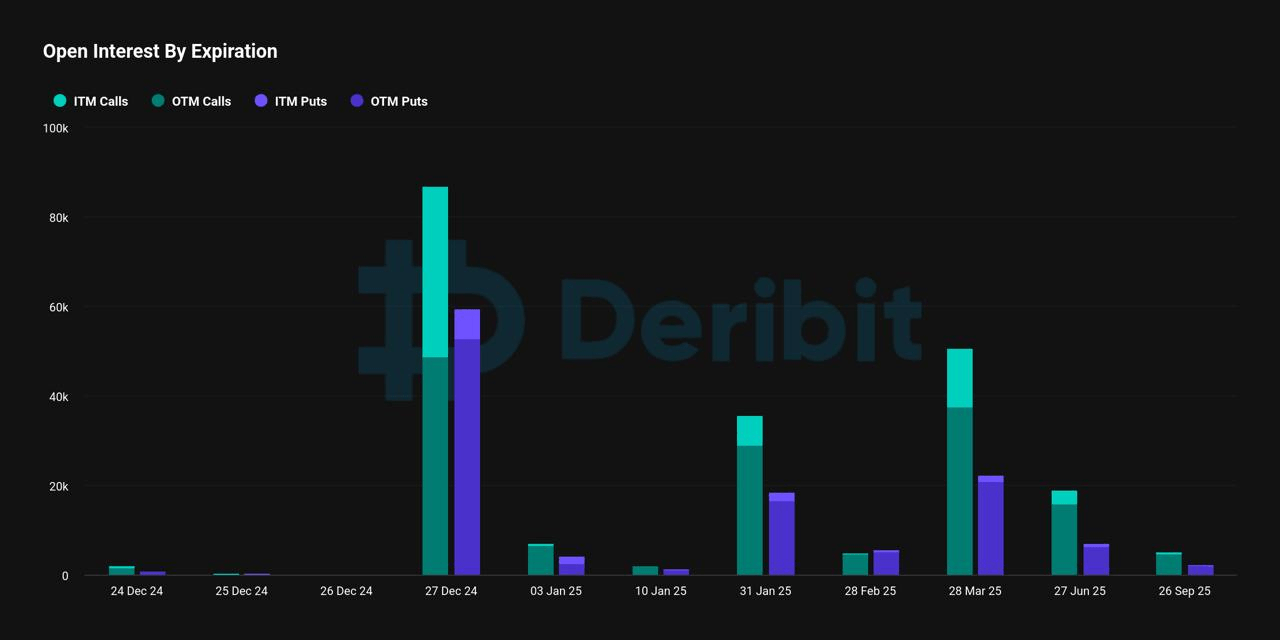

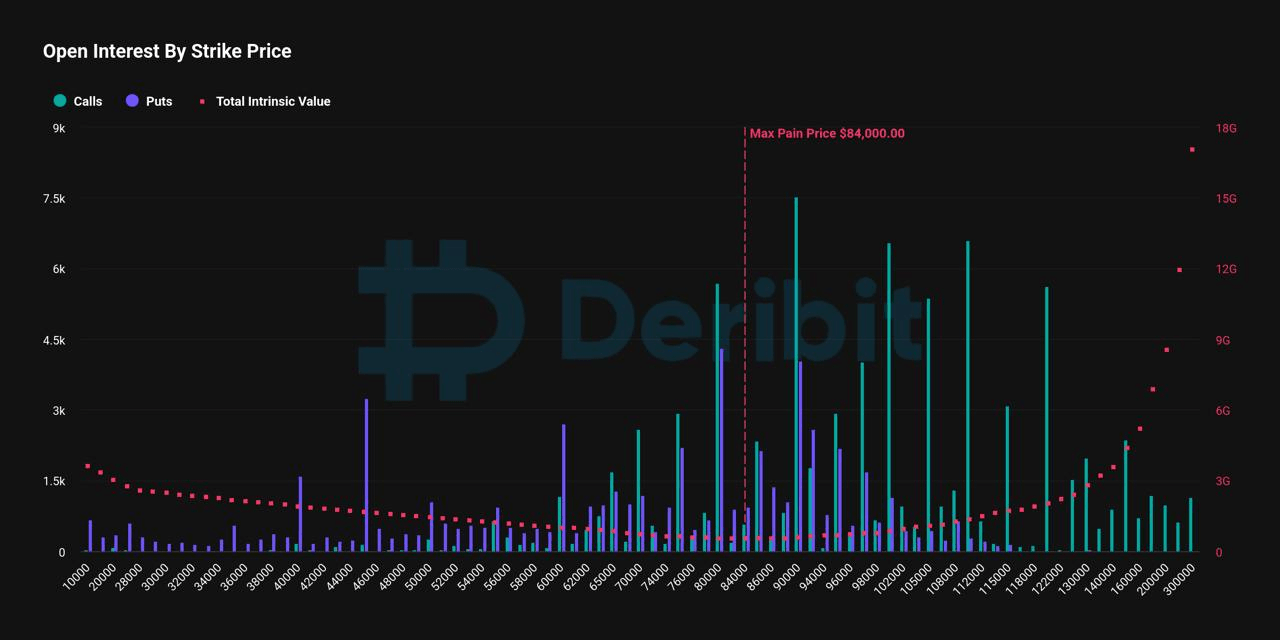

In a note sent to Bitcoin.com News, Luuk Strijers, Deribit‘s CEO disclosed that the put-call ratio for the expiry stands at 0.69, reflecting seven puts for every 10 calls. He noted that December’s expiry dwarfs others, with 146,000 contracts outstanding—double the next largest expiry in March 2025, which holds 73,000 contracts.

Strijers explained that this Friday’s expiry represents 44% of the total bitcoin options OI, which currently amounts to $32 billion. Deribit, the world’s leading crypto options exchange, has highlighted that more than $4 billion worth of these contracts are expected to expire in the money, a development likely to trigger significant trading activity.

While 2024 has been a bullish year for bitcoin, uncertainty clouds the upcoming expiry. Heightened volatility of volatility, reflected in the sharp fluctuations of Deribit’s DVOL index, underscores the precarious market sentiment.

“The much-anticipated annual expiry is poised to conclude a remarkable year for the bulls,” Strijers told our news desk.

The Deribit CEO added:

However, directional uncertainty lingers, highlighted by heightened volatility of volatility (vol-of-vol), as evidenced by recent sharp fluctuations in DVOL.

Strijers also remarked that “the previously dominant bullish momentum has stalled, leaving the market highly leveraged to the upside. This positioning increases the risk of a rapid snowball effect if a significant downside move occurs. All eyes are on this expiry, as it has the potential to shape the narrative heading into the new year.”

This historic expiry carries implications beyond the immediate, providing critical insight into positioning and sentiment as the year transitions into 2024.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。