The level of this liquidation is the second largest in history, far exceeding the "312" incident.

Written by: WOO

On December 5, Bitcoin officially broke through the $100,000 mark, signaling the start of a new wave of cryptocurrency excitement. Just as market sentiment was boiling, a sudden sharp decline occurred on December 10, with Bitcoin dropping from $100,000 to a low of $94,100 in just six hours, a decrease of 6%.

At the same time, excluding Bitcoin and Ethereum, altcoins (Total 3) faced an even more severe drop, reaching as high as 14%.

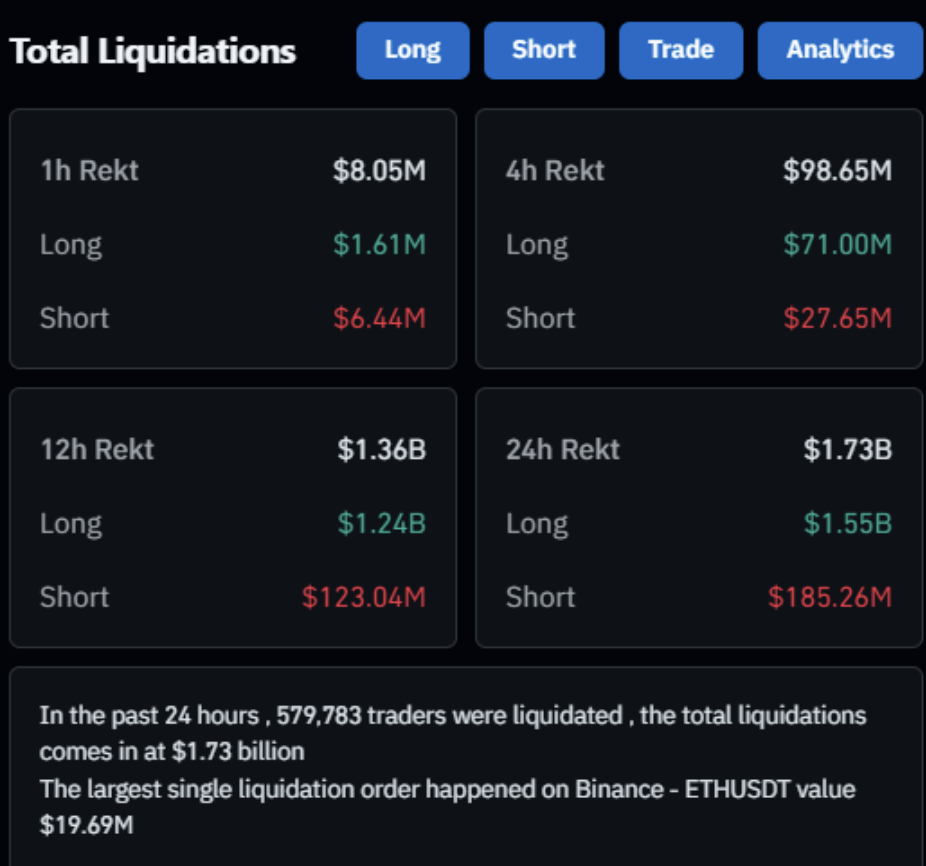

According to Coinglass data, the liquidation amount within 24 hours reached $1.734 billion, with the number of liquidated individuals reaching 580,000, far exceeding the scale of 100,000 liquidations during Bitcoin's 50% drop on March 12, 2020.

This drop came unexpectedly; although Bitcoin's price later rebounded to around $97,000, the positions that were forcibly liquidated could not be recovered. Was this drop just a normal correction? Or has the peak of this round been reached? Let WOO X Research take you through the reasons behind the crash and future outlook!

Source: Coinglass

Altcoin Market Sentiment Soars, Excessive Leverage Exists

On November 14, WOO X Research published an article predicting that the market cycle was on the "eve of an altcoin explosion." At that time, Bitcoin's market share was about 61%, but within a month, this figure had dropped to 55%. The current market cycle is defined as the altcoin explosion phase.

Meanwhile, Total 3's total market capitalization broke through $1 trillion, with a growth of 55% over the past month.

The rotation to altcoins rising is not the main reason for the drop; rather, it is the overly optimistic sentiment that has led to a significant amount of leverage in the market.

Altcoins represented by ETH and SOL have both reached historical highs in contract positions, rising in tandem with token prices. This phenomenon can be interpreted as: crypto users do not actually own these tokens but are using leverage to go long, with higher positions indicating increasingly strong bullish sentiment.

Before the crash tonight, ETH's position reached $27 billion, up from $17 billion a month ago, an increase of nearly 60%. The price increase has not kept pace with the massive increase in positions, indicating strong speculative sentiment.

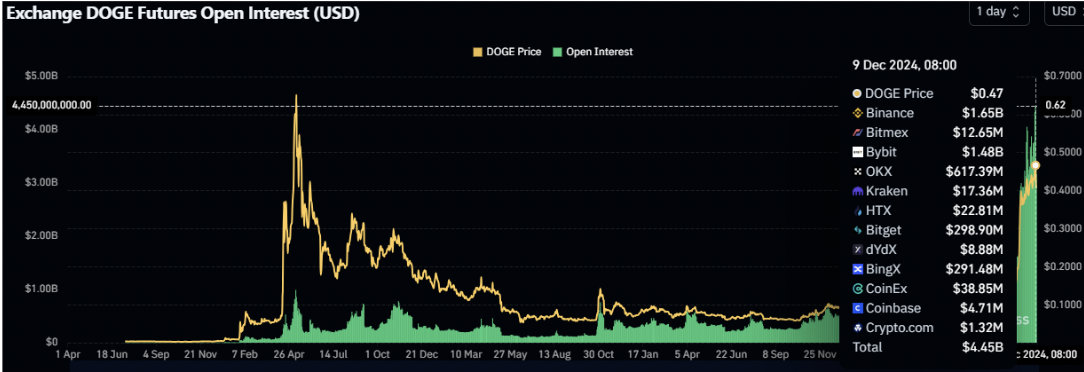

The example of ETH is just a microcosm; most altcoins have seen even more significant changes in position, such as Doge, XRP, and Pepe. Altcoins can be viewed as "leveraged" Bitcoin, and combined with the characteristics of contract trading leverage, there is currently excessive leverage in the market that needs to be cleared for progress.

Source: Coinglass

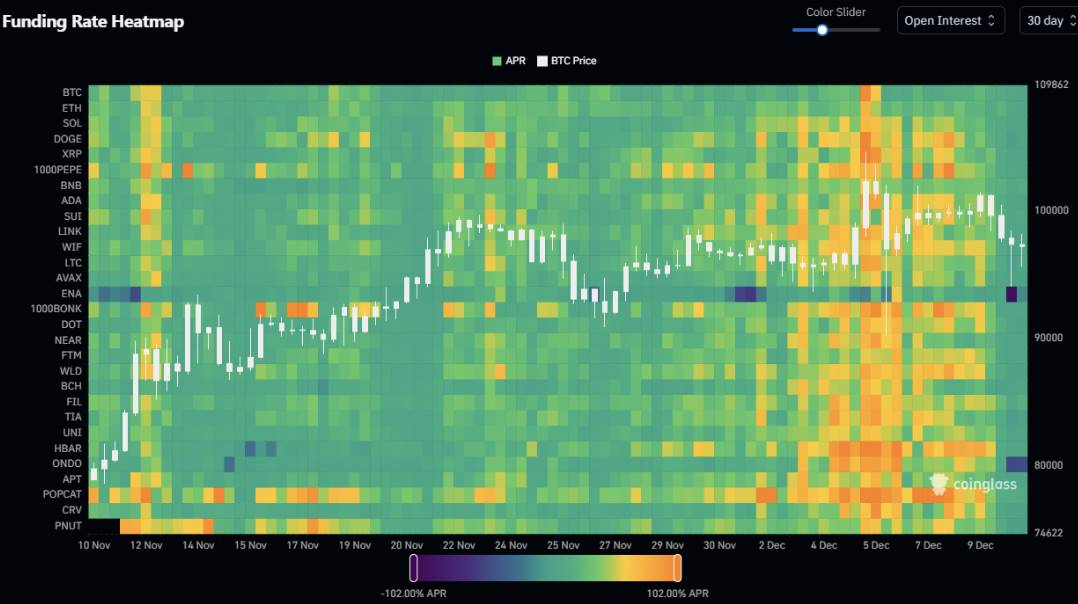

Additionally, from the perspective of funding rates, it can also be observed that the market was already in an overheated state before the crash.

Reviewing the relationship between Bitcoin's price movements and altcoin funding rates over the past month, during Bitcoin's rise from $70,000 to $100,000, the funding rates for altcoins did not show significant increases, with annualized rates mostly falling in the 10%-30% range, and only a few days did sporadic tokens exceed 100%.

From the chart below, it can be observed that after December 4, the altcoin market experienced consecutive days of significant increases in funding rates, mostly falling in the 60%-100% range.

The resonance of rising positions and funding rates further confirms that there is currently a large amount of leverage in the market, and the main reason for the drop is simple: it is the chain reaction of high leverage liquidations.

Source: Coinglass

External Events: Hawkish Statements + Christmas Holidays

The aforementioned points highlight the excessive leverage in the crypto market, while external events include recent hawkish statements from the Federal Reserve. In this context, analysts from Australia's largest banking group, Macquarie Bank, pointed out that the recent slowdown in the downward trend of U.S. inflation, the unemployment rate being lower than expected since September, and the optimistic performance of the U.S. financial market are the main factors driving the Fed towards a more hawkish stance.

Additionally, with the CPI and unemployment data set to be released on December 11 and 12, along with the upcoming Christmas holidays, it is understandable that European and American investors have a demand for profit-taking and risk aversion in the face of many uncertainties.

Summary: The Bull Market Continues, Liquidation is Normal

We are more inclined to view this drop as a clearing of leverage, and our outlook for the 2025 bull market remains unchanged.

Whenever discussing the crypto space, speculation is always involved, and high leverage serves as an emotional indicator for this market. Most overly high emotions do not mean that they can drive the market forward; rather, new capital needs to be injected into the market. Returning to the essence of price increases, it is about the law of supply and demand. It can be observed that institutions' interest in both Bitcoin and Ethereum has not diminished; spot ETFs continue to see net inflows, with Ethereum experiencing 11 consecutive days of net inflows, even setting a record on November 30 with a single-day net inflow exceeding that of Bitcoin's spot ETF.

Moreover, various institutions are applying for ETFs for other tokens, such as SOL and XRP. It can be confirmed that institutions still hold a strong interest in the crypto market. When supply remains unchanged and external demand increases, whether for Bitcoin or altcoins, the crypto bull market is expected to continue.

Source: sosovalue

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。