Author: Coinbase

Compiled by: Felix, PANews

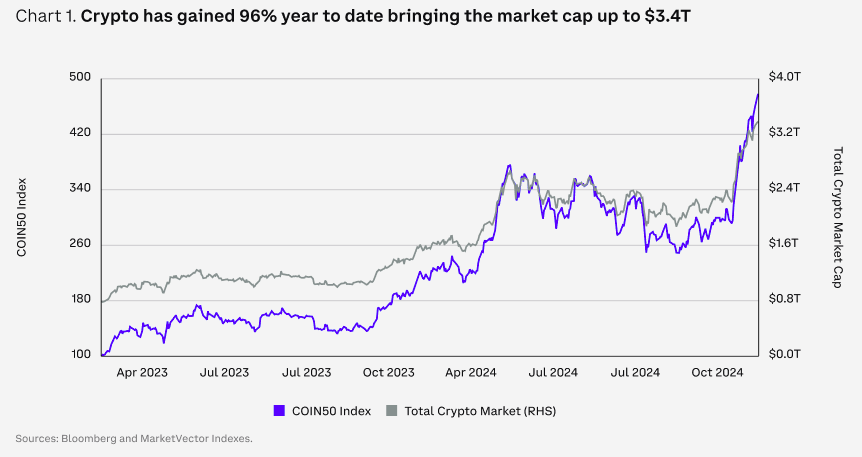

Looking ahead to 2025, the crypto market is poised for transformative growth. With increasing institutional adoption and expanding use cases across various sectors, the maturity of this asset class continues to gain momentum. In just the past year, spot ETFs have been approved in the U.S., the tokenization of financial products has surged, stablecoins have seen significant growth, and further integration into global payment frameworks has occurred.

Achieving this is no easy task. While it is easy to view these successes as the result of years of effort, an increasing number of people believe that this is actually just the beginning of a grand journey.

Considering that just a year ago, this asset class was stumbling due to interest rate hikes, regulatory crackdowns, and an uncertain path forward, the progress in cryptocurrency is even more impressive. Despite all these challenges, cryptocurrencies have become a solid alternative asset, proving their resilience.

However, from a market perspective, the upward trend in 2024 does exhibit some notable differences from previous bull market cycles. Some of these are superficial: "Web3" has been replaced by the more appropriate term "onchain." Others have more profound implications: the demand for fundamentals has begun to replace the influence of narrative-driven investment strategies, partly due to increased institutional participation.

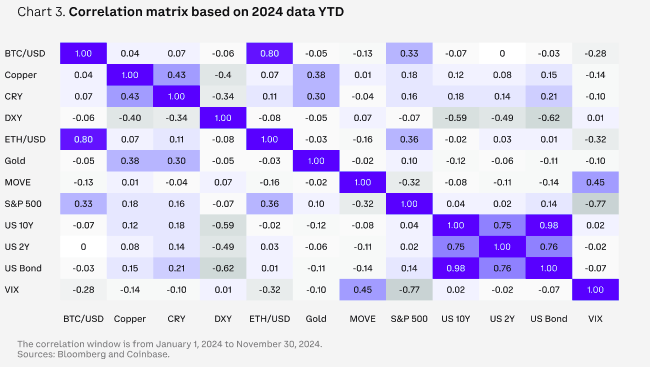

Moreover, not only has Bitcoin's dominance surged, but innovations in DeFi have also pushed the boundaries of blockchain—making the foundation of a new financial ecosystem within reach. Central banks and major financial institutions around the world are discussing how crypto technology can make asset issuance, trading, and record-keeping more efficient.

Looking ahead, the current crypto landscape presents many promising developments. At the forefront of disruption, we are focusing on decentralized peer-to-peer exchanges, decentralized prediction markets, and AI agents equipped with crypto wallets. On the institutional side, there is immense potential in stablecoins and payments (bringing crypto and fiat banking solutions closer together), low-collateral on-chain lending (facilitated by on-chain credit scoring), and compliant on-chain capital formation.

Despite the high awareness of cryptocurrencies, the technology remains obscure to many due to its novel technical structure. However, technological innovations are expected to change this status quo, as more projects focus on improving user experience by abstracting blockchain complexity and enhancing smart contract functionality. Success in this area could expand the accessibility of cryptocurrencies to new users.

Meanwhile, the U.S. has laid a clearer regulatory foundation for 2024, well ahead of the November elections. This sets the stage for greater progress in 2025, potentially solidifying the position of digital assets in mainstream finance.

As the regulatory and technological landscape evolves, significant growth in the crypto ecosystem is expected, as broader adoption will drive the industry closer to realizing its full potential. 2025 will be a pivotal year, with breakthroughs and advancements likely to help shape the long-term trajectory of the crypto industry for decades to come.

Theme 1: Macro Roadmap for 2025

What the Fed Wants and What the Fed Needs

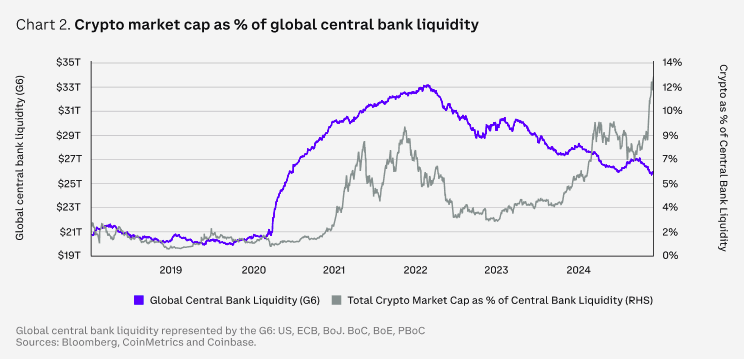

Trump's victory in the 2024 U.S. presidential election is the most significant catalyst for the crypto market in Q4 2024, driving Bitcoin up 4-5 standard deviations (compared to the three-month average). However, looking ahead, the response of short-term fiscal policy may not be as meaningful as the long-term direction of monetary policy, especially with the Fed's critical moments approaching. Yet, separating the two may not be so easy. The Fed is expected to continue easing monetary policy in 2025, but the pace may depend on the expansiveness of the next set of fiscal policies. This is because tax cuts and tariffs could push inflation higher, and while the overall CPI year-on-year has fallen to 2.7%, the core CPI remains around 3.3%, above the Fed's target.

Regardless, the Fed aims to suppress inflation from current levels, which means prices need to rise, but slow down from now on to help achieve its other mission—full employment. On the other hand, households have been demanding lower prices after experiencing the pain of rising costs over the past two years. However, while falling prices may be politically expedient, they could potentially lead to a vicious cycle that ultimately results in an economic recession.

Nonetheless, thanks to declining long-term interest rates and the U.S. exceptionalism 2.0, a soft landing seems to be the current baseline. At this point, the Fed's rate cuts are merely a formality, as credit conditions have already loosened, providing a supportive backdrop for cryptocurrency performance in the next 1-2 quarters. Meanwhile, with more dollars circulating in the economy, the anticipated deficit spending of the next government (if realized) should translate into greater risk-taking (crypto purchases).

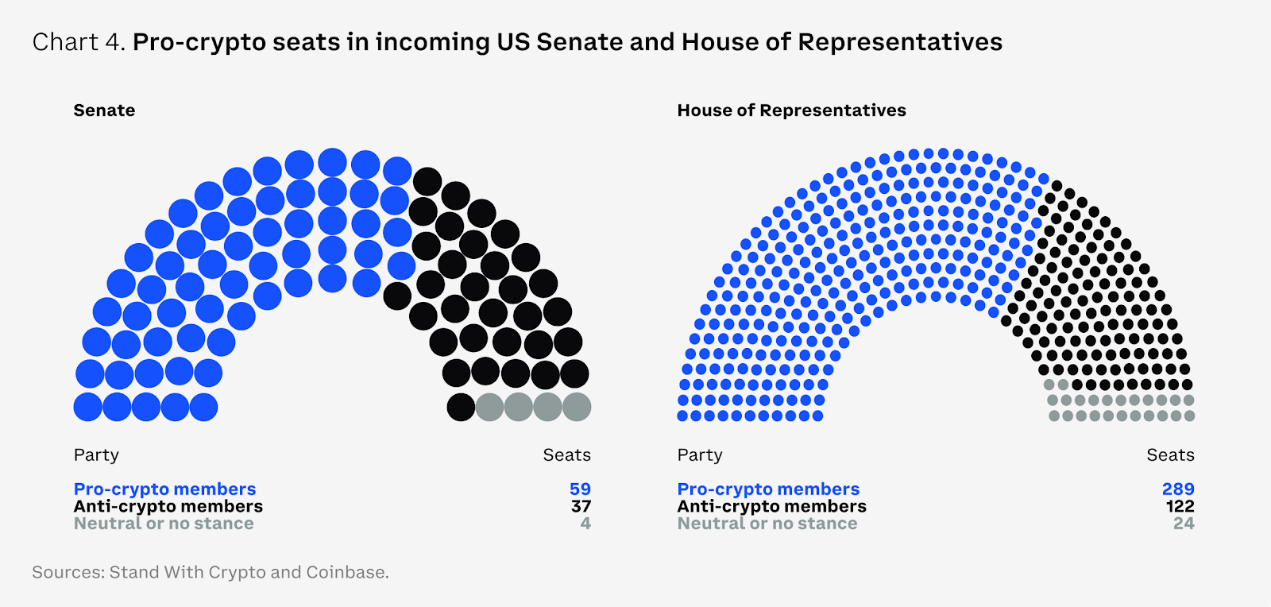

The Most Crypto-Friendly U.S. Congress Ever

After years of battling regulatory ambiguity, the next legislative session in the U.S. may enhance regulatory clarity for the crypto industry. This election sends a strong message to Washington that the public is dissatisfied with the current financial system and desires change. From a market perspective, bipartisan support for cryptocurrencies in both the House and Senate suggests that U.S. regulation may shift from "headwinds" to "tailwinds" in 2025.

One new topic of discussion is the possibility of establishing strategic Bitcoin reserves. Following the Bitcoin Nashville conference, Senator Cynthia Lummis (WY) not only introduced a Bitcoin bill in July 2024 but also proposed a Pennsylvania Bitcoin Strategic Reserve Act. If passed, the latter would allow the state treasurer to invest up to 10% of the general fund in Bitcoin or other crypto-based instruments. Michigan and Wisconsin have already held cryptocurrencies or crypto ETFs in their pension funds, with Florida following suit. However, creating strategic Bitcoin reserves may face challenges, such as legal restrictions on the amount of Bitcoin the Fed can hold on its balance sheet.

Meanwhile, the U.S. is not the only jurisdiction preparing to make regulatory progress. The growing global demand for crypto is also changing the competitive landscape for regulation internationally. The EU's crypto asset regulatory framework (or MiCA) is being implemented in phases, providing a clear framework for the industry. Many G20 countries and major financial centers like the UK, UAE, Hong Kong, and Singapore are also actively developing rules to accommodate digital assets, creating a more favorable environment for innovation and growth.

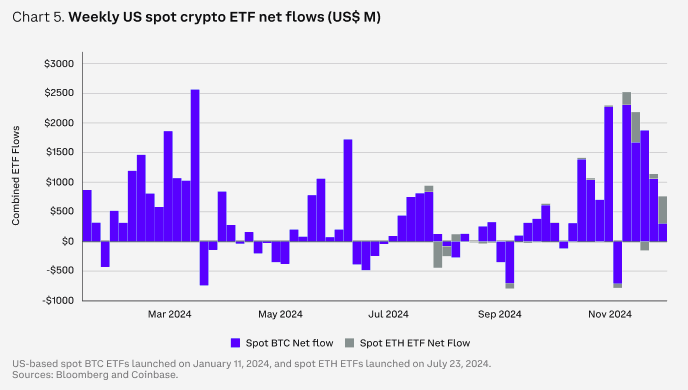

Crypto ETF 2.0

The approval of spot Bitcoin and Ethereum exchange-traded products and funds (ETPs and ETFs) in the U.S. marks a watershed moment for the crypto economy, with net inflows of $30.7 billion since their inception (approximately 11 months). This far exceeds the $4.8 billion attracted by the SPDR Gold Shares ETF (GLD) in its first year after launching in October 2004 (adjusted for inflation). According to Bloomberg, this places these tools in the top 0.1% of the approximately 5,500 new ETFs launched in the past 30 years.

ETFs have reshaped the market dynamics of BTC and ETH by establishing new demand anchors, pushing Bitcoin's dominance from 52% at the beginning of the year to 62% in November 2024. According to the latest 13-F filings, nearly all types of institutions are now holders of these products, including endowments, pension funds, hedge funds, investment advisors, and family offices. Meanwhile, the introduction of U.S. regulatory options on these products (in November 2024) may enhance risk management and improve the cost-effectiveness of these assets.

Looking ahead, the industry is focused on issuers potentially expanding the range of exchange-traded products to include other tokens such as XRP, SOL, LTC, and HBAR, although potential approvals may only have a positive impact on a limited asset group in the short term. However, what is more noteworthy is what would happen if the U.S. SEC allows for staking ETFs or removes the authorization for cash rather than physical creation and redemption of ETF shares. The latter authorization introduces a settlement delay between when authorized participants (APs) receive buy or sell orders and when issuers can create or redeem corresponding shares. This delay, in turn, causes a misalignment between the ETF share price on the screen and the actual net asset value (NAV).

Introducing physical creation and redemption could not only improve price consistency between share prices and asset net values but also help narrow the price spread of ETF shares. In other words, participants (APs) would not need to quote cash prices above the trading price of Bitcoin, thereby reducing costs and improving efficiency. The current cash-based model also brings other implications related to the continuous buying and selling of BTC and ETH, such as increased price volatility and triggering taxable events, which do not apply to physical transactions.

Stablecoins, the "Killer App" of Cryptocurrencies

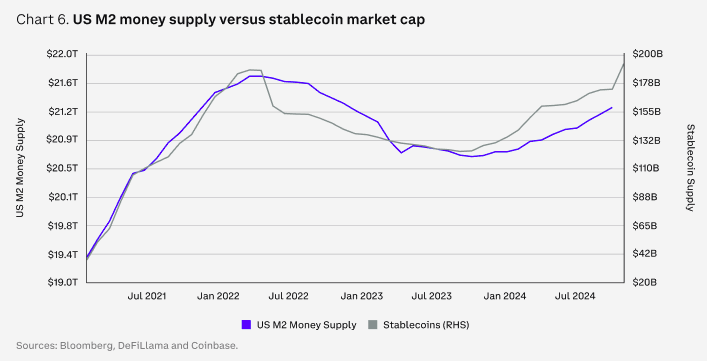

In 2024, stablecoins experienced significant growth, with a total market capitalization increase of 48%, reaching $193 billion (as of December 1). Some market analysts believe that based on the current trajectory, the industry could grow to nearly $3 trillion within the next five years. While this may seem high, considering this valuation is comparable to the current size of the entire cryptocurrency market, it represents only about 14% of the $21 trillion total supply of U.S. M2.

The next wave of true adoption for cryptocurrencies may come from stablecoins and payments, which can explain the surge of interest in this field over the past 18 months. Compared to traditional methods, they facilitate faster and cheaper transactions, leading more payment companies to expand their stablecoin infrastructure, thereby increasing the utilization of digital payments and remittances. In fact, we may soon see stablecoins' primary use cases extend beyond transactions to global capital flows and commerce. However, beyond broader financial applications, the ability of stablecoins to address the U.S. debt burden has also garnered political interest.

As of November 30, 2024, the stablecoin market has completed nearly $27.1 trillion in transactions, almost three times the $9.3 trillion recorded in the same 11 months of 2023. This includes a significant amount of peer-to-peer (P2P) transfers and cross-border business-to-business (B2B) payments. Businesses and individuals are increasingly utilizing stablecoins like USDC to meet regulatory requirements and integrate extensively with payment platforms such as Visa and Stripe. In October 2024, Stripe acquired the stablecoin infrastructure company Bridge for $1.1 billion, marking the largest deal in the crypto industry to date.

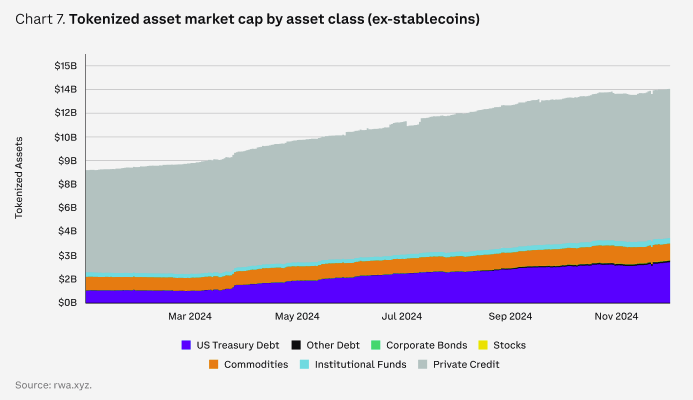

Tokenization Revolution

According to data from rwa.xyz, tokenization continued to make significant strides in 2024, with the tokenization of real-world assets (RWA) growing from $8.4 billion at the end of 2023 to $13.5 billion by December 1, 2024 (excluding stablecoins), an increase of over 60%. Multiple analysts predict that the industry could grow to at least $2 trillion and potentially up to $30 trillion within the next five years—an increase of nearly 50 times. Asset management firms and traditional financial institutions like BlackRock and Franklin Templeton are increasingly embracing the tokenization of government securities and other traditional assets on permissioned and public blockchains, enabling near-instant cross-border settlements and 24/7 trading.

Institutions are attempting to use such tokenized assets as collateral for other financial transactions (e.g., those involving derivatives), which can simplify operations (e.g., margin calls) and reduce risk. Additionally, the RWA trend is expanding beyond assets like U.S. Treasuries and money market funds, gaining traction in private credit, commodities, corporate bonds, real estate, and insurance. Ultimately, tokenization could simplify the construction and investment processes of entire portfolios by bringing them on-chain, although this may take several more years.

Of course, these efforts face a range of unique challenges, including liquidity fragmentation across multiple chains and ongoing regulatory hurdles—though significant progress has been made in both areas. Tokenization is expected to be a gradual and ongoing process; however, the recognition of its advantages is clear. This period is an optimal time for experimentation, ensuring that businesses remain at the forefront of technological advancements.

DeFi Renaissance

DeFi is dead. Long live DeFi. DeFi suffered significant blows in the last cycle as some applications used token incentives to guide liquidity, offering unsustainable yields. However, a more sustainable financial system has emerged, combining real-world use cases with transparent governance structures.

The shift in the U.S. regulatory landscape may revitalize the prospects for DeFi. This could include establishing a framework for managing stablecoins and pathways for traditional institutional investors to participate in DeFi, especially as the synergy between off-chain and on-chain capital markets becomes increasingly apparent. In fact, DEXs currently account for about 14% of CEX trading volume, up from 8% in January 2023. In the face of a more favorable regulatory environment, the possibility of decentralized applications (dApps) sharing protocol revenues with token holders is also growing.

Moreover, the role of cryptocurrencies in disrupting financial services has been recognized by key figures. In October 2024, Federal Reserve Governor Christopher Waller discussed how DeFi could largely complement centralized finance (CeFi), arguing that distributed ledger technology (DLT) could make record-keeping in CeFi faster and more efficient, while smart contracts could enhance CeFi's capabilities. He also noted that stablecoins could be beneficial for payments and serve as "safe assets" on trading platforms, although they require reserves to mitigate risks such as runs and illicit financing. All of this suggests that DeFi may soon expand beyond the crypto user base and begin to engage more with traditional finance (TradFi).

Theme 2: Disruption Paradigm

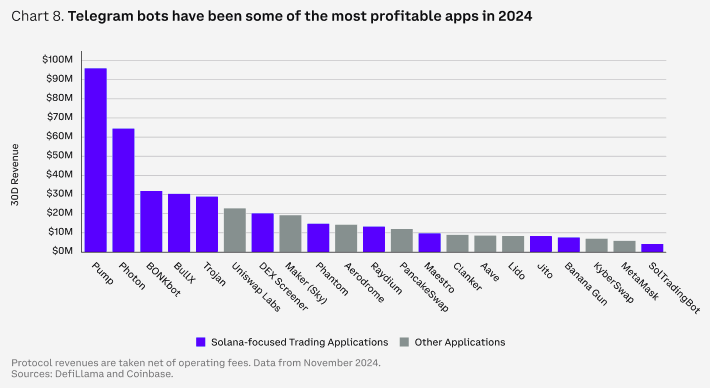

Telegram Trading Bots: The Hidden Profit Center of Cryptocurrencies

After stablecoins and native L1 transaction fees, Telegram trading bots became the most profitable area in 2024, even surpassing major DeFi protocols like Aave and MakerDAO (now Sky) in terms of net protocol revenue. This is largely a result of increased trading and memecoin activity. In fact, meme tokens have been the best-performing crypto sector in 2024 (measured by total market cap growth), with trading activity for meme tokens (on Solana DEXs) soaring throughout Q4 2024.

Telegram bots are a chat-based interface for trading these tokens. Custodial wallets are created directly in the chat window, and can be funded and managed through buttons and text commands. As of December 1, 2024, bot users primarily focused on Solana tokens (87%), followed by Ethereum (8%) and Base (4%).

Like most trading interfaces, Telegram bots earn a percentage fee from each transaction, up to 1% of the transaction amount. However, due to the volatility of the underlying assets they trade, users may not be deterred by high fees. As of December 1, the highest-earning bot, Photon, has accumulated $210 million in fees year-to-date, close to the $227 million of Pump, Solana's largest memecoin launcher. Other major bots, such as Trojan and BONKbot, also achieved substantial profits of $105 million and $99 million, respectively. In contrast, Aave's protocol revenue for the entire year of 2024 was $74 million after fees.

The appeal of these applications lies in their ease of use for DEX trading, especially for tokens that have not yet been listed on exchanges. Many bots also offer additional features, such as "sniping" tokens at launch and integrated price alerts. The trading experience on Telegram is quite attractive to users, with nearly 50% of Trojan users retained for four days or longer (only 29% of users stop using it after one day), generating a high average revenue of $188 per user. While the increasing competition among Telegram trading bots may eventually lower trading fees, by 2025, Telegram bots (along with other core interfaces discussed below) will still be a major profit center.

Prediction Markets: Betting

Prediction markets may be one of the biggest winners of the 2024 U.S. elections, as platforms like Polymarket outperformed polling data, with their predictions being closer to the actual outcomes than traditional polls. This is a broader victory for crypto technology, as blockchain-based prediction markets demonstrate significant advantages over traditional polling data and showcase the technology's potential differentiated use cases. Prediction markets not only highlight the transparency, speed, and global access provided by crypto technology, but their blockchain foundation also allows for decentralized dispute resolution and outcome-based automatic payment settlements.

While many believe the relevance of these dApps may wane after the elections, their utility has already expanded into other areas such as sports and entertainment. In finance, they have proven to be more accurate sentiment indicators compared to traditional surveys released alongside economic data like inflation and non-farm payroll figures, which may continue to play a role and remain relevant after the elections.

Games

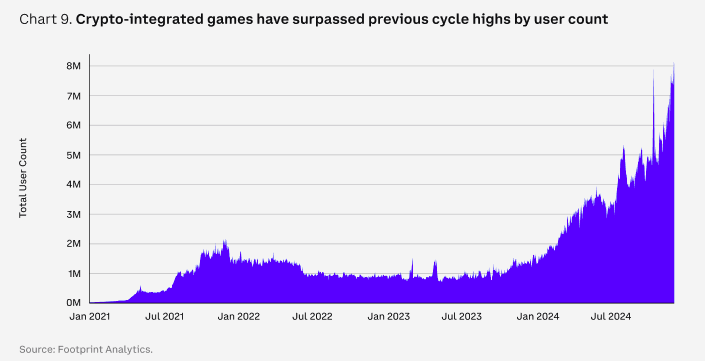

Games have long been a core theme in the crypto space due to the transformative potential of on-chain assets and markets. However, attracting a loyal user base for crypto games (a hallmark of most traditionally successful games) has been a challenge, as many crypto game users are profit-driven and may not be playing for entertainment. Additionally, many crypto games are browser-based, often limiting their audience to cryptocurrency enthusiasts rather than the broader gaming community.

However, compared to the previous cycle, games that integrate cryptocurrencies have made significant progress. At the heart of this trend is a shift from the early crypto punk ethos of "fully owning your game on-chain" to selectively placing assets on-chain, unlocking new features without compromising gameplay itself. In fact, many prominent game developers now view blockchain technology more as a utility tool rather than a marketing gimmick.

The first-person shooter and battle royale game "Off the Grid" exemplifies this trend. At launch, the game's core blockchain component (Avalanche subnet) was still in the testnet phase, yet it became the top free game on Epic Games. Its core appeal lies in its unique gameplay mechanics rather than its blockchain tokens or item trading market. Crucially, this game has also paved the way for crypto-integrated games to expand their distribution channels for broader market appeal, and it is available on Xbox, PlayStation, and PC (via the Epic Games Store).

Mobile devices are also an important distribution channel for crypto games, including native apps and embedded applications (such as Telegram mini-games). Many mobile games also selectively integrate blockchain components, with most activities actually running on centralized servers. Generally, these games can be played without setting up any external wallets, reducing the entry barrier and allowing those unfamiliar with crypto to engage with these games.

The lines between crypto and traditional gaming may continue to blur. Upcoming mainstream "crypto games" may integrate crypto technology without focusing solely on it, emphasizing polished gameplay and distribution rather than game-earning mechanics. That said, while this may lead to broader adoption of cryptocurrencies as a technology, it remains unclear how this will directly translate into demand for liquid tokens. In-game currencies are likely to remain isolated across different games.

Decentralized Real World

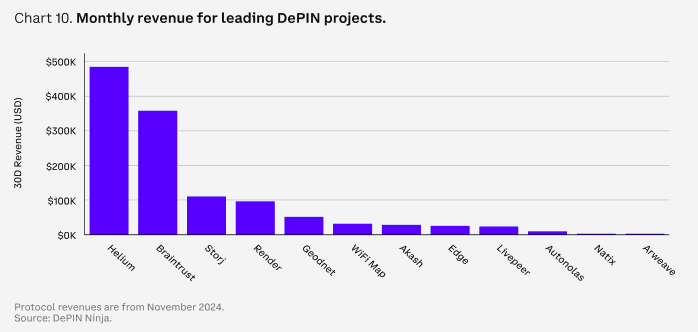

Decentralized Physical Infrastructure Networks (DePIN) have the potential to transform the allocation issues of the "real world" by guiding the creation of resource networks. In other words, DePIN can theoretically overcome the initial economies of scale typically associated with such projects. DePIN projects range from computing power to cellular towers to energy, creating a more resilient and cost-effective way to integrate these resources.

The most typical example is Helium, which distributes tokens to individuals providing local cellular hotspots. By issuing tokens to hotspot providers, Helium has been able to launch coverage maps in urban areas across the U.S., Europe, and Asia without the overhead of building and distributing cellular towers or incurring significant upfront costs. Instead, early adopters are motivated by the opportunity to gain early exposure and equity in the network through tokens.

The long-term revenue and sustainability of these networks should be evaluated on a case-by-case basis. DePIN is not a panacea for resource allocation, as industry pain points can vary significantly. For instance, pursuing decentralized strategies may not be suitable for a particular industry, or it may only address a small portion of the issues within that industry. There may be wide disparities in network adoption, token utility, and revenue generated—all of which could relate more to the underlying industry they target than to the underlying technology networks they use.

Artificial Intelligence, Real Value

Artificial Intelligence (AI) has been a focal point for both traditional and crypto market investors. However, the impact of AI on cryptocurrencies is multifaceted, with its narrative frequently changing. In the early stages, blockchain technology aimed to address issues related to the authenticity of AI-generated content and user data sources (i.e., tracking data authenticity). AI-driven intent-based architectures were also seen as potential improvements to the crypto user experience. Later, the focus shifted to decentralized training and computing networks for AI models, as well as crypto-driven data generation and collection. Recently, attention has turned to autonomous AI agents capable of controlling crypto wallets and communicating via social media.

The comprehensive impact of AI on cryptocurrencies remains unclear, as evidenced by the rapid cycling of various narratives. However, this uncertainty does not diminish the potential transformative effects AI may bring to cryptocurrencies, as AI technology continues to achieve new breakthroughs. Non-technical users are also finding it increasingly easier to use AI applications, which will further accelerate the development of creative use cases.

The biggest question is how these shifts will manifest as lasting value accumulation for tokens versus company equity. For example, many AI agents operate on traditional technologies, with short-term "value accumulation" (i.e., market attention) flowing to memecoins rather than any underlying infrastructure. While tokens associated with infrastructure layers have also seen price increases, their usage growth often lags behind concurrent price rises. The speed of price increases relative to network metrics reflects a lack of strong consensus among investors on how to capture AI growth within cryptocurrencies.

Theme Three: Blockchain Metagaming

Multichain Future or Zero-Sum Game?

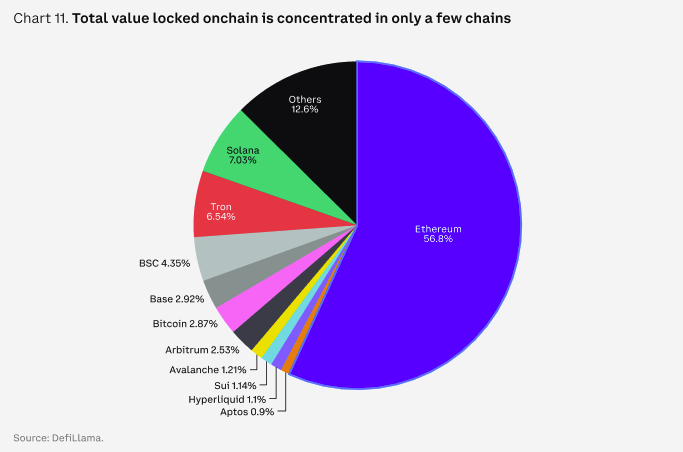

A major theme returning from the last bull market cycle is the popularity of L1 networks. Newer networks are increasingly competing to lower transaction costs, redesign execution environments, and minimize latency. Even as high-quality block space remains scarce, the L1 space has expanded to the point of now having an oversupply of general block space.

Additional block space itself is not necessarily more valuable. However, a vibrant protocol ecosystem, combined with an active community and dynamic crypto assets, can still allow certain blockchains to command additional fees. For example, Ethereum remains the center of high-value DeFi activity, despite its mainnet execution capacity not improving since 2021.

Nevertheless, investors are attracted to the potential differentiated ecosystems on these new networks, even as the barriers to differentiation are rising. High-performance chains like Sui, Aptos, and Sei are competing for market share against Solana.

Historically, DEX trading has been the largest driver of on-chain fees, requiring strong user logins, wallets, interfaces, and capital—creating a cycle of increasing activity and liquidity. This concentration of activity often leads to a winner-takes-all scenario across different chains. However, the future may still be multichain, as different blockchain architectures offer unique advantages to meet various needs. While application chains and L2 solutions can provide tailored optimizations and lower costs for specific use cases, a multichain ecosystem allows for specialization while still benefiting from the broader network effects and innovations across the entire blockchain space.

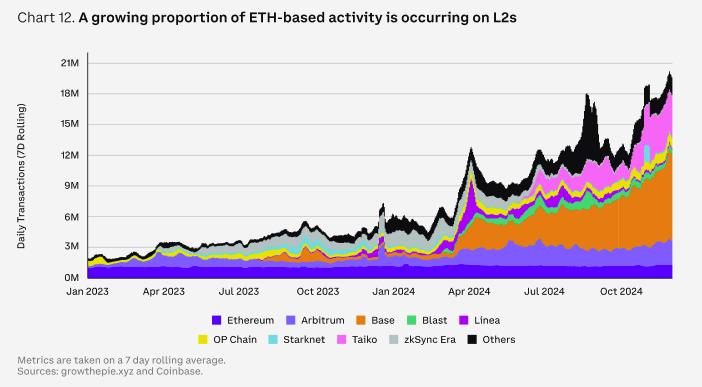

Upgrading L2s

Despite the exponential growth in the scalability of L2s, debates surrounding Ethereum's rollup-centric roadmap continue. Criticisms include L2s "extracting" from L1 activity and their fragmented liquidity and user experience. In particular, L2s are seen as the source of declining Ethereum network fees and the fading narrative of "ultrasound money." New focal points in the L2 debate are also emerging, including trade-offs in decentralization and the potential fragmentation of different virtual machine environments (EVM).

Nonetheless, from the perspective of increasing block space and reducing costs, L2s have achieved some success. The introduction of blob transactions in the March 2024 Ethereum Dencun (Deneb+Cancun) upgrade reduced average L2 costs by over 90% and increased activity on Ethereum L2s by tenfold. Additionally, various execution environments and architectures are able to experiment within ETH-based environments, which is a long-term advantage of the L2-centric approach.

However, this roadmap also has some drawbacks in the short term. Cross-rollup interoperability and general user experience are becoming more challenging to navigate, especially for newcomers who may not fully understand the differences between ETH across different L2s or how to bridge between them. In fact, while bridging speed and costs have improved, the need for users to first interact with cross-chain bridges can diminish the overall on-chain experience.

While this is a real issue, the community is seeking many different solutions, such as superchain interoperability within the Optimism ecosystem, real-time proofs and super transactions for zkRollups, resource locking, sequencer networks, and more. Many of these challenges are being addressed at the infrastructure and network layers, and these improvements may take time to reflect in the user interface.

Meanwhile, the growing Bitcoin L2 ecosystem is harder to navigate due to the lack of unified security standards and roadmaps. In contrast, Solana's "network expansion" tends to be more application-specific and may be less disruptive to current user workflows. Overall, L2s are being implemented across most major crypto ecosystems, although they vary widely in form.

Everyone Has a Chain

The increasing convenience of deploying customized networks is prompting more applications and companies to build chains where they have more control. Mainstream DeFi protocols like Aave and Sky have clear goals to include blockchain launches in their long-term roadmaps, and the Uniswap team has also announced plans for a DeFi-focused L2 chain. Even more traditional companies are getting involved, with Sony announcing its new chain, Soneium.

As the blockchain infrastructure stack matures and becomes increasingly commoditized, owning block space is seen as more attractive—especially for regulated entities or applications with specific use cases. The technology stack enabling this is also changing. In previous cycles, application-centric chains primarily utilized Cosmos or Polkadot Substrate SDKs. Additionally, the evolving RaaS industry, represented by companies like Caldera and Conduit, is driving more projects to launch L2s. These platforms facilitate easy integration with other services through their marketplaces. Similarly, Avalanche subnets may see increased adoption due to their managed blockchain service, AvaCloud, which simplifies the launch of custom subnets.

The growth of modular chains may correspondingly impact the demand for Ethereum blob space and other data availability solutions (such as Celestia, EigenDA, or Avail). Since early November, the usage of Ethereum blobs has reached saturation (three blobs per block), growing by over 50% since mid-September. Demand does not seem to be slowing, as existing L2s (like Base) continue to expand throughput, and new L2s are launching on the mainnet, although the upcoming Pectra upgrade in Q1 2025 may increase the target number of blobs from three to six.

Theme Four: User Experience

User Experience Improvements

A simple user experience is one of the most important drivers of mass adoption. While cryptocurrencies have traditionally focused on deep technology, the current emphasis is rapidly shifting towards simplified user experiences. In particular, the entire industry is pushing to abstract the technical aspects of cryptocurrencies into the background of applications. Many recent technological breakthroughs have made this shift possible, such as adopting account abstraction to simplify onboarding and using session keys to reduce signature friction.

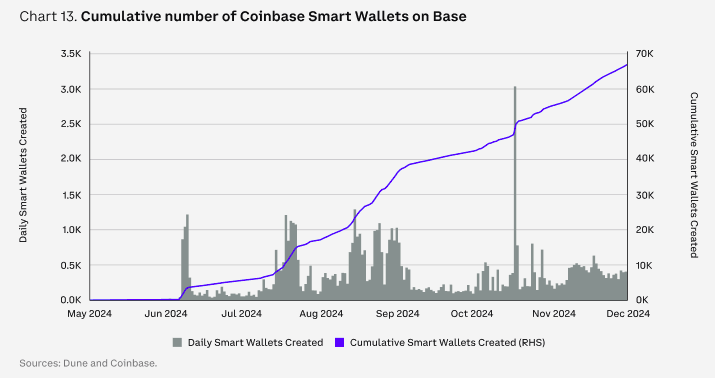

The adoption of these technologies will make the security components of crypto wallets (such as seed phrases and recovery keys) invisible to most end users—similar to the seamless security experiences of today's internet (e.g., https, OAuth, and keys). Trends toward key login and in-app wallet integration are expected to become more prevalent in 2025. Early signs include key login for Coinbase Smart Wallet and Google-integrated login for Tiplink and Sui Wallet.

The abstraction of cross-chain architecture may continue to pose the biggest challenge to the crypto experience in the short term. While cross-chain abstraction remains a focus of research at the network and infrastructure level (e.g., ERC-7683), it is still far from front-end applications. Improvements in this area require enhancements at the smart contract application level and wallet level. Protocol upgrades are necessary for unifying liquidity, while wallet improvements are essential for providing users with a clearer experience. The latter will ultimately be more important for expanding adoption, even though current research efforts and industry debates are focused on the former.

Owning Interfaces

The most critical shift in the crypto user experience will come from efforts to "own" user relationships through better interfaces. This will happen in two ways. First, as mentioned above, through improvements to independent wallet experiences. Onboarding processes are becoming increasingly streamlined to meet user needs. Direct integration of applications (such as trading and lending) within wallets may also lock users into a familiar ecosystem.

Meanwhile, applications are increasingly abstracting blockchain technology components to the background through integrated wallets to compete for user relationships. This includes trading tools, games, on-chain social applications, and membership applications that automatically provide wallets for users registered through familiar methods like Google or Apple OAuth. Once logged in, on-chain transactions are funded by the payer, with the costs ultimately borne by the application owner. This creates a unique dynamic where the revenue for each user needs to align with the costs of their on-chain operations. Although the latter costs continuously decrease as the blockchain scales, it also forces crypto applications to consider which data components to submit on-chain.

Overall, there will be fierce competition to attract and retain users in the crypto space. As indicated by the average revenue per user (ARPU) of Telegram trading bots mentioned earlier, many retail crypto traders tend to be relatively price insensitive compared to existing TradFi entities. In the coming year, establishing user relationships is expected to become a key focus for protocols beyond the trading space.

Decentralized Identity

As regulatory transparency continues to increase, more assets are being tokenized off-chain, making the simplification of KYC and anti-money laundering (AML) processes increasingly important. For example, certain assets are only available to qualified investors located in specific regions, making identity verification and authentication a core pillar of the long-term on-chain experience.

There are two key components to this. The first is the creation of on-chain identities themselves. Ethereum Name Service (ENS) provides a standard for resolving human-readable “.eth” names to one or more wallets across chains. This change is now present in networks like Basenames and Solana Name Service. With major traditional payment providers like PayPal and Venmo now supporting ENS address resolution, the adoption of these core on-chain identity services has accelerated.

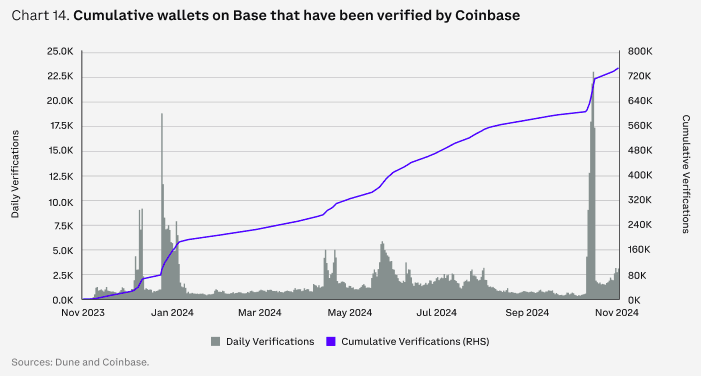

The second core component is building attributes for on-chain identities. This includes confirming KYC verification and other jurisdictional data that protocols can subsequently view to ensure compliance. At the heart of this technology is the Ethereum Attestation Service, a flexible service that allows entities to assign attributes to other wallets. These attributes are not limited to KYC; they can be freely expanded to meet the needs of the verifiers. For example, Coinbase's on-chain verification utilizes this service to confirm that a wallet is associated with a user who has a Coinbase trading account and is located in certain jurisdictions. Some new permissioned lending markets on Base targeting real-world assets will control usage through these verifications.

Related: Presto: From Chaos to Clarity, 2024 Crypto Market Review and 2025 Predictions

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。