Table of Contents:

Review and Technical Analysis of BTC's Weekly Trend;

Overview of the Crypto Market, Quick Read on Weekly Popular Coins' Price Movements/Fund Flows;

Inflow and Outflow of Spot ETF Funds, with $3.38 Billion Inflow Last Week;

CEX Weekly Outflow Exceeds 35,000 BTC, Balance Hits New Historical Low;

High Funding Rates for BTC Contracts;

BTC Contract Liquidation Map;

BTC Market Cap Proportion Adjustment and Altcoin Index Rebound;

Upcoming Large Token Unlock Data.

Fundamental Hotspot Interpretation: This Week's Federal Reserve Meeting Minutes.

1. BTC Weekly Trend Review and Technical Analysis:

Last week, BTC maintained a generally upward trend, rising from a low of $89,276 to around $99,588, with a maximum increase of 16.24%. After reaching a historical high near the $100,000 mark over the weekend, it faced pressure and retraced to $95,735 before rebounding, closing the week around $97,900, with an overall weekly increase of 8.95%.

CoinAnk's trend shows that since November 6, the day of the U.S. election when Trump won, BTC has been in a clear bullish trend. The current trend support level has moved up to around $95,000, which will serve as a watershed for bullish and bearish positions. If the market stabilizes above this support level, the bullish trend will likely continue, with the potential to set new historical highs. However, if it effectively breaks below $95,000, it will lean bearish in the medium to short term, entering an adjustment phase.

Currently, it is in the MACD top divergence repair phase on the four-hour level. As time progresses, there is a possibility of forming a death cross on the daily level, which would lead to a significant correction. The current support levels to watch are $91,860, $87,000, and $85,000. The short-term resistance above is near the $100,000 mark and the historical high.

2. Overview of the Crypto Market, Quick Read on Weekly Popular Coins' Price Movements/Fund Flows

In the past week, the crypto market, categorized by concept sectors, saw significant fund inflows concentrated in major areas such as the Optimism ecosystem, Arbitrum ecosystem, Solana ecosystem, and Avalanche ecosystem, with the first three sectors nearing $2 billion in scale and the Avalanche ecosystem also seeing over $1 billion in net inflows. Thus, we observed a rotation of altcoins in these concept sectors during the latter half of last week.

The primary reason for the substantial net inflows into these three concept sectors is the large issuance of USDT and USDC stablecoins. In the last three days of the week, Tether issued a total of 5 billion USDT, of which 2.83 billion USDT flowed into the crypto market. Over the past 20 days, the total net issuance has reached 13 billion USDT.

3. Inflow and Outflow of Spot ETF Funds, with $3.38 Billion Inflow Last Week.

According to CoinAnk data, since last Monday, BTC spot ETFs have been in a state of net inflow, accumulating over $3.38 billion, setting a new historical high for weekly net inflows, with a net increase of 26,861.87 BTC. BlackRock's IBIT continues to lead, increasing its holdings by nearly 20,000 BTC in a single week, accounting for 72.3% of the total increase. Currently, the total asset value of BTC spot ETFs is $107.488 billion, with an ETF net asset ratio (market cap compared to total Bitcoin market cap) reaching 5.48%, and the historical cumulative net inflow has reached $30.843 billion.

The continuous inflow of ETF funds has also driven BTC prices upward, while the mining output is only 3,150 BTC, leading to a supply-demand imbalance that has caused the circulating BTC in the secondary market to continue to decline.

4. CEX Weekly Outflow Exceeds 35,000 BTC, Balance Hits New Historical Low.

CoinAnk data shows that in the past week, major cryptocurrency exchanges have seen a cumulative outflow of 35,526.94 BTC, with Binance seeing an outflow of 20,300.96 BTC, Bitfinex 6,494.83 BTC, and Coinbase 2,224.92 BTC. Currently, the cumulative balance of Bitcoin on crypto exchanges has fallen below 2.3 million BTC, hitting a new historical low.

A large amount of BTC is being withdrawn from exchanges, possibly indicating that investors are losing interest in short-term trading and are seeking to hold their coins for the long term, or that there is strong demand for off-exchange wallet addresses, such as self-custody or cold wallets. The current amount of BTC held by CEX has dropped to a historical low, further confirming the shift in investor confidence. This change may have various impacts on the market.

The reduction in BTC supply in the market may provide price support, as the decreased circulation could create scarcity in the new market, thereby driving prices up. Additionally, the increased preference for self-custody among investors may lead to more funds flowing into other non-custodial solutions, further promoting the trend of decentralization in the crypto market, which will continue to affect the market and contribute to the maturation and stability of the cryptocurrency market.

Of course, any market change comes with uncertainty; history can serve as a reference but may not follow established patterns. A significant portion of the flow has gone into ETFs, which are essentially traded in the secondary market, amounting to over 1 million BTC. If we add this to the BTC within the crypto ecosystem, the circulating amount has not actually decreased and may have even increased. We will explain the reasons in detail:

We cannot simply look at the exchange BTC balance data; the current on-chain data has some distortion. For example, data from various countries' spot ETFs is not counted in the exchange balances, but they are essentially traded in the secondary market. We estimate that the current scale of BTC held by various spot ETFs exceeds 1 million BTC, merely shifting from one pool to another. The exchange BTC balance has fluctuated between 2.3 million and 3 million BTC over the past two years. Sometimes more exchanges are counted, and sometimes fewer, due to changes in criteria. Previously, only the top ten CEX data was counted, which was roughly around 1.8 to 2 million BTC. The scale of over 1 million BTC in spot ETFs, when compared to the exchange, is equivalent to nearly half or more than a third of the scale, so it must be considered comprehensively.

Therefore, we believe that the BTC circulating in the secondary market has not truly decreased; it has merely shifted to traditional financial markets such as the NYSE, CME, and NASDAQ for ETF share trading. These transactions will directly influence BTC trading and will not significantly reduce the actual circulating amount of BTC in the market.

5. High Funding Rates for BTC Contracts

According to CoinAnk contract data, since September 14, the funding rate for BTC contracts has maintained a positive value, indicating that long positions are excessive and need to pay funding fees to short positions. Since November 11, there have been multiple instances of extremely high funding rates, ranging between 0.04% and 0.05%, indicating that long positions are entering a FOMO (Fear of Missing Out) state, competing to buy and pushing BTC prices up from $78,470 to near $100,000.

6. BTC Contract Liquidation Map

According to CoinAnk contract data, if the BTC price rises to a historical high and breaks $99,588, there will be $1.017 billion in short positions liquidated;

If the BTC price falls below last week's low of $95,330, there will be $1.152 billion in long positions liquidated.

7. BTC Market Cap Proportion Adjustment and Altcoin Index Rebound

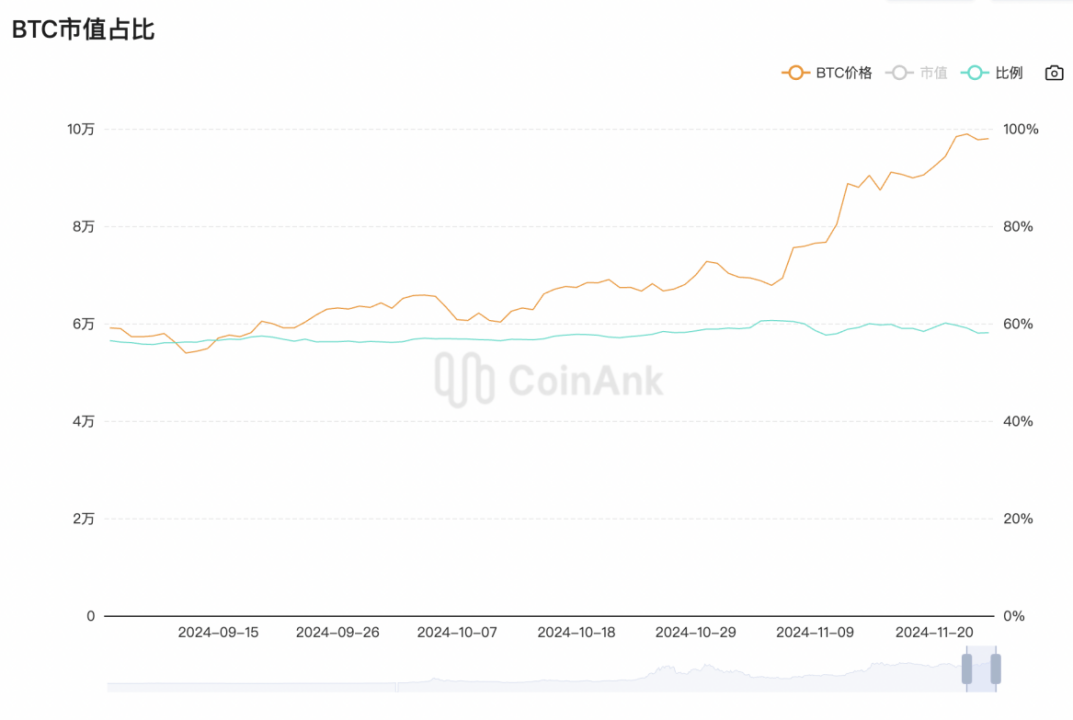

According to CoinAnk data, BTC's market cap proportion has recently crossed above 60% several times. Last week, as BTC prices rose, the market share peaked at 60.1%. During the weekend's BTC price fluctuations and corrections, liquidity spread, and existing funds flowed back into altcoins, leading to a rotation and rise in altcoins, which in turn caused BTC's market cap proportion to adjust.

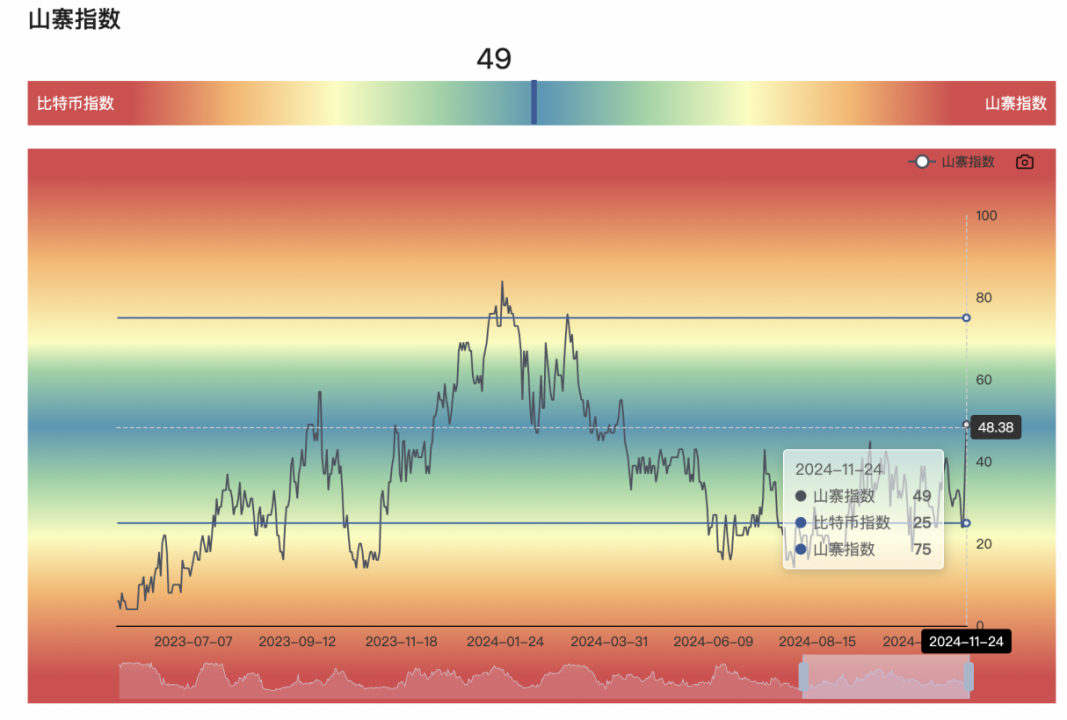

According to CoinAnk's unique data, the current altcoin index is at 48.38, operating near the index midpoint, indicating a relatively healthy state. The altcoin index has recently rebounded, reaching a new high since early April this year. This indicates that the current rebound has not yet recovered the decline since the March highs for altcoins, suggesting potential space for growth. However, attention should be paid to the rotation and speculative performance of different coins. Generally, the rebound of altcoins tends to lack sustainability, and if BTC corrects, altcoins are likely to fall in sync.

8. Upcoming Large Token Unlock Data:

This week, SUI, OP, and IMX will see a large one-time token unlock, releasing a total value of over $300 million, including:

Sui (SUI) will unlock 64.19 million tokens on December 1 at 8:00 AM, valued at approximately $216 million, accounting for 2.26% of the circulating supply;

Optimism (OP) will unlock 31.34 million tokens on November 30 at 8:00 AM, valued at approximately $68.32 million, accounting for 2.5% of the circulating supply;

Immutable (IMX) will unlock 24.52 million tokens on November 29 at 8:00 AM, valued at approximately $42.41 million, accounting for 1.47% of the circulating supply;

1inch (1INCH) will unlock 98.74 million tokens on November 30 at 8:00 PM, valued at approximately $38.73 million, accounting for 7.72% of the circulating supply.

This week, attention should be paid to the negative effects of these token unlocks, avoiding spot trading and seeking short opportunities in contracts. Among them, 1INCH and SUI have a larger proportion and scale of circulating supply unlocked, warranting extra attention.

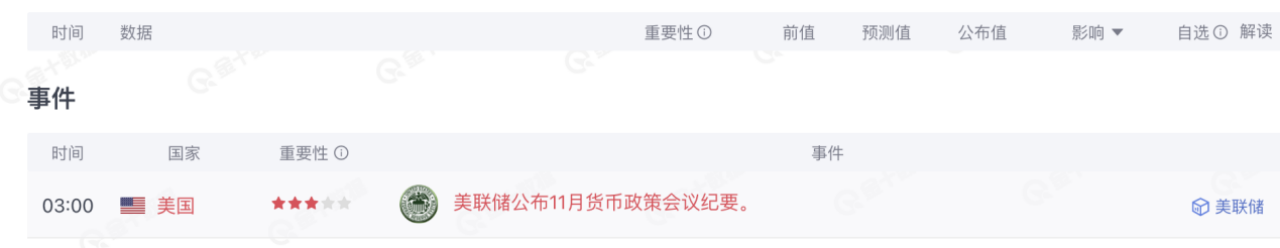

- Hotspot Interpretation: Federal Reserve's November Monetary Policy Meeting Minutes

On November 27, the Federal Reserve will release the minutes from the November monetary policy meeting. Currently, investors expect the likelihood of a rate cut in December to be slightly above 50%. This expectation is based on multiple factors. According to CME's "FedWatch" data, the probabilities of a rate cut have fluctuated over different time periods but overall slightly exceed the probability of maintaining the current interest rate. In terms of economic data, there are signs of a slowdown in the economy, yet it remains resilient, which makes the expectations for a rate cut not very strong. Regarding inflation, it has not spiraled out of control and there is some room for moderate rate cuts. Officials' statements also reflect a cautiously supportive attitude towards rate cuts, leading to the current expectation.

The direction of the Federal Reserve's monetary policy has a significant impact on the crypto market. If a rate cut occurs in December, it is likely to be a positive factor for the crypto market. On one hand, a rate cut means that the cost of using funds in the market decreases, which may prompt some funds to flow out of traditional savings, bonds, and other relatively low-yield areas in search of higher-yield investment channels. Given the unique financial attributes and potential high returns of cryptocurrencies, it is very likely that this portion of funds will flow into the crypto market, thereby driving up cryptocurrency prices and increasing the overall activity in the crypto market. On the other hand, rate cuts are often implemented as a regulatory measure against a backdrop of certain economic slowdown pressures, which can create fluctuations in market confidence towards traditional financial assets. The crypto market, being relatively independent of the traditional financial system, may attract some investors who view it as a risk diversification option, leading to an increased allocation to crypto assets and prompting a wave of activity in the crypto market. However, if a rate cut does not materialize, it may frustrate the expectations of crypto market investors, leading to a price correction and a decrease in market activity in the short term. Investors would reassess market risks and adjust their investment strategies, potentially entering a period of observation and consolidation in the crypto market.

Written by: laolibtc

CoinAnk Research Institute

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。