After 4 years in operation, Lido is yet to become profitable.

Even with $34B in TVL and dominating 28% of the entire ETH staking market share.

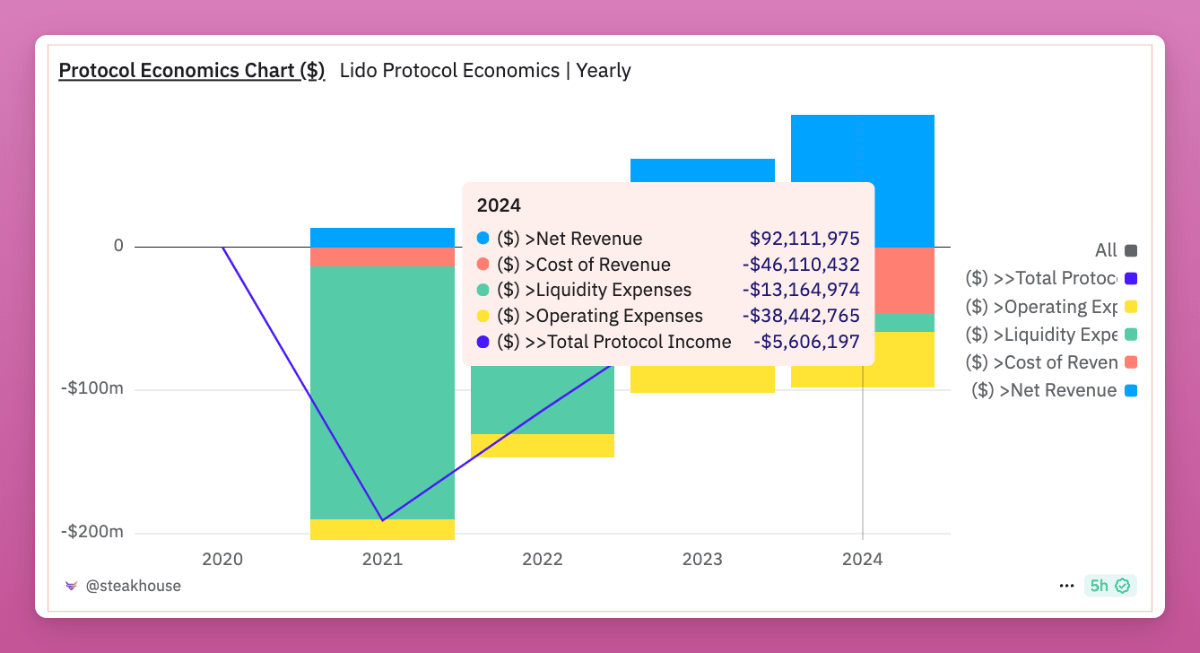

In 2024, Lido expenditures accounted for $97.6M while revenue "just" $92.1M

To cut costs, Lido stopped SOL staking business a year ago.

Now, the DAO proposes to sunset Lido staking business for Polygon and focus solely on Ethereum ecosystem.

We all like to talk about "revenue sharing" fee switch for token holders.

That's one of my main motivations why I joined a few DAOs as a delegate this year, notably Lido.

But running a profitable DAO is tough.

Lido is not alone: Multiple L2s and DeFi protocols just burn cash.

In April, Lido DAO voted on the rev share proposal but it failed to reach quorum.

In fact, to turn a revenue sharing, there first must be some real profit to share.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。