Why did shareholders politely refuse the strategic investment in emerging assets?

Written by: Pzai, Foresight News

As the United States makes significant progress in the compliance of Bitcoin investments, more and more companies are beginning to show interest in crypto assets. With the successful experience of MicroStrategy, the National Center for Public Policy Research (NCPPR) officially recommended that Microsoft invest 1% of its profits in Bitcoin to hedge against inflation.

On December 10, Microsoft's major shareholders voted against including Bitcoin on the company's balance sheet. Market sentiment was thus somewhat impacted, with Bitcoin trading at $97,304 at the time of writing, a pullback from recent highs. Is the "crypto booster" favored by all U.S. stock investors? And why did shareholders politely refuse the strategic investment in emerging assets?

Emerging Interest

In October of this year, Microsoft included Bitcoin investment-related matters in its SEC filing for the shareholder voting meeting, a proposal put forth by the conservative think tank NCPPR. The board recommended that shareholders vote against this proposal, stating that there was "no necessity" for its implementation, as the company's management had "carefully considered this proposal." Additionally, it noted that volatility "is a factor to consider when evaluating cryptocurrency investments." Two months later, Bitcoin once again surpassed historical highs, and MicroStrategy, also a publicly traded company, became a dark horse in the U.S. stock market by embracing Bitcoin, with its stock price soaring rapidly in a short period.

Due to its successful experience, MicroStrategy CEO Michael Saylor attempted to persuade Microsoft shareholders to support the NCPPR proposal. Saylor emphasized the value of Bitcoin as "digital capital" and pointed out that if Microsoft allocated part of its assets to Bitcoin, it could lead to significant stock price growth. Furthermore, NCPPR played a video claiming that Microsoft should not miss out on the "next wave of technology" brought by Bitcoin, showcasing the potential value of holding Bitcoin.

However, despite this, Microsoft's major shareholders chose to support the board's opinion, believing that including Bitcoin on the company's balance sheet did not align with the long-term interests of shareholders. They expressed concerns that Bitcoin's high volatility could negatively impact the company's financial stability and were uncertain whether such an investment could guarantee positive returns for investors. Proxy advisory firm Glass Lewis also noted that experts generally believe that investing in cryptocurrencies cannot ensure an increase in the overall return rate of an investment portfolio.

Market Sentiment

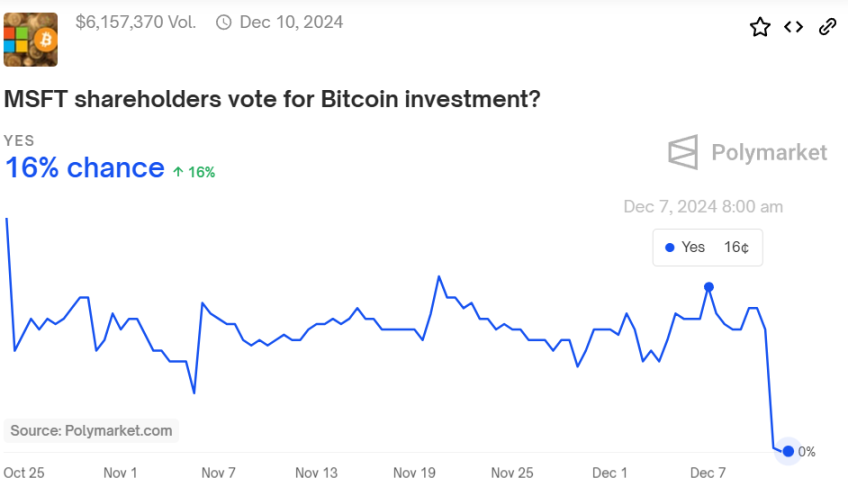

In the market, traders were generally pessimistic about Microsoft's shareholders' decision, with the likelihood of agreeing to the Bitcoin investment proposal fluctuating between 10% and 20% on Polymarket.

Aside from Microsoft's attempts, some companies in the U.S. stock market are actively trying to incorporate Bitcoin into their corporate reserve assets, such as Tesla, Riot Platform, and Galaxy Digital. If Microsoft were to take similar action, it would become the largest Bitcoin-holding company by market capitalization. Bernstein analysts stated that large tech companies have significant liquidity available for deployment through Bitcoin, but given the dominance of their core businesses, Bitcoin may become a non-substantial part of corporate asset strategies, while smaller companies with cash surpluses and weak core businesses could emulate MicroStrategy's model.

It is noteworthy that Microsoft's two major institutional investors—Vanguard and BlackRock—played a significant role in this vote. As one of Microsoft's largest shareholders, the attitudes of these institutional investors had a decisive impact on the final outcome. At the same time, BlackRock itself offers crypto ETF products to clients and is active in the crypto investment market. However, in Microsoft's strategic choices, these shareholders leaned towards more stable assets, indicating that while some large financial institutions have begun to venture into the cryptocurrency market, they remain cautious about the risks of strategically holding such assets.

In summary, the results of Microsoft's shareholder vote reflect the current dilemma faced by American companies when considering whether to enter the cryptocurrency space: on one hand, as Bitcoin prices continue to rise and the effects of Trump's presidency lead more companies to accept it as a legitimate investment tool and reserve asset; on the other hand, due to concerns about the safety and stability of corporate funds, there are corresponding limitations on investment scale. In this context, Microsoft chose to maintain its existing investment strategy, continuing to focus on more stable and predictable investment options. However, this vote has already sent a strong signal to the crypto market and raised expectations for future crypto adoption.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。