Bitcoin (BTC) gained 4.4% against the U.S. dollar in the same time frame, but ether raced ahead with a 10.66% climb. So far in 2024, BTC has left ethereum (ETH) in the dust, outperforming it nearly threefold—a gap that showcases a clear difference in their market momentum this year.

Still, ethereum tends to shine when bitcoin slows its roll, and Wednesday, Nov. 27, was no exception. Ether boasted $47.87 billion in trade volume, with top exchanges like Binance, Digifinex, and Bybit leading the action.

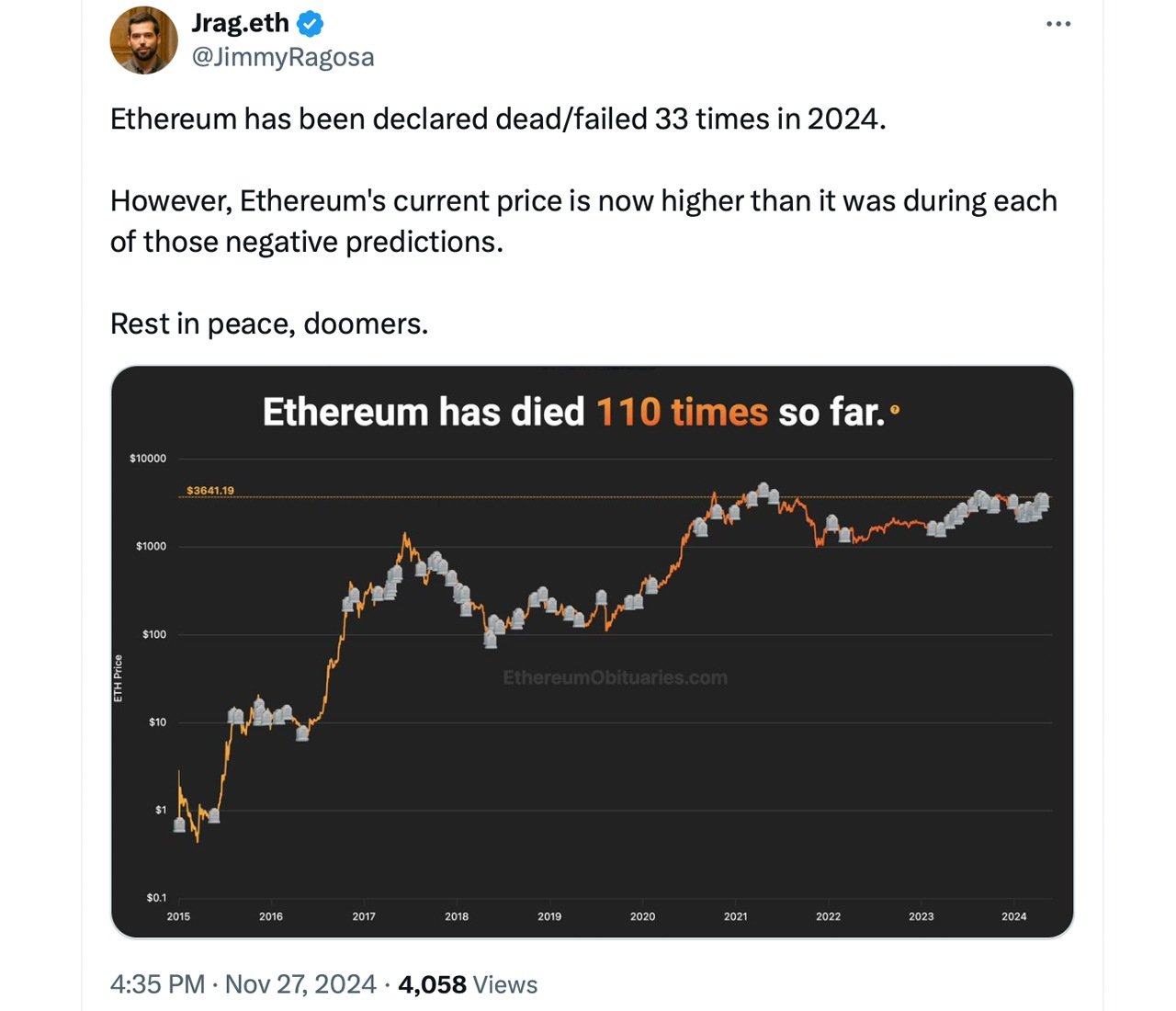

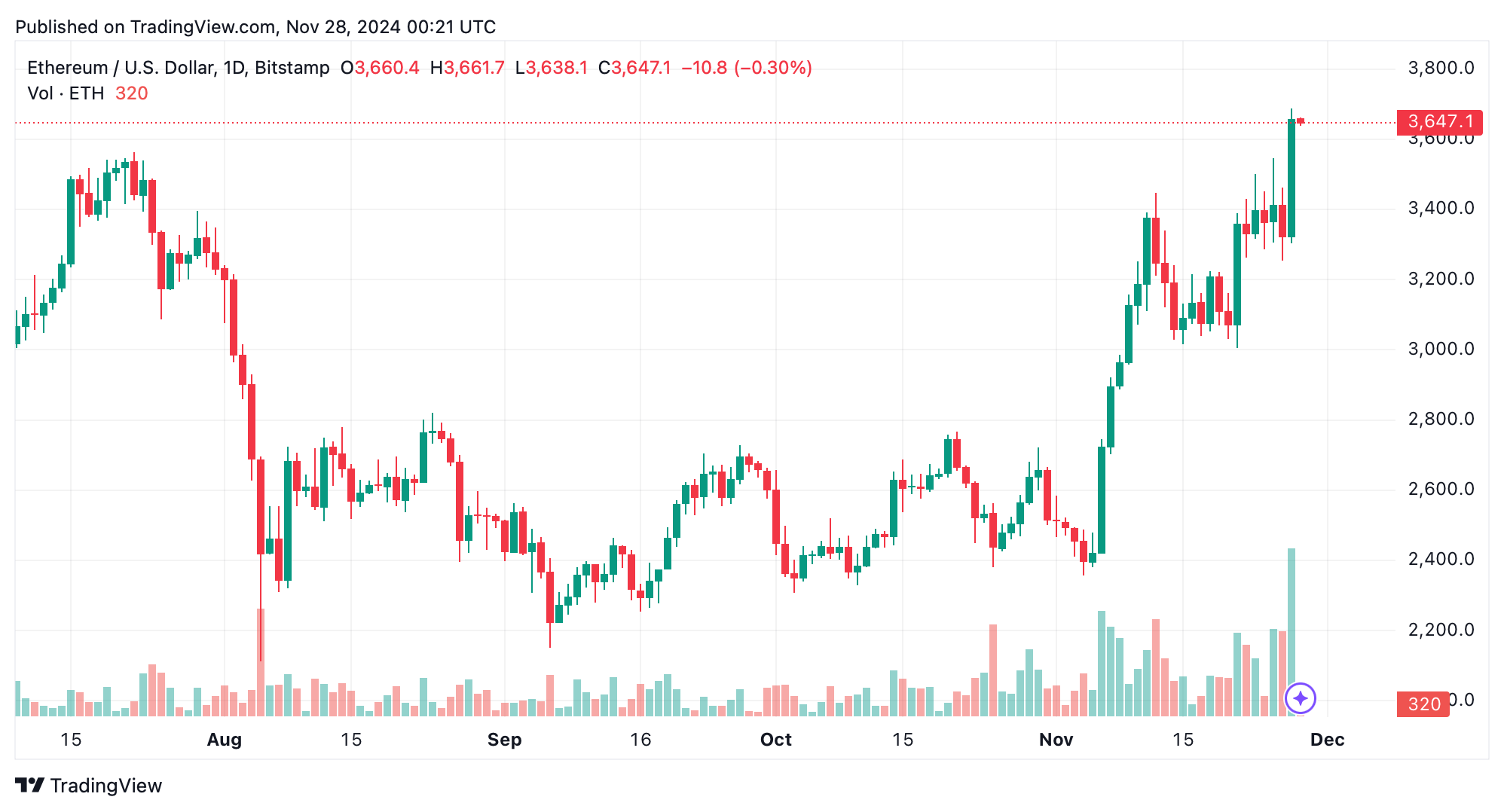

Tether (USDT) emerged as ETH’s most popular trading pair, trailed by the U.S. dollar, FDUSD, USDC, BTC, the Korean won, and the euro. Meanwhile, on the derivatives side, ether saw $56.5 million in liquidations over the past day—$47.73 million of which came from ETH short positions. Trading at $3,647, ether still has a climb of 24.8% ahead to reclaim its all-time high of $4.8K set in 2021.

This upward momentum has sparked optimism among enthusiasts. “Ethereum weekly SuperTrend triggers buy signal,” Tony “The Bull” Severino said on X. “Ether did a 120% rally after 2023’s buy signal.” Severino added:

Another 120% from today’s signal would be $7,500 per [ethereum].

Ethereum’s recent climb hints at a possible shake-up in the crypto scene, as traders set their sights on altcoins. Blockchaincenter.net’s Altcoin Season Index (ASI) currently scores a 65 out of 100, edging closer to the 75 needed to declare it “altcoin season.” Though ether still has ground to cover to reach its peak, this momentum could revive enthusiasm for altcoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。