Crosscats, built using the Solver Network paradigm, has achieved an MVP (Minimum Viable Product) with just 650 lines of code, realizing the fourth paradigm in the BTC cross-chain solution. It has reached higher efficiency, more user-friendly interactions, and lower costs in the segmented cross-chain market between AltVMs➡️AltVMs and AltVMs➡️EVMs compared to more mainstream paradigms.

In the current cryptocurrency market, cross-chain bridges are a fiercely competitive red ocean track. To what extent has this segmented market become saturated? Just from Arbitrum to Optimism, there are 24 different cross-chain bridge options. And this is not the most brutal aspect. Due to the strong network effects and the Matthew effect in the cross-chain bridge market, the four major players—Stargate, Across, CCTP, and Orbiter—dominate nearly 90% of cross-chain transaction volume, while the remaining 55 players (within the scope of DefiLlama statistics) share about 10% of the market.

However, even so, new players continue to enter the cross-chain bridge space. Compared to DEXs and decentralized lending protocols, the cross-chain bridge market always has new niche markets that provide survival space for new players. Moreover, for on-chain players looking for early alpha opportunities in new L1/L2s, cross-chain demand is primary, taking precedence over trading and lending demands. Even better, cross-chain bridges can generate cash flow by charging fees and can enhance the liquidity and application scenarios of Native Tokens by constructing cross-chain trading pairs based on Native Tokens.

These reasons make the cross-chain bridge track one of the top choices for crypto entrepreneurs, even amidst high competition. This includes Catalyst's launch of Crosscats.

Due to the previous combination of top VC financing to create expectations + point PUA + airdrop farming to generate TVL and trading volume data, this traditional approach has become unfeasible after Layerzero. As a new player, Crosscats can no longer rely on these old tricks to achieve an exit.

So how to break the deadlock? The answer is to pursue PMF (Product-Market Fit). It sounds complex, but it boils down to two steps:

Step 1: Build based on a new product paradigm

The product paradigm of cross-chain bridges has undergone three significant iterations: MPC multi-signature cross-chain bridges, PoS chains/Rollups as Relayer intermediary cross-chain bridges, and cross-chain bridges supported by the Solver Network.

The Solver Network, based on the RFQ market-making mechanism, possesses characteristics such as MEV resistance, gas-free transactions, and high capital efficiency in same-chain asset swaps, which are not found in AMM market-making algorithms. The continuous growth in trading volume and adoption of leading projects like CowSwap and UniswapX has also validated the feasibility and robustness of the Solver Network in production environments.

Since it is so useful, there is no reason not to apply the Solver Network in the cross-chain asset swap scenario to compete with the current mainstream paradigm of Liquidity Pool + AMM + Massage.

In fact, for new players like Crosscats, the mainstream paradigm's TVL-heavy asset model is not feasible. In contrast, during the same period, Stargate's trading volume reached $1 billion, with a TVL of $400 million.

The core of the multi-chain Solver Network is how to standardize user intent expression between homogeneous and heterogeneous chains. Crosscats is compatible with the ERC7683 standard launched in collaboration with Across and Uniswap.

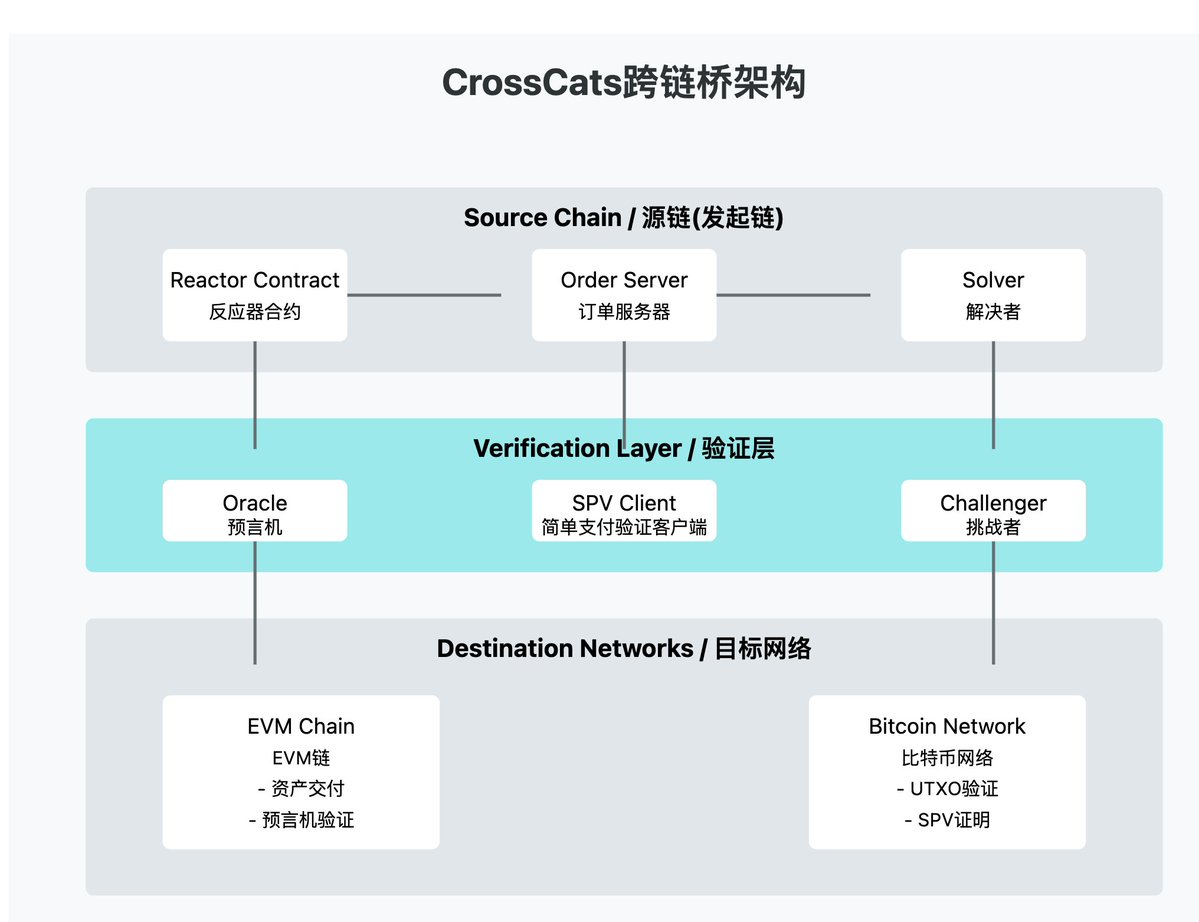

To understand Crosscats' cross-chain implementation mechanism, we start with the architecture of Crosscats' cross-chain bridge.

CrossCats is an intent-based cross-chain interchange protocol, and its architecture consists of the following layers:

Source Chain Layer: The chain executing the main business logic, including:

Reactor Contract: Handles order initialization and verification

Order Server: Coordinates orders and matches them

Solver: Executes cross-chain transactions

Verification Layer:

Oracle: Verifies transactions on EVM chains

SPV Client: Verifies Bitcoin transactions

Challenger: Handles dispute resolution

Target Chain Layer:

EVM Chain: Used for token delivery and oracle verification

Bitcoin Network: Used for UTXO verification and SPV proof

Order Initiation and Execution Process:

User Signature: The user signs the order description (e.g., "1 ETH for 3000 USDC")

Solver Claim: The Solver needs to provide collateral to claim the order

Asset Delivery: Different handling based on the type of chain

VM to VM: Payment through Oracle contracts

VM to BTC: Payment through Bitcoin transactions

Payment Release Mechanism: CrossCats offers three payment release options:

a) Optimistic Execution:

Assumes the solver has completed the payment

Automatically releases after the dispute period

If disputed, reverts to explicit verification

b) Explicit Verification:

Verification proof can be submitted at any time

Higher cost but faster speed

Supports batch verification to reduce costs

c) Underwriting Mechanism:

Can transfer order liability to a third party

Allows the initial solver to quickly recover funds

The underwriter is responsible for subsequent verification

Compared to mainstream cross-chain bridge paradigms, the Solver Network paradigm adopted by Crosscats offers higher capital efficiency, lower costs for accessing new L1/L2s, and is VM-agnostic. The downside is its weaker composability, but AMM cross-chain bridge LPs also rarely combine with other DeFi assets, so this drawback is relatively minor.

Step 2: Target new incremental markets

As described at the beginning of the article, the landscape of the existing cross-chain bridge market is already very solid. Lightweight new players like Crosscats are best focused on new incremental markets. So where are these incremental markets? The Catalyst team's judgment is that the cross-chain demand lies in AltVMs➡️AltVMs and AltVMs➡️EVMs.

Previously, people believed that EVM was sufficient; EVM compatibility and full EVM compatibility were once the biggest selling points for many L1/L2s. However, with the outstanding performance of Solana, Cosmos, and Sui in this cycle, people are gradually realizing the value of diversified VMs.

We know that EVM excels at token transfers, MoveVM is good at complex asset management, SVM excels in high-throughput parallel execution, and Starknet's ZKVM is suitable for matrix operations, making it more compatible with AI large model training.

Currently, three of the top ten most active chains in cryptocurrency are AltVMs. A new batch of protocols with altVM characteristics, such as Movement, Fluent, Eclipse, Soon, and Fuel, which feature fast block times, quick finality, parallel execution, local fee markets, and enhanced security, are about to launch their mainnets.

For Crosscats, entering the altVMs cross-chain market at this time allows it to enjoy the growth dividends of existing AltVM chains while seizing key ecological positions in new AltVM chains.

Notably, there is a leviathan among AltVMs: the Bitcoin mainnet. We know what the core challenge of the Bitcoin ecosystem is: how to achieve trustworthy, secure, and fast BTC cross-chain interoperability? Currently, there are three mainstream solutions: multi-signature gateways based on the Rollup paradigm, trustless bridges based on bitVM2, and third-party bridges using Massage + Liquidity Pool. Among these, the trustless bridge based on bitVM2 is still in the white paper stage and has not yet been deployed in a real production environment.

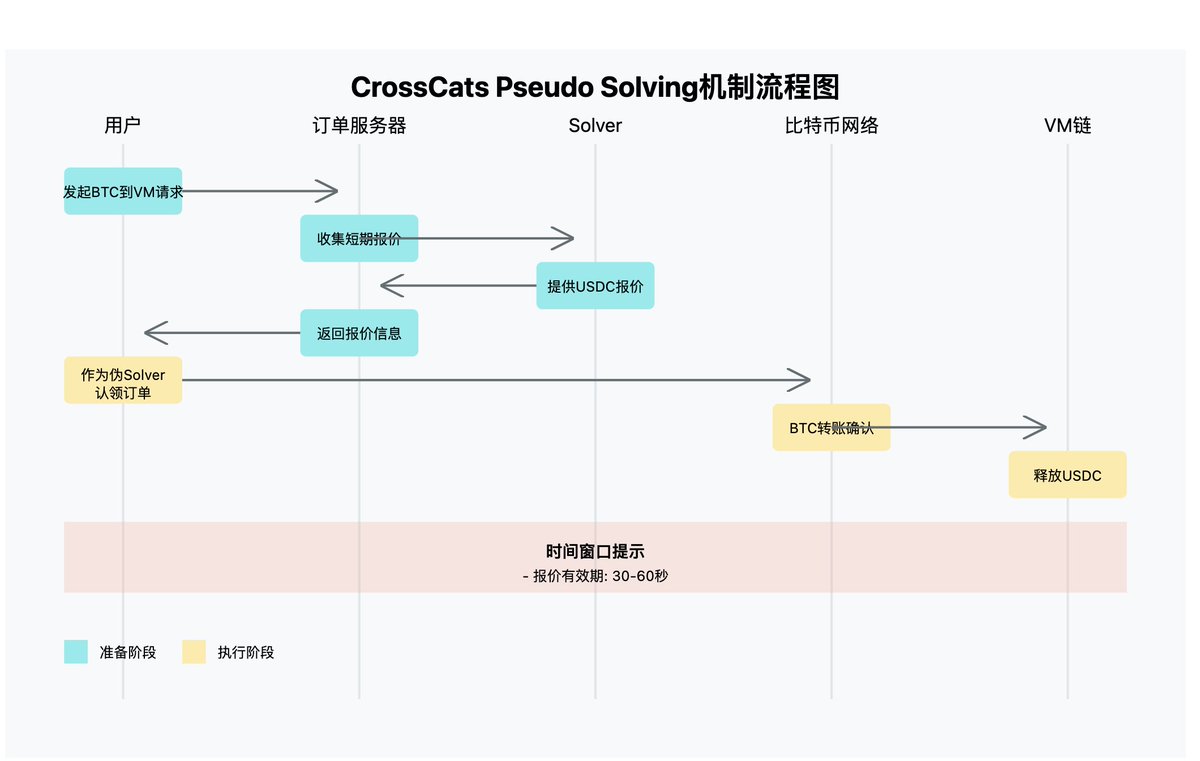

Using the Solver Network paradigm to handle the process from ordinary VM to BTC is straightforward, but issues arise when going from BTC to VM, as assets cannot be directly "pulled" from the Bitcoin network. Crosscats has specially designed a Pseudo Solving mechanism to address this issue.

For example, if a user wants to exchange 1 BTC for 50,000 USDC:

Reverse Order Creation:

The user does not directly create an order for "BTC for USDC"

Instead, they look for a reverse order: "50,000 USDC for 1 BTC"

Quote Collection:

Collect short-term Bitcoin quotes from Solvers through the order server

These quotes have specific validity periods

User Action:

The user acts as a "pseudo-solver"

Selects and quickly claims a suitable reverse order

Completes the transaction with their Bitcoin

Completion of Exchange:

The user receives the input asset from the order (50,000 USDC)

This is exactly the asset the user wanted to exchange for

Compared to mainstream solutions, Crosscats offers a faster user experience for BTC cross-chain transactions, lower costs, higher capital efficiency on the LP side, and reduced risks.

That's all.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。