Bitcoin’s rally to a record $95,000 high on Wednesday saw bitcoin ETFs also hit a historic milestone of $100 billion in total net asset value. According to data from Sosovalue, the 12 spot bitcoin ETFs’ combined net asset value hit $100.55 billion, approximately 5.4% of bitcoin’s market capitalization.

The top three bitcoin ETFs were Blackrock’s IBIT with $45.38 billion in net assets, followed by Grayscale’s GBTC with $20.61 billion in net assets. Fidelity’s FBTC made up the top three with $18.44 billion in net assets.

The net inflows into the 12 ETFs totalled $773.47 million on Wednesday with $5.09 billion total value traded. This was a drop of $63.89 from the previous day’s inflow of $837.36 million.

IBIT was the main driver of the positive flows with $626.52 million coming into the fund. GBTC on the other hand had no inflows for the day. Fidelity’s FBTC contributed $133.94 million in inflows with Bitwise’s BITB $9.3 million, and Ark Invest’s and 21shares’ ARKB $3.8 million rounding up the inflows for the day.

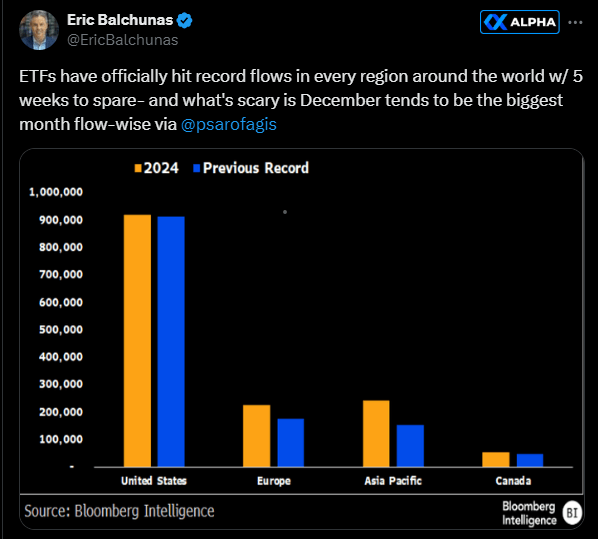

With bitcoin projected to hit the $100,000 mark in the coming days, ETFs could witness more historic inflows. Eric Balchunas, Senior ETF Analyst for Bloomberg shared on X, “ETFs have officially hit record flows in every region around the world with 5 weeks to spare, and what’s scary is December tends to be the biggest month flow-wise.”

On the other hand, spot ethereum ETFs in the United States experienced net outflows of $30.3 million on Wednesday, prolonging their five-day negative flow streak. Yesterday, the trading volume of the nine ether ETFs decreased to $338.3 million from $345.1 million the day before.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。