The whale in question shifted a fortune of 2,700 bitcoins that had been untouched since December 2013. Originally acquired on Dec. 20, 2013, when bitcoin traded at $694 each, the trove was worth around $1.8 million at the time. Fast forward to today, the decade-old digital assets are now worth a staggering $257 million.

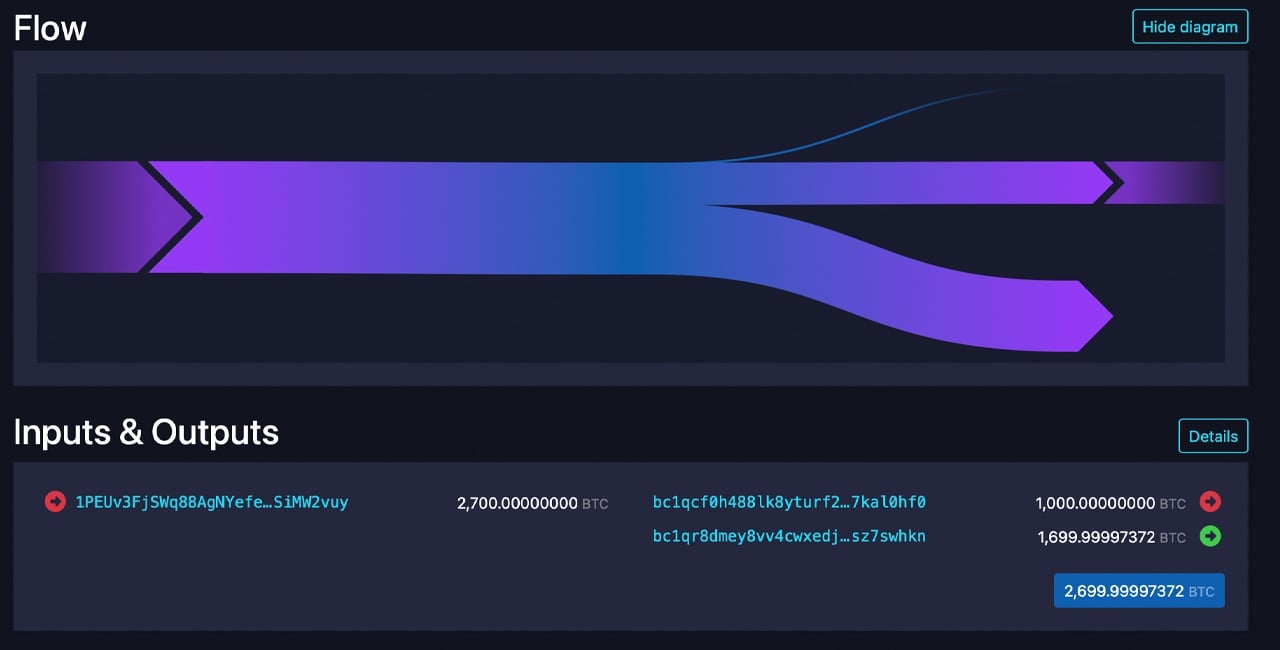

Flow source: mempool.space.

These bitcoins were sourced from a legacy Pay-to-Public-Key-Hash (P2PKH) wallet. Of the total, 1,000 BTC landed in a new Bech32 address, while 1,699.99 BTC were sent to a separate Bech32 wallet. To transfer a quarter of a billion dollars’ worth of bitcoin, the sender paid a mere 2,628 satoshis—just $2.46.

This onchain activity was first identified by btcparser.com. At the time of writing, the funds remain split across the two addresses. Recent weeks have seen several dormant bitcoin holdings resurface, coinciding with the cryptocurrency nearing the $100,000 mark. Just yesterday, 50 BTC from a mining reward dated Oct. 9, 2010, were moved for the first time since being mined.

The resurgence of dormant bitcoin activity hints at growing confidence or strategic positioning as BTC holds its weight just below the $100,000 milestone. These movements, whether prompted by profit-taking, renewed engagement, or future-proofing, underscore the enduring significance of bitcoin‘s early adopters. Such actions also highlight the minimal costs associated with transacting substantial sums on the blockchain, a testament to its evolving infrastructure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。