Original | Odaily Planet Daily (@OdailyChina)

As 2024 comes to a close, people in the crypto space have their own year-end summaries: first, to see if their investment returns have outperformed the market (reminder: BTC has risen over 130% this year), and second, to summarize the development of the sectors/ecosystems they are focused on throughout the year.

The Solana ecosystem, Base ecosystem, TON ecosystem, and AI Agent sector have all had their shining moments this year. However, for the Bitcoin ecosystem, despite many events occurring this year, including infrastructure development and application innovation, it has not yet met the expectations people had at the beginning of 2024.

As a result, some have summarized the Bitcoin ecosystem's silence this year as a "failure," while steadfast ecosystem OGs continue to choose to "believe." As an ordinary player in the Bitcoin ecosystem from the beginning, I choose to conclude this year with the word "regret."

2024 Actually Had a Good Start

2024 actually had a good start for the Bitcoin ecosystem. At the beginning of the year, people were filled with expectations for the Bitcoin ecosystem, believing that 2024 would be the year of its complete explosion and entry into the mainstream, much like the current belief that 2025 will be the year of the AI Agent ecosystem's explosion.

Why did we have such high expectations for the Bitcoin ecosystem's development in 2024? Perhaps it is because since the birth of the Ordinals protocol in December 2022, the Bitcoin ecosystem has undergone a year of growth and consensus building, transitioning from the "barbaric era" to the "industrial era," with project teams, VCs, and mainstream exchanges all entering the space, forming three main tracks: asset issuance protocols, L2, and Bitcoin staking.

From the perspective of asset issuance protocols, influenced by Binance's launch of BRC20 token ORDI and SATS spot trading at the end of 2023, the concept of inscriptions became popular again at the beginning of 2024. This not only sparked enthusiasm that led other chains to follow suit and start inscription modes but also boosted the prices of other asset protocols like ARC20, SRC20, PIPE, etc. Additionally, the rune pre-mining and airdrop gameplay launched by RSIC and Runestone in January 2024 filled people with anticipation for the upcoming Runes protocol.

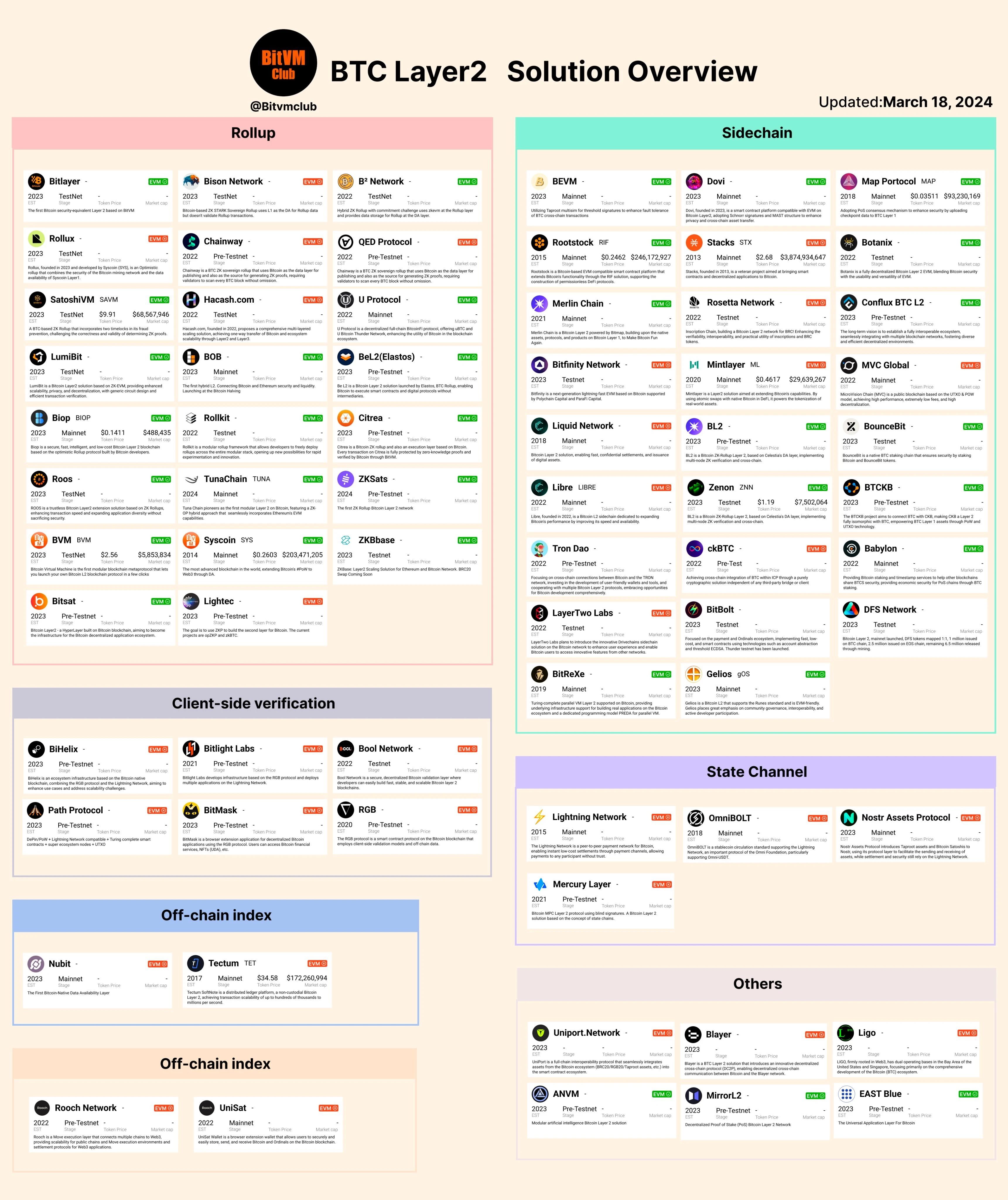

From the development of L2, Bitcoin L2 experienced explosive growth at the beginning of 2024. With the hot trading and issuance of layer one assets, the congestion issues on the Bitcoin mainnet and players' demand for increased playability of mainnet assets made Bitcoin L2 a popular entrepreneurial direction. By early 2024, it was reported that over 100 Bitcoin L2 projects had emerged in a short period. Although many of these were poorly constructed and "quick cash grabs," overall, domestic and foreign VCs began to invest heavily in Bitcoin L2, hoping that Bitcoin L2 could replicate the glory of the Ethereum L2 ecosystem in 2024.

In March 2024, @Bitvmclub summarized 69 Bitcoin L2 projects.

Regarding Bitcoin staking, the Bitcoin staking protocol Babylon announced the completion of a $18 million funding round in December 2023, officially launching the narrative of Bitcoin staking and re-staking. With the example of Ethereum's top-tier re-staking project EigenLayer, people believed that with Bitcoin's stronger consensus foundation and security compared to Ethereum, the prospects for Bitcoin staking and re-staking in 2024 would be very promising. This would not only awaken dormant Bitcoin whales to participate in the Bitcoin ecosystem but also create a re-staking ecosystem comparable to Ethereum's.

In addition to the overall positive trends in the three main tracks at the beginning of 2024, the general infrastructure of the Bitcoin ecosystem (such as wallets, cross-chain bridges, and trading markets) was also gradually improving during this time. Unisat and OKX Wallet have technically supported multiple asset protocols, becoming major wallets and trading markets in the Bitcoin ecosystem.

The approval and listing of the Bitcoin spot ETF on January 11, 2024, marked Bitcoin's formal integration into traditional finance. This also further strengthened people's expectations for the Bitcoin ecosystem, as a network valued at trillions of dollars would inevitably develop into a market scale of hundreds of billions of dollars.

However…

Regrettably, the Bitcoin ecosystem in 2024 did not receive the attention and development that surpassed previous bull market peaks, instead entering a long period of silence.

Mainnet Asset Performance Deteriorating

On April 20, 2024, Bitcoin experienced its fourth halving, and the token protocol Runes, developed by Ordinals founder Casey, also announced its launch. To compete for inscription numbers, project teams raised on-chain transaction fees to over 2000 satoshis/byte. People believed this was the beginning of Runes taking over BRC20 to sustain the prosperity of the Bitcoin ecosystem, but unexpectedly, Runes peaked at the start, and speculative enthusiasm faded within just two weeks. Although the market cap of Runes briefly surpassed $2 billion in June and November, the vitality and liquidity of new projects within the ecosystem remained sluggish.

At the same time, the performance of other asset protocols this year was similar. ORDI's peak drop reached 70%, and while new assets initially triggered FOMO among market participants, they later declined due to a lack of new capital and traffic, such as the PIZZA airdrop from Unisat and the CAT20 from the Fractal network.

The reasons for this include that, after experiencing previous Bitcoin bull markets, the narrative of fair asset issuance for Bitcoin has failed to excite the outside world and cannot generate a wealth effect again; and the lack of synergy between domestic and foreign markets, as the larger communities for Runes are primarily led by overseas users, while major funds in the Chinese-speaking region remain focused on BRC20, such as the currently popular inscription "ground-pushing coins" 𝛑, 𐊶, etc.

Bitcoin L2 Survival Rate Below 20%

Unfortunately, the Bitcoin L2 ecosystem in 2024 also did not achieve the prosperity that was initially expected. "Except for the Lightning Network, all other Bitcoin L2s are castles in the air," Casey, the founder of the Ordinals protocol, criticized when discussing Bitcoin L2 in an interview.

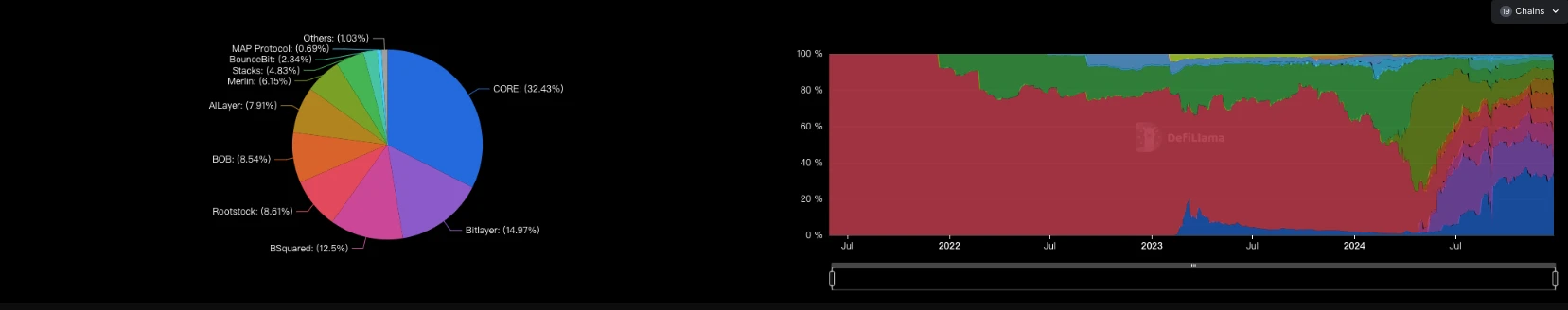

In the past 12 months, there have been over 100 Bitcoin L2 projects, but according to DefiLlama, only 19 L2s remain, with a total value locked (TVL) of about $2.8 billion. In contrast, the Ethereum L2 ecosystem has a single Arbitrum with a TVL of $3 billion.

So why has the expansion of the Ethereum L2 ecosystem been validated as feasible, while the development in the Bitcoin ecosystem has not been satisfactory?

Most early Bitcoin L2s lacked innovation. In the early days of the Bitcoin L2 track, many L2s adopted an EVM-like architecture combined with cross-chain bridges to expand the Bitcoin mainnet quickly to attract investment and build ecosystems. While this method borrowed from Ethereum's experience, making it easy and quick to build chains and lowering user education costs, it lacked innovation and was often met with skepticism, such as "if this is called Bitcoin L2, then Ethereum is the best Bitcoin L2." This has proven to be true, and as the hype faded, these hastily assembled L2s quickly disappeared.

Bitcoin L2s started the TVL competition too early. Perhaps influenced by the Ethereum L2 blast, Bitcoin L2s learned from the beginning to stimulate TVL growth through incentives and team formations. Merlin, a popular chain among Bitcoin L2s, launched the first shot in the Bitcoin TVL competition on February 9, 2024, achieving a TVL of $543 million within just 24 hours. At the same time, B² Network, BEVM, and Bitlayer also began competing for TVL.

Ultimately, Merlin won this competition with a TVL of over $3 billion within a month and launched its official token MERL on OKX on April 19. After its launch, the price of MERL peaked at $1.78 USDT but quickly collapsed, with a peak drop of 85%. Since then, those focused on price have shifted from anticipation to disappointment and criticism of the Bitcoin L2 ecosystem.

Who Recognized the Bitcoin Staking Narrative?

The luxurious financing lineup and "narrative appeal" of Babylon and its associated Bitcoin re-staking ecosystem were another expected track in the Bitcoin ecosystem for 2024. When Babylon's mainnet launched its first staking phase in August, it attracted widespread attention, reaching the limit of 1,000 BTC within just three hours. Currently, Babylon's TVL stands at 57,051.72 BTC, approximately $5.64 billion. However, compared to EigenLayer's impressive TVL of $15.718 billion, Babylon's TVL is only one-third of that, and despite Bitcoin continuously reaching new highs, the market's attention on Babylon has not increased. Who exactly has recognized the Bitcoin staking narrative?

Market and product mismatch; true large holders are unwilling to part with their Bitcoin. Babylon's narrative slogan is to unlock the liquidity of 21 million BTC through staking, but the market may not be convinced. The market tends to view Ethereum as a native financial asset on-chain, while still considering Bitcoin as "digital gold," which partially explains why the funding scale for Bitcoin spot ETFs is much larger than that for Ethereum spot ETFs.

For large Bitcoin holders, as Bitcoin continues to rise, they are even less willing to part with their holdings. For traditional finance, Bitcoin spot ETFs and MSTR are what they truly favor in BTCFi. This is in stark contrast to the Ethereum ecosystem, which inherently encourages staking.

Babylon sets the stage, but the performance is by others. According to data from Babylon's official website, re-staking protocols such as Lombard, Solv Protocol, PumpBTC, Bedrock, and Chakra account for over 60% of Babylon's total staking volume. The operation of these platforms can be summarized as users exchanging their BTC for the platform's wrapped BTC, which the platform then deposits into Babylon, allowing users to enjoy dual rewards from both Babylon and the platform's points. However, the issue is that the BTC deposited by users and the platform's wrapped BTC may not be limited to a 1:1 ratio, with the circulating wrapped BTC potentially exceeding the locked BTC value, which may contain liquidity risks.

At the same time, the security of re-staking protocols is also worth considering. Previously, Bedrock suffered an attack that resulted in approximately $2 million in losses on DEX. Although Babylon claims to use a self-custody solution to protect user funds, most of the re-staking protocols behind it use custodial solutions, which contradicts the concept initially promoted by Babylon. Therefore, not only are large holders reluctant to stake BTC, but retail investors may also hesitate to participate in staking due to unclear returns and insufficient security guarantees.

In summary, while the Bitcoin ecosystem had a good start in 2024, the performance of the Runes protocol peaked upon launch, various asset protocols quickly cooled down, the dramatic developments of Merlin and other Bitcoin L2s, and the Babylon ecosystem failing to bring about the anticipated BTCFi bull market all leave us feeling regretful about the development of the Bitcoin ecosystem this year.

Will everything get better in 2025?

It is important to emphasize that what I have said above is not to short the Bitcoin ecosystem or to draw a final conclusion about it—there is always a gap between people's beautiful expectations for the future and the actual situation in reality, and I refer to this gap as "regret," which is also my summary of the Bitcoin ecosystem this year.

To this day, there are still steadfast holders and builders in the Bitcoin ecosystem. Communities around ORDI, Runes DOG, PUPS, and others are continuously building, while OKX Wallet and Unisat are still working on infrastructure development. Although the Bitcoin L2 bubble has burst, the surviving teams have not given up, and a series of innovations like OP_CAT are on the way. Babylon may have its Token Generation Event (TGE) in January or February 2025…

Will everything be alright in 2025? Although we did not witness a larger-scale explosion in the Bitcoin ecosystem this year, I still believe that the Bitcoin ecosystem will become the protagonist of this cycle, confidently welcoming 2025.

If it were you, what keyword would you give to this year's Bitcoin ecosystem?

Related Reading

When will the bull market's wind reach the Bitcoin ecosystem?

A Brief History of the Bitcoin Ecosystem: Written on the Eve of the Bitcoin Ecosystem Explosion

Bitcoin breaks $100,000, but the ecosystem remains lukewarm; what do seasoned players think?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。