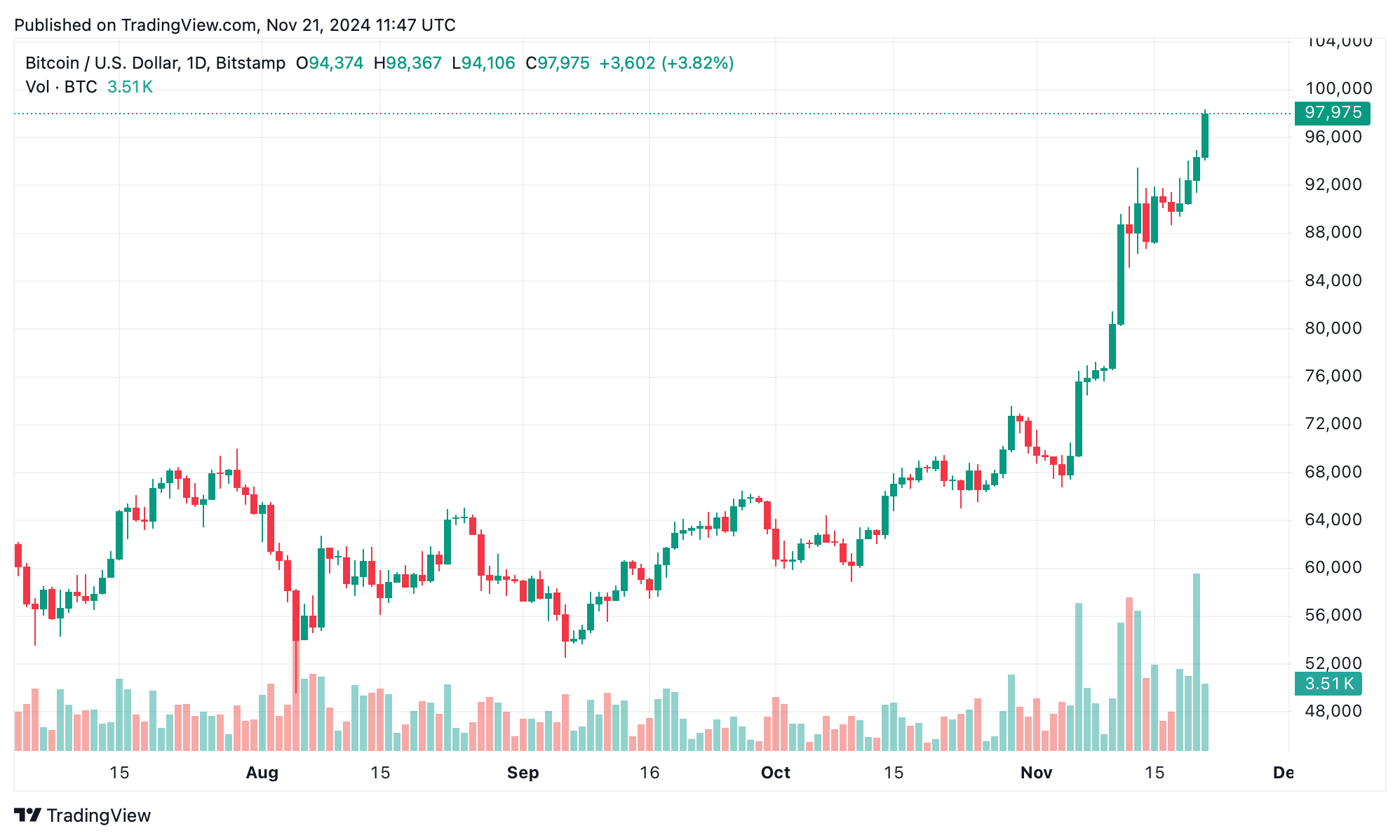

On Thursday morning at 6 a.m. Eastern Time, the leading cryptocurrency bitcoin (BTC) rose 5.2% against the U.S. dollar in the past 24 hours and 7.8% over the past week, reflecting growing market confidence.

The cryptocurrency’s total market capitalization now stands at $1.94 trillion, edging much closer to the $2 trillion milestone. Bitcoin’s remarkable surge was fueled by a 24-hour trade volume of $100.8 billion, highlighting heightened investor activity during the overnight trading sessions.

At 6 a.m. ET, BTC reached $98,367.

Derivatives markets also saw significant action during bitcoin’s rally. A total of $457.15 million in the broader crypto economy was liquidated in the past 24 hours. Bitcoin short positions accounted for $99.43 million, while $25.74 million in long positions were cleared. Binance recorded the largest single liquidation order—valued at $4.63 million—on the ETH/BTC trading pair.

The spike in bitcoin’s price underscores its resilience amidst increasing mainstream adoption and market speculation. Analysts attribute the surge to growing institutional interest and bitcoin’s limited supply, which continues to drive demand as a hedge against inflation.

Despite the optimism, the market remains volatile, as demonstrated by the liquidation of 160,255 traders in the past day. Market participants are closely monitoring whether bitcoin will breach the $100,000 barrier—a psychological and technical milestone.

The cryptocurrency’s ascent reinforces its role as a transformative asset, captivating investors globally and igniting discussions about the future of decentralized finance and blockchain technology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。