When Meme Has Fundamentals.

Written by: Tuo Luo Finance

In terms of the hottest track in the past two weeks, DeSci is undoubtedly the one.

Since November 8, when Binance Labs announced its investment in BIO Protocol, this once-silent concept has risen again under the joint endorsement of CZ and Vitalik, attracting hot money. RIF and URO have generated thousands of times in wealth, creating a new potential MEME track.

DeSci, also known as decentralized science, refers to the act of establishing public infrastructure through Web3 technology to achieve open and fair funding, storage, and dissemination of scientific knowledge, as cited by Messari. DeSci encourages scientists to openly share research results and gain recognition while allowing anyone to easily access and contribute to research outcomes. In simple terms, DeSci aims to solve research problems based on blockchain technology, covering fundraising, knowledge sharing, peer review, intellectual property, and more.

From the performance of the track, DeSci focuses on fundraising, with most project models relying on tokenization to finance projects and support research and development. At the same time, research results are often encouraged to be recorded on-chain to enhance transparency and protect intellectual property. Currently, the core role of DeSci is to open up new funding channels for scientific research that requires long-term investment. By linking the seemingly unrelated fields of cryptocurrency and scientific research, it gives tokenization more practical significance, thus being heavily promoted by the market as one of the cases of MEME practical application.

Regarding the root cause of this round of DeSci's explosive popularity, the celebrity effect is key. On November 8, it was disclosed that Binance completed strategic financing for BIO Protocol, bringing this "on-chain science version of Y Combinator" to the forefront. Subsequently, CZ attended the DeSci Day event held by Binance in Bangkok, where Vitalik was also present. Their joint discussion on DeSci further propelled it into the spotlight.

The crypto community, adept at spotting trends, quickly surged into the DeSci craze. Pump.Science became an instant hit, and the RIF and URO projects generated thousands of times in profits, allowing this track to break out completely. Andrew Kang, a partner at Mechanism Capital, even stated, "The DeSci field now feels like the DeFi era in early 2019. Everything is still very primitive and experimental, but a basic conclusion can be drawn: it has enormous potential." As a result, even amidst a significant market correction, the DeSci sector still rose against the trend by 3.35%, according to SoSoValue data.

Although the vision for DeSci is promising and opening funding channels for scientific research undoubtedly holds value, the current situation clearly shows that speculation outweighs actual utility. Essentially, the long-term nature of scientific research significantly diverges from the short-term profit-seeking nature of the MEME field, making it feel quite unrealistic to hope for a blend of pure speculation in the MEME track with the zero speculation in the research field.

On one hand, scientific research involves significant uncertainty; drug development can take decades, and if the direction is wrong, it can lead to total failure. It requires sustainable long-term investment, which is why research funding typically adopts a model led by the state and major enterprises, combining state capital with social capital to hedge risks and maintain competitiveness. However, in the crypto market, attention is the core; trends are hard to sustain. Currently, the hot money surrounding DeSci is mainly concentrated on the meme coin issuance platform Pump.Science, indicating the market's focus on profit-making effects.

In fact, from a conceptual standpoint, DeSci seems a bit like new wine in an old bottle. If we trace back to history, VitaDAO, initiated by Vitalik in July 2021, is one of the earliest and most representative DeSci projects, but its development has not been as spectacular as its concept suggests.

VitaDAO is a community-owned project dedicated to funding early longevity research, aiming to promote scientific innovation through the collective power of the community, researching and supporting projects aimed at extending human lifespan and preventing age-related diseases. In other words, VitaDAO is a DAO community focused on longevity research.

Previously, due to traditional pharmaceutical company Pfizer's strategic investment in the project, VitaDAO briefly sparked discussions, but it quickly faded as the conversation waned. Currently, VitaDAO is also widely expanding, having deployed $4.2 million to fund 24 projects and collaborating with well-known universities like Newcastle University. However, in comparison to its actions, the actual results seem quite limited. Since 2021, it wasn't until recently at Devcon that Vitalik finally showcased VitaDAO's first product, VD001.

On the other hand, while putting research results on-chain can enhance transparency and protect intellectual property, it is almost a structural disruption in the relatively closed research field. In today's research system, most research teams maintain a high level of confidentiality regarding research results and experimental data to prevent unauthorized theft, use, or disclosure of research outcomes, especially when deep interests are involved, confidentiality becomes paramount. With the strong entry of decentralization, the security of data is naturally hard to guarantee.

With the support of the above two factors, it can be anticipated that, aside from superficial applications in research content, review fairness, and data tokenization, only topics that are extremely difficult to implement, time-consuming, and highly collaborative will align with the crypto model. From this wave of enthusiasm, most DeSci projects are targeting a core issue of common concern for all humanity—longevity, which has led the market to jokingly refer to DeSci as the on-chain elixir of life.

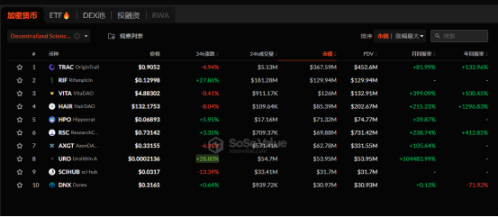

Eternal life is ultimately just a beautiful vision, and the market's interest in DeSci is primarily for the liquidity it brings. Although the BIO Genesis community fundraising activity initiated by BIOProtocol raised $33 million, and the DeSci sector has soared in the past two weeks, the primary market actions are limited, and large institutions have yet to participate. From the perspective of leading projects, the secondary market performance is also quite mediocre, with the market capitalization of VITA and RIF both falling between $120 million and $200 million, far from the $1 billion market capitalization of other leading sectors.

Development status of the DeSci sector, source: sosovalue

However, if we disregard the long-term aspect, DeSci is relatively a good segment in the MEME world. Compared to other MEMEs, DeSci has a stronger narrative. While the celebrity effect may not last long, the existence of actual research projects provides a fundamental effect, and any innovation in research and product development will strengthen the narrative. The biomedical sector is generally open to fundraising, and the emerging nature of this field makes it more likely to connect with the crypto space. Additionally, DeSci has the potential for a breakout effect; the current celebrity effect in this sector is still concentrated within the crypto community, led by Vitalik and CZ, while celebrities from traditional medical and research fields have yet to enter, and large institutions have not emerged, providing direction for future narratives.

Returning to the macro market, whether it’s zoos or artists, AI-driven or research-validated, it can be seen that MEME has become the main carrier of market funds. However, the previous round of immense wealth accumulation was still led by altcoins. Looking solely at the altcoin market, Bitcoin has risen from $10,000 to the brink of $100,000, while the follow-up effect of Ethereum has significantly diminished, and the performance of altcoins has mostly declined. Among the top ten crypto assets, only SOL and XRP have seen increases, and the explosive growth of altcoin seasons seems hard to replicate.

At the core, the change in the flow of funds is key. In traditional bull market transmission, the general path is from high-stability assets gradually sinking to low-stability assets, activating high-yield preferences from low-yield sources, i.e., mainstream coins - altcoins - MEME coins - other sectors, but this year, that path is not as it used to be. However, currently, with the entry of institutions and the saturation of project numbers, external large new liquidity will only flow into the Bitcoin ecosystem, and the public chain ecosystem lacks strong applications emerging. Altcoins are deeply trapped in a supply-demand institutional crisis, with Bitcoin becoming a siphon for ecological funds, and funds from other sectors being siphoned off as well. Only the fast in-and-out, wealth-effect-concentrated MEME stands out, thus turning the altcoin season into a MEME season.

A typical proof is that Pump.fun has become the biggest winner of the bull market. According to Dune data, as of November 24, pump.fun's cumulative revenue approached $230 million ($228,908,720), with a total of approximately 3.74 million tokens deployed.

Of course, the two are not mutually exclusive; the rise of MEME does not mean the collapse of altcoins. Under regulatory relaxation and sector rotation, altcoins may still have the potential to turn the tide. However, the elevation of MEME's market position undoubtedly reflects a structural shift in the market. In fact, whether it’s Pumpfun live broadcasts, TikTok calls, or AI-driven initiatives, with the entry of Generation Z and the rapid evolution of new technologies, the crypto market is undergoing profound changes in narrative logic, communication modes, and operational methods.

Traditional altcoin projects, which revolve around token releases to maintain long-term narratives while continuously harvesting profits, are becoming unsustainable. The market is no longer willing to pay for VC tokens but is shifting towards a direction that is fairer, more autonomous, and closer to the core of tokens, with attention becoming increasingly scarce. In this regard, the combination of MEME and projects seems to be more competitive than a single project; altcoins are speculative, while MEME is relatively fair. MEME lacks long-term sustainability, while projects provide fundamental support, and the two are highly compatible. This may also be one of the reasons for the rise of concepts like AIMEME and DeSci.

However, regardless, the formation of consensus is highly random, and MEME gold mines are few and far between. According to Panews data, as of November 21, Pump.fun has issued a total of 3.59 million tokens, a scale that far exceeds the total token issuance in the past decade of the crypto world. Among them, the number of tokens graduated (fully filled on the curve line Raydium) is 50,389, accounting for about 1.4%. The number of tokens with a market capitalization exceeding $100 million is only 32, with less than one ten-thousandth of MEME's market capitalization exceeding $10 million.

In the long run, finding a balance between attention and long-term sustainability will become an important issue for the development of MEME, but for individuals, surviving and not going to zero is the premise of everything.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。