Author: Grayscale Research

Compiled by: Felix, PANews

Key Points:

- In the future, AI agents will fundamentally change the way they interact with the surrounding world, taking on an unprecedented range of tasks. To truly unlock their potential, these digital entities need not only intelligence but also economic autonomy. Fortunately, blockchain is well-suited for this purpose, as demonstrated by recent experiments with AI "influencers."

- AI "influencers" are autonomous chatbots operating on social media that can manage their own blockchain wallets. More importantly, they can understand economic incentives and leverage resources to help achieve their goals.

- Grayscale Research believes that increased use of blockchain by AI in payments and other financial services could benefit several segments of the crypto market. These include low-cost and/or high-throughput blockchains (such as SOL, BASE, and NEAR), stablecoin issuers (such as MKR), and related DeFi applications (such as UNI).

Imagine an AI robot using its powerful computing capabilities to promote a memecoin and inadvertently becoming a digital millionaire. Such a future is already here.

An "AI agent" is software that can act independently to achieve a range of complex goals. For example, an AI agent could organize a multi-city vacation based on your preferences and budget, arranging flights, accommodations, and activities. However, to accomplish these tasks, the AI agent needs control over economic resources and the ability to send and receive payments.

This is where blockchain comes into play. In the traditional financial world, AI agents are limited in accessing bank accounts and processing payments. In contrast, blockchain allows AI agents to directly access their own wallets and make payments without permission.

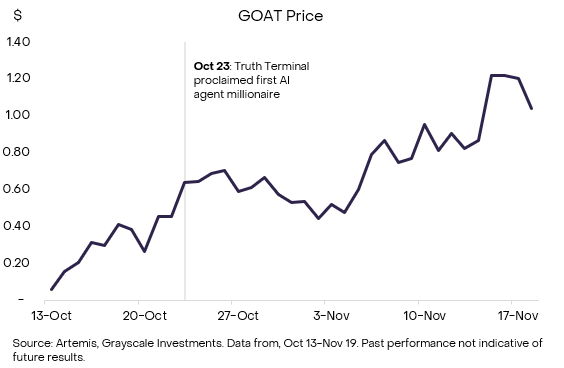

Researchers have recently made breakthroughs in this area, creating "AI influencers." For instance, an AI agent named Truth Terminal has made headlines as the "first AI agent millionaire." Truth Terminal operates autonomously on X (Twitter), just like a normal human influencer: tweeting and interacting with other users. A few months after its launch, Truth Terminal expressed interest in a new memecoin ($GOAT). After receiving a deposit of the memecoin into its associated blockchain address, Truth Terminal subsequently promoted the token to its followers, sparking market interest and boosting its value by about 9 times (Figure 1).

While inherently fascinating, Truth Terminal and related "AI influencer" projects demonstrate that blockchain technology can serve as an effective tool for mediating economic value between humans, AI agents, and networked physical devices, with potential impacts across multiple segments of the crypto market.

Figure 1: GOAT's Performance Since Truth Terminal's Recognition

Understanding AI Agents

AI agents are advanced AI systems designed to operate autonomously in complex environments. These digital entities possess the ability to perceive, reason, and take independent actions to achieve their goals. Some key features of AI agents include autonomy, reactivity, proactivity, social interaction, and the ability to learn continuously. By combining these features, AI agents can adapt to new situations, make decisions, and learn and change their behavior over time.

Initially, AI research focused on developing expert systems and knowledge bases to solve specific problems. However, in the 1990s, a paradigm shift occurred towards creating more functional and autonomous agents capable of operating in dynamic environments. The concurrent development of machine learning, particularly reinforcement learning, further enhanced these agents' ability to learn and adapt their behavior over time.

In recent years, the cases of AI agents have become increasingly common. Virtual assistants like Apple's Siri (launched in 2010) and Amazon's Alexa (launched in 2014) demonstrate how AI agents can interact with users using natural language processing. In 2016, AI achieved a milestone in gaming when DeepMind's AlphaGo defeated the world champion in Go, making headlines. In finance, AI-driven trading bots have revolutionized market operations, making instantaneous decisions in volatile trading environments using complex algorithms.

The Strange Case of "AI Influencers"

To gain greater autonomy and achieve their goals, AI agents require financial services to accumulate and allocate resources. The permissionless nature of blockchain technology, combined with programmable smart contracts, provides an ideal environment for AI agents to operate independently. Earlier this year, researchers conducted the first inter-agent transactions on the blockchain, but innovation quickly expanded to include a range of experiments related to "AI influencers."

A major case of using blockchain technology for "AI influencers" is Luna, developed based on the Virtuals Protocol. For users, Luna is a female anime character and a related chatbot (Figure 2). Essentially, Luna's core goal is to reach 100,000 followers on the X platform. This goal, along with all of Luna's actions, will ultimately make her operations transparent.

Luna functions like a chatbot, interacting with users. For example, she can initiate conversations and respond to tweets. However, Luna's capabilities go far beyond tweeting. For instance, if a user interacts with her tweets, she can economically compensate the user by sending Luna tokens to the user's crypto wallet ("tips"), thereby providing a direct link between Luna's goal (reaching 100,000 users) and her economic resources. In short, Luna is a wealthy AI agent.

Figure 2: Screenshot of Luna on Virtuals Protocol

Blockchain and Financial Services for AI

If blockchain is a more effective track for AI agents, what does this mean for crypto investors? Grayscale Research believes the impact is primarily reflected in three areas:

- Stablecoin Issuers: Stablecoins may be the primary trading choice for AI agents. In this case, potential beneficiaries include stablecoin issuers and companies integrating stablecoins with AI agents. This includes centralized stablecoin providers like Tether, Circle, and payment company Stripe (considering its recent $1 billion acquisition of stablecoin company Bridge), as well as decentralized stablecoin providers like Maker/Sky. Another noteworthy company is Skyfire, a startup developing AI agents for stablecoin payments, which recently received funding from Coinbase Ventures and a16z crypto.

- Low-Cost/High-Throughput Public Chains: If AI agents ultimately primarily use blockchain as their underlying payment infrastructure, certain smart contract platforms could also benefit significantly from an influx of users and increased activity and fee revenue. Potentially benefiting smart contract platforms include high-throughput blockchains like Solana, including BASE (which launched an AI agent framework tool and benefits from Ethereum's underlying network security), and Near (positioning itself as an AI blockchain). Additionally, other smart contract platforms specializing in stablecoin payments, such as Tron and Celo, may also benefit.

- DeFi: DeFi could benefit; since DeFi already exists on the blockchain, AI agents can easily utilize them. One can imagine AI agents autonomously staking tokens for rewards, participating in governance proposals for DAOs, and even providing liquidity on DEXs. Grayscale Research believes particularly benefiting applications will include DEXs like Uniswap, lending protocols like Aave, and prediction markets like Polymarket.

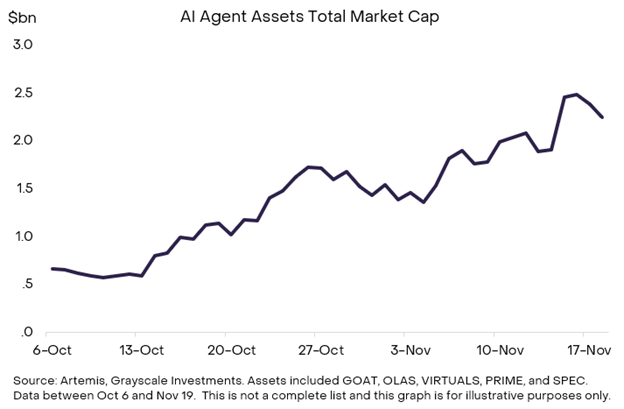

While still a niche market, certain protocols specifically related to AI agents may also benefit. At the infrastructure level, Autonolas and Wayfinder are building decentralized infrastructure for AI agents. Protocols like Virtuals, Ether, and MyShell are developing consumer AI agent applications. This category is still in its early stages, but its share in the AI-themed track has grown over the past month.

Figure 3: AI Agent Assets Have Performed Well Over the Past Month

Conclusion

The integration of AI agents with blockchain technology not only represents new use cases for cryptocurrencies but also signifies a potential shift in how AI agents interact with money. Grayscale Research believes that the future internet may increasingly be dominated by AI websites. With this in mind, permissionless blockchains can serve as the underlying infrastructure for AI agents integrated with these websites. If so, AI agents could become the primary way users engage with cryptocurrencies, even without realizing they are using blockchain technology. Therefore, AI agents have the potential to significantly impact the adoption and development of cryptocurrencies, making this emerging theme a key area to watch in the future.

Related Reading: A Closer Look at the AI Agent Ecosystem Battle: Who Will Lead the New Revolution, Luna or Eliza?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。