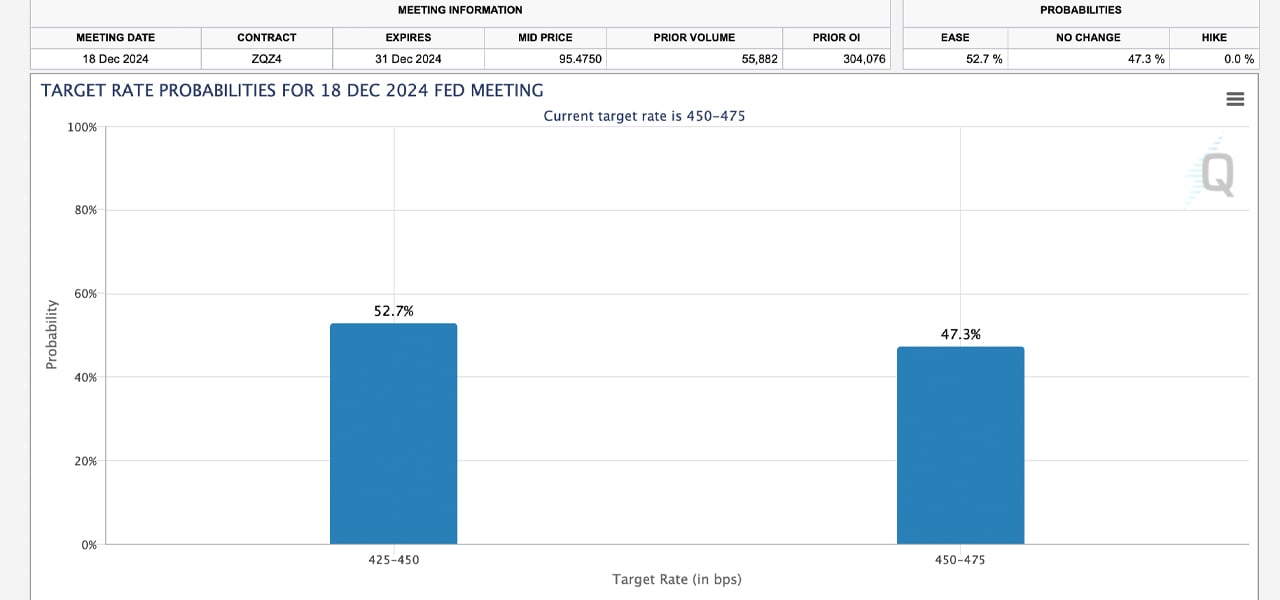

The U.S. Federal Reserve‘s federal funds rate outlook for December remains a toss-up. The odds of no rate change and a modest 25 basis points reduction are running close, but the quarter-point cut slightly leads. CME’s Fedwatch tool, which leverages the pricing of 30-day Federal Funds futures contracts to predict potential rate shifts, places the probability of a 25bps cut at 52.7%.

CME Fedwatch tool odds on Sunday, Nov. 24, 2024.

This tool calculates probabilities by subtracting the futures contract price from 100, offering a market-driven perspective on anticipated interest rate decisions. Meanwhile, the chances of no cut are also significant, sitting at 47.3%. Analysts continue to hold mixed views on whether the Federal Reserve will lower rates in December.

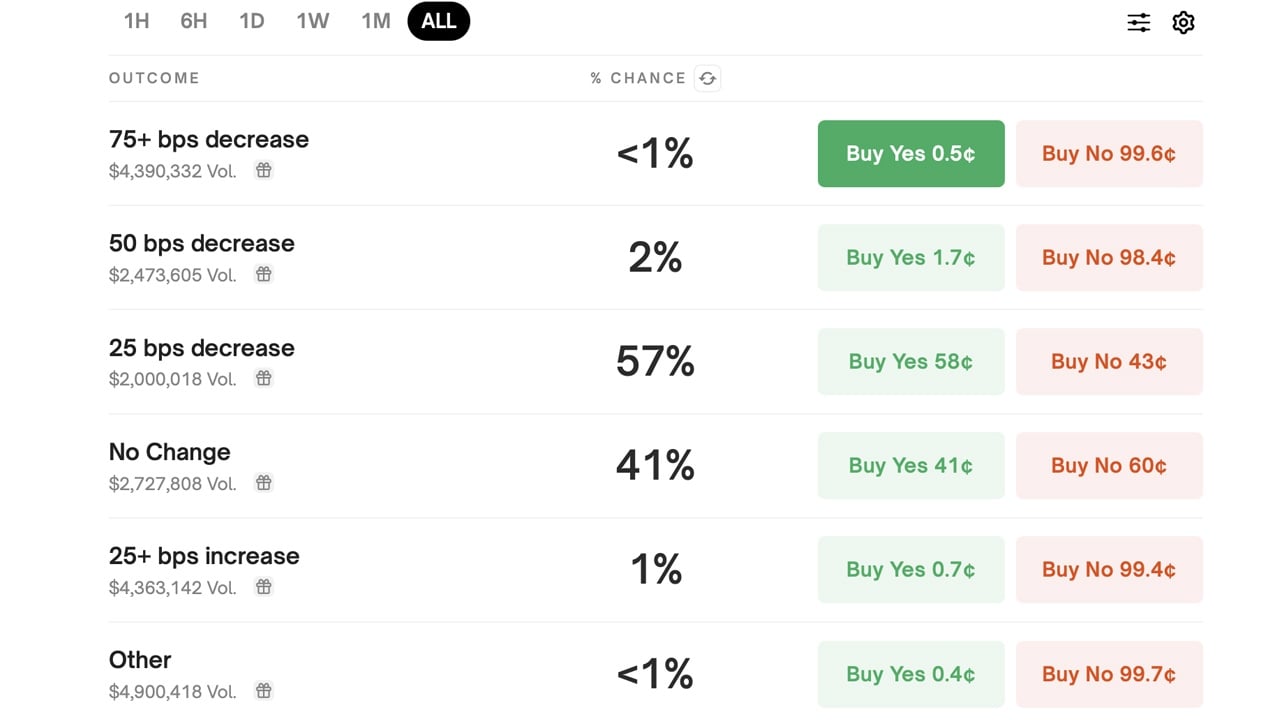

For instance, Morningstar’s Preston Caldwell anticipates a 0.25% cut, pointing to recent inflation metrics and broader economic conditions. On the other hand, Nomura analysts predict a pause, citing strong economic signals. Polymarket bettors mirror this divide, assigning 57% odds to a quarter-point reduction. As of Nov. 24, Polymarket wagers have reached $20.85 million.

Polymarket odds on Sunday, Nov. 24, 2024.

Polymarket participants also assign a 41% chance to no rate adjustment, a slim 2% chance to a half-point cut, and a mere 1% to a quarter-point hike at the Dec. 18 FOMC meeting. The evolving probabilities reflect a market grappling with conflicting economic signals. As CME Group’s Fedwatch tool and Polymarket data suggest a slight lean toward easing, the divergence in expert opinions underscores the current uncertainty.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。