Today's homework may not be so frustrating. Everyone should know that Microsoft's vote did not pass, which is normal; everyone had expected it. Therefore, although the failure to pass has caused some emotional impact, it is very limited. Some friends asked what caused today's decline, especially since it had already risen quite well, returning to $98,000 before the U.S. stock market opened. Why is it falling more as the market opens? Is there some negative news in the U.S.?

I wonder if everyone remembers that the last time we saw such a decline was the day before the U.S. employment data was released. At that time, the expectations for unemployment rates and wages were not very good, leading to a risk-averse sentiment. Tomorrow's CPI might also trigger investors' risk-averse sentiment.

Many media outlets have previously suggested that the U.S. inflation data for November, to be released at 9:30 PM Beijing time on December 11, could be the last opportunity to change the Federal Reserve's decision on interest rate cuts in December. Looking at the current data expectations, the broad inflation rate for October is 2.6%, with the market expecting 2.7% for November, and the Cleveland Fed also expecting 2.7%. The month-on-month rate has been adjusted from 0.2% to 0.3%, while the only relatively stable data is the core inflation, which hasn't changed much.

Moreover, the Cleveland Fed's inflation expectations for December are continuing to rise, which could raise concerns among investors about whether the Federal Reserve will continue to cut rates in December. If they do not cut rates, the easing environment will be questioned.

But will this affect the rate cut in December? Personally, I don't think so, because the Federal Reserve places more importance on core PCE, which can also be reflected in core CPI. However, the core CPI for November has hardly changed. Therefore, the Federal Reserve is unlikely to react significantly to the broad CPI data for November. Another reason is that the unemployment rate has risen to 4.2%, making a rate cut in December a normal choice for the Federal Reserve.

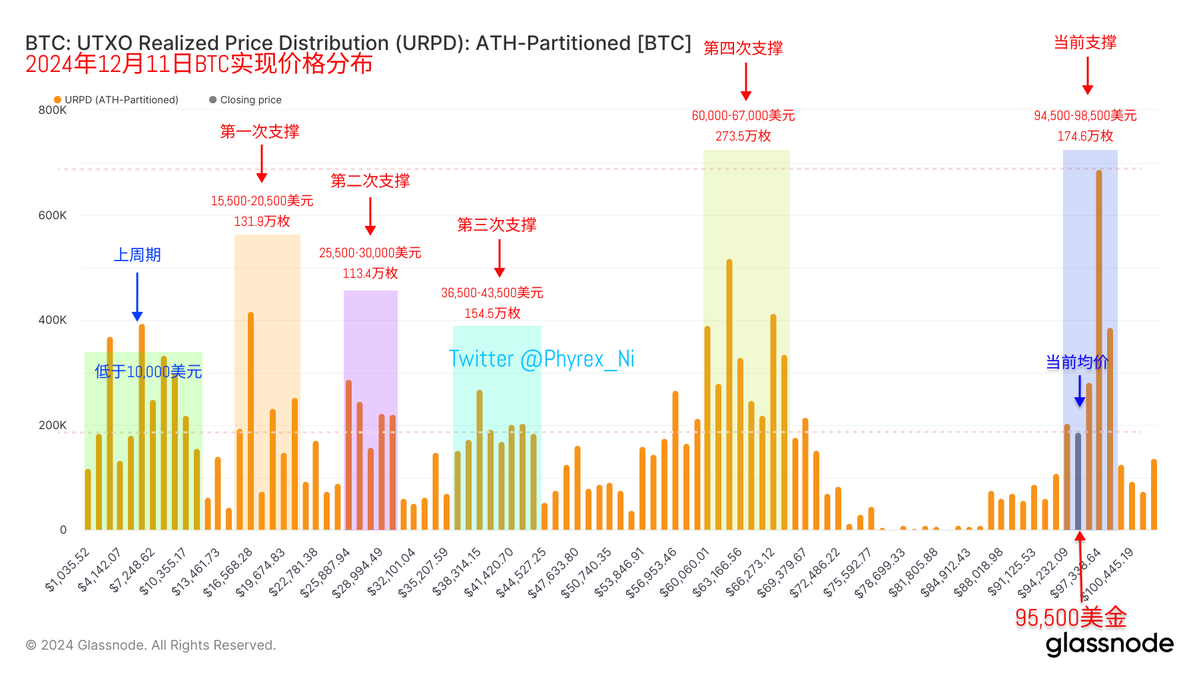

On the other hand, looking at the data from #BTC itself, it is indeed not very ideal. A large number of pre-election investors are starting to exit, which is a fact. More than 100,000 BTC with holding prices between $60,000 and $90,000 have changed addresses, and 78,000 BTC with holding costs above $98,000 have also changed hands. This data is substantial, indicating that not only short-term investors are participating in the turnover, but even long-term investors are also seeing significant turnover.

In conclusion, there are indeed signs of panic, but it has not reached the point of breaking support. On the contrary, during today's rebound, the position between $94,500 and $98,500 remains very strong, not to mention the earlier position between $60,000 and $67,000. Therefore, my personal view is that the support around $95,000 is still very solid, and I have not yet seen signs of support being broken. The focus now is on the Federal Reserve's interest rate meeting on the 19th.

Before going to bed, I will set a buy order around $94,500 to see if I can purchase a #Bitcoin.

Data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。