Reprint with permission from the "Biteye" community

Author: Biteye Core Contributor Viee

Editor: Biteye Core Contributor Crush

Community: @BiteyeCN

* The full text is approximately 3000 words, with an estimated reading time of 6 minutes

Before reading this article, please first learn about GMGN's guide to navigating Meme coins in the introductory article “Overnight Hundredfold! How to Use GMGN to Navigate Meme Coins (Introductory Edition).”

The introductory article mentioned how to find new Meme coins, analyze and filter them, and manually trade, providing some reference for newcomers who want to play with Meme coins on-chain.

This article is the advanced edition, mainly focusing on using indicators to filter Meme coins, using websites/Telegram Bots for automated trading and limit orders, helping everyone further utilize GMGN as a tool to improve trading speed and security.

GMGN website:

https://gmgn.ai/

01

Using GMGN Indicators for Advanced Meme Coin Filtering

In the introductory article, we analyzed the approach to scanning chains and judging potential Meme coins, specifically based on trends, narratives, market capitalization, community, and market dynamics to determine whether to buy. So how can we quickly scan chains and filter safe tokens from the GMGN token dashboard from an indicator perspective?

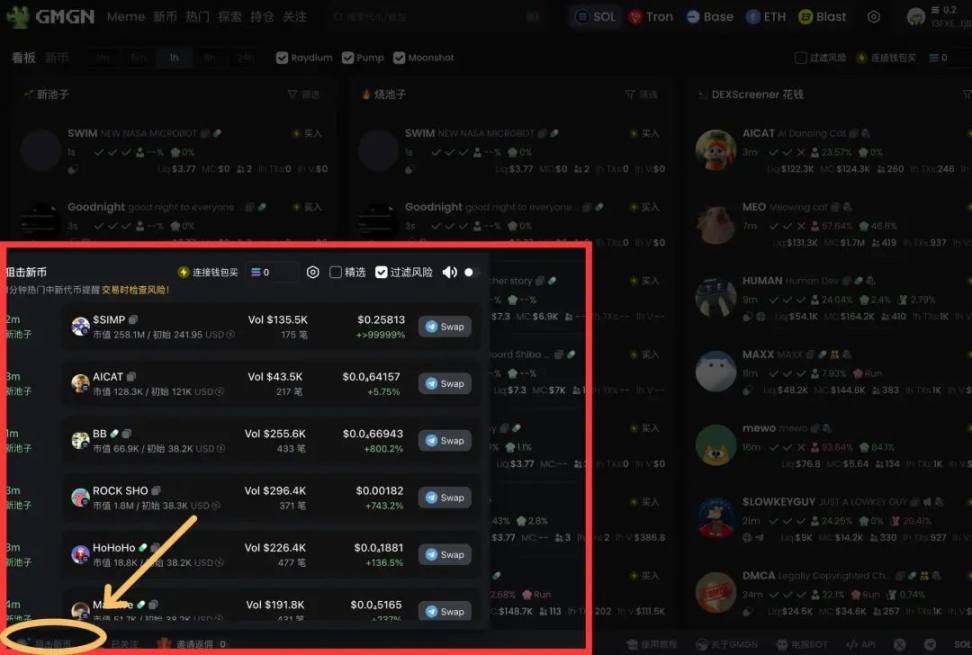

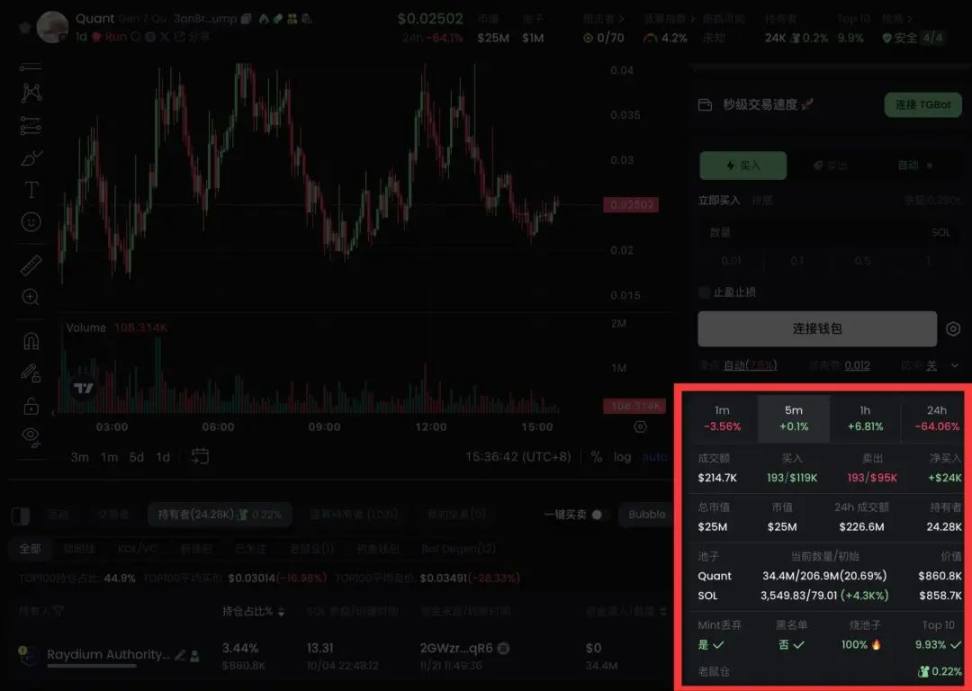

Focus on the "Sniping New Coins" section in the lower left corner of GMGN. After discovering a new token, click to enter the token trading interface for detailed analysis.

First, look at the indicators in the lower right corner:

Liquidity Pool Size: Ideally, the liquidity pool should be above 100 SOL. Although participating with a smaller amount (like a few dozen SOL) is possible, it carries higher risks due to the potential impact of large holders dumping. However, be wary of some scammers using large pools to mislead users.

Real Transaction Count: Observe the real transaction count after the opening. If the transaction count exceeds 60 within 1 minute or exceeds 600 within 5 minutes, it indicates that the token is relatively safe. Ensure these transactions are genuine and not artificially inflated.

Mint Permission Revocation: If the project team has revoked the permission to mint additional tokens, it is relatively safe. This means they cannot arbitrarily mint more tokens, thus reducing the risk of dumping.

Blacklist: Confirm whether the project team has the authority to blacklist any wallet. If "no," it is relatively safe; if "yes," there may be risks, as this means certain users could be restricted from selling tokens.

Burning the Liquidity Pool: Check if the liquidity pool (LP) has been burned. The higher the burn rate, the lower the risk, as it means the project team cannot withdraw liquidity. A 100% burn indicates that the project team cannot withdraw funds, providing the highest security. If the LP has not been burned, there is about a 60% chance of a "rug pull" (i.e., developers suddenly withdrawing funds). This step is crucial for assessing project safety.

Top 10 Holdings: Observe whether the total holdings of the top 10 holders are less than 30% of the total supply. If so, it indicates that the token's holdings are dispersed, reducing the risk of market manipulation by a single large holder.

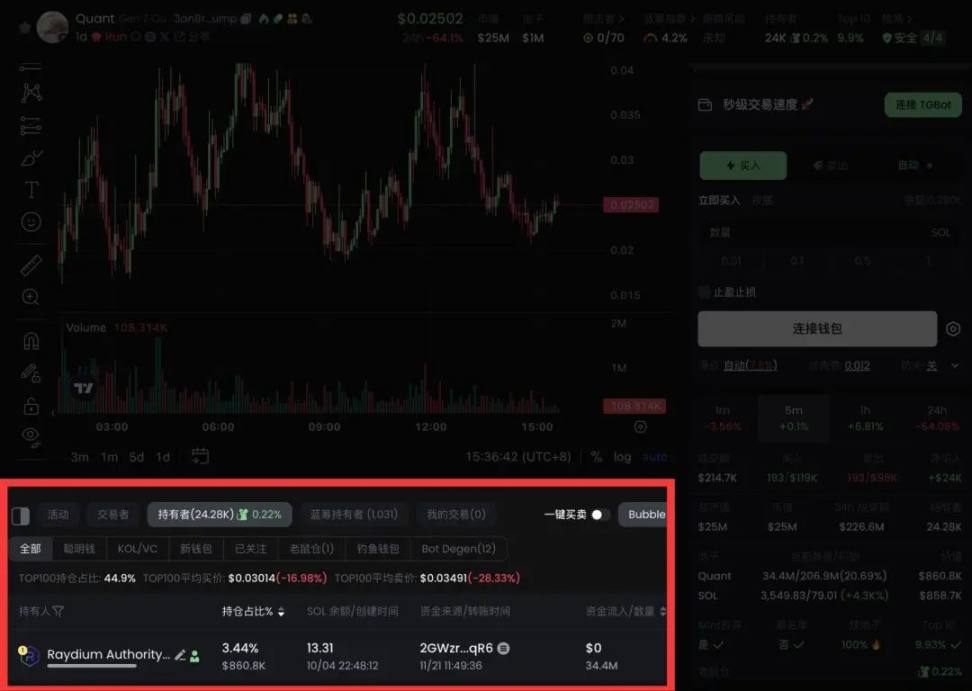

Next, look at the holding indicators below the K-line in the middle:

Monitoring for Wash Trading: Observe whether there is a wash trading phenomenon; the lower the wash trading ratio, the better. A high ratio may indicate that the project team is manipulating the market, increasing investment risks. It is recommended that the wash trading ratio does not exceed 20%. Ideally, having no wash trading at all is the best scenario.

Finally, check the indicators above, including social media and snipers:

Analyzing Large Holder Sniping: If large holders quickly enter at the opening while the liquidity pool is shallow, there is a 90% chance that this will lead to a price crash, so caution is needed.

By using the above indicators, you can more effectively filter out safe and potentially profitable Meme coins, reducing risks and increasing success rates.

02

Using the GMGN Website for Advanced Trading

After selecting potential tokens, how do you trade? A beginner's tutorial has already detailed the GMGN trading system and simple manual buy/sell operations in the previous article. This advanced tutorial mainly focuses on limit trading and automated trading.

Enter the token address in the GMGN search box, or directly filter the tokens you believe have potential on the GMGN token dashboard, then click to enter the token trading interface.

Bind your TG wallet: On the right side of the token trading interface, click "Bottom Fishing," switch to the Telegram bot, and bind your TG wallet.

Creating Limit Orders on the GMGN Website

Set up the order:

Return to the GMGN website and click on the bound wallet.

Click "Bottom Fishing," then enter the buy quantity, slippage, and anti-sniping settings.

Create the order: Click "Create Limit Buy Order" to successfully complete the limit order.

Selling with a limit order follows the same process; click "Automatic Sell," enter the quantity, slippage, and anti-sniping parameters, and click "Create Limit Sell Order" to successfully complete the limit order.

03

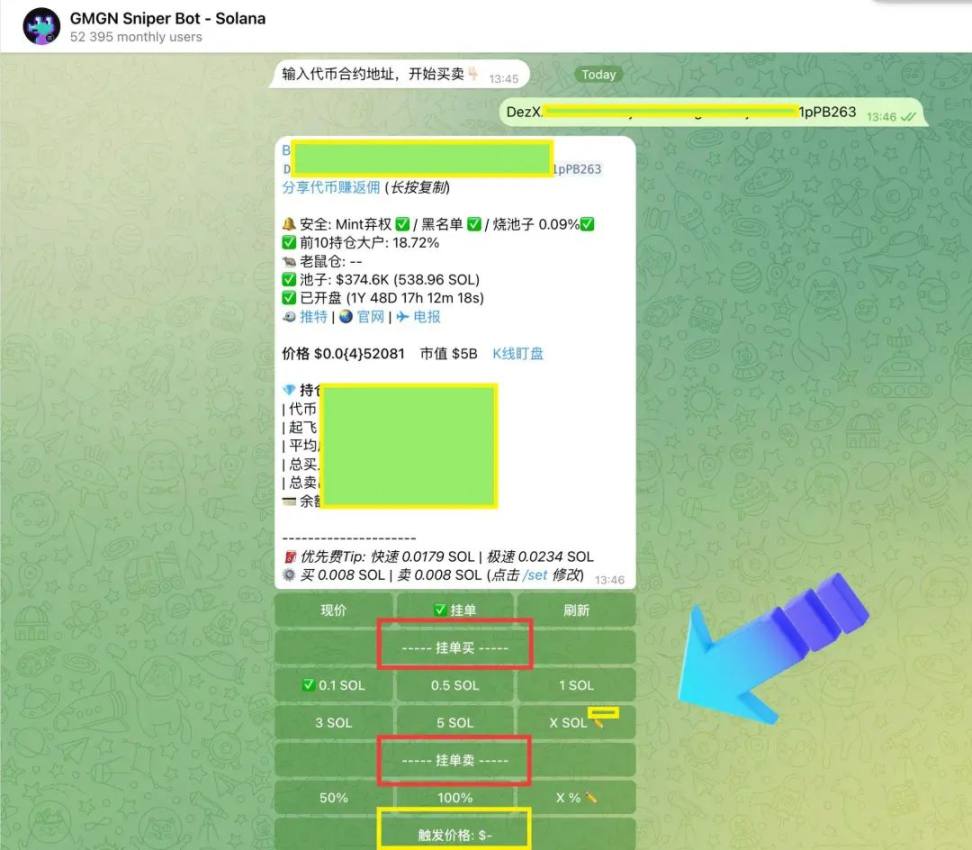

Using the Telegram Bot for Advanced Trading

Compared to website orders, there is a more convenient and faster trading method: using the Telegram Bot. When you send the token contract address to the Telegram bot, it will automatically purchase based on preset conditions or automatically sell the token at preset values without any further action required. How to achieve this?

First, add the GMGN Telegram Sniping Bot as a friend.

https://t.me/GMGN_sol_bot

1. Using the Telegram Bot for Limit Buy

Send the contract: In the TG Sniping Bot, enter /start, select "Buy," and input the token contract address.

Set up the order:

After entering the contract, select the "Order" tab.

Set the amount of SOL to purchase; you can customize the amount or use preset values.

Set the trigger price, which can be a specific price or percentage, and choose the order validity period (e.g., 6 hours, 24 hours, 2 days).

Complete the order: Click "Create Order" to successfully set the limit buy.

2. Using the Telegram Bot for Limit Sell

Send the contract: In the TG Sniping Bot, enter /start, select "Sell," and input the token contract address.

Set up the order:

After entering the contract, click "Order," and select the "Limit Sell" area.

Set the proportion of the quantity you want to sell; you can also customize the amount or use preset values.

Set the trigger price: Set the trigger price, which can be a specific price or percentage, and choose the order validity period (e.g., 6 hours, 24 hours, 2 days).

Complete the order: Click "Create Order" to successfully set the limit sell.

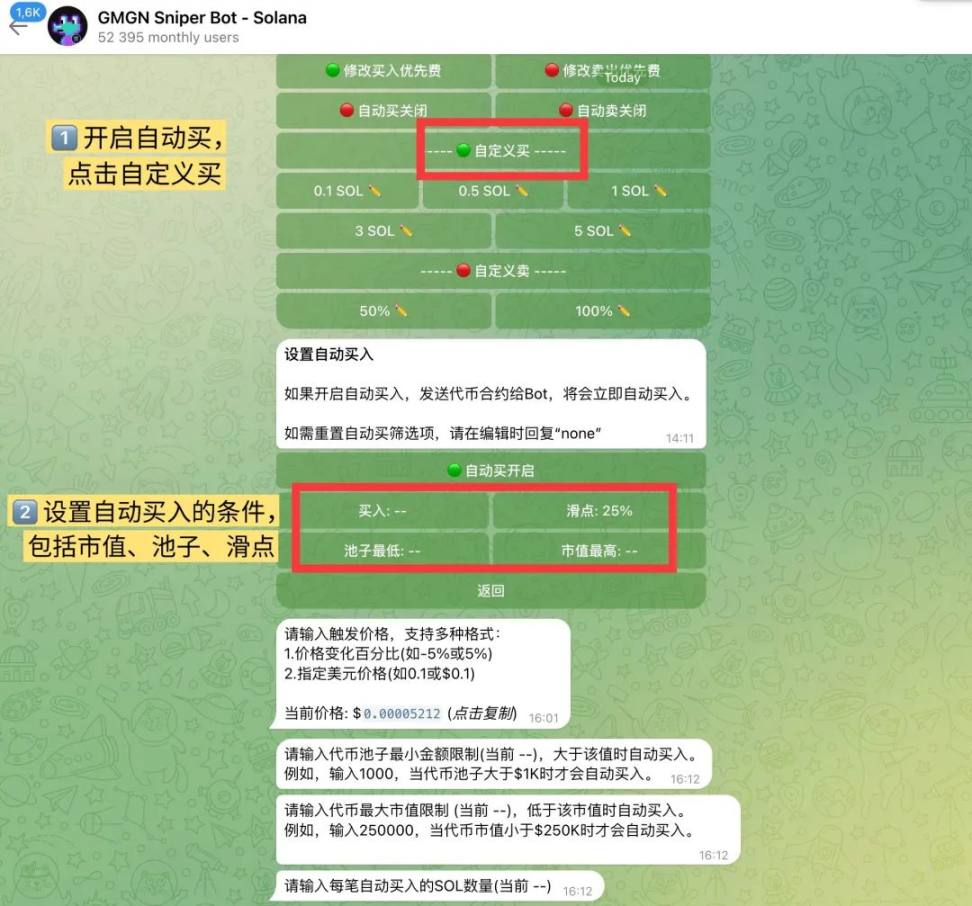

3. Using the Telegram Bot for Automatic Buy

Set up automatic buying:

In the chat, enter /start, then select "Settings" to enter the automatic buying options.

Click "Enable Automatic Buy," and set the SOL amount for each transaction.

Set the minimum amount limit for the token pool, ensuring that purchases will only trigger when the pool exceeds that value. For example, entering 2000 means purchases will only trigger when the token pool exceeds $2000.

Set the maximum market cap limit, ensuring that only tokens with a market cap below that value are purchased. For example, entering 200000 means purchases will only occur for tokens with a market cap less than $200,000.

Execute the purchase: Once the setup is complete, send the token contract address to the bot, and it will automatically purchase based on the preset conditions.

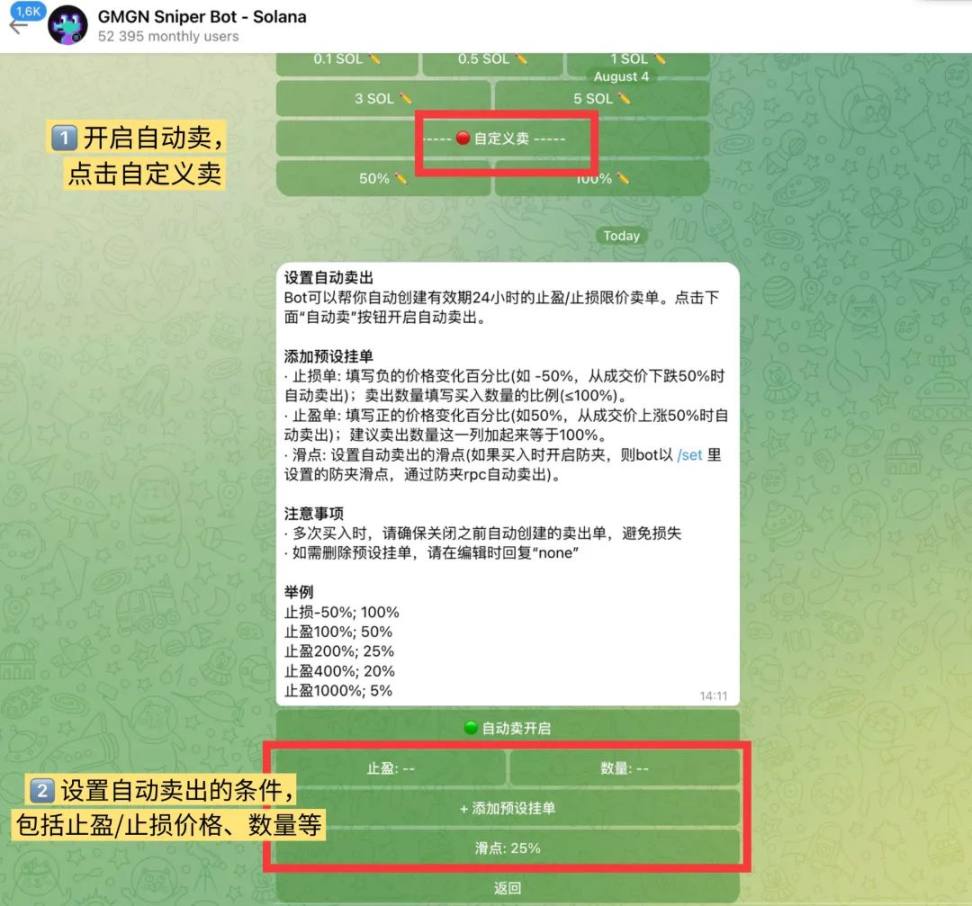

4. Using the Telegram Bot for Automatic Sell

Set up automatic sell preset values:

In the chat, enter /start, then select "Settings" to enter the automatic sell settings, or directly send /autosell.

Click "Enable Automatic Sell," then add preset orders.

Configure Stop Loss and Take Profit Orders:

Stop Loss Order: Enter a negative percentage (e.g., -30% means automatically sell when the price drops by 30%) and set the proportion of the quantity to sell (not exceeding 100%).

Take Profit Order: Enter a positive percentage (e.g., 30% means automatically sell when the price rises by 30%), and it is recommended that all sell quantities add up to 100%.

Execute the sell: Once the configuration is complete, the bot will automatically create stop loss and take profit limit sell orders with a validity period of 24 hours.

04

Summary

Through these advanced operations, you can efficiently filter, automate trading, and set limit orders for meme coins using the GMGN platform and the Telegram Sniping Bot, thereby improving trading speed and efficiency.

It is important to note that all Telegram bots face the issue of private keys being hosted on servers, and the GMGN Bot is no exception. Therefore, try not to keep too many funds in the bot; once you make a profit, transfer it to an exchange or your own on-chain wallet as soon as possible.

Recently, on-chain activity has been very high, with Bitcoin racing towards $100,000, and the meme coin sector continues to create wealth myths.

As a newcomer, it is very easy to develop FOMO (Fear of Missing Out) feelings, which is understandable. However, I would like to remind everyone again that hundreds of thousands of meme coins appear on-chain every day, and most will go to zero. The probability of finding a golden dog (with a market cap of tens of millions or over a hundred million) is extremely low, not to mention being listed on major exchanges.

In summary, the higher the potential returns, the higher the risks. Please take responsibility for yourself!

The tokens mentioned above are just examples and not recommendations. The views expressed do not represent Biteye's position and are for informational sharing only, not investment advice. Readers are advised to comply with the laws and regulations of their location!

About Us

Biteye is Asia's leading Web3 research community, generating forward-looking investment research content and tools through community and AI-driven methods, helping community members explore the Web3 rabbit hole.

WeChat Group: Add assistant @Biteye01 to join the group

Twitter: @BiteyeCN

Discord: Discord.gg/ME582FXR4F

* Disclaimer: The content shared in this article is for learning and communication purposes only, does not constitute any investment advice, and does not represent Biteye's position. If you like our articles, please click the business card below to follow us!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。