The future development of the stablecoin market depends on network effects, compliance, technological innovation, and distribution capabilities, with significant differences in value capture potential and competitive advantages across different sectors.

Author: @HadickM

Translation: Blockchain in Plain Language

Recently, I have received many questions about the future direction of the stablecoin market and which areas will be the most valuable. Therefore, I am sharing some rough insights here.

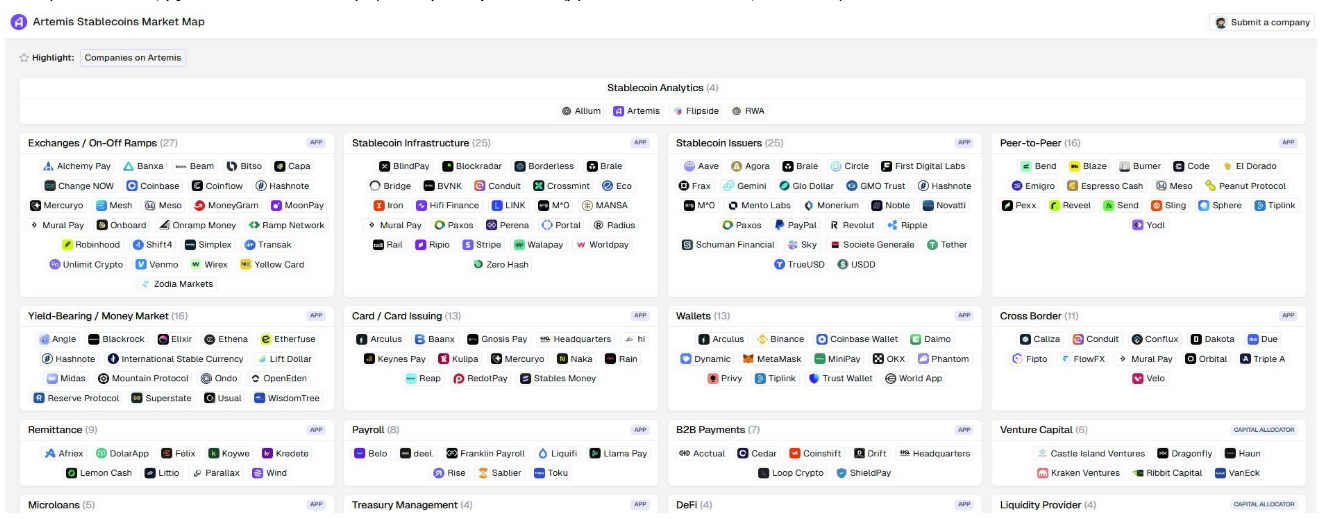

To clearly analyze the market, I have divided it into several categories—more detailed than most frameworks on the market (though not as complex as the market map by @artemis__xyz above). This categorization is necessary because payment systems are inherently very complex and nuanced. For investors, it is especially important to understand the roles and ownership of each link, as many often overlook the subtleties involved. These categories include:

(1) Settlement Networks

(2) Stablecoin Issuers

(3) Liquidity Providers

(4) Value Transfer/Payment Services

(5) Aggregated API/Messaging

(6) Merchant Payment Gateways

(7) Stablecoin-Driven Applications

You may ask: why categorize so many areas, especially since I haven't even covered wallets or third-party compliance, which are core infrastructures? The reason is that each area has its own unique defensive "moat," and the ways of value capture vary significantly. Although there may be overlaps between different providers, understanding the unique value of each part is crucial.

Here are some of my views on the future distribution of value:

1. Settlement Networks

The core of this area is network effects, including deep liquidity, low fees, fast settlement times, stable uptime, and built-in compliance and privacy protection. It is expected that this area will form a "winner-takes-all" market structure. I personally believe that general-purpose blockchains will struggle to meet the scale and standards of mainstream payment networks. In the future, it is more likely that general-purpose chains will be extended or that layer two solutions will play a role. More importantly, we need solutions tailored for payments. The winners in this area will be highly valuable and may focus on stablecoins and payments.

2. Stablecoin Issuers

Currently, issuers like @circle and @tether_to are obvious winners, primarily benefiting from strong network effects and high interest rates. However, in the future, if they continue to operate more like asset management companies rather than payment companies, they will face developmental bottlenecks. They need to invest in: fast and reliable infrastructure, high-standard compliance systems, low-cost minting and redemption processes, integration with central banks and core banks, and better liquidity management (as @withAUSD is doing).

While "stablecoin as a service" platforms (like @paxos) may spawn many competitors, I still believe that stablecoins issued by neutral non-bank or fintech companies will become the biggest winners, as the competitive environment allows for reliance on a trusted neutral third party when trading between closed systems. Stablecoin issuers have already accumulated significant value, but to continue succeeding, they must break through the limitations of mere issuance.

3. Liquidity Providers (LPs)

Current liquidity providers are typically over-the-counter (OTC) platforms or trading platforms. These entities are either large successful cryptocurrency companies or some less competitive small firms that focus on stablecoin business. This area appears highly homogeneous, with low pricing power. The moat mainly lies in low-cost capital acquisition, stable uptime, deep liquidity, and a wide range of trading pairs. In the long run, large players may dominate this field, and I believe liquidity providers focused on stablecoins will find it difficult to establish a strong and lasting competitive advantage.

4. Value Transfer/Payment Services (the "PSP" in the stablecoin space)

These platforms are sometimes referred to as "stablecoin orchestration" platforms, such as @stablecoin and @conduitpay. They build competitive advantages by having proprietary payment networks and establishing direct relationships with banks (rather than relying on third-party providers). The moats of these companies lie in: strong banking relationships, flexibility in handling various payment forms, global coverage, liquidity advantages, stable uptime, and high levels of compliance capability.

Although many companies claim to possess these capabilities, very few truly have proprietary infrastructure. The winners in this area will have some pricing power, forming regional duopolies or oligopolies, and will develop into large enterprises while complementing traditional payment service providers.

5. Aggregated API/Messaging Platforms

These platforms often claim to do the same thing as payment service providers (PSPs), but in reality, they merely package or aggregate APIs and do not directly assume compliance or operational risks. More accurately, they are marketplaces for PSPs and liquidity providers (LPs). Although they can currently charge high fees, over time, these fees will be squeezed (and may even be completely replaced) because they do not handle the "pain points" in payment flows or infrastructure building. They often refer to themselves as the "Plaid of the stablecoin space," overlooking that blockchain has already solved many of the core issues that Plaid deals with in traditional banking/payments. Unless these platforms get closer to end users and take on more functions in the technology stack, they will struggle to maintain profitability and business growth.

6. Merchant Gateways/Payment Channels

Companies in this area help merchants and businesses accept stablecoin or cryptocurrency payments. They sometimes overlap with PSPs but more often provide convenient developer tools while integrating third-party compliance and payment infrastructure, packaging it into user-friendly interfaces. Their goal is to become a Stripe-like entity, winning the market through easy integration and then expanding horizontally. However, unlike the early days of Stripe, developer-friendly payment options are now ubiquitous, and "distribution capability" is key. Traditional payment companies can easily collaborate with orchestration companies to add stablecoin payment options, making it difficult for pure crypto payment gateways to carve out their own market. While companies like Moonpay or Transak once had strong pricing power, I believe this advantage will not last. In the B2B space, companies that provide unique software features for large fund management or large-scale stablecoin usage may have a chance to succeed, but in the B2C space, the likelihood of failure is high. Overall, this area faces significant challenges.

7. Stablecoin-Driven Fintech and Applications

Today, building a "new bank" or "fintech" application centered around stablecoins is easier than ever, so this area will be filled with intense competition. The ultimate winners will depend on distribution capability, market entry ability, and product differentiation, just like traditional fintech. However, when well-known brands like Nubank, Robinhood, and Revolut can easily add stablecoin features, it becomes challenging for startups to stand out in developed markets, especially when their differentiation is merely "stablecoin-driven finance."

In emerging markets, there may be more opportunities (as seen in the case of @Zarpay_app), but in developed markets, startups relying solely on stablecoin features are likely to struggle to succeed.

Overall, I expect a very high failure rate in this area, and consumer startups focused on crypto/stablecoins will face significant challenges. However, enterprise solutions may still have opportunities to carve out a niche market.

Of course, this does not cover some edge cases and cross-sectors. But this framework provides guidance for us as investors to delve deeper into this area. If you have any feedback, feel free to share.

Article link: https://www.hellobtc.com/kp/du/12/5578.html

Source: https://x.com/HadickM/status/1866101987021836289

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。