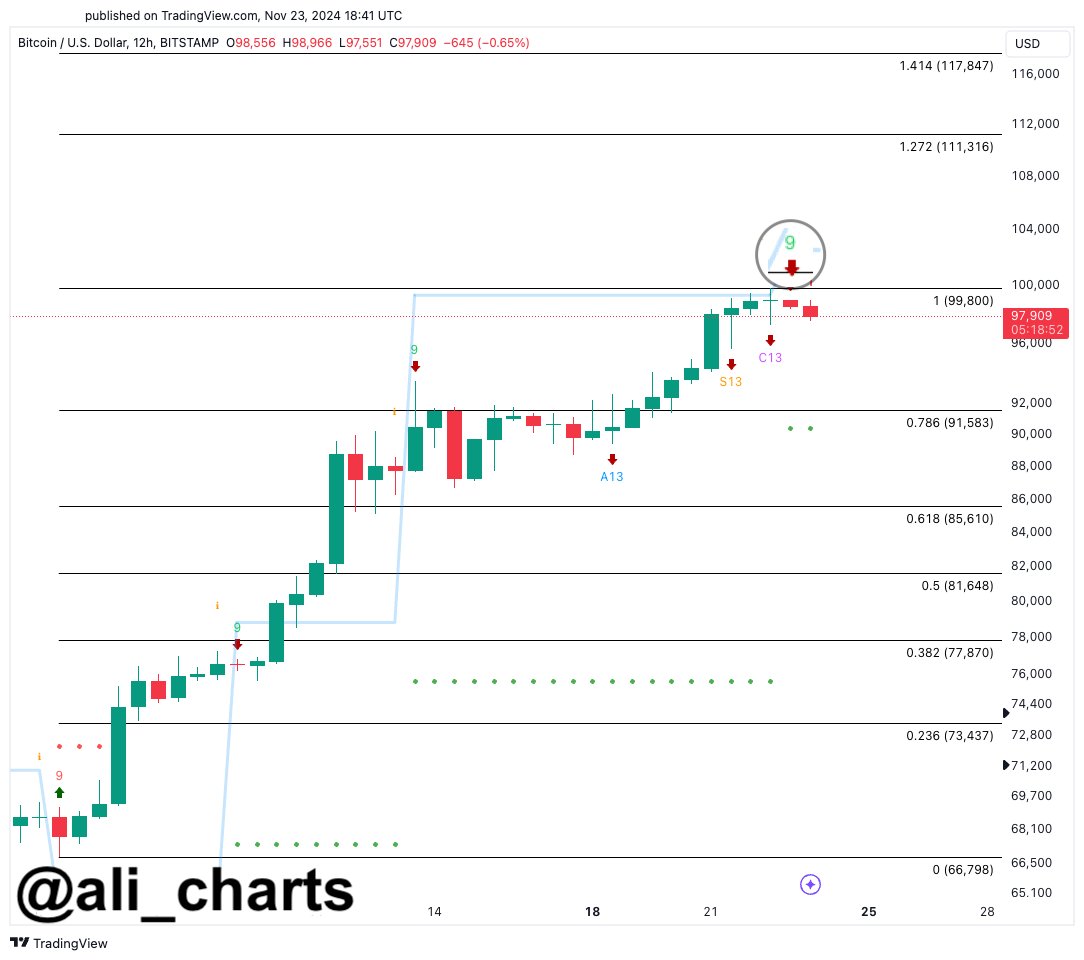

On Nov. 12, 2024, an X trader known as Ali flagged a bearish pattern for bitcoin’s 12-hour chart, using the TD Sequential indicator to support the observation. Ali’s analysis points to a possible price dip to $91,583, with the potential for an extended low of $85,610 in a worst-case scenario. However, Ali made it clear that bitcoin could negate the sell signal entirely if it manages to close above $100,535.

“The TD Sequential presented a sell signal on the bitcoin (BTC) 12-hour chart, anticipating a price correction to $91,583 or even $85,610,” Ali posted on X to the accounts 89,300 followers. “BTC needs to close above $100,535 to invalidate the sell signal.”

The TD Sequential, created by Tom DeMark, is a popular tool for spotting potential trend reversals in assets like bitcoin. It helps traders time their market moves with precision by identifying when a trend might shift direction. The indicator has two key parts: the Setup and the Countdown. The Setup tracks consecutive price bars closing higher or lower than the previous ones, hinting at a possible trend continuation. After that, the Countdown kicks in, confirming trend exhaustion if specific criteria are met. – Image Source: @ali_charts.

Bitcoin is riding a wave of bullish momentum across multiple timeframes, trading between $97,076 and $97,547 as of Nov. 25, 2024. Yet, oscillators like the relative strength index (RSI) and Stochastic indicators suggest neutral momentum and potentially overheated conditions. Adding to the mix, trading volume has tapered off after bitcoin edged close to the pivotal $100,000 psychological resistance, reflecting a more cautious stance among market participants.

While moving averages (MAs), including the exponential moving average (EMA) and simple moving average (SMA), point to a bullish long-term trend, fading momentum near $100,000 could open the door to stronger selling pressure if the resistance holds. Analysts have flagged $95,000 and $93,000 as possible support levels, while Ali’s ultra-bearish forecast of $85,610 looms as a deeper retracement in a worst-case scenario.

Should bitcoin decisively break above $100,000, it could spark fresh buying interest and further cement its long-term upward trend. On the flip side, a failure to clear this level might validate bearish projections, potentially leading to additional downside movement. Traders are closely monitoring volume and resistance levels to determine whether the next move will favor bulls or bears.

Ali’s projection of lows between $91,583 and $85,610 underscores the critical importance of the $100,000 threshold in shaping bitcoin’s near-term direction. While higher timeframes maintain a bullish outlook, the bearish TD Sequential signal advises caution. A solid close above $100,500 could flip the narrative, neutralizing the correction scenario and reigniting optimism for new highs. Until then, traders are wise to tread carefully.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。