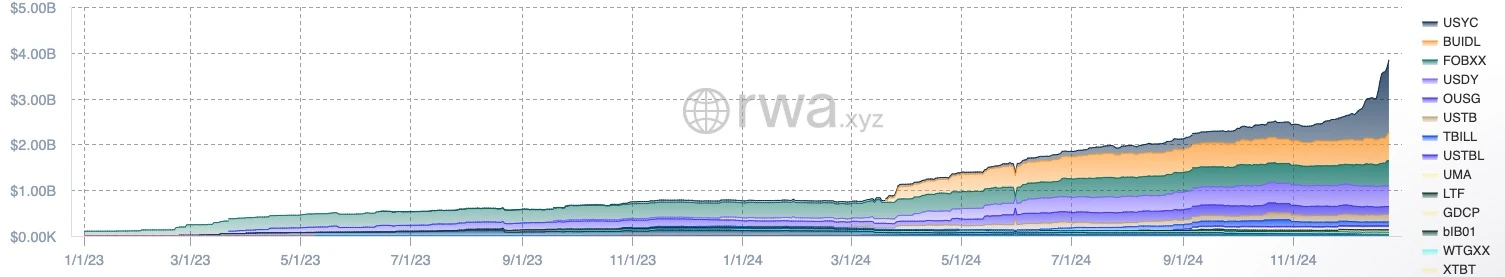

As one of the most liquid and highest-rated assets globally, US Treasury bonds occupy an important position in the tokenization process within the RWA (Real World Assets) sector. In 2024, the market value of tokenized US Treasury bonds surged from over $1 billion at the beginning of the year to recently surpassing $3 billion, with an annual growth rate exceeding 500%, ranking first in the RWA sector in terms of growth. As of now, the total market value has exceeded $3.8 billion, with over 11,000 holders.

This growth is primarily attributed to the participation of traditional financial institutions. Firms like BlackRock and Securitize have launched tokenized funds on public blockchains, attracting multiple project collaborations, with Ondo being a representative project. Ondo holds a significant position in the tokenization of US Treasury bonds and is one of the few projects with a platform token.

Additionally, Hashnote's Hashnote Short Duration Yield Coin (USYC) has emerged strongly, surpassing BUIDL in market value by the end of 2024, becoming the first to break the $1 billion mark and capturing over 40% of the market share. MakerDAO has also announced plans to invest $1 billion in tokenized US Treasury bonds. This move indicates that decentralized finance (DeFi) is increasingly integrating with traditional financial assets, promoting the application of tokenized US Treasury bonds in decentralized finance.

Overall, the tokenized US Treasury bond market has shown a steady growth trend in 2024, driven by the participation of traditional financial institutions and the launch of innovative products. With more institutions joining and continuous technological development, tokenized US Treasury bonds are expected to further expand and become an important asset within the RWA sector.

Private Credit

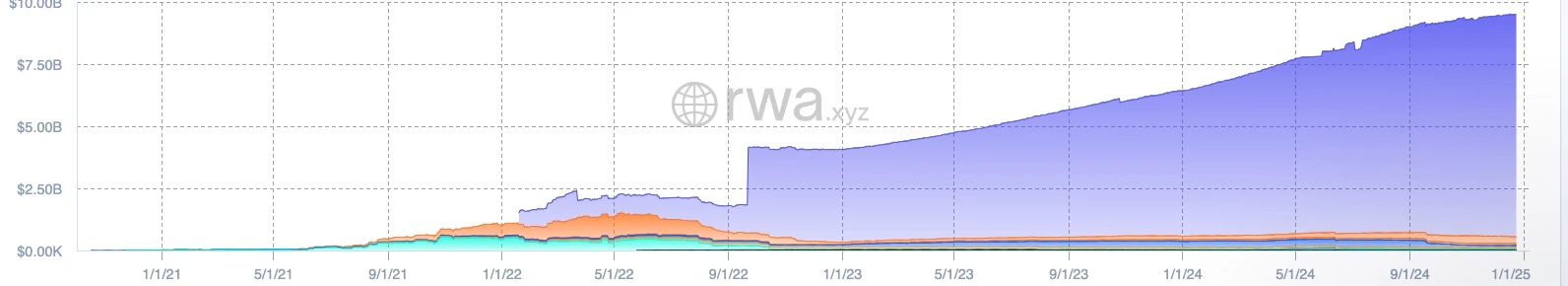

In the RWA sector, excluding stablecoins, the private credit segment holds a significant market share. According to RWA.xyz data, the total active loan value in the private credit market has reached $9.53 billion, with a total loan value of $16.2 billion and over 2,300 loan agreements involved. The average annual percentage rate (APR) is approximately 9.91%.

Among them, Figure Technologies, the largest non-bank home equity line of credit (HELOC) lender in the US, holds the highest market share in private credit, having issued over $10.4 billion in loans, of which approximately $9.096 billion are active loans.

As a crypto-native project, Maple Finance has also made significant progress in this field, with a total loan value of $2.44 billion, of which about $270 million are active loans, and an annualized interest rate of 9.72%. This year, it launched a new product focused on DeFi lending, Syrup.fi, upgrading its platform token MPL, with the new token SYRUP introducing staking features to enhance protocol revenue conversion.

Additionally, protocols like Centrifuge and Goldfinch are also driving the growth of on-chain credit, supporting loans of $560 million and $170 million, respectively.

These blockchain-based private credit platforms are gradually transforming the traditional credit market by providing transparent, standardized, and low-cost loan processes. Most importantly, blockchain enables global liquidity to fund on-chain credit without requiring permissioned access, offering borrowers more financing channels. The tokenization of borrowers' financial data and on-chain cash flows may further optimize the credit process, making it more automated, fair, and precise.

Currently, the private credit market is gradually expanding, with more non-standardized credit products emerging, showcasing strong growth potential. The CEO of Securitize has also stated that the prospects for tokenized private credit are broad, and it is expected to become a key segment in the RWA sector. As market demand for innovative financial products increases, private credit is likely to become an important growth point within the RWA sector.

Commodities

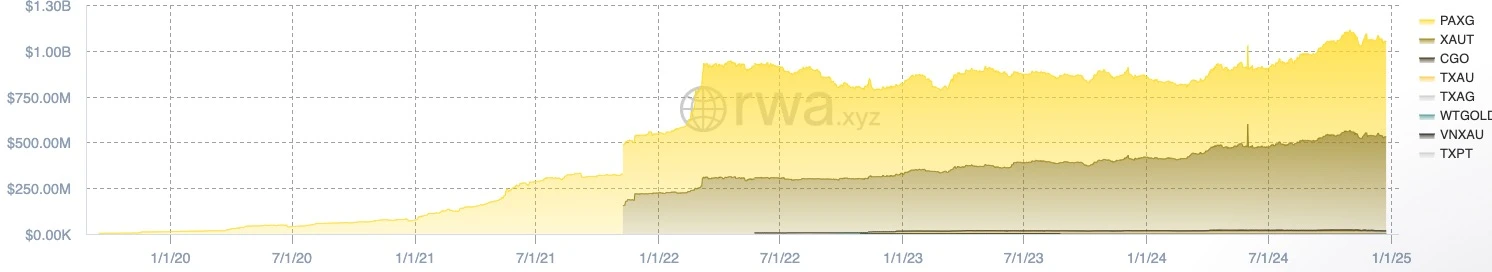

In 2024, the tokenization of commodities is gradually becoming an important trend in the financial market, particularly in the gold sector. Gold, as one of the most stable assets globally, is attracting increasing attention in its tokenization process. According to the latest data, the total market value of gold tokens has reached $1.05 billion, with a total of 58,610 holders of gold tokens, indicating that this market is gradually gaining recognition and participation from investors.

In the gold token issuance market, Paxos and Tether Holdings dominate, promoting market development through tokenized gold products like PAXG and XAUT. Paxos and Tether Holdings hold market shares of 49.59% and 48.71%, respectively, with both companies' gold tokens pegged 1:1 to physical gold, ensuring the value stability of gold tokens. Besides these two major issuers, other companies like Comtech Gold and Aurus are also involved, but their market shares are relatively small, at 1.1% and 0.45%, respectively.

The main advantages of gold tokenization lie in its ability to leverage blockchain technology to enhance transparency, liquidity, and tradability. Through blockchain, gold token transactions can achieve real-time settlement without the need for traditional financial intermediaries, thereby reducing transaction costs and time delays. Additionally, the application of smart contracts allows gold tokens to serve not only as investment tools in traditional markets but also as collateral assets participating in lending and other financial activities on DeFi platforms. This decentralized characteristic enables investors to trade gold 24/7, overcoming the time constraints and physical delivery issues of traditional gold markets.

With the entry of more traditional financial institutions and decentralized finance platforms, the gold tokenization market is showing rapid development momentum. Although the market is still in its early stages, gold tokens, as a flexible investment tool, have already provided global investors with diversified options, especially in asset allocation and risk management.

Others

The breadth and diversity of the RWA track make it one of the important areas for the application of blockchain technology. In addition to the four main sectors mentioned earlier in this article (such as bonds, real estate, private equity, and commodities), the RWA track also encompasses several promising sub-sectors. Areas such as real estate, stocks and funds, art, and carbon credits are all rapidly developing fields. Each sector has its unique market characteristics and demands, with varying potential. The tokenization process of real estate is accelerating globally, particularly in enhancing the liquidity of high-value real estate projects. The tokenization of stocks and funds provides investors with more flexible and lower-threshold investment methods, especially with the innovation of circulating traditional stocks and funds on-chain, allowing investors to directly participate in global markets. Furthermore, art, as a unique physical asset, is also being tokenized through blockchain technology, enabling more investors to participate in high-value art investments. The tokenization of the carbon credit market has also attracted attention in the environmental sector, as blockchain technology can help improve the transparency and liquidity of carbon credit trading, promoting the sustainable development of green investments.

However, despite the potential of these sub-sectors, many are still in their early stages, with relatively low market values or unable to be measured by market value standards, which is why this article does not delve deeply into these sectors.

In addition to the diversity of RWA products, the public chains issuing these RWA products have also become a focal point of market attention. According to Bitwise, Ethereum remains the primary issuance chain in the RWA market, holding an 81% market share. With its strong technical foundation and ecosystem, Ethereum has become the preferred platform for many RWA projects. Meanwhile, Ethereum's continuous updates and upgrades provide ongoing momentum for its leading position in the RWA track.

Besides Ethereum, other emerging public chains are gradually carving out their share. For instance, Solana, with its high throughput and low transaction fees, is attracting more and more RWA projects to issue on its platform. Additionally, other public chain platforms such as Avalanche, Polygon, and Sui are also joining the RWA track, providing more options for the market.

Based on these major public chain platforms, some emerging public chain projects are also gaining prominence, focusing on providing asset tokenization solutions. Among them, Mantra stands out as one of the most notable representatives, attracting widespread market attention. Mantra's token OM has surged by 160 times in the past year, a remarkable achievement attributed to its collaboration with MAG (one of the largest real estate developers in Dubai). Through this partnership, Mantra has tokenized the financing of a $500 million real estate plot and development project, allowing on-chain investors to participate in funding the project, and investors can also partake in equity returns once the project is completed. Through this innovative model, Mantra not only brings more capital into the real estate industry but also provides investors with direct opportunities to participate in asset appreciation.

Moreover, startup projects focused on the RWA sector are continuously emerging, with the fully modular integrated Layer-1 blockchain Plume recently securing $20 million in funding, with over 180 protocols already being built within its ecosystem, and an asset scale exceeding $4 billion. It is believed that soon, another batch of promising public chains dedicated to the RWA sector will come into the public eye.

Investment Dilemmas Behind the RWA Boom—How Retail Investors Choose Targets

Since 2023, RWA has become a hot topic in the Web3 field. Whether in social media discussions or as a focal point at offline conferences, RWA is seen as the next significant trend in Web3. However, despite the anticipation for the future of RWA, there is still a lack of clear perspectives on how to invest in this field.

The widespread attention on the RWA concept stems from its potential to combine traditional financial assets with blockchain technology. This field differs from many experimental projects in the early days of the crypto industry, as it possesses mature revenue models and operates more closely to traditional asset management companies. Most RWA projects do not rely on token financing, primarily adopting centralized models to ensure compliance and management efficiency, rather than emphasizing decentralized community governance.

Data shows that the total market value of RWA products is approximately $14.9 billion, but most projects have not launched platform tokens and are unlikely to do so in the future. This is partly because these projects' business models do not require token economics for support and are also constrained by the regulatory environment. This characteristic makes the participation path for ordinary investors appear vague, with more discussions in the market focusing on "optimistic future potential" rather than actual actions.

Currently, the RWA sector is still in its early stages, with the core driving force coming from traditional financial institutions. They are bringing real assets onto the blockchain in a compliant manner, building the foundational product layer. For ordinary investors, participation opportunities at this stage are limited, requiring them to wait for the gradual improvement of infrastructure before engaging through innovations and revenue mechanisms of blockchain-native projects.

Two Main Investment Approaches

At this stage, there are two main approaches to investing in RWA: one is to directly purchase RWA products, and the other is to invest in the platform tokens of RWA-related projects.

Direct investment in RWA products requires consideration of the following points:

Compliance and SPV: Investors should pay attention to the compliance of the products to ensure that investments comply with local regulatory laws. Additionally, products managed through Special Purpose Vehicles (SPVs) require special attention to the background, operational model, and compliance of the SPV. The operational model of the SPV directly affects the security and liquidity of the assets, so investors should carefully review relevant audit reports and compliance certifications.

Choose well-known asset issuers: Prioritize products issued by reputable financial institutions or platforms, such as US Treasury bonds or high-quality stocks. These platforms typically have robust asset custody and risk management mechanisms, effectively reducing investment risks. In contrast, smaller platforms require additional scrutiny regarding the security of their asset custody and the background of their management teams.

Security of asset custody: Investors need to ensure that assets are managed by established third-party custody platforms to reduce the risk of losses due to mismanagement or security vulnerabilities. Choosing reputable custody institutions, such as banks or professional asset management companies, and understanding their insurance mechanisms and risk mitigation measures is an important step in ensuring asset security.

At the current stage, direct investment in RWA products is not the primary focus for most readers of this article; investing in platform tokens is a more attractive option. However, how to choose suitable targets among the numerous RWA projects issuing platform tokens has become a significant challenge. Here are some suggestions from the author to help investors make more informed decisions:

Do not overly focus on the actual role of platform tokens: Most platform tokens of RWA projects do not possess actual value, typically only providing governance rights without distribution rights to platform profits. This is because the current RWA track is still in the early stages of large-scale real asset tokenization, with most projects still led by traditional companies that rely more on asset management fees and other means to achieve returns rather than obtaining investment returns through token issuance.

Pay attention to the project's market share in the sub-sector: Many RWA projects may merely be "selling concepts," with their actual market share in the sub-sector being almost zero. Such projects often rely on token issuance to maintain operations rather than benefiting from actual asset management or market share expansion. For projects where the product market value significantly exceeds the token market value, investors should pay close attention. This indicates that the project's development in the actual market is relatively healthy and that it may achieve a higher market share in the future, thereby driving the value of the token.

Focus on the potential of diversified RWA projects: The market value of a single RWA project may be subject to bubbles, and there may be a significant gap between product market value and token market value. However, if a project is involved in other sectors (such as DeFi, NFTs, blockchain infrastructure, etc.) in addition to the RWA field, its token performance often tends to be better. Diversified sectors and application scenarios can provide more robust growth momentum for the project, so investors should pay attention to those projects that are not limited to the RWA field, as their expansion in different sectors can help increase the actual demand and value of the token.

Emphasize real-world partnerships: The RWA sector currently relies more on real-world partnerships and support, especially with the participation of traditional financial institutions and well-known enterprises. Projects that can attract collaborations from these institutions often indicate stronger compliance, market trust, and risk control capabilities. Therefore, investors should focus on RWA projects that have partnerships with reputable institutions, banks, or other traditional financial platforms. These collaborations can not only bring more resources to the projects but also provide investors with greater security, while also giving these projects higher narrative value and development potential in the market.

Future Outlook for the RWA Sector in 2025

Looking ahead to 2025, RWA is gradually becoming one of the core driving forces for the development of Web3. Citibank analyst Alex Saunders emphasizes that with the acceleration of asset digitization, the widespread adoption of RWA will inject long-term vitality into the crypto market. Coupled with the efficiency improvements in on-chain capital flows brought about by the popularity of stablecoins, the position of blockchain in traditional finance will be further solidified.

Additionally, Coinbase pointed out in its 2025 market forecast that RWA will become the next wave of growth in the blockchain industry. With the improvement of the regulatory environment and the maturation of technological infrastructure, traditional financial institutions will participate in the on-chain asset field on a larger scale. The tokenization of high-value assets such as bonds and real estate is expected to bring more liquidity and stability to the crypto market, gradually becoming a new pillar of the on-chain economy.

From the current market performance, data from 2024 has already validated the growth potential of RWA. According to a report from rwa.xyz, this year, the market size of tokenized RWA has grown by 60% year-on-year, reaching $14.9 billion. In the coming years, the tokenization of asset classes such as private credit, real estate, and commodities will further expand the application scope of this market, providing investors with more transparent and efficient financial tools.

Although the comprehensive popularization of on-chain tokenized assets will take time, its potential is undeniable. Against the backdrop of gradually relaxed regulations and continuous technological advancements, the explosion of RWA may become an important turning point in the transformation of the crypto industry. For investors seeking long-term value, 2025 will be a critical moment to position themselves in the RWA sector—this year may not only become a turning point for technological innovation but also a milestone for the deep integration of traditional finance and the crypto industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。