The South Korean cryptocurrency market is once again at the center of global attention with a recent surge in trading activity. The huge trade volumes and widespread participation in South Korea‘s crypto market saw the Korean won (KRW) overtake the U.S. dollar in the first quarter of 2024.

With Upbit, South Korea’s largest cryptocurrency exchange accounting for over 70% of the country’s trading volume, this crypto resurgence after the remarkable $40 billion crash of LUNA is underpinned by both historical patterns and recent developments.

A Q4 report by Tiger Research showed that approximately 15% of South Korea’s population, amounting to 7.78 million people actively participate in South Korean exchanges.

Historically, young people in South Korea have always bet big on cryptocurrencies, perceived as a sustainable way to build wealth in a country with a high unemployment rate. A survey by Samarin HR, a Korean-based recruiting portal for South Korean workers revealed that 49.8% of South Korean workers aged 30 years to 39 years have invested in cryptocurrencies with 37.1% of workers in their 20s following suit.

A look at the recent trading patterns on Korean exchanges reveals that the country is once again experiencing a massive growth spurt in crypto trading with exceptional volumes. On Upbit, trading volume has grown by over 100% in the last seven days, rising from $5.4 million on Nov. 21 to $11.9 million on Nov. 25. For context, trading volume in Q3 ranged from between $800 million to $1.2 billion.

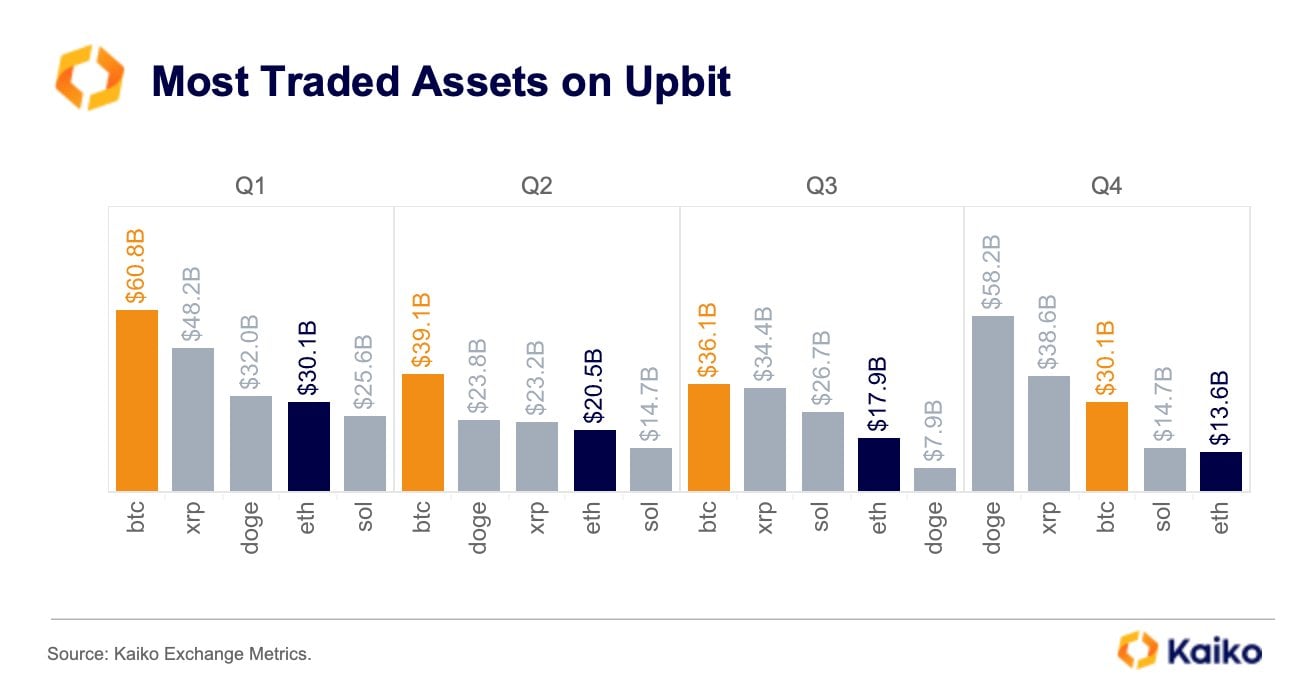

The biggest contributors to this rapid swing in trading volume have been DOGE and XRP with XLM and SAND also weighing in. In Q4, the trading volume for Doge and XRP stood at $58.2 billion and $38.6 billion, much higher than the trading volume for bitcoin at $30.1 billion.

The volume on SAND highlighted the popularity of lower-cap tokens among Koreans with the metaverse token experiencing a significant upswing for the first time in three years. The SAND/KRW pair on Upbit had a $1.6 billion 24-hour trading volume as of Nov.25, accounting for 13% of the exchange’s $11.9 billion total trading volume. On Bithumb, XRP dominated with a trading volume of $433.9 million, representing 14% of the total trading volume.

One of the most distinctive highlights of the Korean market’s passion for cryptocurrency is the “Kimchi Premium.” It stands for the price differential between domestic and international exchanges, which is a unique characteristic of the Korean market. High volatility is frequently observed, and the premium changes dramatically depending on the state of the market.

This spike in trading volume indicates the degree of retail interest and money inflows into the market, highlighting South Korea’s strong retail investor sentiment. It may be useful in forecasting bitcoin developments and offering insightful information on the features of the Korean market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。