The Bitcoin network has processed a total of 1.12 billion transactions, settling a transfer volume of $131.25 trillion, with miners earning a cumulative total of $71.49 billion.

Written by: CryptoVizArt, UkuriaOC, Glassnode

Translated by: Felix, PANews

Key Points:

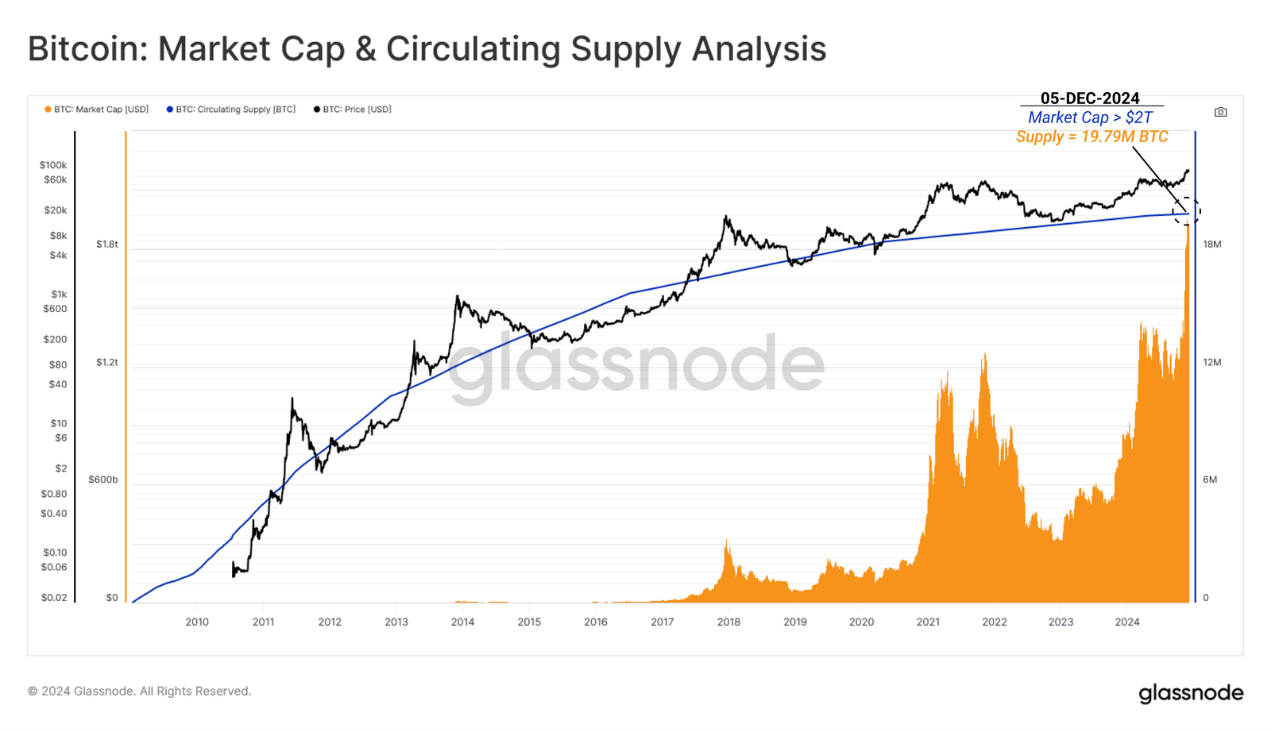

After 5,256 trading days, Bitcoin first broke the $100,000 mark on December 5, with a market cap briefly exceeding $2 trillion.

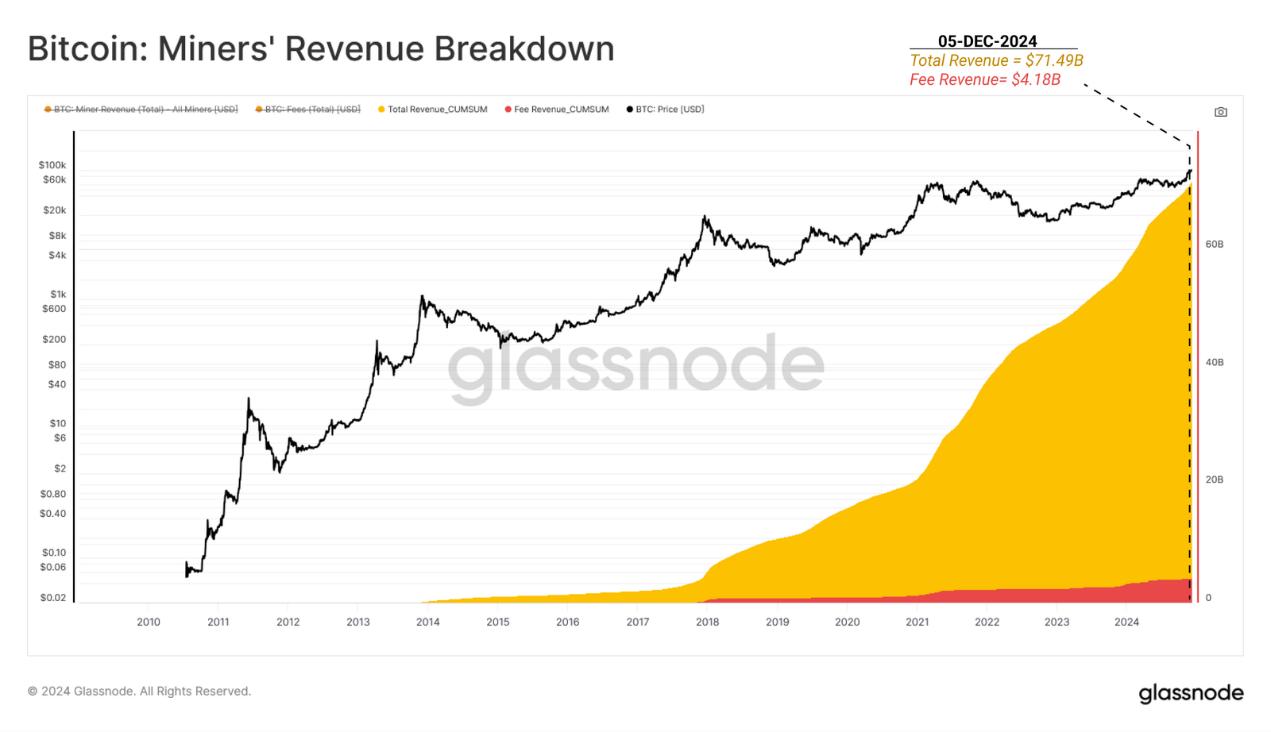

Miners have earned a cumulative total of $71.49 billion, reflecting the security and economic incentives of the Bitcoin network.

The Bitcoin network has processed a total of 1.12 billion transactions, settling a transfer volume of $131.25 trillion, with data adjusted for real entities providing a clearer reflection of actual economic activity.

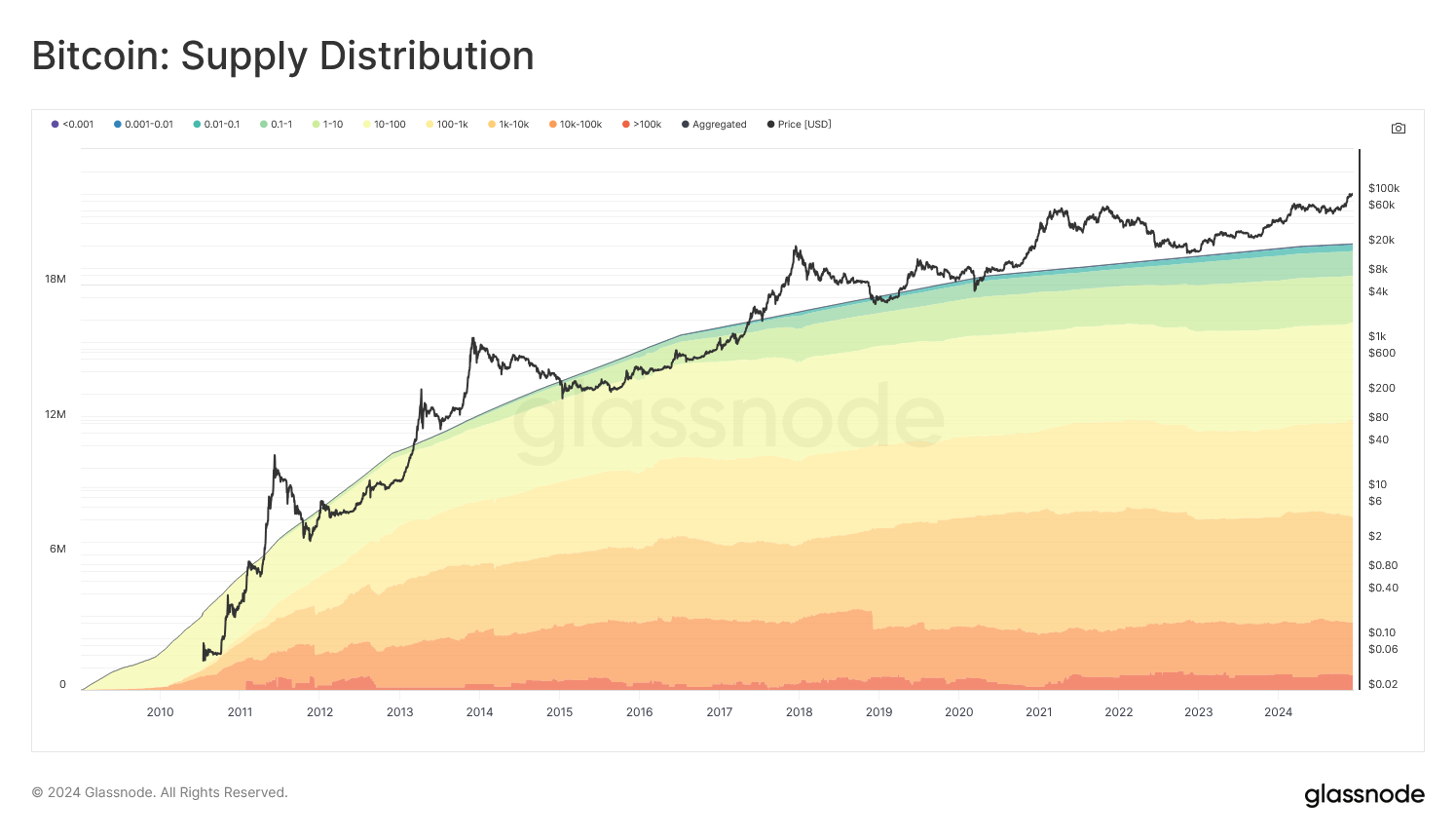

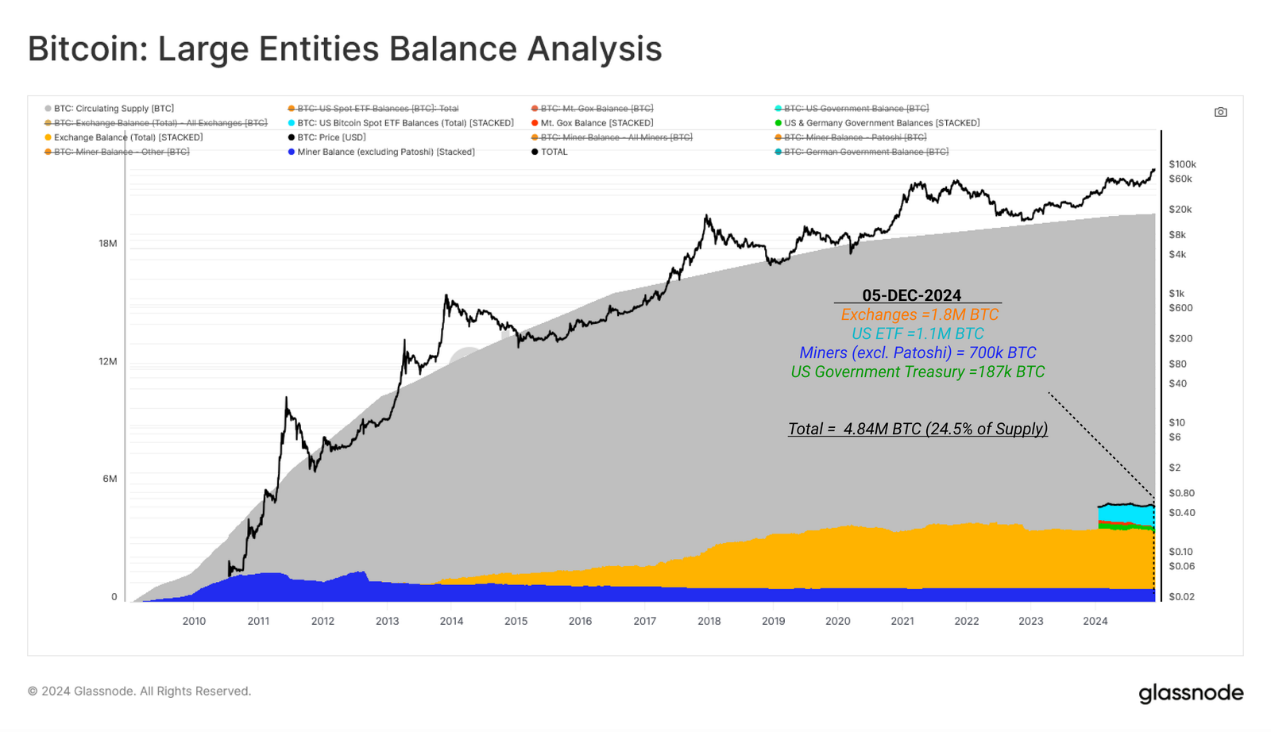

Details of holdings among different groups show that Bitcoin holders are widely distributed, encompassing both retail and institutional-sized holders.

This article explores the evolution of the Bitcoin network and its economic foundation, reviewing Bitcoin's journey from the genesis block to breaking the $100,000 mark.

Market Expansion

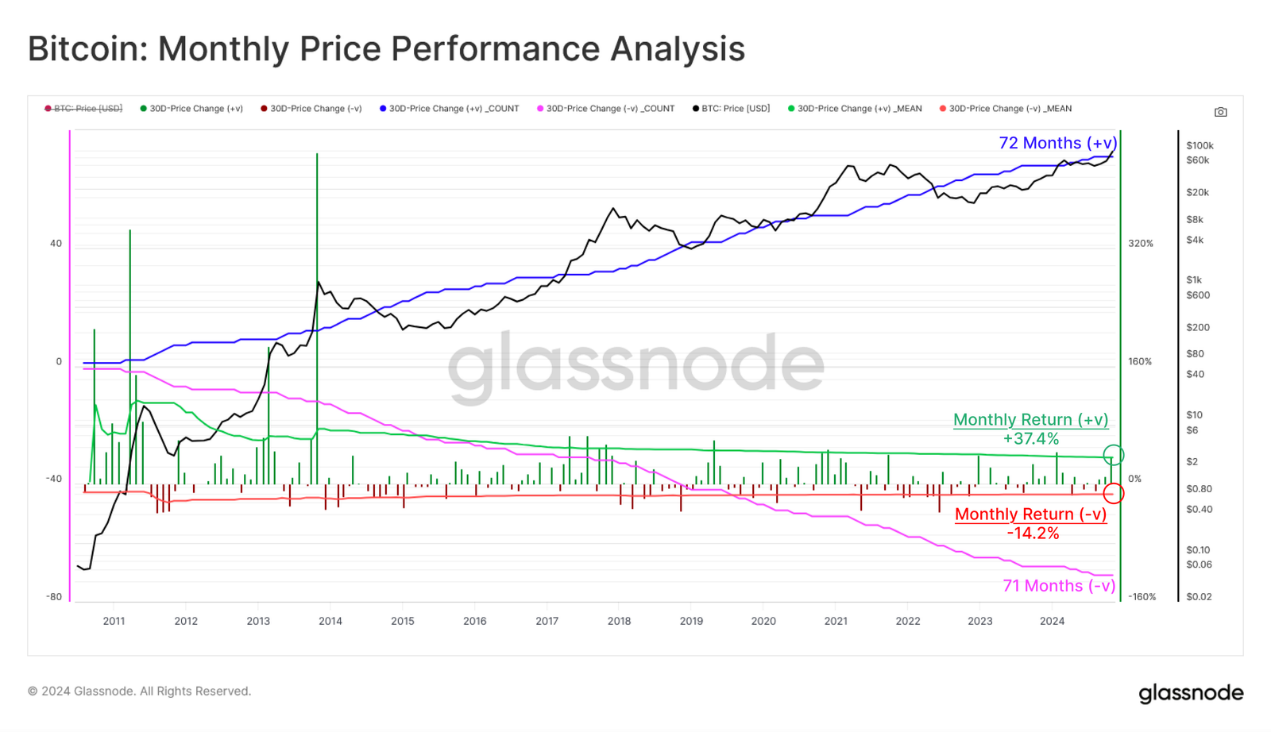

Bitcoin's trading price has been active for 5,256 days, rising from a few cents to $100,000. This journey includes 72 positive monthly candlestick charts (including December 2024), with an average increase of 37.4%, and 71 negative monthly candlestick charts, with an average decrease of -14.2%.

This reflects a remarkable balance between bull and bear markets, as well as a positive tilt during the most significant price increases.

As of December 5, a total of 19,791,952 BTC have been mined, accounting for 94.2% of the total supply of 21 million coins. The market cap of Bitcoin also briefly surpassed $2 trillion, exceeding the market cap of silver (approximately $1.84 trillion).

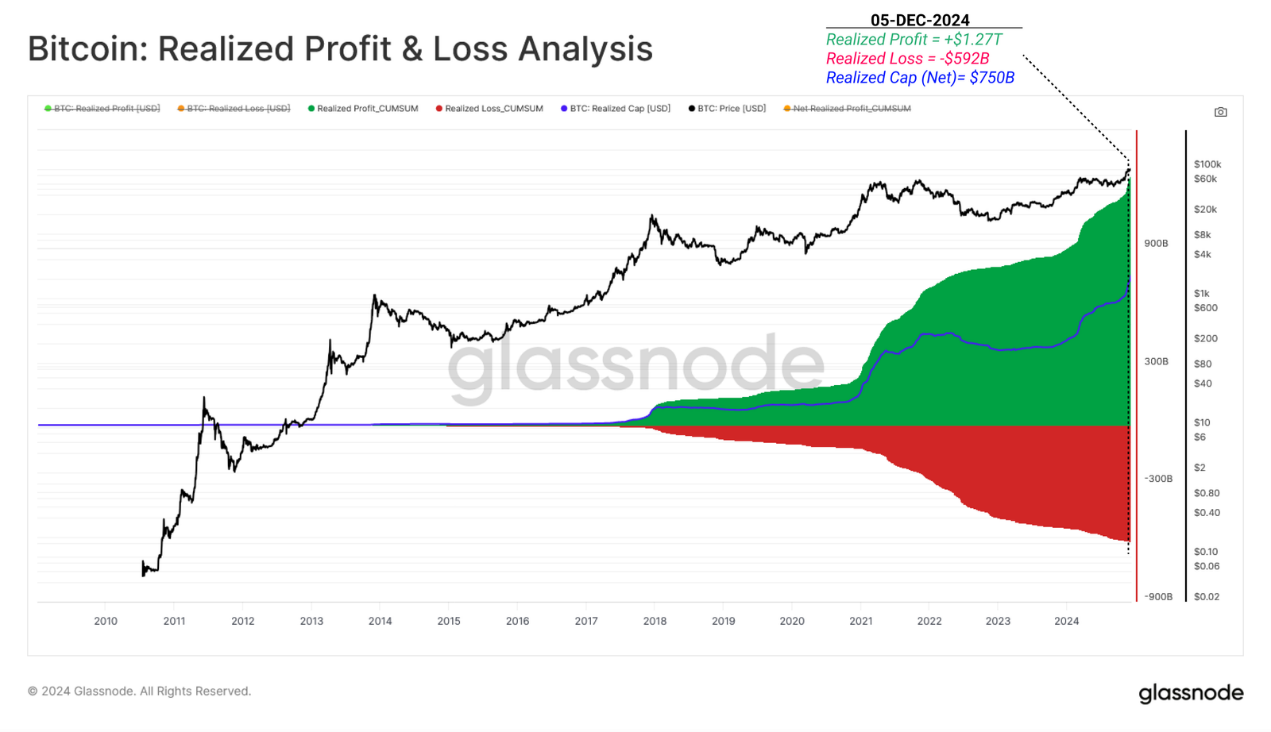

During this market expansion period, investors realized $1.27 trillion in profits and incurred $592 billion in on-chain losses (based on the difference between buying and selling prices). This resulted in a cumulative net capital inflow (actual market value) of $750 billion, highlighting the immense value that has flowed into the Bitcoin network throughout its lifecycle.

Supply Distribution

Among the mined Bitcoins, the distribution by different wallet sizes is as follows:

0.001 BTC: 5,491 BTC (0.027%)

0.001–0.01 BTC: 42,683 BTC (0.216%)

0.01–0.1 BTC: 271,641 BTC (1.373%)

0.1–1 BTC: 1,077,839 BTC (5.446%)

1–10 BTC: 2,093,845 BTC (10.581%)

10–100 BTC: 4,306,780 BTC (21.761%)

100–1,000 BTC: 4,342,868 BTC (21.935%)

1,000–10,000 BTC: 4,693,216 BTC (23.716%)

10,000–100,000 BTC: 2,309,654 BTC (11.671%)

>100,000 BTC: 647,934 BTC (3.274%)

It is noteworthy that most large whale wallets (holding 1,000+ BTC) are associated with exchanges, ETFs, and large institutions (such as MicroStrategy). Each of these large entities represents collective ownership of thousands to millions of customers and shareholders.

Notable holdings include 1.8 million Bitcoins held on exchanges (accounting for 9.1% of the supply) and 1.1 million Bitcoins managed by U.S. ETFs (accounting for 5.6% of the supply). Additionally, miners (excluding Patoshi) hold 700,000 Bitcoins (accounting for 3.5% of the supply), while the U.S. Treasury holds 187,000 Bitcoins (accounting for 0.9% of the supply), reflecting the widespread distribution of Bitcoin among various entities and highlighting the increasing institutionalization and centralization of Bitcoin custody. (Note: The earliest independent miners mined a large number of Bitcoins, and the community believes this miner is Satoshi Nakamoto, referring to this mining model as Patoshi.)

Network Evolution

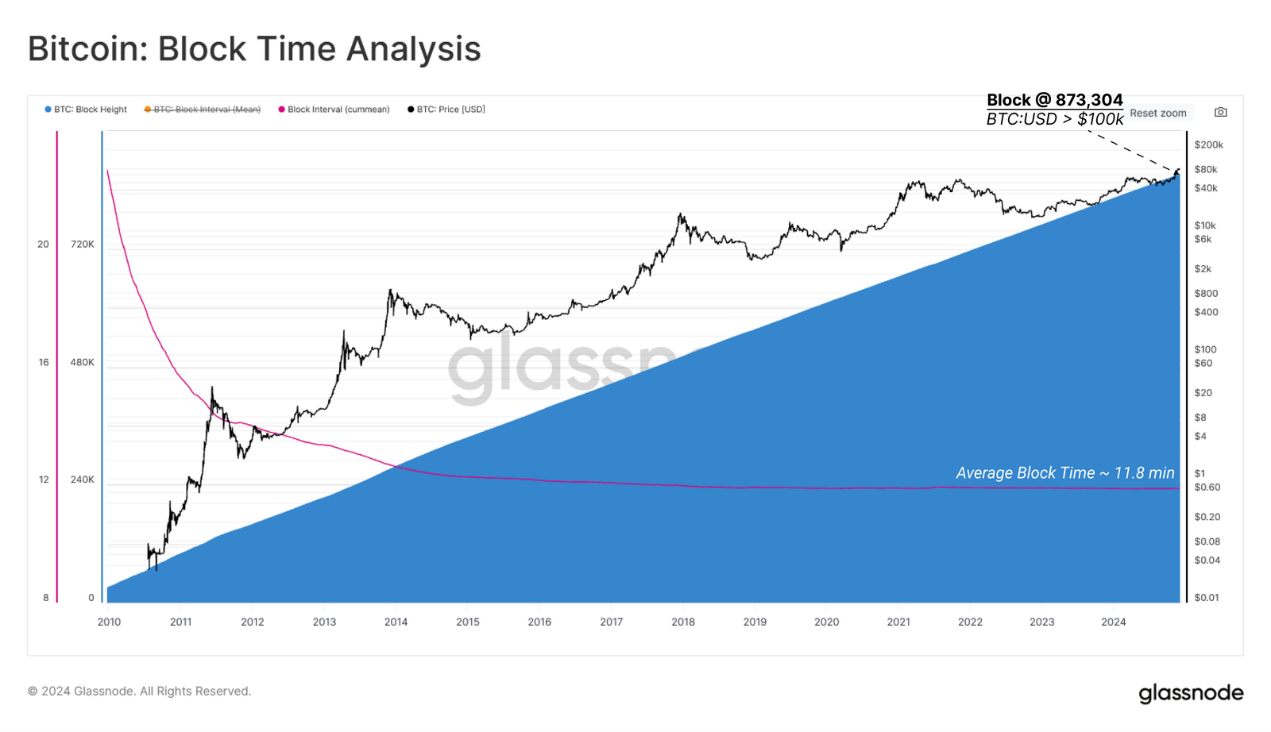

Since the genesis block, a total of 873,304 blocks have been mined, with an average block generation time of 11.8 minutes. Although the current average block interval is about 9.6 minutes due to the increase in hash rate, the early years saw a slow start because Satoshi overestimated the performance of laptop CPUs relative to the initial difficulty settings.

During the same period, network difficulty has increased dramatically. With the growing security and computational power behind Bitcoin, the network difficulty has risen to 446,331,432,498,125,300,000,000 after 418 difficulty adjustments (excluding periods without adjustments).

The difficulty adjustment goal of Bitcoin's proof-of-work (PoW) consensus is to mine a block approximately every 10 minutes, regardless of changes in network hash rate. Mining difficulty is dynamically adjusted every 2016 blocks (approximately every 2 weeks) to align with the target block time of 600 seconds.

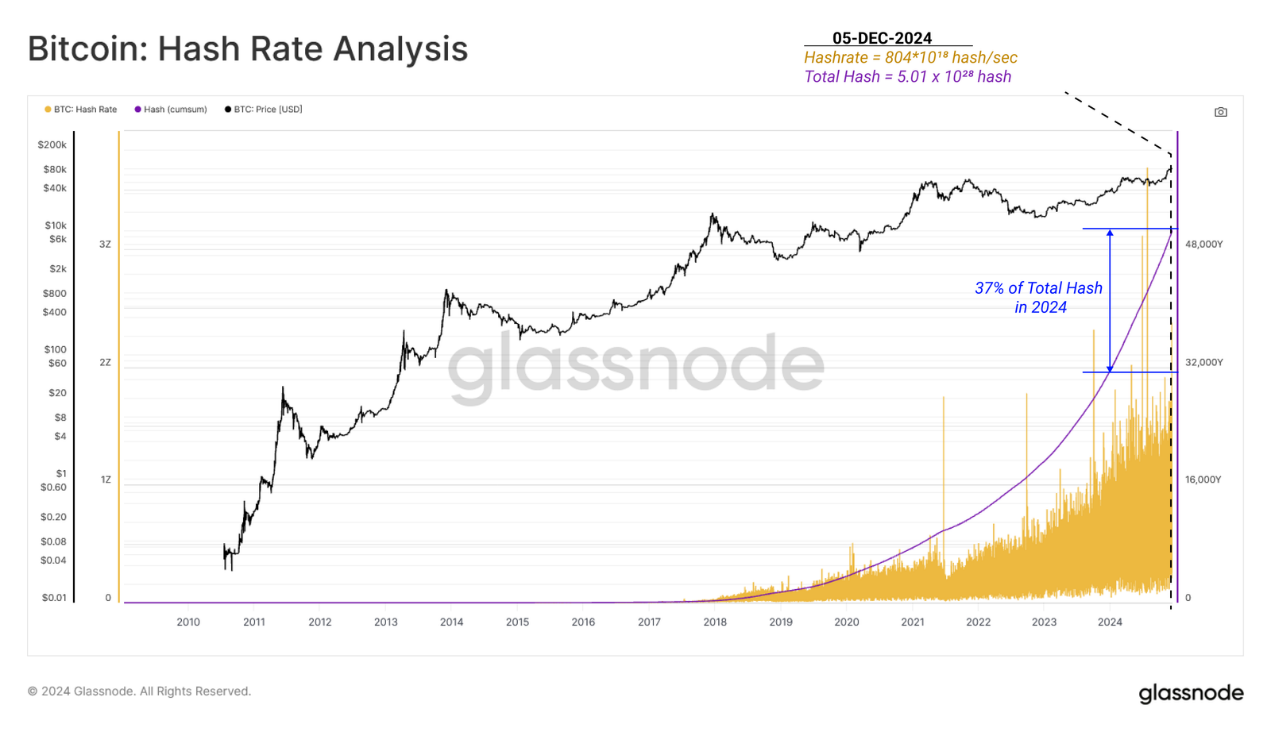

When Bitcoin reached $100,000, the network hash rate surged from 128,185 hashes/second to 804,407,834,059,443,100,000 hashes/second. To date, miners have cumulatively computed approximately 5.01 x 10^28 hashes. Notably, the hashes computed in 2024 account for 37% of the total hashes.

As of December 5, miners have earned a cumulative total of $71.49 billion, with the value of block rewards based on the day of block mining. This income includes $67.31 billion in block subsidies obtained through minting new coins and $4.18 billion in transaction fees paid by users. This accounts for only 3.57% of Bitcoin's peak market cap of $2 trillion, reflecting the enormous returns on the security budget invested.

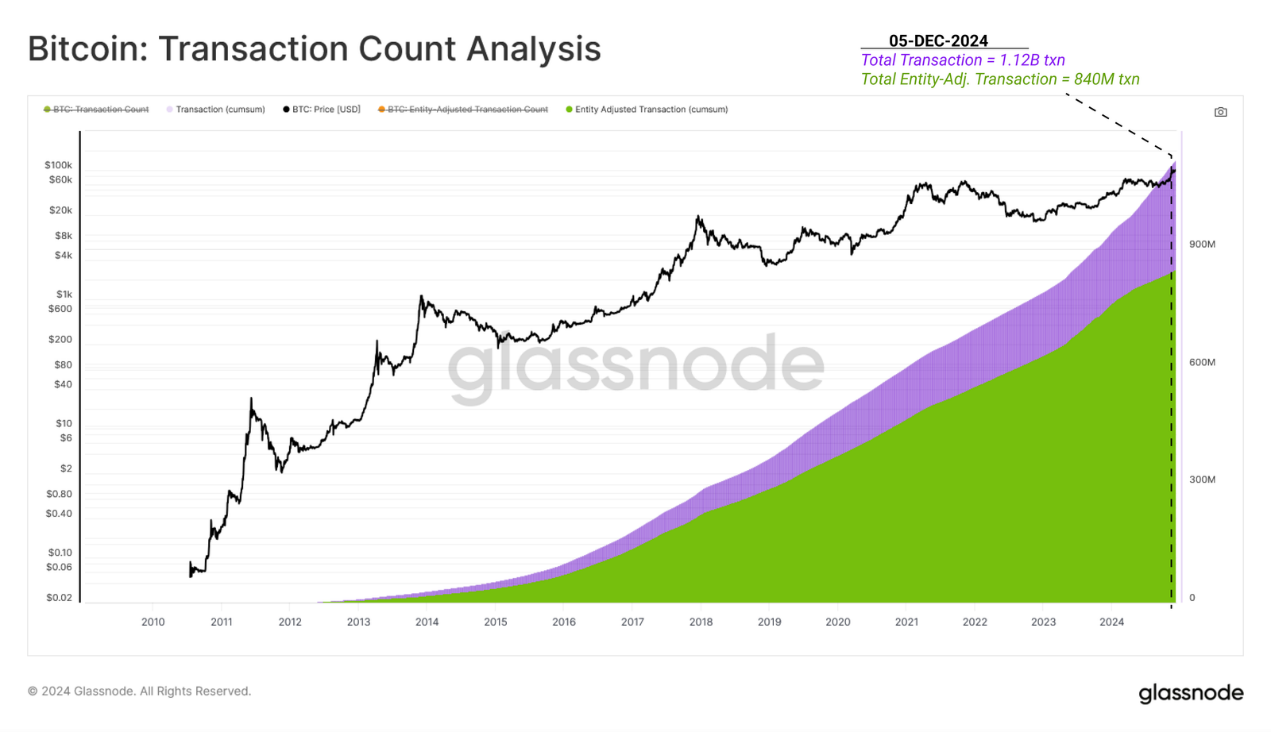

Bitcoin's transaction volume has also seen astonishing growth. To date, the Bitcoin network has successfully processed 1.12 billion transactions (unfiltered), with internal transfers filtered out, resulting in a total of 840 million actual economic transactions.

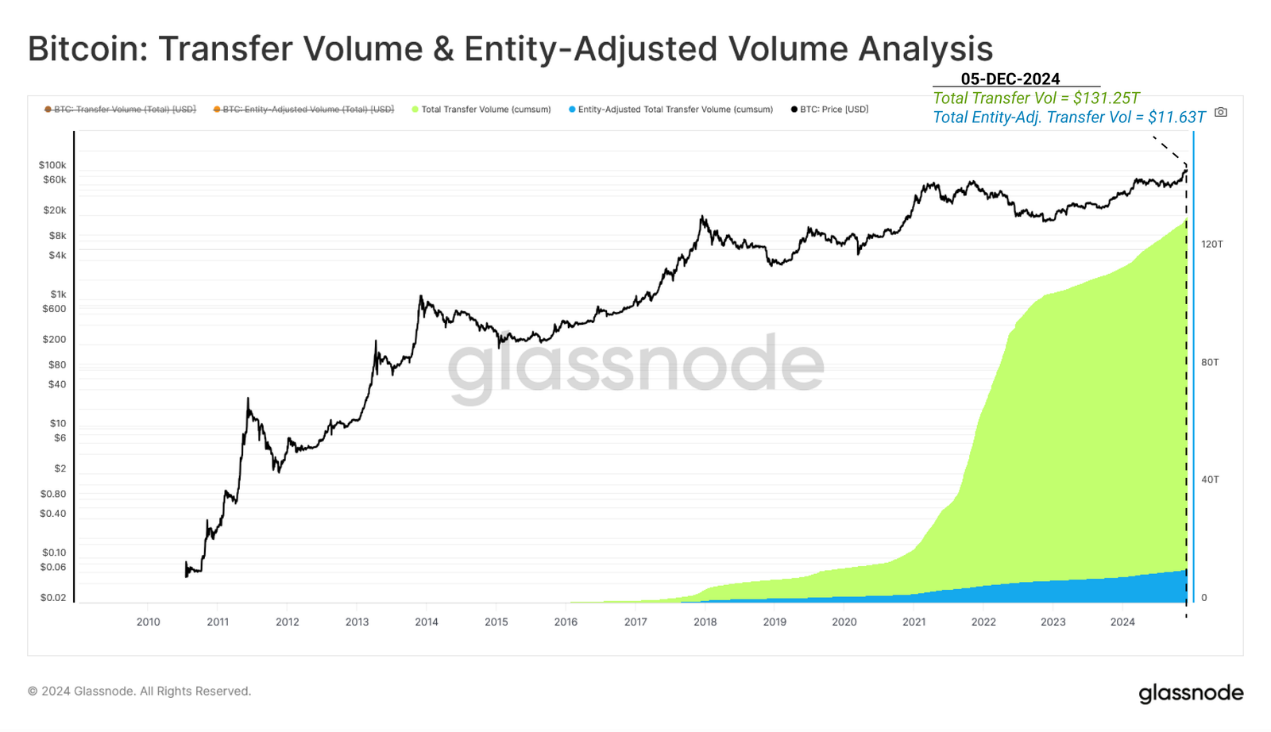

Based on the dollar value of transactions at the time of confirmation, the Bitcoin network has cumulatively processed a transaction volume of $131.25 trillion. After adjustments, the filtered transfer volume is $11.63 trillion, accounting for only 8.86% of the total.

This reflects that most transactions are essentially economic in nature. However, the vast majority of on-chain transfer volume may be related to the management of large exchanges and custodial wallets.

Conclusion

The rise of Bitcoin's price to $100,000 not only symbolizes a price milestone but also demonstrates its extraordinary journey from a small corner of the internet to a significant global financial infrastructure. Since the genesis block, the Bitcoin network has made remarkable strides, achieving a market cap of $2 trillion, surpassing silver, and settling a transaction volume of $131 trillion through 1.12 billion transactions.

The network has cumulatively paid miners $71.49 billion in value, accounting for just over 3% of its market valuation, to support its input costs, reflecting the astonishing returns on input costs. Bitcoin's hash rate is nearing historical highs, and its holder base is highly decentralized, playing an increasingly important role on the world stage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。