Reference Source: W. E. Messamore

Author|Golem(@web3_golem)

In this bull market, Bitcoin's gains have far outpaced those of Ethereum. As of now, BTC has accumulated a 133% increase this year, while ETH has only seen a 50% rise. Some in the community have joked, “When BTC was priced at $52,000, ETH was breaking through $3,300; when BTC was at $72,000, ETH was still breaking through $3,300; now that BTC is breaking through $100,000, ETH has finally broken through $3,300.”

Aside from BTC, the prices of public chain tokens known as "Ethereum killers" have also surpassed ETH. According to OKX data, in the past month, SUI has risen by 74%, SOL by 50%, and DOT by 131%. Although ETH's price reached $3,500 last Saturday, some investors still feel that the prospect of it reaching $4,000 in this bull market is bleak.

Greg Magadini, Director of Derivatives Trading at Amberdata, stated in a report to clients, “Due to its value proposition as a 'stable currency', ETH is facing significant upward resistance, and Ethereum is turning towards inflation, with almost all DeFi transactions executed on L2, which I believe is significantly dragging down ETH prices.”

So, as the second-largest blockchain in the crypto industry, will Ethereum's performance in this cycle truly lag behind BTC and other "Ethereum killers" as many say? It may still be too early to draw conclusions; the evolution of mainstream blockchains is an extremely long game — anyone who prematurely thinks they have won the war will fall into complacency and ultimately lose everything.

The following clues suggest that Ethereum may be building momentum for a "counterattack," with a breakthrough of $4,000 just around the corner.

ETH/BTC Exchange Rate Shifts Again

From a technical analysis perspective, the price exchange rate between ETH and BTC is at a cyclical turning point and has formed a bottom. Based on past experience, this indicates that Ethereum's price may soon rise, potentially even surpassing Bitcoin's gains.

Legendary commodity and forex trader Peter Brandt posted on X platform on November 21, stating “A letter from the grave?” along with a chart showing the price of Ethereum against the Bitcoin exchange rate. As shown in the chart, it illustrates how ETH rose when the ETH/BTC exchange rate was at a low four years ago.

ETH Vs SOL

Over a longer time frame, during Ethereum's dormancy, Solana has experienced a strong bull market, which may also indicate that there is more upside potential in Ethereum's market from a sector rotation perspective.

During the U.S. election period, comparing the relative performance of ETH and the three most popular meme coins on the Ethereum chain with SOL and the three most popular meme coins on the Solana chain serves as another important signal for assessing the competitive altcoin market.

As of November 25, over the past 30 days, SOL outperformed ETH with a 50% increase compared to ETH's 34% rise. Nevertheless, Ethereum's top three meme coins (SHIB, PEPE, FLOKI) still outperformed Solana's meme coins (Bonk, WIF, POPCAT) during the same period.

The cumulative 30-day return on investment for Ethereum plus its top three meme coins was 220%, while Solana plus its top three meme coins had a return of 200%.

Institutional Support for Ethereum

In addition to the increase in monthly net inflows into Ethereum ETFs and the rise in Ether futures trading volume in November, institutional investors have shown high confidence in ETH. Institutional investors are not holding ETH for the short term; they are also locking it in staking contracts, which not only protects the network and serves as an additional means of earning yield but also indicates that institutional investors are confident in Ethereum and its long-term growth prospects.

In early October, Carlos Mercado, a data scientist at blockchain strategy company Flipside Crypto, pointed out that the number of Ethereum stakers has grown by over 30% in the past 12 months. A survey conducted by New York-based blockchain intelligence firm Blockworks Research in mid-October revealed that 69.2% of respondents stake Ethereum, with 78.8% of them being investment firms or asset management companies.

Moreover, institutional investors are taking other measures to maintain liquidity while staking ETH, with reports indicating that over 52% of respondents participate in liquid staking. This shows that these traditional financial participants are becoming increasingly mature within the Ethereum DeFi ecosystem.

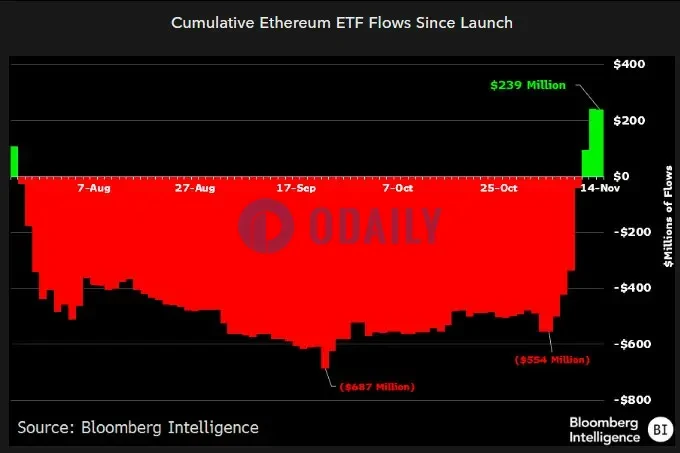

Bloomberg senior ETF analyst Eric Balchunas also stated that since Trump's victory, Ethereum ETFs have emerged from a period of capital outflow, finally welcoming fresh air and net inflows. According to the Bloomberg Intelligence data he presented, the cumulative capital flow for Ethereum ETFs has turned positive, indicating that institutional investors' confidence in Ethereum continues to grow.

DAPP Trading Volume Grows Within the Month

Another fundamental analysis of Ethereum's price is the monthly activity of DApps protected by its blockchain network, or Web3. According to data from DApp Radar, as the ETH/BTC exchange rate reaches a historical turning point and ETF investor sentiment turns bullish, Ethereum's DApp trading volume is on the rise, and it coincides almost perfectly with the increase in ETH futures trading volume and ETF inflows.

In the past 30 days, Ethereum's DApp trading volume has far outpaced that of DeFi tokens. Ethereum's decentralized application layer trading volume reached $150 billion, far exceeding the $32 billion of Arbitrum (ARB) in second place and the $26 billion of BSC (BNB) in third place.

At the same time, The Block Pro also pointed out on November 21 that driven by ETF inflows, Bitcoin's rise, and bullish sentiment post-election, Ethereum's daily on-chain trading volume surged to $7.13 billion, marking the highest level of the year, with an 85% increase in just two weeks.

Ethereum Price Prediction: Will It Reach $6000 by 2025?

Crypto analyst Ali Martinez predicted on November 20 that by the end of this macro market cycle, ETH will outperform Bitcoin. In his optimistic forecast for the coming months, he believes Ethereum will rise to $6,000, while also expecting Ethereum to reach at least $4,000 in this cycle.

He stated, “Every market cycle goes through a phase where Ethereum outperforms Bitcoin, which has not yet happened in the current cycle, but is certainly about to. Since ETH is still lagging, there is an opportunity to buy before it outperforms the market.”

NDV co-founder Christian2022.eth also stated, “Since October, I have gradually built a position of over $8 million in BNB, believing that in the second half of the bull market, BNB and ETH will catch up and lead.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。