As bitcoin hovers above $90,000, trading at $94,342 per coin at 11:40 a.m. EDT on Tuesday, an address from 2014 made a significant move. Originally acquired on Dec. 22, 2014, in the legacy Pay-to-Public-Key-Hash (P2PKH) address “1JQJn,” the funds were tracked by btcparser.com. The bitcoin was transferred to another P2PKH wallet, with 0.00003 BTC sent to a separate wallet.

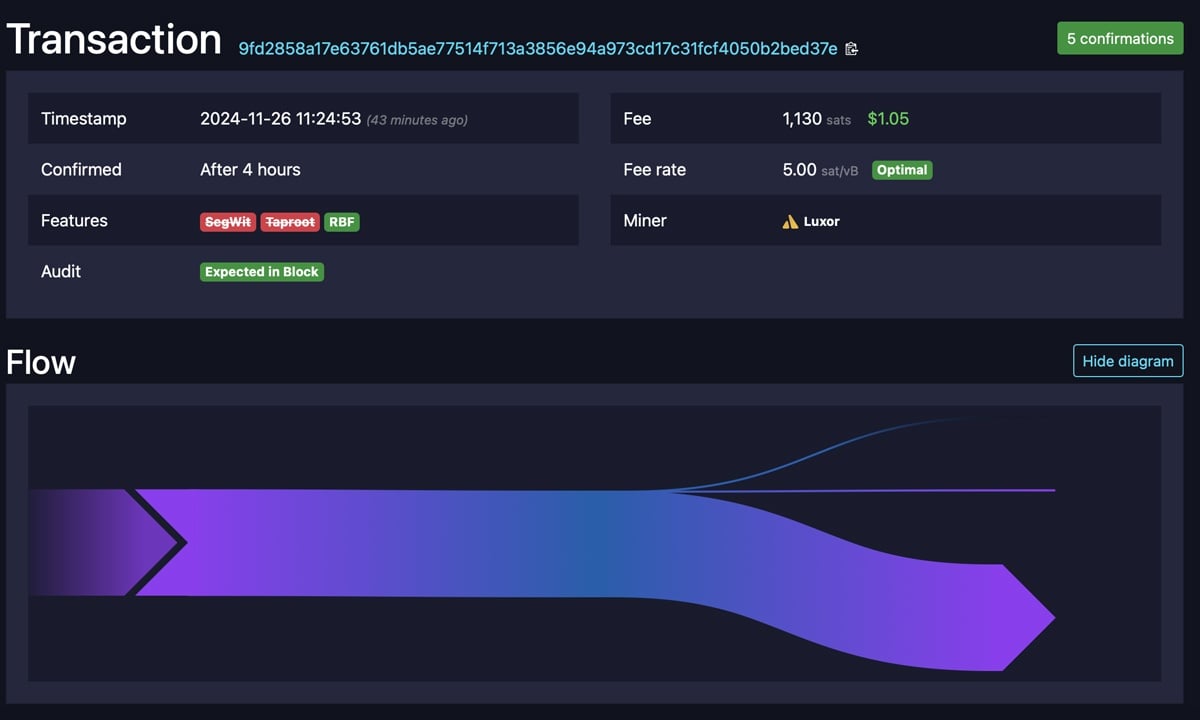

The transfer saw 1,300 sats worth of BTC paid to miners worth $1.05, as it sent 0.00003 BTC worth $2.79 and the rest of the funds went to a change address that still holds 1,964.99 BTC.

Interestingly, that 0.00003 BTC wasn’t a transaction fee. Instead, the 1,965 BTC migrated to a change address. Back in 2014, when the bitcoin was first acquired, prices were just $334 per coin. That means the original value of this digital treasure chest was $656,310—a stark contrast to its current worth of $185.3 million.

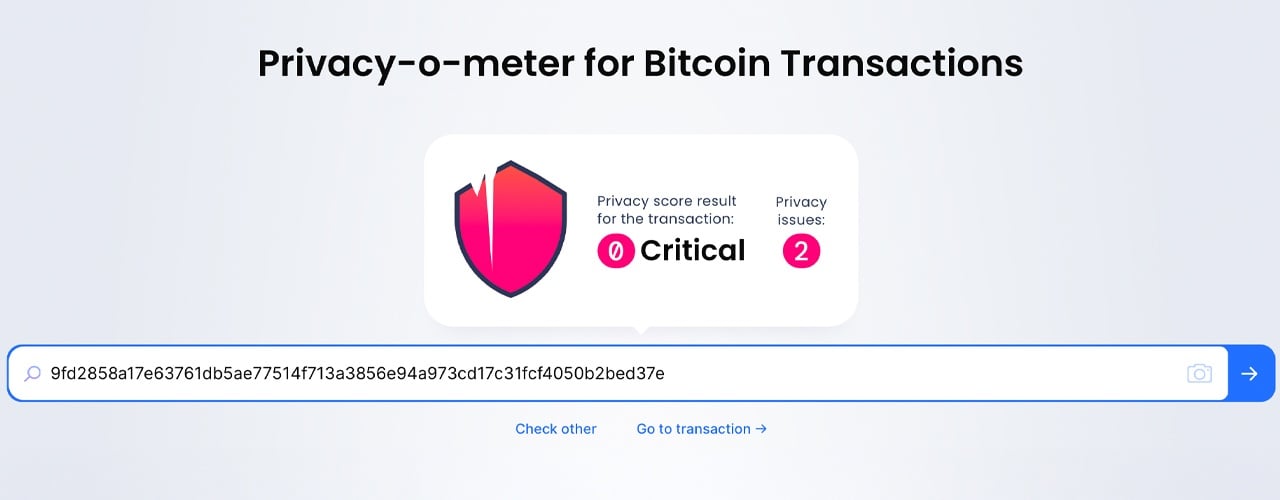

The transaction had very little privacy scoring a 2 out of 100 according to the blockchain explorer Blockchair’s privacy tool. This was due to matched addresses identified and one of the two outputs is 1000 times bigger than the other.

Bitcoin’s surge above $90,000 has awakened several dormant wallets from their digital slumber. For example, on Nov. 21, when BTC reached its all-time high of $99,800, another historic wallet from October 2016 moved 500 BTC at block height 871,347. Additionally, earlier this month, a massive 2010-era wallet transferred 2,000 BTC, while 400 BTC from 2012 also made its way into the market.

The renewed activity among these early wallets hints at a variety of motivations. Whether it’s strategic repositioning, profit-taking, or another reason entirely, such transactions showcase how bitcoin’s record-breaking prices influence movement decisions, sparking intrigue about what drives these high-value transfers.

As bitcoin teeters near peak valuations, these wallet movements serve as a compelling reminder of the leading cryptocurrency’s transformation—from a niche digital experiment to a financial powerhouse. The transition from dormant to active wallets encapsulates not only the passage of time but also the growing significance of bitcoin as a global asset. Each shift tells a part of the story of bitcoin’s rise, from its humble beginnings to the trillion-dollar behemoth we see today. By 12 p.m. on Nov. 26, BTC was back below the $94,000 range at $93.7K.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。