Original | Odaily Planet Daily (@OdailyChina_)

_

Author|Nan Zhi (@AssassinMalvo)_

Since the approval of the Bitcoin spot ETF, the price of Bitcoin has soared, just a step away from the $100,000 mark. However, in this bull market, only "Bitcoin has risen alone," with Bitcoin's share of the total market capitalization of cryptocurrencies continuously increasing.

Will the altcoin season come again? Or is the $100,000 Bitcoin already the peak of the bull market? We compared data from the past four years to answer this question.

Basic Situation Description

Data Sources

The data involved in this article includes ① Bitcoin price, ② Bitcoin contract funding rate, ③ Bitcoin contract trading volume, ④ Bitcoin contract active buy trading volume, ⑤ total market capitalization of stablecoins, ⑥ total market capitalization of cryptocurrencies, ⑦ total market capitalization of Bitcoin, ⑧ Nasdaq trading volume, etc.

Among them, the contract prices in ① come from Binance, and the spot prices come from CoinGecko; data ②-④ come from Binance contracts; ⑤, ⑥, and ⑦ come from CoinGecko and DefiLlama; ⑧ comes from Yahoo Finance.

Chart Highlights

This article aims to "qualitatively" explore the market development stage rather than conduct a quantitative analysis, so to enhance the readability of the charts, the charts used in this article are drawn using Origin, and except for the "stablecoin market capitalization" data, all data has been smoothed (parameters are Savitzky-Golay smoothing, window size 30, 2nd order fitting, with a high degree of smoothing, it is recommended that readers focus only on trend changes, and any specific numbers that need to be highlighted will be pointed out directly in the text).

Looking back, what data indicates the arrival of a peak?

Funding Rate

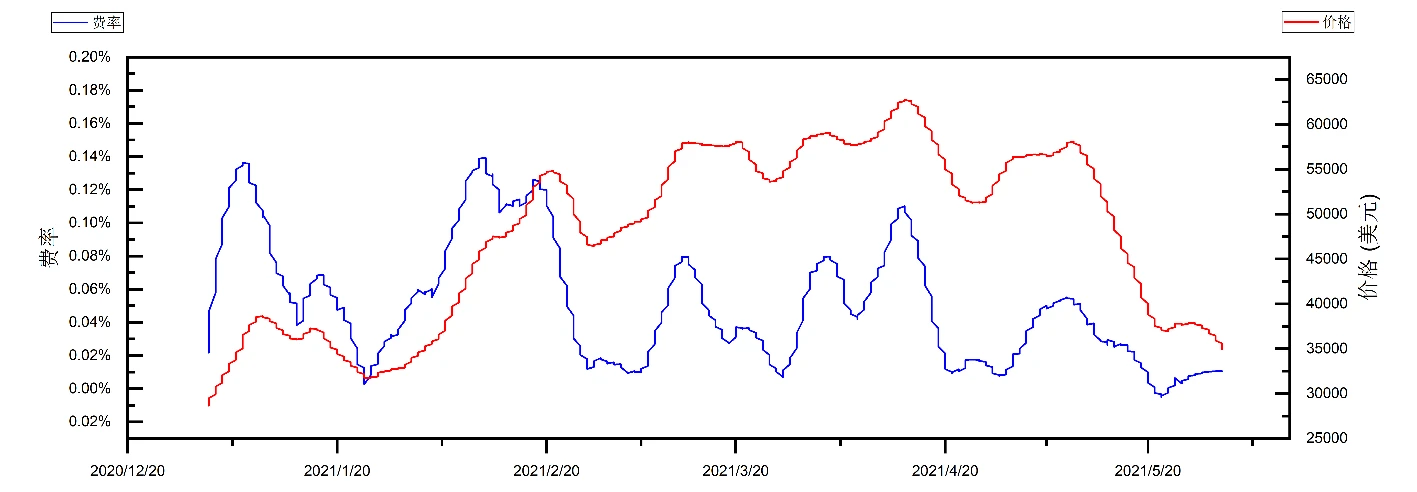

The funding rate is undoubtedly one of the most understood and intuitive data points by the public. We first reviewed the first wave of the bull market from January to May 2021, and the relationship between the Bitcoin funding rate and Bitcoin price is shown in the following chart:

From this, we can observe a very significant pattern: peak prices coexist with extreme rates, and extreme rate values often appear before price peaks. The three extreme values of the rate occurred in early January, mid-February, and mid-April, corresponding to prices of $40,000, $45,000, and $60,000, respectively.

However, it is also important to note that a high rate does not necessarily mean an absolute peak; rather, the rising rate is more pronounced in the early stages of the bull market.

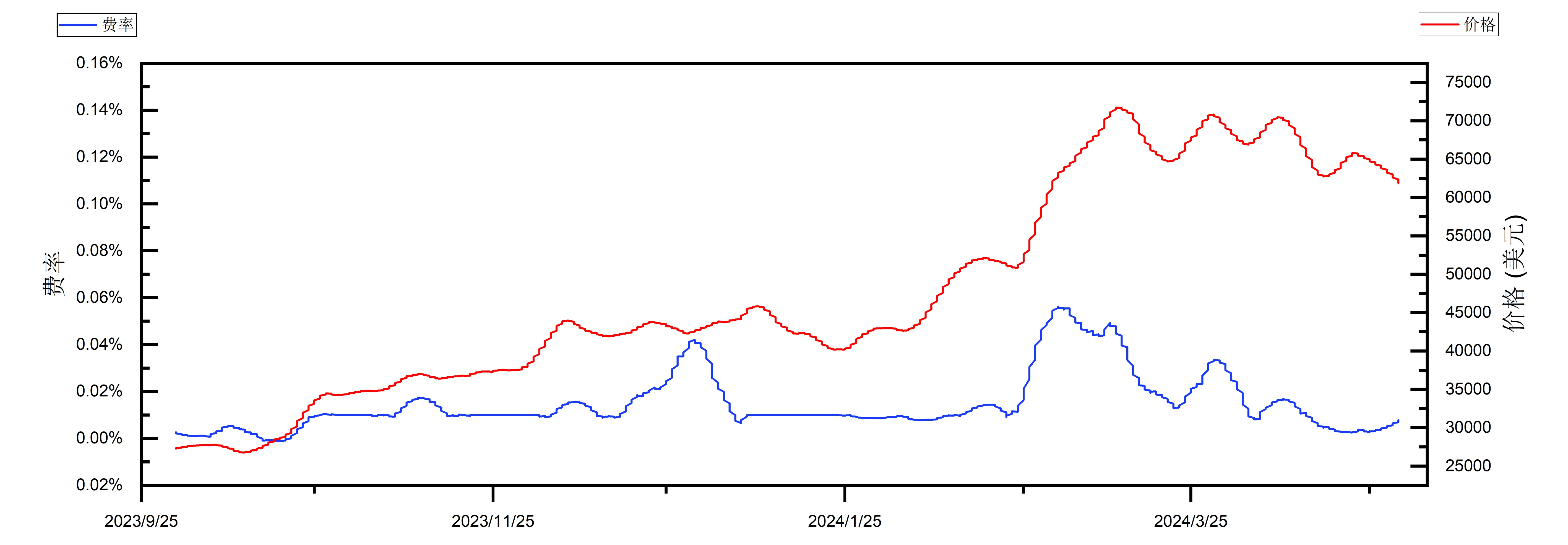

The Bitcoin funding rate and trend from the end of 2023 to April 2024 are shown in the following chart:

It can be seen that the market around 2024 has clearly "cooled down" a lot; although Bitcoin has reached a new historical high, the rate has not broken through the 0.1% mark again (the maximum value occurred on March 5, with a price of 66,839 USDT). However, we also see that the rate reached a high point ahead of the price peak.

Active Buy Trading Volume

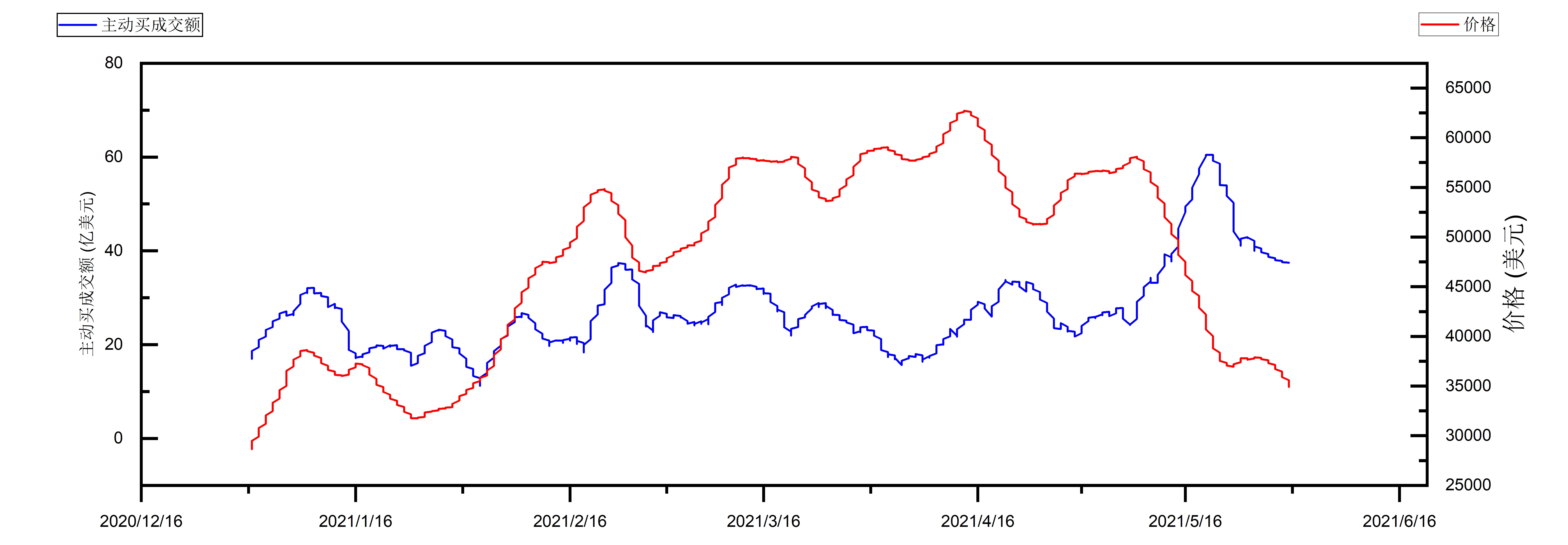

Here we selected the active buy trading volume of Bitcoin contracts on Binance as the research object, also choosing January to May 2021 as the study period. It is also evident that this indicator acts as a "lagging indicator."

The peak of active buy trading volume often lags behind the price peak, and during the decline from the peak, the active buy trading volume rises faster, indicating that users in 2021 preferred to actively buy the dip during downturns.

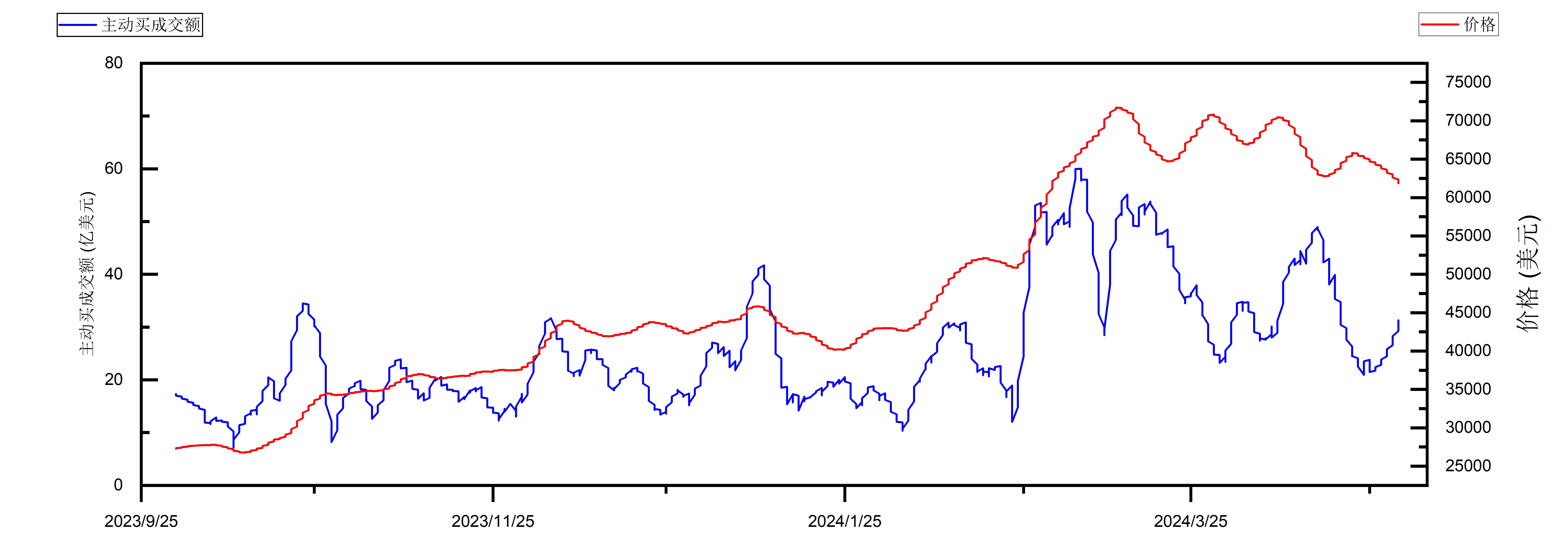

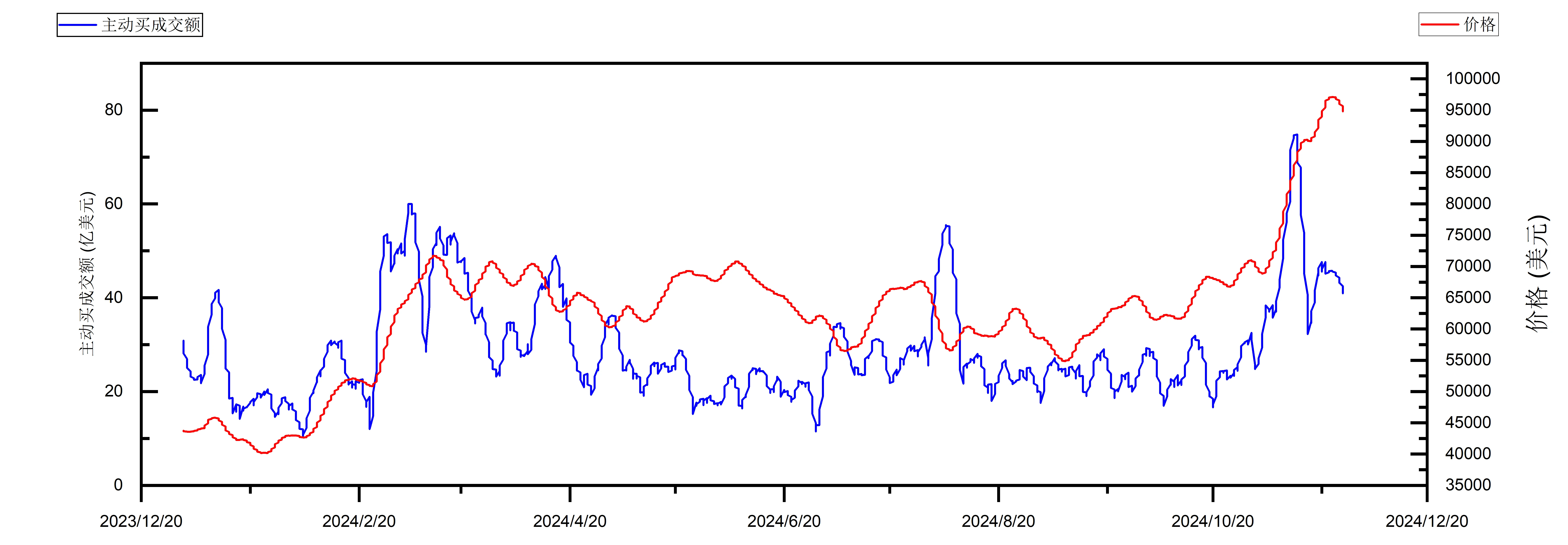

The data from the end of 2023 to April 2024 is shown below. Interestingly, this indicator has become a "leading indicator," with active buy trading volume appearing simultaneously or slightly ahead of the price peak, and exhibiting greater and more significant volatility, which may become an effective reference indicator.

Stablecoin Circulating Market Capitalization

In the 2021 bull market, the Federal Reserve's unlimited QE and the influx of hot money from outside the circle drove Tether to issue USDT wildly, accelerating the progress of the bull market. We first reviewed the total market capitalization of USDT and the total market capitalization of cryptocurrencies from 2021 to 2023 as follows:

It can be seen that stablecoins have no correlation with small-scale trends, and a broader perspective at the annual level shows only slight correlation.

Bitcoin Price and Altcoin Season

The Bitcoin price, Bitcoin market capitalization, total altcoin market capitalization, and market share over the past 4.5 years are shown in the following chart:

In terms of 2020 and 2021, when Bitcoin first started to rise, the market share of altcoins sharply declined, then quietly turned around in early 2021; as Bitcoin rose, the share of altcoins increased.

Returning to the present, Bitcoin has already completed the first and second waves of the rise, but the decline in altcoin share is not rapid, and there are no obvious signs of bottoming out or rebounding.

It is difficult to pinpoint the trend, but from an absolute value perspective, the key market shares in the last bull market were 30% at the lowest point in early January 2021 and 40% in mid-February 2021, while the current value is 46%, not far from the most recent starting point.

Market Activity

Last week, on-chain analyst @ai_9684xtpa posted on X platform stating: "Since the launch of the GOAT contract on Binance at the end of October, it is clear that Binance's attitude towards Memecoins has begun to change. In the past 30 trading days (2024.10.07 - 11.15), Binance's trading volume was 10% higher than Nasdaq, 2 times that of the New York Stock Exchange (NYSE), and 16 times that of Coinbase, accounting for about 50% of the global centralized exchange trading volume.

First ask if it is, then ask what it is—Has the market trading volume reached a historical peak? Our data review shows that on November 12, the trading volume of Bitcoin contracts set the fourth highest record in four years (the top three occurred on March 5, August 5, and February 28, 2024), while the fifth highest point was on May 19, 2021.

So does a peak in trading volume mean a market top? The data from the past four years is shown in the following chart:

It can be seen that only three peaks exceeded $30 billion, and the first two occurred near the peak.

(Note: The actual peak trading volume was $50 billion to $60 billion; the extreme values were smoothed out here.)

What stage are we in?

In summary, the funding rate, active buy trading volume, and total trading volume are leading indicators of the market. The total trading volume has issued a warning; what stage are the other two indicators currently in?

The funding rate is shown below; it can be seen that the funding rate is currently still at a low point, far from the levels of March this year, let alone the crazy phase of 2021.

The active buy trading volume is shown in the following chart, and this indicator also set a historical high on November 21.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。