According to AICoin market data, today (November 22), BTC has surpassed $99,000, reaching a peak of $99,300, extremely close to the $100,000 mark. Meanwhile, MicroStrategy announced yesterday (November 21) that it has completed the issuance of $3 billion in convertible senior notes maturing in 2029. On the same day, Citron Research tweeted about shorting MSTR positions for hedging.

MicroStrategy Completes $3 Billion Bond Issuance

MicroStrategy announced on November 21 that it has completed a $3 billion issuance of 0% convertible senior notes, planning to use some or all of the proceeds to purchase Bitcoin. These bonds will mature in December 2029, and the company aims to further increase its Bitcoin holdings through this issuance.

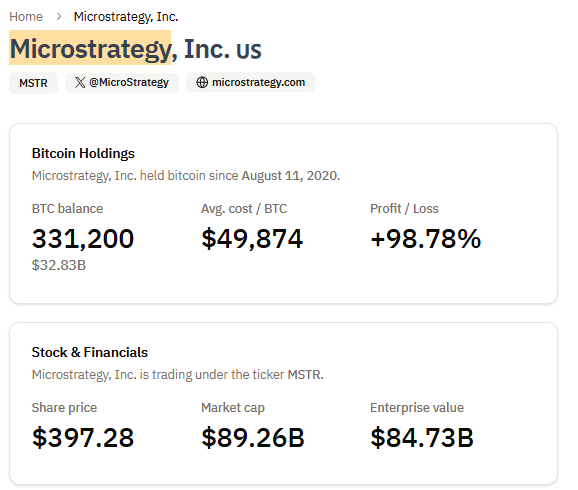

According to MicroStrategy's "21/21 Plan," the company plans to raise $42 billion over the next three years, which includes $21 billion in equity and $21 billion in fixed-income securities, for large-scale Bitcoin purchases. This strategy demonstrates MicroStrategy's firm belief in Bitcoin and its long-term strategy. Currently, MicroStrategy holds 331,200 Bitcoins, valued at over $32 billion.

Image source: x

The 0% interest rate on the bonds means that bondholders will not receive regular interest payments but can potentially gain returns by converting the bonds into MicroStrategy stock. This arrangement allows MicroStrategy to acquire Bitcoin at the lowest ongoing cost while relying on its stock price to provide returns to bondholders. Such bonds are attractive to investors seeking Bitcoin exposure who are willing to accept stock conversion.

Citron Shorting MSTR

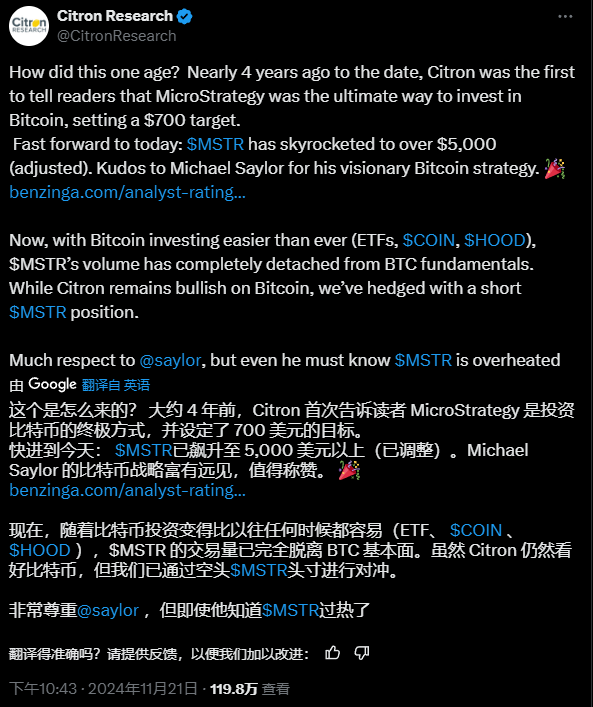

On the same day, the well-known short-selling firm Citron Research announced on social media that it holds short positions on MSTR, believing that its market trading volume has completely detached from Bitcoin's fundamentals. Four years ago, Citron first told readers that MicroStrategy was the ultimate way to invest in Bitcoin, setting a target of $700, while today MSTR has soared to over $5,000.

Citron Research stated, "They remain optimistic about Bitcoin, but they choose to short MSTR for hedging," and added, "We have great respect for @saylor, but he knows MSTR is overheated."

Image source: x

Citron Research's viewpoint reflects the market's skepticism regarding the valuation of MicroStrategy's stock. MicroStrategy's market capitalization once reached 3.3 times the nominal value of its Bitcoin holdings, with a premium exceeding 230%. This high premium reflects the market's recognition of MicroStrategy's unique position as a Bitcoin investment channel, which may gradually diminish as the market diversifies its Bitcoin investment channels.

Does the "Independence Premium" Disappear?

MicroStrategy has gained a very high premium in traditional markets due to its large Bitcoin holdings. However, as the cryptocurrency market matures and more compliant investment channels emerge, this "uniqueness premium" enjoyed by MicroStrategy is gradually weakening. Citron Research's shorting behavior may reflect the market's anticipation of this change.

According to SoSoValue, the trading volume of MSTZ (2x inverse short MSTR ETF) surged on November 21, with a single-day trading volume approaching $1.53 billion, compared to an average daily trading volume of $84 million previously. While Citron Research publicly announced its short position on MSTR, it also indicated that as Bitcoin investment becomes easier than ever (currently, ETFs, COIN, and HOOD can be purchased), MSTR's trading volume has completely detached from BTC's fundamentals.

SoSoValue analysts pointed out that since the chairman of the U.S. Securities and Exchange Commission (SEC) will step down in 2025, subsequent regulatory policies are expected to be more favorable, providing investors with more compliant channels to enter the cryptocurrency market. This trend suggests that MicroStrategy's role as a unique channel for investing in Bitcoin in traditional markets will be weakened, and investors will no longer rely solely on MicroStrategy to access the Bitcoin market.

Conclusion

MicroStrategy's aggressive strategy in Bitcoin investment has garnered market attention and investor enthusiasm. However, with market changes and the diversification of investment channels, its stock's premium and uniqueness may face challenges. Whether MicroStrategy can maintain its position in the market will depend on its ability to respond to Bitcoin price fluctuations and the market's recognition of its strategy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。