The core of de-banking lies in regulatory agencies compelling banks to enforce financial repression, thereby avoiding direct government accountability.

Author: nic carter

Translation: Deep Tide TechFlow

This week, venture capitalist Marc Andreessen appeared on Joe Rogan's podcast and made some controversial remarks regarding the systemic phenomenon of "de-banking," particularly in the crypto industry. At the beginning of the show, he directly named the Consumer Financial Protection Bureau (CFPB) as the behind-the-scenes force driving the de-banking of crypto startups. The CFPB is an agency created under the leadership of Elizabeth Warren. In response, some critics argued that not only is there no such thing as a de-banking problem, but the CFPB is actually working to end this phenomenon.

Several different issues need to be clarified here. First, what exactly is Marc Andreessen complaining about? Is his concern justified? Secondly, what role does the CFPB play in the de-banking of politically unpopular entities—are they a promoter or a blocker?

For many leftists, they may not fully understand the crypto industry and the right's concerns about de-banking. Therefore, following Marc's remarks and Elon’s support on X platform, the left generally feels confused or even disbelieving. I believe it is essential to read the full dialogue between Marc and Joe, as many people are reacting based on snippets, while the conversation actually contains many independent claims and in-depth comments. The complete transcript can be found in the appendix. Let’s explore this in detail.

What are Marc Andreessen's main points?

In the show, Marc made several interconnected claims. He first criticized the CFPB as an almost unmonitored "independent" federal agency that can "intimidate financial institutions, preventing new competition, especially emerging startups that challenge big banks."

He then mentioned that de-banking is a specific harm, defining it as "when individuals or companies are completely kicked out of the banking system." Marc pointed out that this phenomenon typically occurs through banks acting as agents (similar to how the government conducts indirect censorship through big tech companies), while the government maintains a certain distance to avoid direct accountability.

Marc believes that "over the past four years, this situation has affected almost all crypto entrepreneurs. This phenomenon has also impacted many fintech entrepreneurs and anyone trying to launch new banking services, as the government attempts to protect existing big banks." Additionally, Marc mentioned some politically unpopular businesses, such as the legal cannabis industry, escort services, and gun shops and manufacturers during the Obama administration. The Department of Justice (DoJ) referred to these actions as "Operation Choke Point." Later, the crypto industry referred to similar phenomena as "Choke Point 2.0." Marc stated that this action primarily targets the government's political enemies and the tech startups they do not support. "Over the past four years, we have seen about 30 founders affected by de-banking."

Marc further pointed out that the victims include "almost all crypto founders and startups. They are either personally de-banked and forced out of the industry, or their company accounts are closed, leading to an inability to continue operations, or they are sued by the SEC or threatened with prosecution."

Moreover, Marc mentioned that he knows some individuals who have faced de-banking due to "holding unacceptable political views or making inappropriate statements."

In summary, Marc Andreessen made the following points:

De-banking refers to individuals or businesses being deprived of banking services. This may be due to their industry being politically unpopular or their holding political views that differ from the mainstream.

The Consumer Financial Protection Bureau (CFPB) bears at least some responsibility for this, along with some other unnamed federal agencies involved.

The actual operation of this phenomenon is that regulatory agencies delegate the task of financial oppression to banks, allowing the government to avoid direct accountability.

During the Obama administration, the main victims of de-banking were some legitimate but politically unpopular industries, such as cannabis businesses, adult services, and gun shops and manufacturers.

During the Biden administration, crypto industry businesses and entrepreneurs, as well as fintech companies, have become the primary targets. Additionally, sometimes conservatives may also face de-banking due to their political views.

Marc also mentioned that 30 founders from the a16z portfolio have experienced de-banking.

We will evaluate these points in detail at the end of the article.

How do critics view Marc Andreessen's points?

In short, left-liberals are dissatisfied with Marc's remarks. They believe Marc is using the narrative of "de-banking" to support the crypto industry and fintech while ignoring more deserving victims—such as Palestinians who were banned from Gofundme for sending money to Gaza. The mainstream left tends to be more direct, usually supporting the de-banking of their political opponents, thus avoiding the entire issue.

However, there is a segment of the left that maintains a certain ideological consistency, questioning the power of corporations and the government in the realms of speech and finance. (This group may be expanding, especially as the right regains control of some tech platforms and restores certain state powers.) These individuals have been vocal about the issue of de-banking for some time. They recognize that while the current primary victims of de-banking are right-wing dissidents (such as Kanye, Alex Jones, Nick Fuentes, etc.), this phenomenon could similarly occur to the left if the situation were reversed. They define de-banking more narrowly: "De-banking, or what some financial institutions refer to as 'derisking,' refers to banks terminating business relationships with clients deemed politically incorrect, extreme, dangerous, or otherwise non-compliant." (Quoted from an article by TFP). In the article, Rupa Subramanya discusses how banks can completely destroy someone's financial life by perceiving them as having excessive reputational risk. In fact, individuals from different political spectrums are affected—including Melania Trump, Mike Lindell, Trump himself, Christian charities, participants in the "January 6" events, as well as Muslim crowdfunding organizations and charities.

Nevertheless, many leftists remain critical of Marc's views, especially regarding the CFPB. Here are some specific examples:

Lee Fang: The CFPB has been explicitly opposed to de-banking; why would Andreessen say this? What evidence does he have? What he hasn't mentioned is that the CFPB investigated the startups supported by Andreessen because they were suspected of deceiving consumers, not because of political speech. In fact, the roots of de-banking lie with the FBI and the Department of Homeland Security (DHS), not the CFPB.

Lee Fang: De-banking is indeed a serious issue. For example, we have seen truck drivers opposing COVID-19 prevention policies lose their bank accounts for participating in protests, and organizations supporting Palestine being banned from using Venmo. But now, some predatory lenders and scammers are conflating consumer protection with "de-banking," trying to push for deregulation.

Jarod Facundo: I completely do not understand @pmarca. A few months ago, CFPB Director Chopra warned Wall Street not to de-bank conservatives without cause at a federal society event.

Jon Schweppe: I agree with @dorajfacundo. I completely do not understand what @pmarca is specifically referring to. The CFPB has been leading the charge against discriminatory de-banking. What is going on here?

Ryan Grim: The CFPB recently released a very good new rule specifically targeting banks that de-bank users due to political views. Yes, this is a left-wing populist CFPB head standing up for the rights of conservatives. And now, those venture capitalists and Musk who dislike the CFPB are spreading lies to stir public sentiment to weaken the CFPB's power.

Overall, these critics are not friendly towards the cryptocurrency and fintech industries. They believe that the companies in these sectors are not "real" victims of de-banking, especially when compared to crowdfunding platforms that send money to Gaza. In their view, the crypto industry is "reaping what it sows." They argue that cryptocurrency founders are guilty of token inflation, fraud, and deception, and therefore it is only natural for banks to take action against them. "If crypto founders are de-banked, that is merely a regulatory issue with the banks, and it has nothing to do with us."

Additionally, these critics believe that Marc is wrong to blame the CFPB. They assert that the CFPB is precisely an agency dedicated to combating de-banking, and Marc's dissatisfaction with the CFPB is simply because the fintech platforms he invests in are under strict regulation to ensure they do not abuse consumer rights.

Since Marc made his remarks on Rogan's show, many founders in the tech and crypto industries have come forward to share their experiences of being unilaterally deprived of services by banks. Some in the crypto industry believe that the unconstitutional attacks on the crypto sector by regulatory agencies are coming to an end, and they see a glimmer of hope. Calls for investigations into "Operation Choke Point 2.0" have also reached a peak. So, who is right? Is it Andreessen or his critics? Is the CFPB really the culprit? Is the phenomenon of de-banking as serious as Marc claims? Let's start by exploring the role of the CFPB.

What is the CFPB?

The Consumer Financial Protection Bureau (CFPB) is an "independent" agency established in 2011 under the Dodd-Frank Act in the aftermath of the financial crisis. Its scope of responsibilities is very broad, including oversight of banks, credit card companies, fintech companies, payday lenders, debt collectors, and student loan companies. As an independent agency, the CFPB's funding does not rely on Congress (thus avoiding congressional funding scrutiny). Its director cannot be easily dismissed by the president, and the agency can directly create rules and initiate enforcement and legal actions in its own name. It can be said that the CFPB wields considerable power. The establishment of the CFPB was primarily driven by Senator Elizabeth Warren.

The CFPB has been a target of attacks from conservatives and libertarians because it is a new federal agency that operates with minimal oversight. It was established under the leadership of Elizabeth Warren, who is a frequent target of right-wing criticism. The CFPB's goal is to effectively "regulate" fintech companies and banks. However, most of these companies are already subject to strict regulation. For example, banks must be supervised by state or federal (OCC) authorities and report to the FDIC, the Federal Reserve (Fed), and the SEC (if they are publicly traded). Credit unions, mortgage lenders, and others also have their own regulatory bodies. Before the CFPB was established, there was no significant gap in U.S. financial regulation. In fact, the U.S. has more financial regulatory agencies than any other country in the world. Therefore, the right's skepticism about Elizabeth Warren's motives is not without reason.

Regarding the scope of the CFPB's responsibilities:

The CFPB's mandate includes explicit provisions against discrimination in banking services. These include the Equal Credit Opportunity Act (ECOA) and the "Unfair, Deceptive, or Abusive Acts or Practices" (UDAAP) section of the Dodd-Frank Act. According to the ECOA, discrimination in credit transactions based on the following protected categories is prohibited: race, color, religion, nationality, sex, marital status, age, or whether the individual receives public assistance.

However, the "Choke Point" issue raised by Marc Andreessen does not fall within the applicability of these provisions. "Crypto entrepreneurs" or "conservatives" do not belong to the legally defined protected categories. Therefore, even in theory, this part of the CFPB's mandate cannot address politically motivated attacks on specific industries. Furthermore, the ECOA primarily targets credit services rather than the overall issue of banking services.

The UDAAP section of the Dodd-Frank Act is another provision that may relate to de-banking. This clause grants the CFPB broad authority to combat actions deemed unfair, deceptive, or abusive. For example, the large settlement agreement reached between the CFPB and Wells Fargo was based on UDAAP. In theory, if the CFPB were to address the issue of de-banking, it might do so through UDAAP. However, aside from issuing some statements, they have not yet taken any concrete action.

CFPB's Official Statements

CFPB Director Rohit Chopra explicitly opposed payment platforms banning users for political reasons in a speech at a Federalist Society event in June of this year. In his speech, he expressed concerns about large tech payment platforms (such as PayPal and Venmo) irresponsibly banning users, especially when these platforms do not provide any opportunity for users to appeal. He specifically mentioned that these platforms might exclude users for expressing politically unpopular views elsewhere. This phenomenon does exist, so it is encouraging that Chopra can publicly discuss these issues.

However, there are two problems here.

First, Chopra's focus is primarily on the irresponsible behavior of private enterprises, especially when these enterprises exhibit monopolistic characteristics. He does not address the risk of government power, namely the possibility that the government could use regulatory tools to force banks to implement "redlining" against entire industries. This is precisely the point that Marc Andreessen criticizes.

Second, while Chopra's remarks are commendable, the CFPB's actual actions in this regard remain limited. Based on current trends, they may regulate large non-bank payment networks. However, the issue of "Choke Point 2.0" involves the power exerted by government financial regulatory agencies over banks. Such issues do not fall within the CFPB's responsibilities but are the purview of the Federal Reserve (Fed), the Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency (OCC), and the administrative departments responsible for regulating these agencies (or Congress in investigative situations). The CFPB does not have the authority to regulate other financial regulatory agencies, so its ability to address "Choke Point"-style behavior is limited. (It is worth mentioning that Chopra is a member of the FDIC board, so he bears some responsibility for any misconduct by the FDIC or at least has some awareness of it.)

Notably, in a court filing in August of this year, the CFPB explicitly stated that de-banking Christians constitutes a discriminatory act and pointed out that the agency has the statutory authority to address this issue. This statement was seen by Lee Fang as a positive (and surprising) development, as the CFPB has not historically shown particular sympathy towards conservative groups. As mentioned earlier, religious groups fall under the legally defined "Protected Class," so there is little controversy regarding the CFPB's legal intervention in financial exclusion against religious groups. However, we have yet to see the CFPB take similar actions regarding non-protected categories (such as ordinary conservatives or industries like cryptocurrency), which will be explored in detail in the next section. Nevertheless, this move is undoubtedly a step in the right direction.

CFPB's Actions

Recently, the CFPB finalized a new rule that brings digital wallets and payment applications under its regulatory scope, treating them as akin to banking institutions. Under this rule, large digital payment platforms, including Cash App, PayPal, Apple Pay, and Google Wallet, are required to provide transparent explanations for account closures. In the rule announcement, the CFPB explicitly mentioned the phenomenon of "de-banking." However, it is important to note that this rule applies to "large tech companies" or peer-to-peer payment applications, not banks. There have been no enforcement actions taken under this rule yet, so we cannot assess its effectiveness in practice.

So, can this rule curb behaviors similar to "Operation Choke Point 2.0"? The answer is almost certainly no. First, this rule only targets the actions of tech companies, not banks. Second, "Choke Point"-style behavior is not a decision made autonomously by banks but rather systemic pressure exerted by federal regulatory agencies on banks against entire industries. If the CFPB notices, for example, that cryptocurrency startups are systematically being cut off from banking services, they would have to confront the FDIC, the Federal Reserve (Fed), the OCC, and even the White House directly to terminate such practices. However, given Elizabeth Warren's strong opposition to cryptocurrency, one cannot help but question whether the CFPB would take such action. More importantly, the fundamental issue of "Choke Point" lies in regulatory agencies overstepping legal boundaries in an attempt to de-bank entire industries, rather than being an autonomous action by individual banks (which merely act as passive executors of regulatory orders).

In theory, under UDAAP provisions, if a particular industry (such as cryptocurrency) experiences systematic account closures, the CFPB has the authority to investigate. However, the recently introduced payment application rule (which some critics of Marc Andreessen cite to demonstrate the CFPB's anti-de-banking stance) does not apply to banks. Furthermore, the CFPB has yet to take substantive measures regarding the issue of de-banking in its actual enforcement actions.

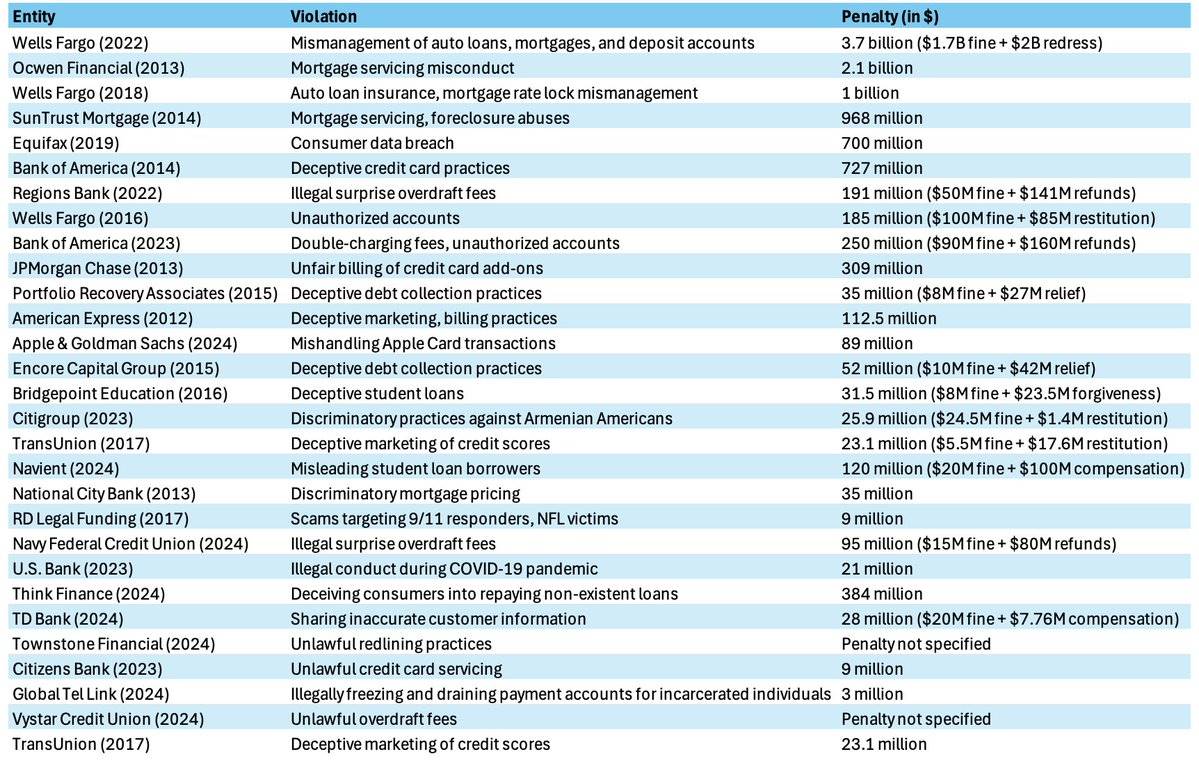

Major Enforcement Actions by the CFPB

In the CFPB's enforcement record, I found no settlement cases directly related to de-banking. Here are their top 30 settlement cases sorted by amount:

The closest relevant case is the Citigroup case in 2023. At that time, they were found to have discriminated against Armenian Americans in credit card applications. According to Citigroup, this practice was due to a higher fraud rate in the Armenian community in California (triggered by fraud rings). Ultimately, Citigroup paid a fine of $25.9 million.

Another case is the Townestone Financial case in 2020. The CFPB found that the company discouraged African Americans from applying for mortgages in its marketing and thus paid a fine of $105,000.

It is important to note that nationality and race fall under the "Protected Class" defined by U.S. law, so these cases do not involve purely political "redlining." This is fundamentally different from the critics' accusations of de-banking in the cryptocurrency industry.

Additionally, I reviewed the most recent 50 settlement cases from the CFPB since March 2016 and found no cases involving the arbitrary deprivation of banking services. Among these 50 cases, 15 involved UDAAP violations (such as the well-known Wells Fargo case), 8 involved fair lending violations, 5 involved student loan servicing, 5 involved inaccurate credit reporting issues, 5 involved mortgage servicing, 4 involved auto loan discrimination, and 3 involved illegal overdraft practices. As for the issue of de-banking: there were none.

Criticism of Marc Regarding De-banking of Crypto/Fintech Companies and Conservatives

The situation on this issue is very clear. I have documented in detail the phenomenon known as "Operation Choke Point 2.0." This practice originated during the Obama administration and re-emerged during the Biden administration. In 2013, Obama's Department of Justice (DoJ) launched the "Operation Choke Point" program, an official initiative aimed at targeting certain legitimate but politically unpopular industries through the banking sector, such as payday lending, medical marijuana, the adult industry, and gun manufacturers. Iain Murray discussed this in detail in his article "Operation Choke Point: What It Is and Why It Matters."

During the Obama administration, the FDIC, under the leadership of Marty Gruenberg, persuaded banks to "de-risk" companies in over a dozen industries through insinuation and threats. This practice sparked strong protests from conservatives and was exposed by members of the House led by Congressman Luetkemeyer. Critics argued that this secret regulation conducted through "persuasion" was unconstitutional because it was not carried out through formal rulemaking or legislative processes.

In 2014, a DoJ memo regarding this practice was leaked, leading to a critical report from the House Oversight and Government Reform Committee. The FDIC subsequently issued new guidance requiring banks to assess risks on a case-by-case basis rather than implementing "redlining" across entire industries. In August 2017, the Trump administration's DoJ officially terminated this practice. In 2020, Brian Brooks, the Trump-appointed Comptroller of the Currency, issued the "Fair Access" rule aimed at ending de-banking based on reputational risk.

However, in May 2021, Biden's acting Comptroller of the Currency, Michael Hsu, rescinded this rule. In early 2023, following the collapse of FTX, individuals in the crypto industry, including myself, noticed that similar "Choke Point" strategies were being implemented against cryptocurrency founders and companies. In March 2023, I published an article titled "Operation Choke Point 2.0 is Underway, and Cryptocurrency is the Target" and followed up with another article in May, revealing more new developments.

Specifically, I found that the FDIC and other financial regulatory agencies secretly imposed a "15% deposit cap" policy on banks regarding companies related to cryptocurrency. This means that banks are not allowed to accept deposits from crypto-related businesses that exceed 15% of their total deposits. Additionally, I believe that the two banks in the crypto industry, Silvergate and Signature, did not fail due to market reasons but were forced to liquidate or close due to the government's hostile attitude towards the crypto industry.

Since then, cryptocurrency companies have continued to face significant difficulties in obtaining banking services—despite the absence of any public regulations or legislation explicitly requiring banks to limit services to crypto businesses. The law firm Cooper and Kirk pointed out that the practices of "Choke Point 2.0" violate the Constitution.

Recently, I re-investigated this phenomenon and found new evidence suggesting that Silvergate Bank did not fail naturally but was "intentionally executed."

Currently, the "15% deposit cap" policy targeting cryptocurrency banks remains in place, severely restricting industry development. Almost all U.S.-based crypto entrepreneurs have been affected by this— I can confirm that about 80 crypto companies we invested in have faced similar issues. Even my company Castle Island—a venture capital fund that only invests in fiat-related businesses—has experienced sudden closures of bank accounts.

After Marc appeared on Rogan's show, many executives in the crypto industry also shared their experiences. David Marcus revealed that Facebook's Libra project was forced to shut down due to intervention from Janet Yellen. Kraken CEO Jesse Powell, Joey Krug, Gemini CEO Cameron Winklevoss, Visa's Terry Angelos, and Coinfund's Jake Brukhman also stated that their companies faced serious obstacles in obtaining banking services. Caitlin Long has long publicly opposed "Choke Point 2.0" and even founded her own bank, Custodia, but Custodia Bank was stripped of its Master Account qualification by the Federal Reserve and could not operate normally.

While critics may lack sympathy for the crypto industry, it must be acknowledged that the crypto industry is a completely legitimate sector that has been suppressed due to secret directives and insinuations from banking regulators. This suppression is not carried out through legislation or public rulemaking but is orchestrated by administrative agencies behind the scenes, bypassing democratic processes.

Not only the crypto industry but fintech companies are also facing similar dilemmas. According to research from the Klaros Group, since the beginning of 2023, a quarter of the FDIC's enforcement actions have targeted banks that partner with fintech companies, while banks that do not partner with fintechs account for only 1.8%. As an investor in the fintech space, I can personally attest that fintech companies encounter significant difficulties in finding banking partners, a challenge that is nearly comparable to that faced by crypto companies in obtaining banking services.

The Wall Street Journal has criticized the FDIC's actions, pointing out that the agency is "effectively engaging in rulemaking while circumventing the notice and public comment requirements mandated by the Administrative Procedure Act." Such behavior not only causes substantial harm to the industry but also raises widespread questions about its legitimacy.

Andreessen mentioned that there are indeed numerous instances supporting the issue of de-banking of conservatives. For example, Melania Trump mentioned in her recent memoir that her bank account was canceled. The right-wing social media platform Gab.ai also faced similar issues. In 2021, General Michael Flynn had his account closed by JPMorgan due to perceived "reputational risk." In 2020, Bank of America closed the account of the Christian nonprofit Timothy Two Project International and in 2023 froze the account of Christian pastor Lance Wallnau. In the UK, Nigel Farage was de-banked by Coutts/NatWest, an incident that even sparked a small public outcry. These are just a few examples among many.

Under current law, U.S. banks have the right to close accounts for any reason without providing an explanation to customers. Therefore, in essence, Andreessen's point is correct: the phenomenon of de-banking does exist and has far-reaching implications.

Controversy Over the Term "De-banking"

Critics argue that Andreessen is attempting to use the concept of "de-banking" to push his own economic agenda. Some point out that his motivation for focusing on this issue is to alleviate regulatory pressure on the cryptocurrency and fintech industries. Lee Fang mentioned:

"De-banking is indeed an important issue. We see truck drivers opposing vaccine mandates losing their bank accounts due to their activities, and organizations supporting Palestine unable to use payment platforms like Venmo. But now, some predatory lenders and scammers are conflating consumer protection with 'de-banking' to call for regulatory rollbacks."

Additionally, authors from Axios hinted that the consumer financial protection issues Andreessen is concerned about may be related to his company's investments in some controversial new banks, such as Synapse, which collapsed earlier this year. This criticism suggests that Andreessen's focus on "de-banking" is aimed at promoting the interests of the cryptocurrency and fintech industries while evading CFPB oversight on consumer protection.

While the critics' points may sound logical, the reality is more complex. Historically, the Obama administration did develop strategies to use banking regulation to suppress certain industries (such as gun manufacturing and payday lending), which were deemed unconstitutional. The Biden administration has further optimized these strategies and effectively used them to suppress the cryptocurrency industry. For instance, by pressuring partner banks, the government indirectly limited banking services for cryptocurrency companies. These practices are not carried out through legislation or public rulemaking but are executed through administrative means behind the scenes, bypassing democratic processes.

Currently, this strategy has also begun to target the fintech industry. According to research from the Klaros Group, since the beginning of 2023, a quarter of the FDIC's enforcement actions have targeted banks that partner with fintech companies, while the proportion of banks that do not partner with fintechs is only 1.8%. As an investor in the fintech space, I can personally attest that this practice has made it extremely difficult for fintech companies to find banking partners, almost comparable to the challenges faced by cryptocurrency companies in obtaining banking services.

These phenomena indicate that the power of administrative agencies has overstepped its bounds and has severely impacted multiple legitimate industries. Both the cryptocurrency and fintech industries require more transparent and democratic regulatory approaches rather than relying on secret directives and vague policy enforcement. In the future, as regulatory policies adjust, these issues may gradually be revealed and corrected.

Whether commentators like Fang believe that the Biden administration's de-banking actions against cryptocurrency companies will weaken his moral critique of the de-banking of more sympathetic groups is not the point. The fact is that this phenomenon is indeed occurring, and it is de-banking, which is illegal. Similarly, whether Marc Andreessen's criticism of the CFPB is economically motivated is also not important. (According to my investigation, the CFPB has not taken any enforcement actions against any companies in which Andreessen's venture capital firm a16z has invested so far.)

What is important is that banking regulatory agencies (not limited to the CFPB but including multiple agencies) are indeed weaponizing the financial system to achieve political ends. This behavior has far exceeded the authorized scope of administrative power and has harassed legitimate industries. The fact is that this overreach does exist.

Assessment of Andreessen's Views on the Rogan Show

Based on a comprehensive analysis, we can evaluate Andreessen's arguments point by point:

- De-banking refers to individuals or businesses being deprived of banking services due to their industry being politically unpopular or because they hold dissenting political views.

This definition is accurate. Importantly, the severity of de-banking should not change based on whether the victims meet certain people's sympathy standards.

- The CFPB does indeed often take a high-pressure approach towards fintech companies and banks, and its necessity is questionable.

However, based on existing information, the CFPB is not the primary responsible party for "Operation Choke Point 2.0." The more direct responsible parties are the FDIC, OCC, and the Federal Reserve, which have coordinated actions with the Biden administration. Although the CFPB has recently made statements regarding de-banking, it has not taken concrete actions, so it has neither alleviated the problem nor is it the main responsible party.

- The core of de-banking lies in regulatory agencies avoiding direct government accountability by having banks enforce financial suppression.

This model is similar to how large tech companies censor dissenters. By having banks or fintech platforms refuse service, it effectively suppresses "enemies of the regime" while avoiding excessive external scrutiny.

- The "Operation Choke Point" during the Obama administration focused on targeting some legitimate but unpopular industries, including marijuana companies, the adult industry, and gun stores and manufacturers.

This description is accurate. In fact, this operation initially started with the payday lending industry, but Andreessen did not mention this.

- The Biden administration's de-banking actions primarily target cryptocurrency companies and fintech firms, while occasionally involving conservatives.

Both points are true. We have more evidence indicating that the crackdown on the crypto industry is a coordinated action, while the actions against the fintech industry, although less evidenced, have seen the FDIC indirectly pressure partner banks through enforcement actions here. As for the de-banking of conservatives, we have a wealth of anecdotal evidence, but there is no clear internal bank policy explicitly targeting conservatives. Such actions are typically justified on the grounds of "reputational risk" and decided on a case-by-case basis. Ultimately, banks are completely black boxes; they are not required to provide reasons for lowering individual or company risks.

- Founders in a16z's portfolio have been de-banked.

Based on existing information, it is entirely possible, even very likely, that 30 tech founders in a16z's portfolio have been de-banked. As an active cryptocurrency investment institution, many of a16z's investment projects involve cryptocurrency, and almost all domestic cryptocurrency startups have faced banking service issues at some point.

Where Marc Went Wrong

Marc somewhat exaggerates the role of the CFPB. The recent crackdown on the cryptocurrency and fintech industries is actually more led by regulatory agencies such as the FDIC, OCC, and the Federal Reserve, rather than the CFPB. However, Marc did mention some unspecified "agencies" involved in de-banking during the show, even though he did not specifically mention the FDIC, OCC, or the Federal Reserve. Additionally, the influence of CFPB founder Elizabeth Warren on this matter cannot be overlooked. She is one of the main proponents of "Operation Choke Point 2.0," especially as Bharat Ramamurti, whom she appointed, led related actions in the Biden administration's National Economic Council. Therefore, it is understandable that Marc amplifies the responsibility of the CFPB.

Marc's discussion of PEPs is somewhat one-sided. Being classified as a politically exposed person does not directly lead to account closures, but it does increase banks' due diligence requirements for these clients. Marc may have been inspired by the case of Nigel Farage being de-banked by Coutts. In that case, Nigel was considered a PEP, which was indeed a factor, but not the only reason.

Despite some discrepancies in details, Marc's main point is correct, and the critics' rebuttals do not hold up. The CFPB has not yet become an effective force against de-banking, and the phenomenon of de-banking does exist, with particularly noticeable impacts on the cryptocurrency and fintech industries. As Republicans take control of Congress and launch related investigations, more evidence is expected to reveal the true scale and mechanisms of de-banking.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。