Providing "leverage" for more institutions to layout Web3 technology.

Produced by | OKG Research

Author | Jason Jiang

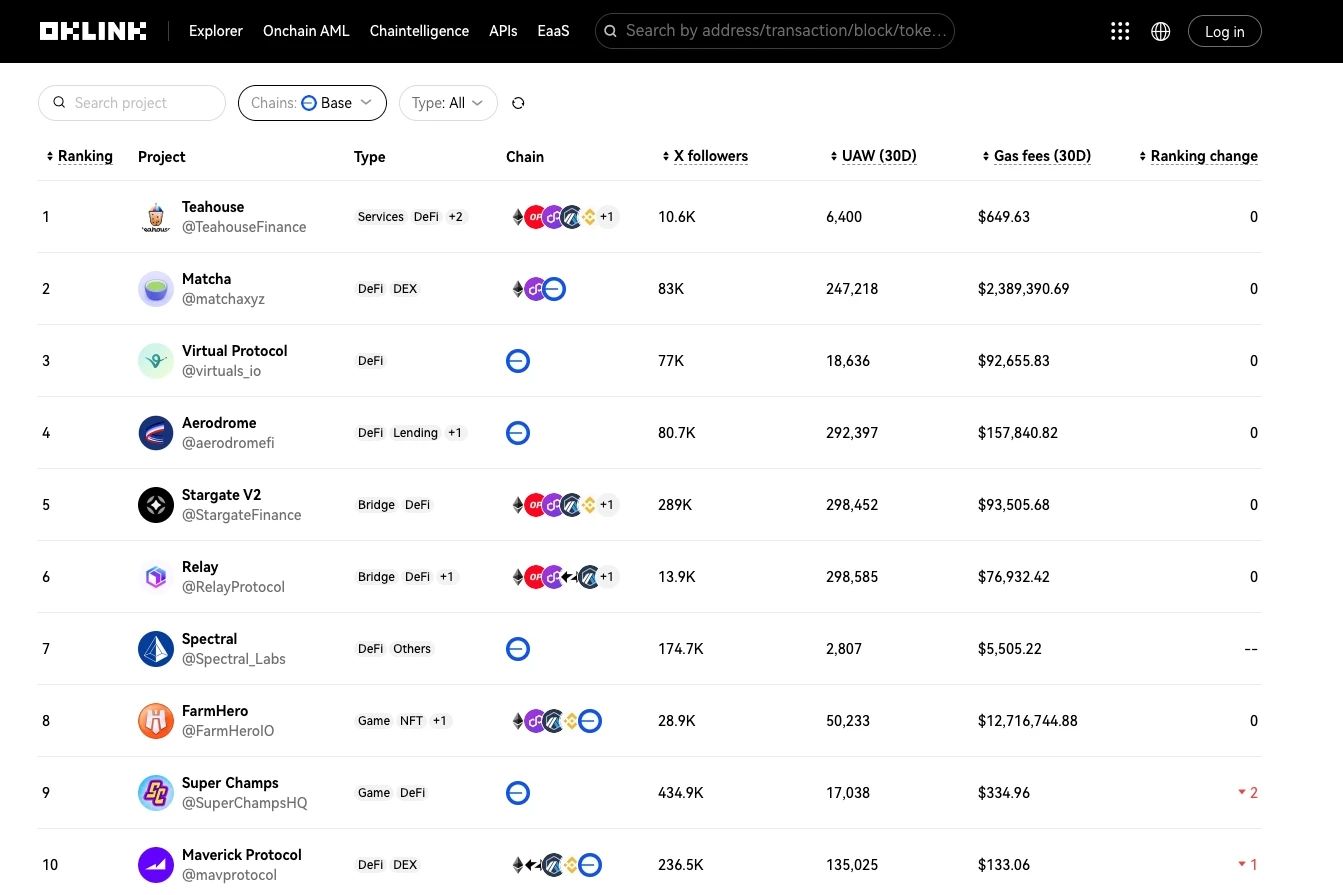

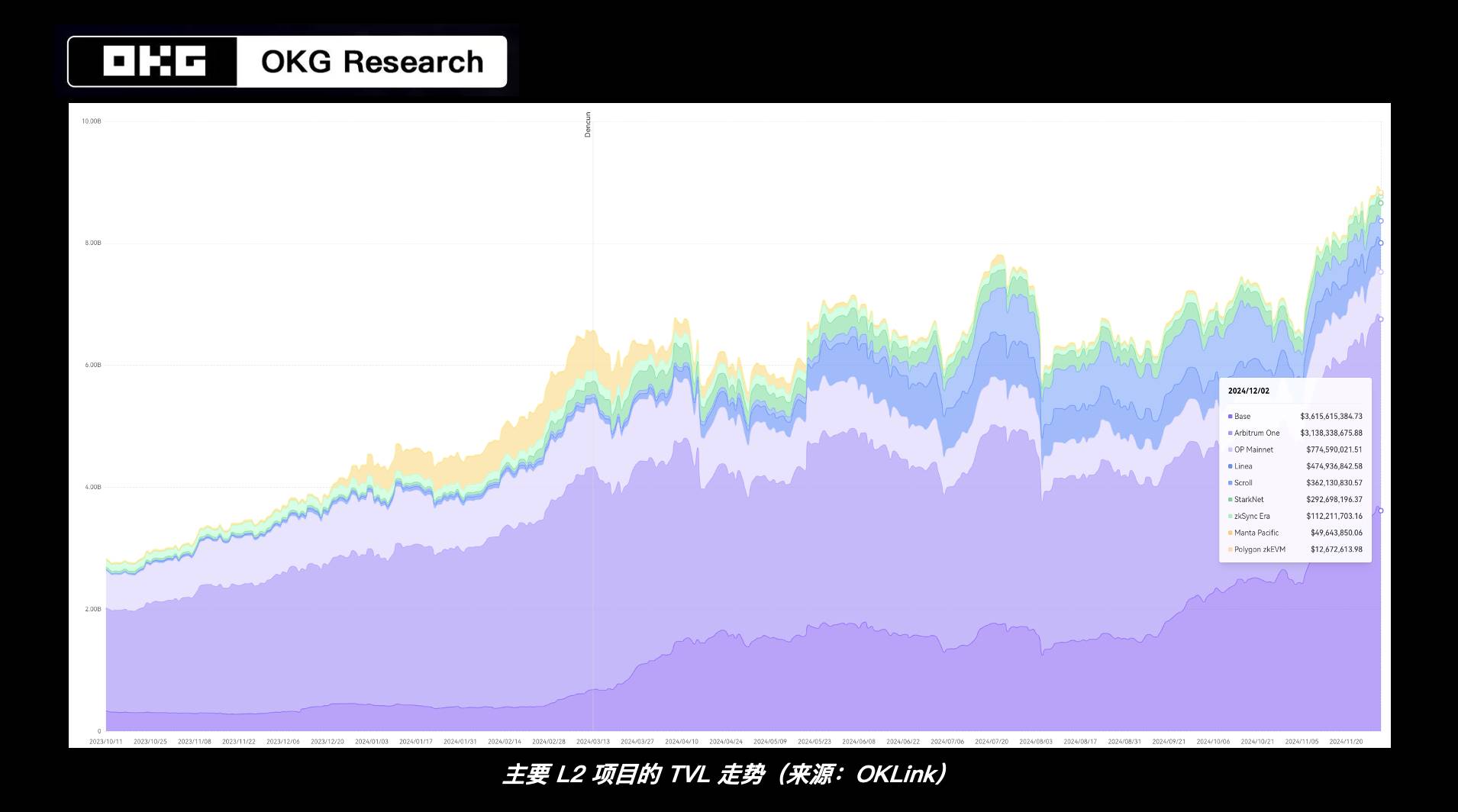

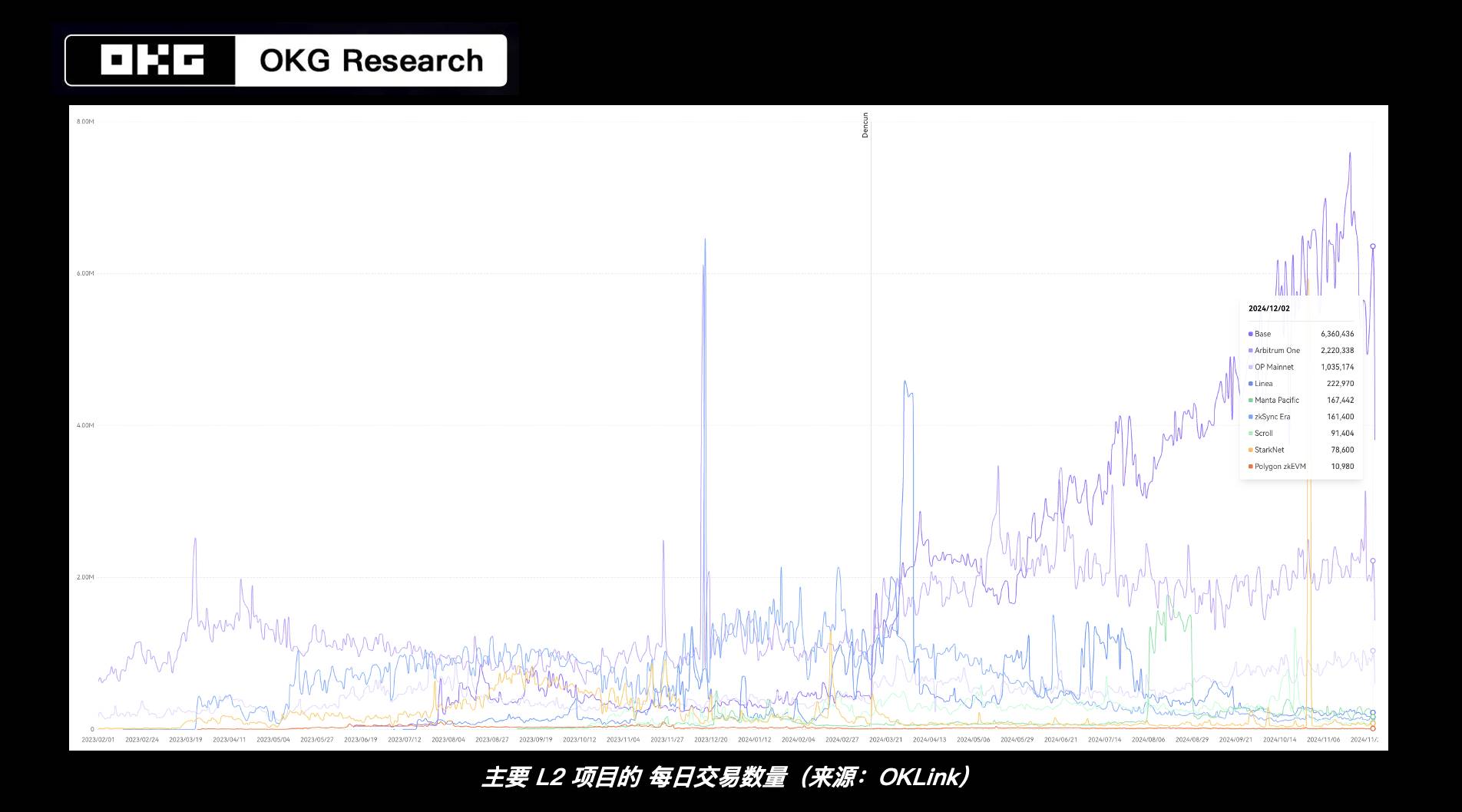

A large amount of capital is flowing wildly into Base. On-chain data shows that in the past month, Base has been the ecosystem with the highest on-chain capital inflow, with a net inflow of $750 million, far exceeding Solana's during the same period (about $300 million). Meanwhile, other indicators are also on the rise: Base's daily transaction volume has exceeded 11 million at its peak, facilitating over 1 billion on-chain transactions cumulatively, and the number of weekly active addresses has increased 20 times compared to the beginning of the year, surpassing Arbitrum to become the L2 project with the highest TVL.

Hot projects on the Base chain (Source: OKLink)

Base's success is attributed to its ability to capture trends and create "blockbusters," but it is also inseparable from the support of Coinbase behind it: Base can easily integrate various products, users, and tools from the Coinbase ecosystem, allowing developers to quickly build on-chain applications and reach over 100 million users and a large amount of assets, facilitating the migration of more users and assets. This is the foundation of Base's development and its natural advantage compared to other L2s. Now, more and more projects like Base that have "backing" are joining the L2 "battle."

Will the next Base emerge among these "backed" L2s?

The liquidity fragmentation and intensified competition brought about by excessive infrastructure have led to continuous criticism and pessimism towards L2s, but this has not dampened the enthusiasm of new entrants. Many institutions are still joining the L2 "battle": the established DeFi project Uniswap has launched its own L2 project Unichain; the Web2 tech giant Sony has also announced the launch of the L2 network Soneium… As the liquidity competition is still ongoing, a new wave of well-backed and high-profile competitors has arrived.

Compared to established L2 projects, these newcomers are somewhat "different."

Early native L2 projects represented by Arbitrum and Optimism were created to address the technical and performance deficiencies of Ethereum, rather than application issues. These projects meet the market's application needs for the main chain with lower gas fees and higher TPS. The premise of success is that the main chain must be active enough: only when the main chain is frequently used can the advantages of L2 be realized, and its value be unlocked. However, Ethereum has faced "internal and external troubles," and although its absolute data still leads, its growth has lagged far behind Solana and others. Thus, even if L2s attached to Ethereum have strong "internal skills," they cannot be fully utilized.

In contrast, new entrants in the L2 market, whether it's Base launched last August, or Uniswap and Sony this year, either have their own applications and traffic support or have huge imaginative space in linking Web2 scenarios. They are less dependent on Ethereum in terms of traffic, scenarios, and ecosystems, and have no intention of replacing Ethereum; they are more focused on how to "monetize" existing L2 technology to optimize and improve their application landscape, gaining a greater competitive advantage.

The reason these projects choose L2 is partly due to the initial success of modular rollup infrastructure, with platforms like OP Stack significantly lowering the technical barriers for deploying L2s, making one-click chain deployment a reality, and not requiring the establishment of new consensus networks, making it a more cost-effective technical choice; additionally, Base's success has also proven that L2 projects can operate healthily without relying on a token system for financial incentives, which has obvious advantages in legal compliance and may attract more institutions.

As the second half of the battle begins, how to leverage the value "leverage" of L2?

Currently, the criticism and pessimism towards L2s are superficially due to market performance falling short of expectations, but the fundamental reason lies in the significant mismatch in the speed of technological iteration and application innovation during this cycle. It's like building a highway with great effort, only to find that there are hardly any cars on the market, and everyone is still in the stage of riding bicycles; at this time, the value of the highway cannot be realized.

How to solve this problem? The most effective way is to accelerate the construction of applications within the L2 ecosystem, narrowing or even eliminating the time mismatch between the two, thereby tightening the demand for infrastructure again, allowing the market to enter a positive cycle of "infrastructure-application-infrastructure," thus leveraging the value of L2.

As Sota Watanabe, Director of Sony SBL and founder of Astar Network, said, “Due to the lack of general user touchpoints and their feedback, the Web3 industry has been making products for itself in the past.” However, with the business and resource advantages of institutions like Sony, the infrastructure and applications of the Web3 industry are expected to break free from the awkwardness of "self-indulgence" within the circle, becoming applications that solve real problems and meet genuine needs, bringing the benefits of Web3 technology to a broader Web2 user base.

At the Ethereum Developer Conference in July this year, Vitalik also stated that “the biggest theme of the Ethereum ecosystem in the next decade is applications.” Now, these new entrants in L2 are coming with applications and are also aimed at applications. While most native L2 projects are still caught up in the "technical narrative," newcomers are already trying to build "toll booths" on the existing L2 highway, guiding more "vehicles" to get on the road.

With the development and maturity of L2 technology, the L1 main chain may be getting further away from ordinary users, and L2 will become the main gathering place for on-chain users and applications. According to OKG Research analysis, over 90% of Ethereum transaction activity is currently occurring on L2 networks. In the future, more institutions, especially Web2 institutions, are bound to choose L2 as their option for building on-chain applications and participating in the Web3 ecosystem.

In this process, a second half battle around applications in L2 may begin. However, this time it will not only be about "technical skills," but also about resources and scenarios. These new L2 forces, backed by institutions and possessing traffic and scenario advantages, may be more likely to bring surprises on the application side than those established projects that have been fighting in the battlefield for longer, thus leveraging the value "leverage" brought by L2 innovation.

If virtual asset spot ETFs provide more investors with asset allocation options in the Web3 era, then L2 may provide more institutions with "leverage" for Web3 technology, allowing Web3 to not only serve Web3 but also leverage the Web2 market, sparking more application innovations.

The content of this article is for market observation and trend analysis only and should not be considered as specific investment advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。