MicroStrategy has achieved short-term success by aggressively purchasing Bitcoin and leveraging financing, but its over-reliance on the rising price of Bitcoin also exposes it to significant risks, especially in the face of future market volatility.

Author: Zack Guzman

Translation: Blockchain in Plain Language

MicroStrategy founder Michael Saylor has become one of Bitcoin's most outspoken supporters, boldly declaring, "There is no second-best option."

Since 2020, Saylor has accumulated over $30 billion in Bitcoin through his publicly traded company, with paper profits exceeding $14 billion, making MicroStrategy the company with the largest Bitcoin holdings. This strategy has garnered praise from Bitcoin extremists while raising questions from traditional investors.

However, as MicroStrategy continues to raise billions of dollars—planning to add $42 billion in financing over the next three years—to quadruple its bet on Bitcoin, concerns are mounting. Is this brewing another massive bubble? How will MicroStrategy's bold actions play out if the price of Bitcoin falls?

1. Echoes of Trading Ghosts

MicroStrategy's Bitcoin strategy bears similarities to one of the most notorious trades in the crypto space, the "GBTC premium trade." At the peak of this arbitrage trade, investors gained exposure to Bitcoin through the Grayscale Bitcoin Trust (GBTC), as its trading price exceeded the value of the underlying Bitcoin holdings. They borrowed against GBTC shares and profited from the premium once the lock-up period ended.

This trade dramatically collapsed in 2021 when the GBTC premium turned into a discount. Companies like Three Arrows Capital and BlockFi, which were over-leveraged or associated with leveraged clients, subsequently went bankrupt. The ensuing wave of bankruptcies, including Genesis's, highlighted the risks of financial strategies built on fragile market imbalances.

Today, critics warn that MicroStrategy is walking a similar tightrope. Unlike the GBTC premium, MicroStrategy has carved out a new path for leveraged Bitcoin trading through its own stock and bonds—effectively transforming the company into a leveraged Bitcoin proxy.

Some periods of MicroStrategy's Bitcoin purchases

2. The Magic of Convertible Bonds

At the core of MicroStrategy's strategy is raising funds through issuing convertible bonds and stocks, which operates as follows:

Borrowing at low interest rates (0%) MicroStrategy offers bonds to bondholders at extremely low or even zero interest rates.

Providing potential stock appreciation in return, bondholders can convert their bonds into MicroStrategy stock when the stock price rises. This potential upside has attracted numerous institutional investors, including Germany's largest insurance company, Allianz.

Purchasing more Bitcoin The funds raised are immediately used to buy more Bitcoin, further driving up the stock price.

This feedback loop has led to an astonishing performance of MicroStrategy's stock, which has risen nearly 500% in 2024 alone. This strategy has been so successful that bond investors, attracted by the potential appreciation of the stock price, are willing to lend billions to the company at a 0% interest rate.

It's a compelling proposition: why settle for low returns on bonds when MicroStrategy can offer you the chance to double or even quintuple your investment? As Saylor stated in a recent investor call, bondholders are fleeing a world of "negative real returns" in pursuit of the potential gains offered by Bitcoin.

Currently, MicroStrategy's strategy is performing exceptionally well, with the rise in Bitcoin prices creating a virtuous cycle. But what happens if Bitcoin's trend reverses?

MicroStrategy holds nearly 387,000 Bitcoins, valued at about $37 billion, but its market valuation has exceeded $100 billion. This extremely high valuation largely relies on the assumption of continued rising Bitcoin prices. If Bitcoin falls, the company's stock price—essentially a leveraged bet on Bitcoin—could plummet significantly.

It is also worth noting that double-leveraged ETFs like MSTU and MSTX, which focus on MicroStrategy, have further exacerbated market speculation based on MicroStrategy's Bitcoin speculation.

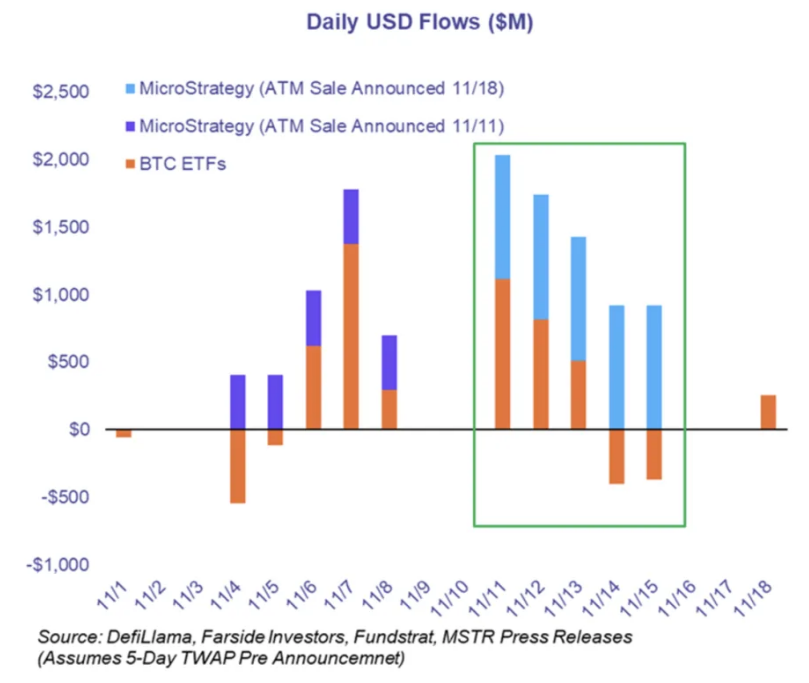

All of this has driven massive Bitcoin purchases. According to research from Fundstrat, MicroStrategy's buying volume has far exceeded the total inflows of all Bitcoin ETFs earlier this month. If the market begins to doubt MicroStrategy's ability to achieve its $42 billion financing goal, Bitcoin prices could fall, further jeopardizing MicroStrategy's financing capabilities. Once this situation shifts, things could deteriorate rapidly. Similar situations occurred during FTX's desperate fundraising attempts and Terra's $40 billion collapse.

Although Saylor has repeatedly emphasized that the company will never sell its Bitcoin, this position may be difficult to maintain if debt pressures increase and Bitcoin prices fall.

3. Lessons from History

The cautionary tale of the GBTC premium trade remains vivid. When market conditions changed, this bubble burst, exposing the fragility of leveraged strategies. While MicroStrategy's approach avoids some of the pitfalls of GBTC trading—such as not relying on inefficient fund structures—it still faces a core risk: if Bitcoin prices fall, leverage could amplify losses.

Saylor's steadfast belief in Bitcoin may inspire confidence, but history shows that markets cannot rise indefinitely. Just as the 2023 Terra collapse saw excessive confidence in a "self-sustaining system" lead to $40 billion in losses, if Bitcoin prices fall, MicroStrategy's stock could face a similar liquidation moment.

However, for those who firmly believe that the U.S. government will soon follow suit and incorporate Bitcoin into its strategic reserves, MicroStrategy's bet has the potential to become one of the greatest investments in history—either renowned as a "stroke of genius" or remembered for its "catastrophic failure."

Link to the article: https://www.hellobtc.com/kp/du/11/5560.html

Source: https://finance.yahoo.com/news/microstrategy-creating-next-big-bitcoin-123000918.html

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。