Organized by: Fairy, ChainCatcher

Performance of Crypto Spot ETFs Last Week

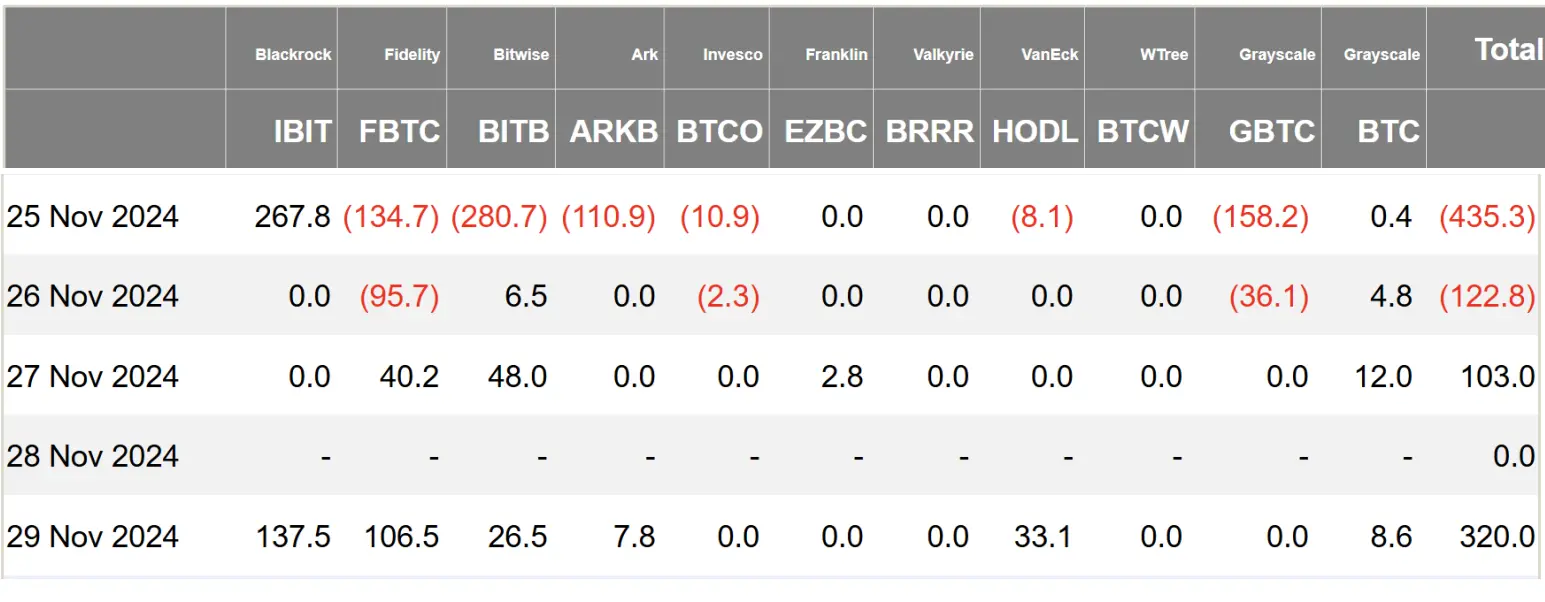

US Bitcoin Spot ETF Net Outflow of $135 Million

Last week, the US Bitcoin spot ETF shifted from inflow to outflow, with a net outflow of $135 million, bringing the total net asset value to $10.528 billion. According to HODL15Capital, US Bitcoin ETFs purchased 71,570 Bitcoins in November. In dollar terms, November was a record month for inflows into US Bitcoin ETFs.

A total of 4 ETFs experienced net inflows last week, with BlackRock's IBIT seeing the highest net inflow of $405 million. Grayscale's GBTC and Bitwise's BITB both had significant outflows, with $194 million and $199 million flowing out, respectively.

Source: Farside Investors

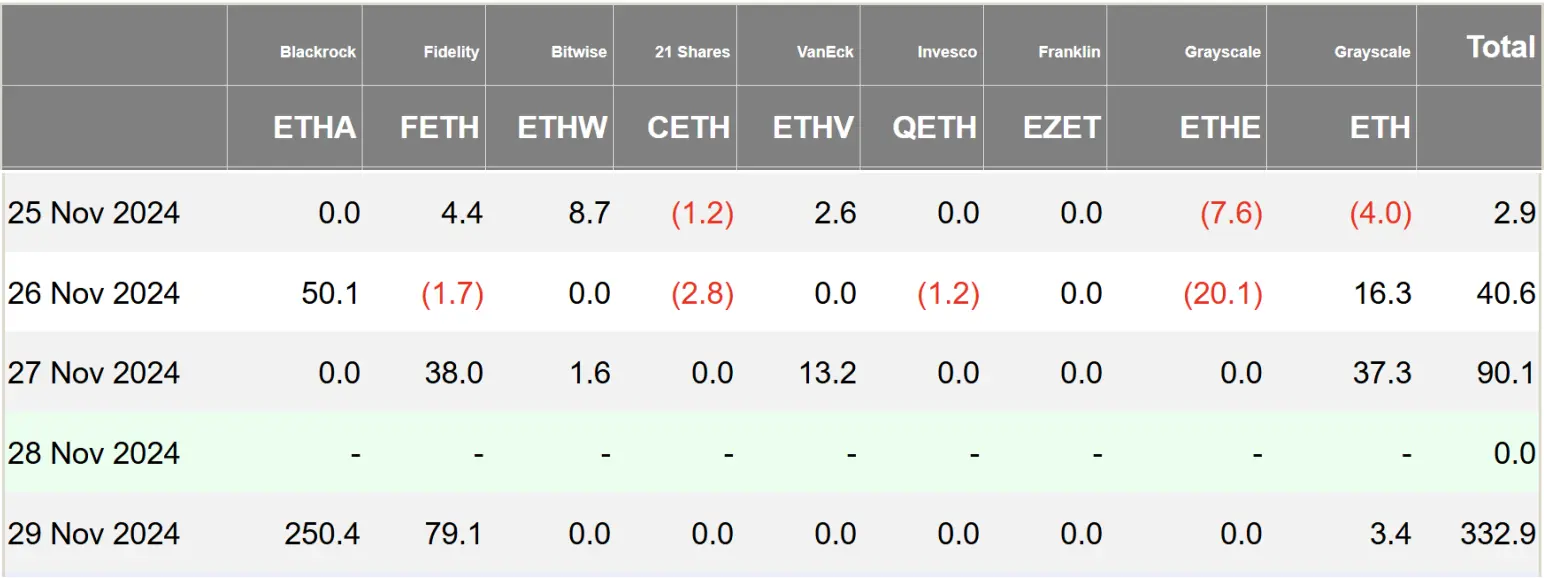

US Ethereum Spot ETF Net Inflow of $466 Million

Last week, the US Ethereum spot ETF had a net inflow of $466 million, bringing the total net asset value to $11.04 billion. On November 29, the Ethereum spot ETF saw a net inflow of $332 million, marking the first time a single day’s net inflow exceeded that of the Bitcoin spot ETF.

Last week, BlackRock's Ethereum ETF had the highest net inflow, amounting to $300 million, with a market value of holdings surpassing $2.5 billion.

Note: Due to the US Thanksgiving holiday, the US stock and bond markets were closed on November 28 and closed early on November 29.

Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Inflow of 334.04 Bitcoins

Last week, the Hong Kong Bitcoin spot ETF had a net inflow of 334.04 Bitcoins, with a net asset value of $46.9 million. On November 25, the Bitcoin spot ETF saw a net inflow of 334.04 Bitcoins, reaching a new high since July 12.

The Hong Kong Ethereum spot ETF had no fund movement, holding a total of 15,200 Ethereum, with a net asset value of $5.401 million.

Data: SoSoValue

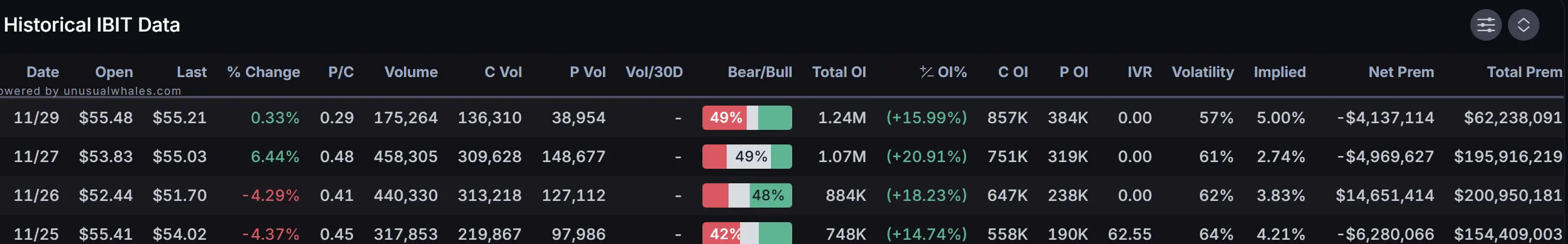

Performance of Crypto Spot ETF Options

Last week, BlackRock's Bitcoin spot ETF options had a total trading volume of 1.39 million contracts, with 458,000 contracts traded on November 27. The implied volatility was relatively low (between 2.74% - 5.00%), indicating that the market expects low volatility. As of November 29, the total open interest (OI) reached 1.24 million.

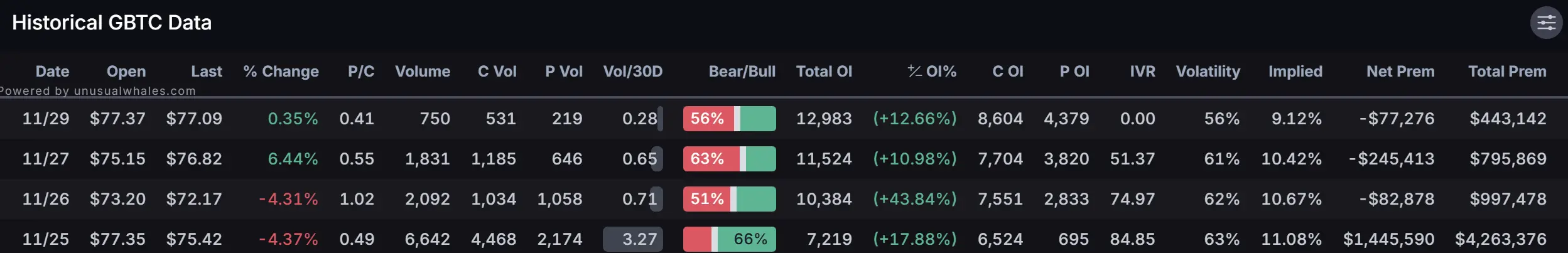

Grayscale's Bitcoin spot ETF GBTC options had a total trading volume of 11,300 contracts last week. As of November 29, the total open interest (OI) reached 12,900.

Data: Unusual Whales

Overview of Crypto ETF Dynamics Last Week

- Bitwise Submits Index ETF Application Covering 10 Cryptocurrencies

Bitwise has submitted an index ETF application to the SEC covering 10 cryptocurrencies, including Bitcoin, XRP, Solana, Cardano, Uniswap, Polkadot, Chainlink, Ethereum, Avalanche, and Bitcoin Cash.

- MIAX Sapphire Exchange Lists Bitcoin ETF Options

According to the latest regulatory filings, MIAX Sapphire will launch options trading for Grayscale Bitcoin Trust (GBTC), Bitcoin Mini Trust (BTC), and Bitwise Bitcoin ETF, competing with Nasdaq and the New York Stock Exchange for the market of related products for spot Bitcoin ETFs.

- DBS Hong Kong Announces Two Client Accounts for Trading Crypto ETFs

DBS Hong Kong announced that all DBS Treasures and DBS Private Banking clients can start trading crypto ETFs on the DBS Digibank app from now on. The virtual asset knowledge client confirmation has also officially launched. The minimum requirement for DBS Treasures client accounts is a deposit of HKD 1 million, while the minimum for DBS Private Banking client accounts is HKD 8 million.

- Hashdex Resubmits Revised S-1 Application for Nasdaq Crypto Index US ETF

According to regulatory filings, asset management company Hashdex has submitted a second revised application for a crypto ETF. The revised document indicates that the crypto index ETF's application with the US SEC continues to make progress. After the SEC requested more time to decide whether to authorize the ETF for trading, Hashdex submitted the first revised S-1 document in October. The document states that the Hashdex Nasdaq Crypto Index US ETF will initially include Bitcoin and Ethereum but may eventually expand to include other digital currencies.

- WisdomTree Registers XRP ETF in Delaware

Global ETF provider WisdomTree has registered an XRP ETF in Delaware.

- VanEck Extends Zero Fee for VanEck Bitcoin ETF (HODL) to January 2026

VanEck announced the extension of zero fees for the VanEck Bitcoin ETF (HODL) to January 2026. HODL is currently the only Bitcoin ETP that charges no fees. If HODL's assets exceed $2.5 billion before January 10, 2026, the fee for assets over $2.5 billion will be 0.20%.

- Cboe Plans to Launch First Cash-Settled Index Options Linked to Bitcoin Price on December 2

These options will be regulated by the US Securities and Exchange Commission (SEC) and will be based on the new Cboe Bitcoin US ETF Index (Ticker: CBTX), which is the first US spot Bitcoin ETF index in the market: a modified market capitalization-weighted index designed to track the performance of a basket of spot Bitcoin ETFs listed in the US. The design of the Cboe Bitcoin US ETF Index is also related to the price of spot Bitcoin, making it a representative metric for measuring the asset.

Views and Analysis on Crypto ETFs

Industry Experts Suggest DOGE ETF May Be Realized in 2025

The historic success of Bitcoin and Ethereum ETFs in 2024 can be considered the biggest news in the cryptocurrency and traditional financial markets this year. With a crypto-friendly White House, could this year’s success pave the way for a Dogecoin spot ETF in 2025?

In response, Nate Geraci, president of ETF Store, stated: “I think everything is on the table under the new government. I hope the new administration acts quickly to designate which crypto assets are securities and which are not. Once that framework is in place, the approval path for the remaining crypto spot ETFs should become clearer.”

Crypto analyst Louis Sykes remarked: “I am very confident we will see Solana ETF trading in the first half of 2025, while the chances for DOGE are much smaller, as Wall Street prefers assets that were not born as memes.”

Bloomberg senior ETF analyst Eric Balchunas commented: “The irony of today is the ETF of tomorrow. You can ask yourself if a DOGE ETF is far off. I would say we will see a DOGE ETF; I think someone will try it because why not?”

Alexander Blume, CEO of Two Prime Digital Assets, stated: “The filing for a DOGE ETF will definitely happen, and with the huge success of the BTC ETF, entrepreneurial financial firms will seek to create any product that could succeed.”

Kaiko: ETF Options Are the Latest Bullish Signal for BTC

Kaiko released a report stating that ETF options are the latest bullish signal for BTC. Several BTC ETF options debuted last week, with BlackRock's IBIT options reaching a notional trading volume of $1.9 billion on the first day, totaling 354,000 contracts. In comparison, BITO options had a trading volume of $360 million when they launched in 2021. This strong buying power highlights the robust demand for BTC-linked derivatives and bullish market sentiment.

Notably, over 80% of the IBIT first-day options trading volume consisted of call options, reflecting a strong belief in the price increase of Bitcoin. Trading activity was primarily concentrated on options with near-term expirations, with contracts expiring in December 2024 dominating. The share of IBIT call options significantly exceeded that of the largest crypto-native options market, Deribit, where call options accounted for 64% of trades.

The launch of Bitcoin spot ETF options may further accelerate institutional adoption. These tools allow investors to hedge risks and develop complex strategies to profit from Bitcoin's volatility. Additionally, they can drive the emergence of structured products, which offer customized investments with specific risk-return characteristics, typically developed by large financial institutions. This could attract new capital and a new wave of experienced institutional traders.

OKG Research: Bitcoin Spot ETF Holdings Exceed 5% Key Threshold

According to statistics from OKLink Research Institute on November 28, since the opening of the US Bitcoin spot ETF channel in January 2024, the BTC holdings of global Bitcoin spot ETFs have been continuously rising.

As of November 28, 2024, the holding ratio of global Bitcoin spot ETFs has reached 5.55% of the total Bitcoin supply. In the financial industry, a holding ratio of 5% is considered a key threshold. For example, according to relevant regulations from the US Securities and Exchange Commission (SEC), shareholders holding more than 5% must report such information to the SEC.

Bloomberg Analyst: Expecting a Doubling of Altcoin ETF Applications in the Next Two Months

Bloomberg ETF analyst Eric Balchunas stated that unless a major crash occurs, the pending altcoin-related ETFs will make the cryptocurrency market "quite crazy."

He mentioned that there are 14 altcoin-related ETFs awaiting approval from the US SEC within the next 12 months, including funds that offer exposure to SOL, XRP, HBAR, LTC, asset baskets, as well as BTC and ETH.

Additionally, Balchunas expects the applications for altcoin ETFs to double in the next two months.

K33 Research: Traders Still Waiting for NYSE and Nasdaq to Launch Bitcoin Spot ETF Options

Vetle Lunde, head of research at K33, stated in an interview with CNBC that the open interest in futures at the Chicago Mercantile Exchange has reached an all-time high, which is currently the primary way most US institutions are purchasing Bitcoin futures contracts. However, many traders have been waiting for major exchanges like the New York Stock Exchange and Nasdaq to launch Bitcoin spot ETF options, as this could enhance liquidity and provide hedging tools.

Vetle Lunde added that the demand for leveraged long exposure to Bitcoin and Ethereum is rising, and VolatilityShares' BTC exposure has also previously reached an all-time high.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。